A banker's check, also known as a cashier's check or bank draft, is a check issued and guaranteed by a bank. The key distinguishing feature of a banker's check from a personal check is that the funds are already set aside, ensuring the payee's security and the guarantee of the bank. A banker's check is a check that is drawn from the bank's own funds and signed by a cashier. The bank guarantees that the check will be cashable, so the person receiving the check knows with certainty that it will not bounce. The primary purpose of a banker's check is to provide a safer and more secure payment method than personal checks or cash, especially for significant transactions. They are typically used in situations where the payee requires assurance that the funds will be available upon cashing or depositing the check. Banker's checks are typically used to cover larger purchases, such as cars or houses—that way, the person selling the car or house does not have to rely on the credit and good faith of the buyer. In situations where the payer and payee may not know each other well, a banker's check acts as a trust-enhancing instrument, assuring the recipient that they will receive the agreed-upon amount without any complications. While difficult to duplicate, banker's checks are notorious for the many scams. The most recognizable feature on a banker's check is the name and logo of the issuing bank. This prominently displayed identifier instantly lends credibility to the check. Alongside the bank's information, the check clearly states the payee's name, ensuring that only the named individual or organization can deposit or cash the check. Before a banker's check is issued, the bank ensures that the amount is fully funded. This either means that the customer requesting the check provides the bank with the exact amount in cash, or the bank debits the amount from the customer's account. Consequently, the funds for the check are effectively "prepaid" and set aside, offering additional security to the recipient. Banker's checks often come with a variety of security features to deter fraud. These might include watermarks, security threads, microprinting, or holograms. Additionally, the quality of the paper used is often unique and harder to replicate, providing another layer of protection against counterfeit attempts. Unlike some other financial instruments, banker's checks are usually non-transferable. This means that once a banker's check has been issued to a specific payee, it cannot be endorsed to another party. This feature provides an added layer of security, ensuring that the funds reach only the intended recipient. Here is what you need to know if you are getting a banker's check: Banker's checks are available from most banks and credit unions. Visit your local bank and request the check from the teller, and then pay the check amount and any applicable fees. Most banks require a small fee for this service. Personal identification, the exact amount of purchase, and names of the payor and payee are needed. Remember to get a receipt for your transaction, this is your proof of purchase and can help you track the check. Since banks and credit unions are the only institutions that can issue these types of checks, you may need to open a checking account (if you don't already have one) in order to use a banker's check. With advanced security features, the likelihood of fraud is significantly diminished. This is especially vital in an era where financial scams and counterfeit operations are becoming more sophisticated. The recipient can be relatively sure that a banker's check is genuine and backed by the bank's guarantee. As banker's checks are prepaid, the funds are guaranteed by the issuing bank. This removes the risk associated with personal checks, which might bounce due to insufficient funds. For a recipient, this assurance is invaluable, especially in high-stake transactions where the risk of non-payment could have significant financial implications. Given the security and assurance of payment associated with banker's checks, they are widely accepted both nationally and internationally. Their reputation as a reliable payment method means that businesses, individuals, and even government entities are more likely to accept a banker's check in comparison to other forms of payment. In recent years, the advancement of printing technology has enabled counterfeiters to produce fake checks with a high degree of authenticity. Victims are often lured into accepting counterfeit checks in various scams, thinking they are secure because of the banker's check label. Once deposited, these checks may initially appear to clear, only to be identified as fraudulent days or even weeks later, leaving the depositor liable for the entire amount. Additionally, fraudsters can engage in activities such as altering the amount or payee name on a legitimate banker's check. Since the funds for a banker's check come directly from the bank's account, the payee might assume immediate access to the funds once the check is deposited. However, like other checks, banker's checks must go through the clearing process, which can result in waiting times. Moreover, if the bank suspects fraud or requires additional verification, there can be longer holds placed on the funds. Furthermore, while uncommon, there are instances where banker's checks go uncashed or are lost, leading to non-redemption. This can tie up funds unnecessarily and might lead to complications if the original issuer requires a refund or replacement. In situations where there are issues related to a banker's check, such as unexpected delays, forgery suspicions, or non-redemption, the options for recourse might be limited. Unlike electronic transactions, which often come with more explicit consumer protection mechanisms, resolving issues with banker's checks can be more cumbersome. This often requires liaising directly with the issuing bank and potentially facing bureaucratic delays. While banker's checks offer many advantages in terms of security and credibility, they usually come at a cost. Many banks charge an issuance fee for banker's checks. This fee varies from bank to bank and can be influenced by factors such as the customer's banking relationship, the amount of the check, or membership tiers. In scenarios where a banker's check is lost, stolen, or there's a need to prevent its cashing for some other reason, a stop payment can be placed on the check. However, this service typically comes with a fee. The cost can vary widely depending on the bank and its policies. To understand what a banker's check is, also called a "cashier's check," we first need to understand what a personal check is. A personal check represents an instruction to transfer a sum of money from the drawer's account to the payee's account. When the payee deposits the check into their account, the check is verified as genuine, and the transfer is performed. An individual with a checking account has the authority to draw checks against the money housed in their account. It's impossible to predict when a check will be deposited after it is drawn. The funds represented by a check are not transferred until the check is deposited and cleared, so it is possible that the drawer's account may not have enough money in the account to fulfill the transfer when the check is deposited. When this happens, a check "bounces" and the payee receives zero money. For this reason, checks are seen as less secure than cash. A banker's check is a check issued and guaranteed by a bank. Unlike personal checks, a banker's check is pre-funded by the bank, ensuring the recipient's security and the bank's guarantee. It offers enhanced security, guarantee of payment, and wider acceptance compared to personal checks. However, there are risks associated with using banker's checks. The risk of forgery and fraud has grown with technological advancements, and potential delays in the clearing process can hinder immediate access to funds. Moreover, limited recourse options exist for addressing issues, requiring direct engagement with the issuing bank. Fees, including issuance and stop payment fees, are also considerations. Despite these risks, banker's checks remain a valuable tool for secure and guaranteed transactions, particularly in scenarios where trust and certainty are crucial. Banker's Check Definition

A banker's check offers the security that a personal check lacks.Purpose of Banker's Checks

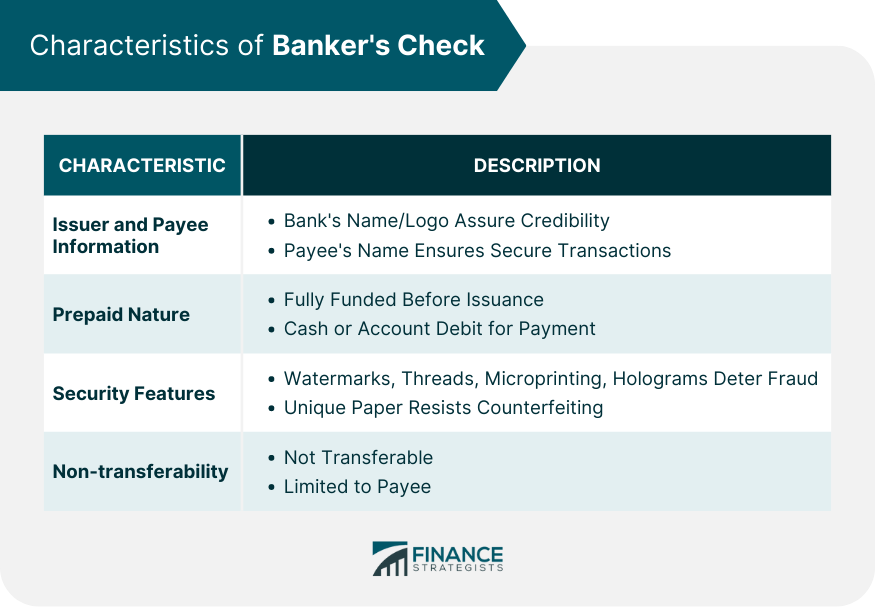

Characteristics of Banker's Check

Issuer and Payee Information

Prepaid Nature

Security Features

Non-Transferability

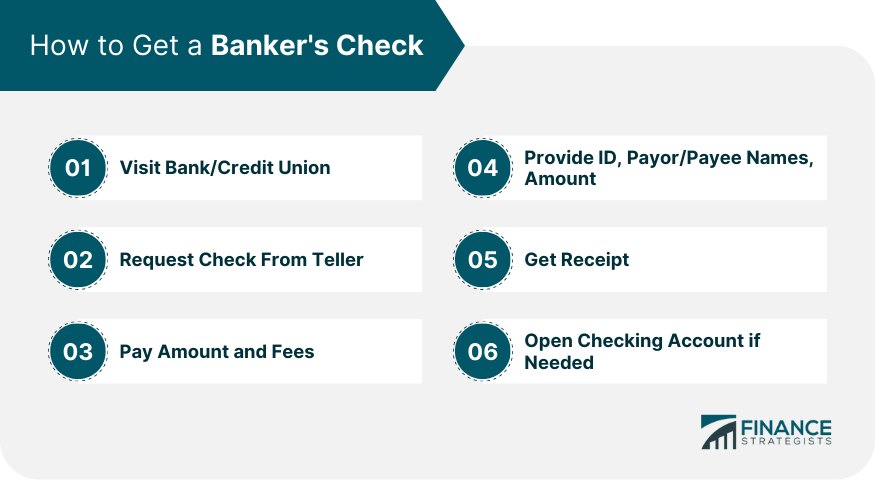

How to Get a Banker's Check

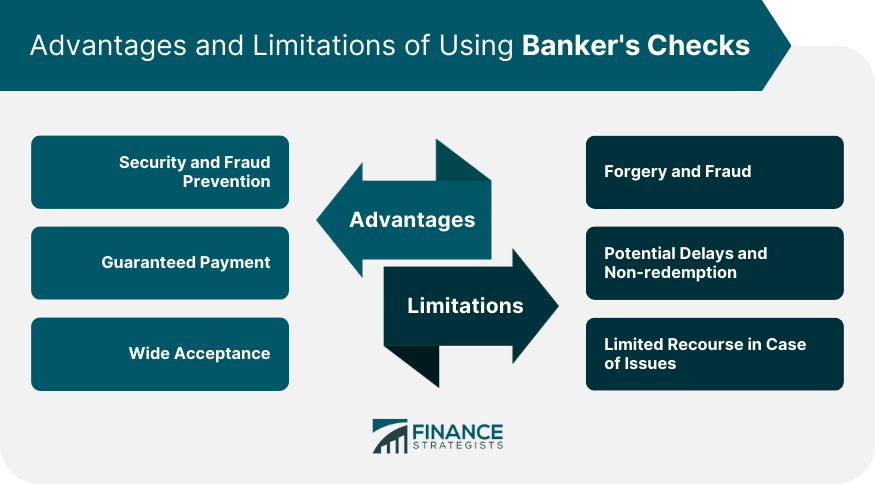

Advantages of Using Banker's Checks

Security and Fraud Prevention

Guaranteed Payment

Wide Acceptance

Limitations of Using Banker's Checks

Forgery and Fraud

Potential Delays and Non-Redemption

Limited Recourse in Case of Issues

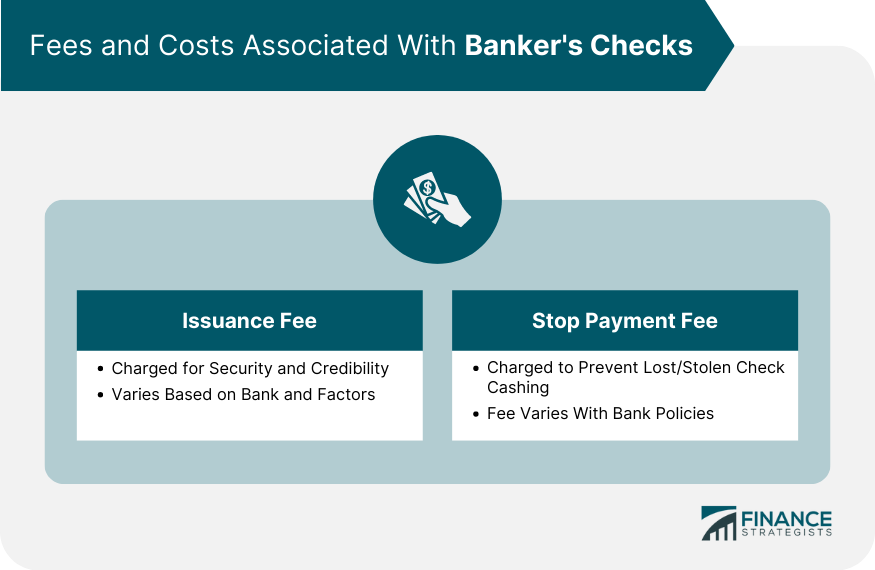

Fees and Costs Associated With Banker's Checks

Issuance Fee

Stop Payment Fee

Personal Check vs Banker's Check

Personal Check Definition

Conclusion

Banker's Check FAQs

A banker’s check is a check that is drawn from the bank’s own funds and signed by a cashier.

The bank guarantees that the check will be cashable, so the person receiving the check knows with certainty that it will not bounce.

Banker’s checks are typically used to cover larger purchases, such as cars or houses—that way, the person selling the car or house does not have to rely on the credit and good faith of the buyer.

Visit your local bank and request the check from the teller, and then pay the check amount and any applicable fees.

The funds represented by a check are not transferred until the check is deposited and cleared, so it is possible that the drawer’s account may not have enough money in their account to fulfill the transfer when the check is deposited.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.