A fiduciary deed is a legal document used to transfer ownership of a property from one party to another when the original owner is unable to sign the deed for legal or other reasons. This type of deed is granted by a fiduciary, such as an executor or trustee, who has the legal authority to sign on behalf of the original owner. They are typically used in situations where the owner of the property is deceased or incapacitated or when the property is owned by a trust. A fiduciary deed differs from other types of deeds, such as warranty deeds and quitclaim deeds, in that it does not guarantee the title to the property. Rather, it simply transfers the ownership of the property from the original owner to the new owner. The new owner takes on any liens or encumbrances that may exist on the property at the time of the transfer. The legal requirements for a fiduciary deed may vary depending on the state in which the property is located. In most cases, it must include the legal description of the property, the name of the original owner, the name of the fiduciary, and the name of the new owner. The fiduciary must also sign the deed in the presence of a notary public and record it with the county recorder's office. Fiduciary deeds are typically used in real estate transactions involving estates, trusts, and guardianships. These situations typically involve an original property owner who is either deceased or incapacitated and, therefore, unable to sign the deed themselves. In the case of estates, a fiduciary deed may be used to transfer ownership of the deceased person's property to their heirs or beneficiaries. This often occurs when the deceased person's will designate an executor, who is then responsible for administering the estate and transferring ownership of the property to the appropriate parties. Similarly, in the case of trusts, a fiduciary deed may be used to transfer ownership of property held in the trust. This may occur when the trust agreement designates a trustee who is responsible for managing the trust's assets, including the transfer of property ownership. In the case of guardianships, a fiduciary deed may be used to transfer ownership of property owned by a minor. This may occur when a minor inherits the property or when a minor owns property that is being sold or transferred. Using a fiduciary deed, the transfer of ownership can be completed without the need for the original owner to sign the deed, streamlining the real estate transaction process. Creating a fiduciary deed can be a complex legal process. It is important to follow all legal requirements to ensure that the deed is valid and enforceable. The specific steps involved in creating a fiduciary deed may vary depending on the state in which the property is located but generally include the following: Before creating a fiduciary deed, it is important to ensure that the fiduciary has the legal authority to sign the deed on behalf of the original owner. This may involve obtaining a court order, such as a probate court order or a guardianship order, that grants the fiduciary the legal authority to act on behalf of the original owner. Once the fiduciary has the necessary legal authority, the next step is to draft the fiduciary deed. This may involve working with a qualified attorney with real estate law experience. The deed must include the legal description of the property, the name of the original owner, the fiduciary's name, and the new owner's name. In order for the fiduciary deed to be valid, it must meet all legal requirements. This may include specific language that must be included in the deed and formatting requirements. In addition, the fiduciary must sign the deed in the presence of a notary public, and the deed must be recorded with the county recorder's office. Potential issues that may arise during the creation process of a fiduciary deed include disputes over the following: Legal authority of the fiduciary to sign the deed Legal ownership of the property Validity of the deed itself These issues may lead to delays or legal challenges to the real estate transaction, underscoring the importance of working with qualified legal professionals to meet all legal requirements. Fiduciary deeds offer several benefits in real estate transactions, particularly when the original owner cannot sign the deed. Some of the advantages of using a fiduciary deed include the following: In situations where the original owner is unable to sign the deed, using a fiduciary deed can streamline the transaction process by allowing the fiduciary to sign the deed on their behalf. This can help avoid delays and ensure that the transfer of ownership is completed efficiently. Fiduciary deeds may provide additional protection to parties involved in the real estate transaction. For example, a fiduciary deed may be used in situations where the original owner is deceased, which can help ensure that the transfer of ownership is valid and enforceable. In addition, fiduciary deeds may include specific language that protects the buyer or new owner from any unknown liens or encumbrances on the property. Fiduciary deeds can also be particularly useful in real estate transactions involving trusts, as they can facilitate the transfer of property ownership from the trust to the buyer or new owner. This can help simplify the process of buying or selling property held in a trust. While fiduciary deeds offer several benefits in real estate transactions, there are also potential risks and drawbacks to consider. Some of the risks and drawbacks of using a fiduciary deed include the following: Using a fiduciary deed can sometimes lead to legal challenges, particularly if there are questions or disputes over the legal authority of the fiduciary to sign the deed on behalf of the original owner. In addition, if the original owner's ownership of the property is in question or if there are unknown liens or encumbrances on the property, this could also lead to legal challenges. While fiduciary deeds may provide some additional protection to parties involved in the transaction, they may not offer the same level of protection as other types of deeds, such as warranty deeds. For example, fiduciary deeds do not guarantee that the person the fiduciary is acting for actually owns the property or how much of an interest is owned. This could lead to disputes or legal challenges in the future. Fiduciary deeds are only used in specific situations where the original owner is unable to sign the deed, such as in situations involving estates, trusts, and guardianships. In other situations, such as a standard real estate transaction where the original owner is able to sign the deed themselves, a fiduciary deed may not be applicable. Overall, while fiduciary deeds can be useful in certain situations, they may also lead to legal challenges and may not provide the same level of protection as other types of deeds. It is imperative to carefully consider the specific circumstances of the real estate transaction and consult with legal professionals to determine if a fiduciary deed is appropriate. A fiduciary deed is a legal document that can be used to transfer ownership of real estate when the original owner is unable to sign the deed. Fiduciary deeds are typically granted by a fiduciary, such as an executor or trustee, who has the legal authority to sign on behalf of the original owner. While fiduciary deeds can streamline real estate transactions and provide additional protection to parties involved in the transaction, they also have potential risks and drawbacks, such as legal challenges and limited protection. It is important to carefully consider the specific circumstances of the real estate transaction and consult with legal professionals to determine if a fiduciary deed is appropriate. In any case, it may be beneficial to seek the guidance of a financial advisor when evaluating opportunities to buy or sell real estate.What Is a Fiduciary Deed?

When Is a Fiduciary Deed Used?

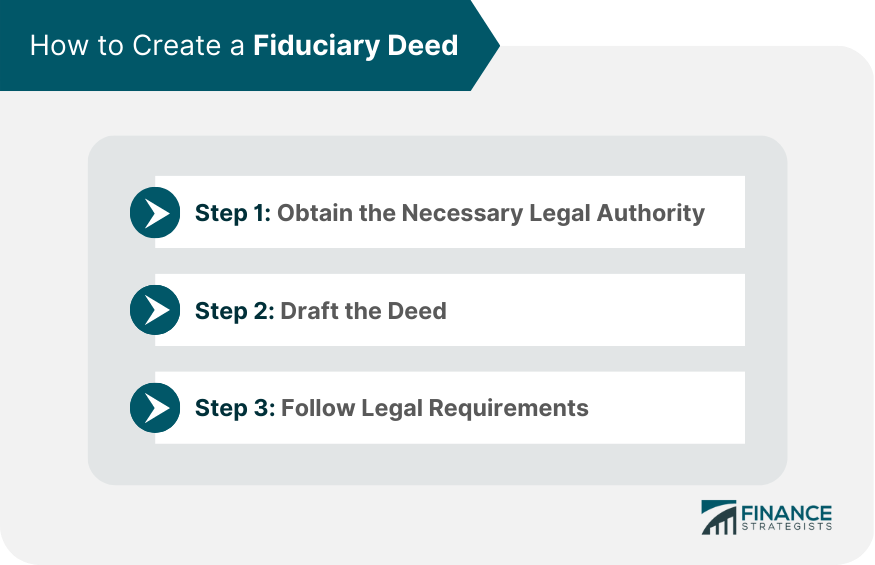

How to Create a Fiduciary Deed

Step 1: Obtain the Necessary Legal Authority

Step 2: Draft the Deed

Step 3: Follow Legal Requirements

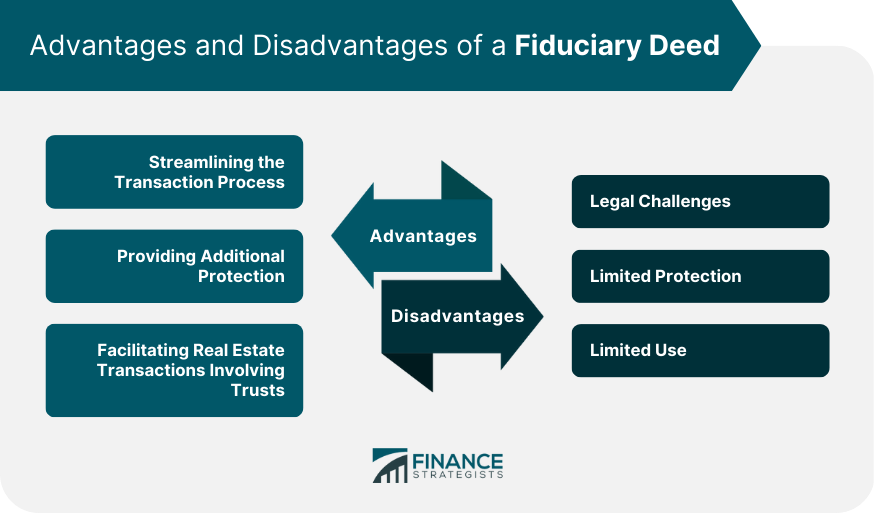

Advantages of a Fiduciary Deed

Streamlining the Transaction Process

Providing Additional Protection

Facilitating Real Estate Transactions Involving Trusts

Potential Risks and Drawbacks of a Fiduciary Deed

Legal Challenges

Limited Protection

Limited Use

Final Thoughts

Fiduciary Deed FAQs

A fiduciary deed is a legal document that transfers ownership of real estate from one party to another when the original owner cannot sign the deed due to legal or other reasons. It is signed by a fiduciary, such as an executor or trustee, who has the legal authority to sign on behalf of the original owner.

Fiduciary deeds are typically used in real estate transactions involving estates, trusts, and guardianships. They may be needed when the original owner is deceased, incapacitated, or a minor and unable to sign the deed themselves.

The legal requirements for creating a fiduciary deed may vary depending on the state in which the property is located. Generally, the deed must include the legal description of the property, the name of the original owner, the name of the fiduciary, and the name of the new owner. The fiduciary must also sign the deed in the presence of a notary public and record it with the county recorder's office.

Some advantages of using a fiduciary deed include streamlining the transaction process, providing additional protection to parties involved in the transaction, and facilitating real estate transactions involving trusts.

Some potential risks and drawbacks of using a fiduciary deed include legal challenges, limited protection, and limited use. Fiduciary deeds may not offer the same level of protection as other types of deeds. They only apply in specific situations where the original owner cannot sign the deed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.