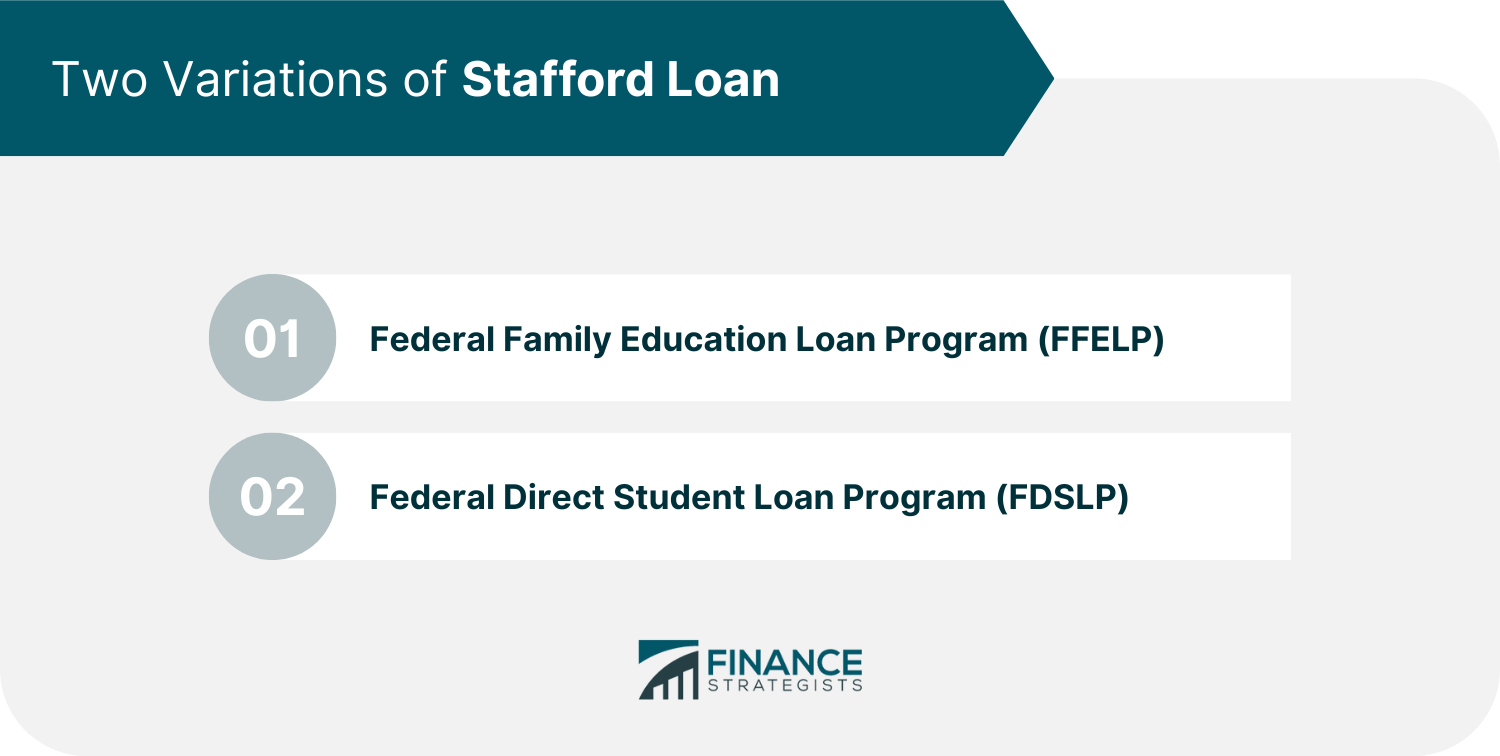

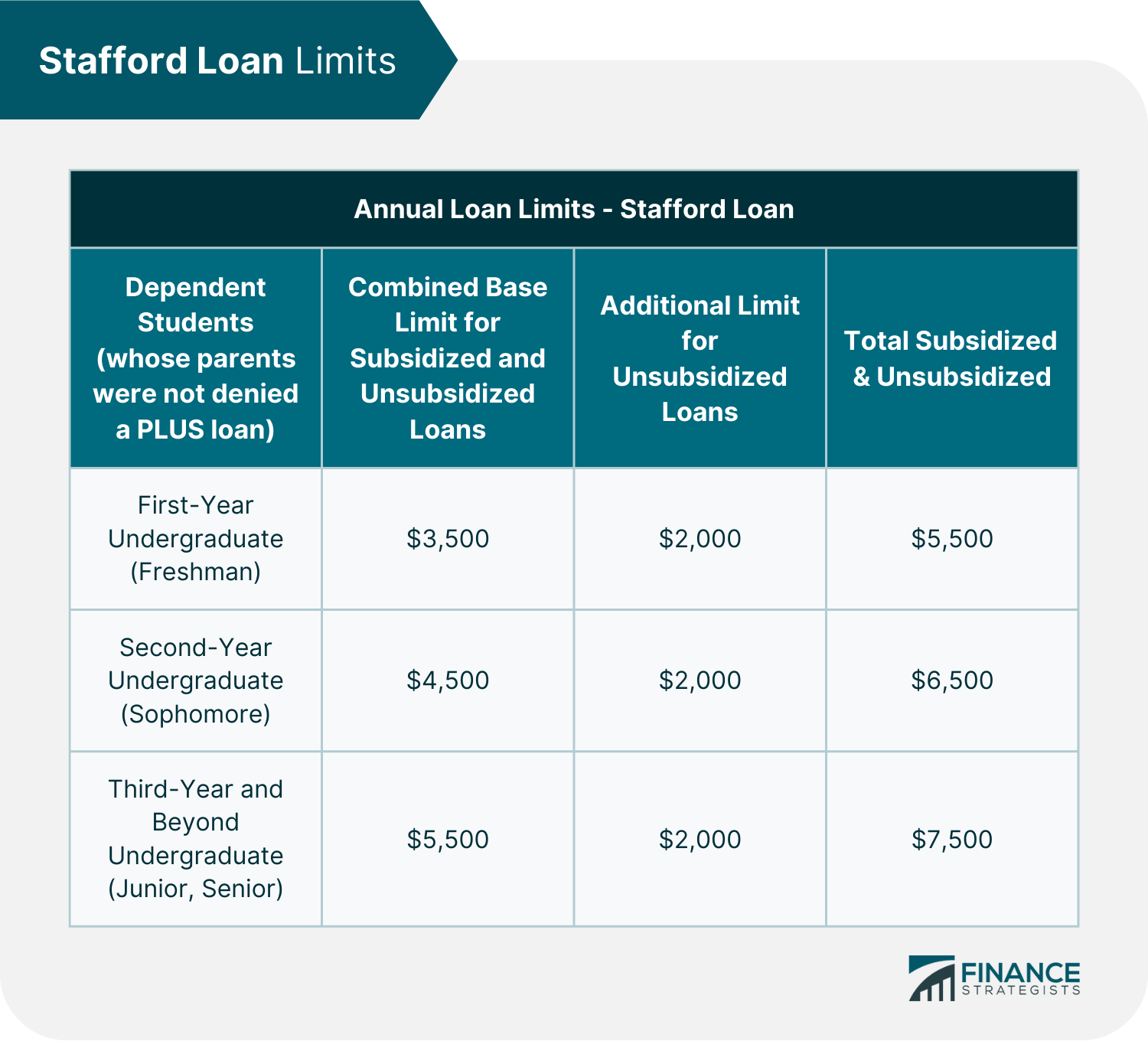

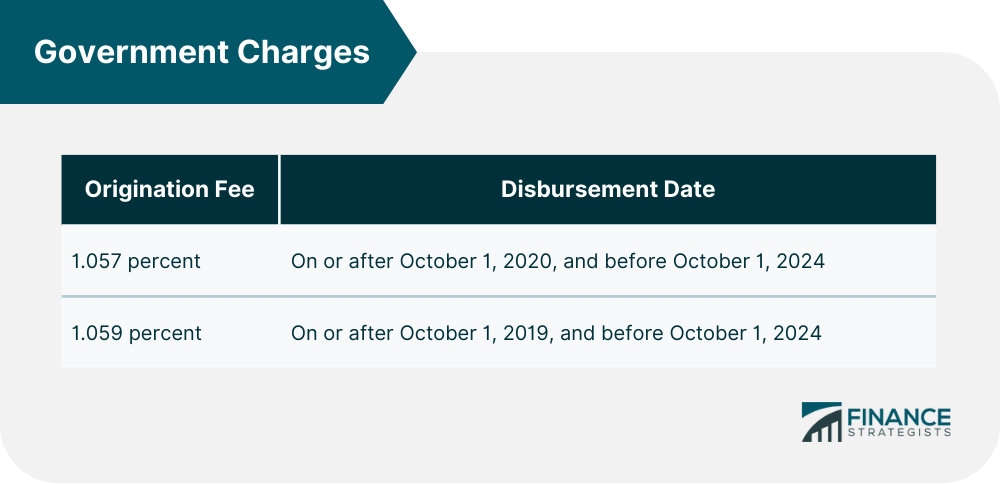

Federal Financial Aids are primarily responsible for providing financial assistance to students who demonstrate need so that they can attend college. Grants, scholarships, and loans are the three main types of aid available through federal programs. Grants are offered to help students pay for their education, These are typically need-based and do not have to be repaid. The most common type of grant is the Pell Grant, which is awarded to low-income undergraduates. Scholarships are usually merit-based and may or may not have to be repaid. Some scholarships are awarded by the federal government, while others are provided by private organizations or colleges themselves. Loans must be repaid with interest and are available through both federal and private programs. Federal loans include the Perkins Loan, the Stafford Loan, and the PLUS Loan. Private loans should only be considered as a last resort after exhausting all other financial aid options. There are many different types of financial aid available to students, so it is important to research all of your options before making a decision. Be sure to file the Free Application for Federal Student Aid (FAFSA) in order to be considered for federal aid programs. You can learn more about financial aid by visiting the U.S. Department of Education’s website or by contacting your college’s financial aid office. The Pell Grant is a direct grant offered by participating institutions to financially needy students who have not yet earned their first bachelor's degree. Students enrolled in specific post-baccalaureate programs that lead to teacher certification, or licensure may also be eligible for the Pell Grant. Participating schools can choose to credit the Federal Pell Grant funds directly to the student's school account, pay the student directly, or use a combination of both methods. Pell Grants are usually awarded to families whose Adjusted Gross Income is below $30,000 per year. Students must be paid at least once every term (semester, trimester, or quarter); if a school does not use formally defined terms, the student must be paid at least twice during the academic year. The Federal Supplemental Educational Opportunity Grant (FSEOG) program is for students with exceptional financial needs enrolled in colleges and universities. Pell Grant recipients with the lowest anticipated family contributions (EFC) would be prioritized for an FSEOG. The FSEOG does not have to be repaid, much like Pell Grants. Depending on when they apply, their financial need, the money available at the institution where the student will be studying, and office of financial assistance policies at your school, qualifying students may receive between $100 and $4,000 each year. The supply of Pell and SEOG grants is limited. The high school counselor will advise the family to complete the Free Application for Student Aid (FAFSA) as soon as possible after January 1 of their senior year in high school. Pell and SEOG scholarships are distributed to the first qualifying students who meet eligibility requirements. If the student qualifies for these grants but delays completing the FAFSA, they may not receive the grant money because it is given out on a first-come, first-served basis. If the college runs out of grant money, qualifying eligible students will not be able to receive any assistance from these programs. The average award is approximately $716. Students may receive a National SMART Grant of up to $4,000 for each third and fourth academic year of study if they are enrolled in an eligible program. A student must meet the following requirements to be considered for each academic year: This grant ended in 2011. The most popular federal student loan is the Stafford Student Loan. It has two variations: Federal Family Education Loan Program (FFELP) No longer available, the Federal Family Education Loan Program (FFELP) consisted of loans provided by private lenders, like banks, credit unions, and savings & loan associations. One example of a private lender offering FFELP loans was Sallie Mae. The federal government guaranteed these types of loans against default. Replacing the FFELP is the Federal Direct Student Loan Program (FDSP). Federal Direct Student Loan Program (FDSLP) The Federal Direct Student Loan Program (FDSLP) gives loans directly to students and their parents administered by "Direct Lending Schools". All Stafford Loans can be subsidized, meaning the government pays the interest while the student is in school, or unsubsidized, where the student pays all the interest. To receive a subsidized Stafford Loan, you have to demonstrate financial need. The federal financial aid system shows that approximately 2/3 of Subsidized Stafford Loans go to students with a family AGI below $50,000. A fourth is granted to those with a family AGI between $50,000 and $100,00, while the remaining 10% goes to families making over $100,000 yearly. The interest on the Unsubsidized Stafford Loan may be capitalized, allowing you to postpone payments until graduation. The interest payments are added to the loan balance, increasing its size and price. Regardless of financial need, all students can apply for an Unsubsidized Stafford Loan. Repayment for Stafford Loans begins six months after graduation or half-time enrollment. The usual ten-year repayment period, although one may negotiate reduced repayments (extended, graduated, and income-based repayment) by consolidating the debts. Stafford Loans have a fixed interest rate of 6.8 percent for loans issued after July 1, 2006. Stafford Loans offer the same interest rate as all lenders, but some give discounts for on-time and electronic payments. The College Cost Reduction and Access Act of 2007 reduced the interest rates on subsidized Stafford loans for undergraduate students. This change took effect July 1, 2008. The interest rate reductions available are specific to undergraduate students taking Subsidized Stafford loans; graduate students and those with Unsubsidized Stafford loans do not qualify. Refer to the table below for more details. The federal government charges a 1.057 percent loan origination fee for Stafford Student Loans first disbursed on or after October 1, 2020, and before October 1, 2024. The federal government charges a 1.059 percent loan origination fee for Stafford Student Loans first disbursed on or after October 1, 2019, and before October 1, 2024. On studentaid.gov/interest-rates, you can find out how much you will pay in loan fees or loan origination fees if you take out student loans and the interest rates for parent plus loans. The Perkins Loan is available to qualifying students with significant financial needs who attend an institution of higher education in the United States. This program is campus-based, with the university acting as the lender and utilizing a restricted pool of funds supplied by the federal government. (The Perkins Loan is one of the best student loans on the market. It is a subsidized loan with no origination or default fees and an interest rate of 5%. The repayment period is ten years.) Your school's financial aid office decides the amount of Perkins Loans you receive. The program caps for undergraduate students are $4,000 per year and $6,000 per year for graduate students, with combined limits of $20,000 for undergraduate loans and $40,000 for both undergraduate and graduate loans. Federal Parent Loans for Undergraduate Students (PLUS) enables parents to take out loans to supplement their children's financial aid packages. This allows them to cover additional costs that the student's aid package does not include, board and lodging, up to the total cost of attendance with no cumulative limit like Stafford Loans. These either come from private lenders as part of the Federal Family Education Loan Program (FFELP) or directly from the government as a Direct PLUS loan--the FFELP PLUS is no longer available. Parents, not students, are held financially responsible for Parent PLUS Loans. If a student agrees to make loan payments but does not do so on time, the parents will be required to cover the debt. The Federal Grad PLUS Loan first became available to graduate and professional students on July 1, 2006. This loan allows them to borrow money to pay for their education expenses. Recently, the PLUS loan has been known as either the Parent PLUS or Grad PLUS Loan. The original name, Parent Loan for Undergraduate Students, is no longer used in any legislation. The interest rate for PLUS Loans within the Federal Family Education Loan (FFEL) program is 8.5% for loans with a first release date after July 1, 2006. The interest rate was previously variable and based on 52-week T-bill rates of +3.10%, but it was capped at 9%. Within the Direct Loan program, PLUS Loans have a fixed interest rate of 7.9%. Unlike Subsidized Stafford and Perkins loans, the student is not exempt from accrued interests while enrolled in school. The PLUS loan has a fee of 4% applied to each disbursement, which is subtracted from the payment. The same interest rate applies to all lenders for the PLUS Loan, although some give incentives for on-time and electronic payments. Repayment continues for up to ten years, and the repayment term begins 60 days after all of the money is handed out. Graduate students can postpone payment for a time while pursuing their education. There is no six-month grace period with this loan program, as with the Stafford Loan program. The option for parents to defer payments on the Parent PLUS loan while their undergraduate child is in school and for a six-month grace period after the student graduates or drops below full-time enrollment was added by the Ensuring Continued Access to Student Loans Act of 2008 (PL 110-227). Payments may also be postponed if the parents are enrolled in college. However, they must first apply for an in-school deferment. That said, since the interest on the PLUS loan is not government-subsidized, the interest on this loan accrues while it is deferred and is capitalized when the loan enters repayment. Parents with PLUS loans can consolidate them just like Stafford and Perkins Loans, but a parent's PLUS loan cannot be combined with the student's Stafford and Perkins Loans since the borrowers are separate. However, if parents have their own Stafford loans, they may combine those with any other PLUS loans they have taken to pay for their children's education. Consolidating PLUS loans allows you to take advantage of various repayment options, such as extended repayment, graduated payment, and income-based repayment. Since the consolidation loan has an interest rate that is limited to 8.25%, combining your FFELP PLUS loans can lower the interest rate by 0.25 percentage points. To get the most out of this interest rate reduction, consider the impact of consolidation on available education loan discounts before consolidating PLUls. Parents must have a good credit history to be eligible for the PLUS loan. Adverse credit history is defined as being behind by 90 or more days on any debt payments or having had any Title IV debt (including a grant overpayment) within the past five years that was subjected to default determination, bankruptcy discharge, foreclosure, repossession, tax lien wage garnishment or write-off. The act, passed in 2008, allowed for mortgage and medical bill payments to be counted as late if they were paid within 180 days instead of the usual 90 days from 2007 through 2009. Suppose a dependent student's parents are denied a PLUS loan or the college financial aid administrator thinks they will be denied a PLUS loan. In that case, the student is entitled to more significant Unsubsidized Stafford Loan limits. Only one parent must apply for and be refused a PLUS loan. However, if one parent is declined a PLUS loan but the other is granted one, the student is not eligible for greater Stafford Loan amounts. Suppose a parent believes they will be refused a PLUS loan or has other exceptional circumstances that prevent them from utilizing the PLUS loan program. In that case, contacting the school is usually a good idea before applying for a PLUS loan. If they obtain a PLUS loan approval, it is much more difficult for the school to grant the student additional unsubsidized Stafford loan eligibility. The language in 34 CFR 682.201(a)(3) states explicitly: It is not an exceptional circumstance for a parent to refuse to borrow a PLUS loan. If the dependent student qualifies for an additional unsubsidized Stafford loan and then the parent receives a PLUS loan, no further payments will be made to the student on the additional unsubsidized Stafford loan but may retain any amounts already disbursed. Subsequent Stafford loan disbursements are limited to the lower unsubsidized Stafford loan limits, regardless of any excess amounts received due to the higher unsubsidized Stafford loan limit. The total amount of Stafford loan disbursement under the cost-of-attendance minus aid-received cap must be considered when calculating the annual cap on the PLUS loan. If federal programs do not cover your borrowing needs, lenders offer supplemental borrowing programs called Private or Alternative Loans. Graduate and professional students could borrow money through the PLUS Loan program beginning July 1, 2006, to pay for their education. Parents can take out home loans or investments to help pay for their child's college expenses. Individuals can even use credit cards and life insurance loads to pay for college and might be able to deduct the interest paid as a student loan deduction. Federal Financial Aid Programs are the cornerstone of college funding in the United States. Grants, Scholarships, and Loans help make up the Federal Financial Aid Programs available to eligible students. All Federal Financial Aid Programs have eligibility requirements that must be met before any money can be disbursed to a student or parent. Once the eligibility requirements are met, the Free Application for Federal Student Aid (FAFSA) is used to determine the type and amount of aid a student or parent may receive. There are many types of Federal Financial Aid Programs available to eligible students, including grants, scholarships, and loans. Grants and scholarships are typically need-based, while loans are usually not. There are a variety of options to help pay for college, and it is important to research all of the possibilities to find the best solution for your unique situation. You can also look into private loans, scholarships, and other forms of financial aid. And finally, you can consider using home equity loans, credit cards, life insurance loans, and other methods of borrowing money to pay for college. Whatever route you choose, be sure to carefully consider all the options and make the best decision for your individual circumstances.Federal Financial Aid Programs

Pell Grant

SEOG

National Smart Grant

Note - Students can receive a National SMART Grant if they enroll in the courses necessary to complete the degree program and fulfill the essential requirements. Stafford Loan

Stafford Loan Limits

(Before, Stafford Loans had variable interest rates based on the 91-day T-bill rate plus 1.7 percent during school with an additional 0.6 percent increase upon graduation limited to 8.25 percent or less, depending on yearly adjustments.)

Interest Rate Phasing-in on Subsidized Stafford Loans for Undergraduate Students

Perkins Loan

Parent Loans

Interest Rates and Fees

Repayment

Consolidating PLUS Loans

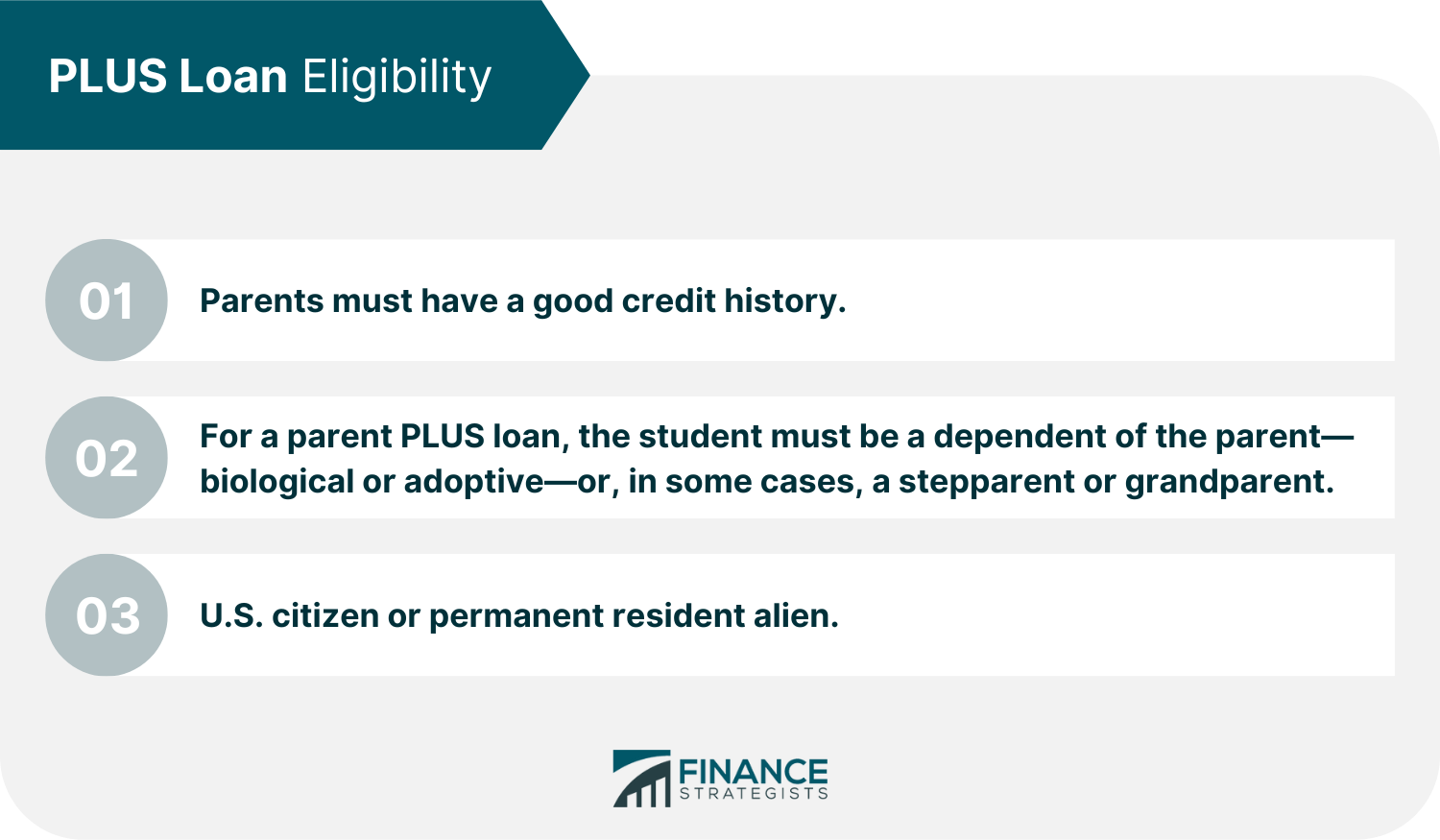

Eligibility

Other Student Loans

Conclusion

Financial Aid FAQs

Financial aid is money that helps students pay for college. It can come from the federal government, the state government, the college itself, or other sources like private organizations and charities. It can be in the form of grants, loans, or work-study.

A financial grant is money that does not have to be paid back. A loan is money that must be paid back with interest.

To apply for Financial Aid, you must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is an online form that collects information about your financial situation so that the government can determine how much money you need to pay for college. Your school’s Financial Aid Office will use the information on your FAFSA to determine how much Financial Aid you qualify for.

Types of Financial Aid include grants, scholarships, and loans. Grants and scholarships are typically need-based and don’t have to be paid back, while loans must be repaid. Loans can come from the federal government, state governments, private lenders, or other organizations.

Yes, Financial Aid Programs have limits on the amount of money that can be awarded. Grants and scholarships typically have annual caps on how much money can be awarded, while loans have maximum amounts that can be borrowed. Financial Aid Programs also have restrictions on how the money can be used and may require students to meet certain academic requirements in order to remain eligible for funding.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.