Deferred annuities are insurance products that guarantee a lump sum or a regular stream of income at a future date. Individuals make either one-time or recurring deposits to fund their accounts. These funds are invested in financial vehicles which grow and return interest. Usually, the money in a deferred annuity is held for at least one year before payouts begin to be issued to the policy owner. Payouts can last for a fixed period, such as 10 or 20 years, or they can continue for the remainder of the policy owner’s life. Deferred annuities can be essential to an individual’s retirement planning portfolio. It can help supplement other forms of retirement income, like Social Security. There are different types of deferred annuities, and individuals can select based on their needs and preferences. No matter the type chosen, those who decide to invest in a deferred annuity can enjoy tax-deferred growth and create a guaranteed income stream. The three basic types of annuities, based on their returns, are: A fixed annuity is the most stable deferred annuity option, but it could also have a lower return. The interest rate is fixed and computed upon purchasing the annuity. The guaranteed minimum yield on a fixed annuity makes this investment best suited for individuals with lower risk tolerance. However, returns from this type of annuity may be lower than other types, so no natural inflation protection is included. The indexed deferred annuity guarantees a minimum yield like the fixed annuity. It also offers the possibility of higher returns because its growth is partially based on the performance of a stock market index, such as the Standard & Poor's 500 (S&P 500). If the chosen index does well, the policy owner's returns will be higher than the guaranteed minimum payment. Because of this possibility for higher growth, indexed annuities may also help to stabilize against inflation. However, annuity owners might not be able to receive 100% of the returns of their investment due to a policy known as a participation rate. This is a limit set by an insurance company on the potential return of an indexed deferred annuity. For example, if the participation rate is 70% and the chosen index grows by 10%, then the annuity's return would only be 7%. Most indexed deferred annuities have a participation rate of around 80%. Indexed deferred annuities might appeal to investors wanting to grow their money and shield it from market volatility. These products have the potential to generate higher returns than established fixed-rate annuities. However, they also entail a relatively higher level of risk. While fixed and indexed annuities offer a guaranteed minimum yield, variable annuities do not. Instead, returns are based on the performance of investments held in subaccounts which can contain stocks, bonds, and money market accounts. If the underlying investments in the variable annuity’s portfolio make money, then returns may increase. This might help protect the funds in the account against inflation. However, if the investment portfolio does not do well, significant losses may also be incurred. Of all three types, variable deferred annuities offer the possibility of the highest returns but it also comes with the risk of the lowest returns. Below is a summary of the other differences between all three types of deferred annuities. A deferred annuity offers several advantages, which include: Deferred annuities offer the potential for tax-deferred growth on the policy owner's investment. This means individuals will only have to pay taxes once they withdraw money from the annuity. Most deferred annuity contracts, except variable ones, have built-in guarantees against the loss of principal, thereby ensuring guaranteed income. One of the advantages of a deferred annuity is that there are no contribution limits, unlike other retirement plans like 401(k)s. Thus, individuals can save up as much as they prefer. Unlike other retirement savings options, deferred annuities provide extra advantages through contract riders. The most common is a guaranteed minimum payment regardless of the investment performance. A death benefit for assigned beneficiaries may also be added. Although deferred annuities have some benefits, there are also some significant drawbacks, such as: An annuity contract can be long and complex. Given the intricacies of fees, guarantees, and investment terms, deferred annuity contracts- especially those involving variable and fixed index annuities- can be challenging to understand. Another disadvantage of a deferred annuity is that policy owners may not have access to their invested funds for several years. Should withdrawals be made, possible surrender charges may be incurred. Deferred annuities typically have high fees, which may affect the investment returns and reduce the overall value of the investment. The cost of additional contract riders like death benefits, minimum payouts, or long-term care insurance may also add up. As part of deferred annuities’ tax benefits, the Internal Revenue Service (IRS) encourages policyholders to keep money in these accounts until retirement. Thus, if a lump sum withdrawal or cancellation of the contract is made before the investor turns 59 ½ years old, a 10% early withdrawal penalty will be incurred, along with corresponding income taxes. In an immediate annuity plan, a lump sum amount is invested and allowed to grow before payouts begin. The policy owner then starts receiving income much sooner than a deferred annuity, usually within a year. On the other hand, a deferred annuity plan is funded by either a lump sum or a series of recurring payments. Under this setup, payouts do not begin until a certain period of time has elapsed, typically a year or more. Both deferred and immediate annuities can offer fixed, indexed, and variable product variations. However, deferred annuities may provide higher returns simply because the funds invested have a longer time to compound and grow. Immediate annuities may be more suitable for individuals nearing retirement and needing an instant source of money. In contrast, deferred annuities may be more appropriate for those with a longer time frame for their investment to grow. If you are looking for a way to supplement your retirement income, annuities can be a solid choice. Furthermore, if you have a longer time frame to work with or prefer to make a series of recurring payments, you may want to invest in deferred annuities over immediate annuities. There are three different types of deferred annuities to select from and the most appropriate one for you depends on your risk tolerance level. Fixed deferred annuities can be good investments when the market is down, because they offer a minimum guaranteed yield. Meanwhile, variable deferred annuities have the highest return of investment during times when the market is performing well. Indexed deferred annuities lie somewhere in between because they guarantee a minimum yield but also increase slightly when the market does well. Whichever type of annuity you choose, it is best to keep in mind that they are primarily insurance products rather than high-growth equity investments. On their own, they might not be enough to provide for your post-retirement needs. However, they make an excellent complement to other retirement planning tools. When deciding whether to invest in a deferred annuity, it is important to consider your goals and needs. If you have maxed out other retirement planning vehicles like the Individual Retirement Arrangements (IRAs), you may consider adding the deferred annuity to your portfolio. Deferred annuities are also worth considering for those who want to take advantage of contract rider benefits and the fact that there are no contribution limits. Unfortunately, deferred annuities can be complex, and they often come with high fees that could reduce the amount of money you ultimately receive. They also are not as liquid as other retirement savings accounts like 401(k)s which have provisions for loans if needed. If you are considering a deferred annuity, read over the contract carefully so that you understand the conditions. In particular, take a close look at any surrender period or death benefits included in the agreement. If you want to discuss your options further, you can contact a financial professional to help you decide if a deferred annuity is the most appropriate retirement savings plan for you.What Is a Deferred Annuity?

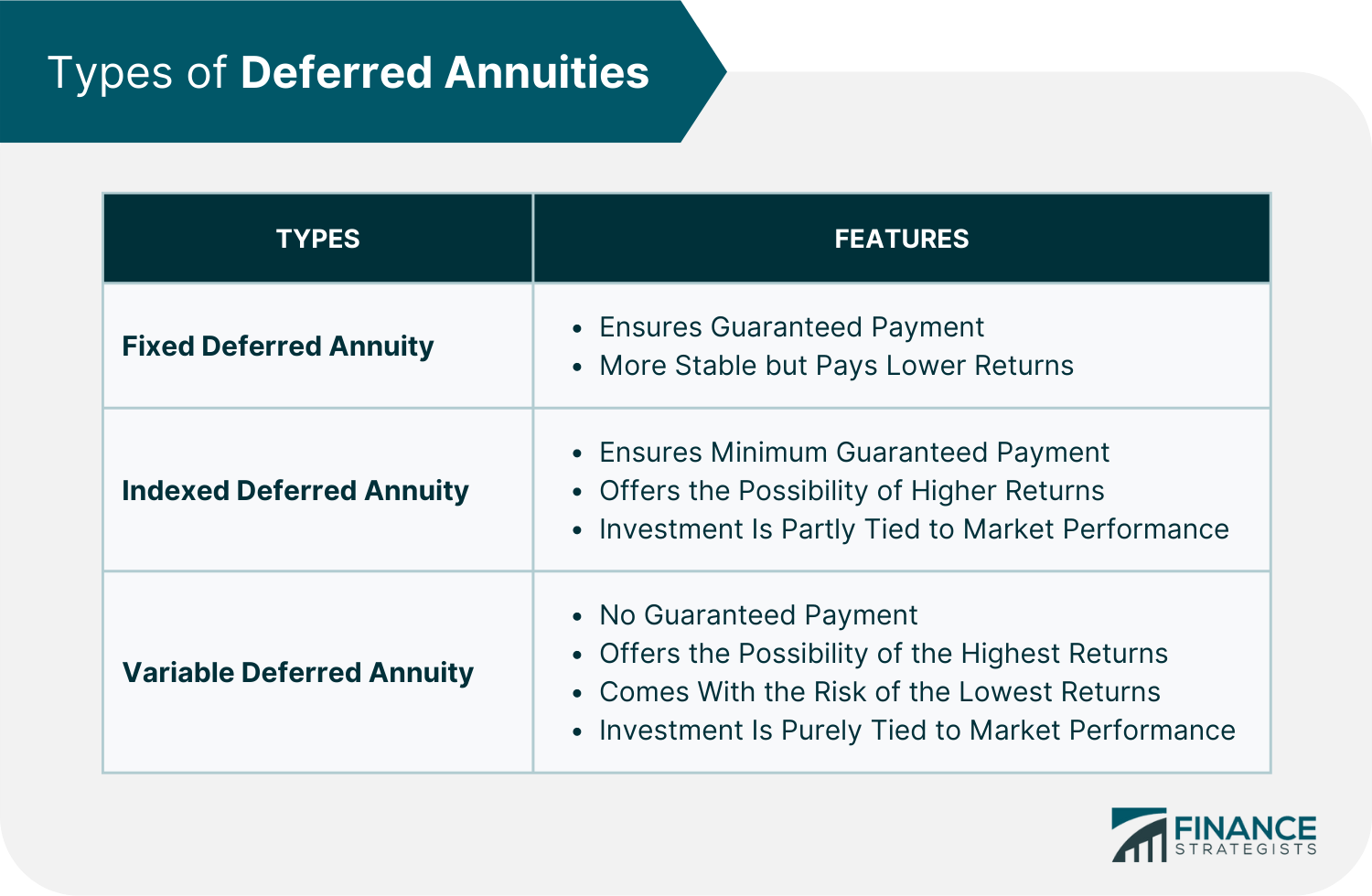

Types of Deferred Annuities

Fixed Deferred Annuity

Indexed Deferred Annuity

Variable Deferred Annuity

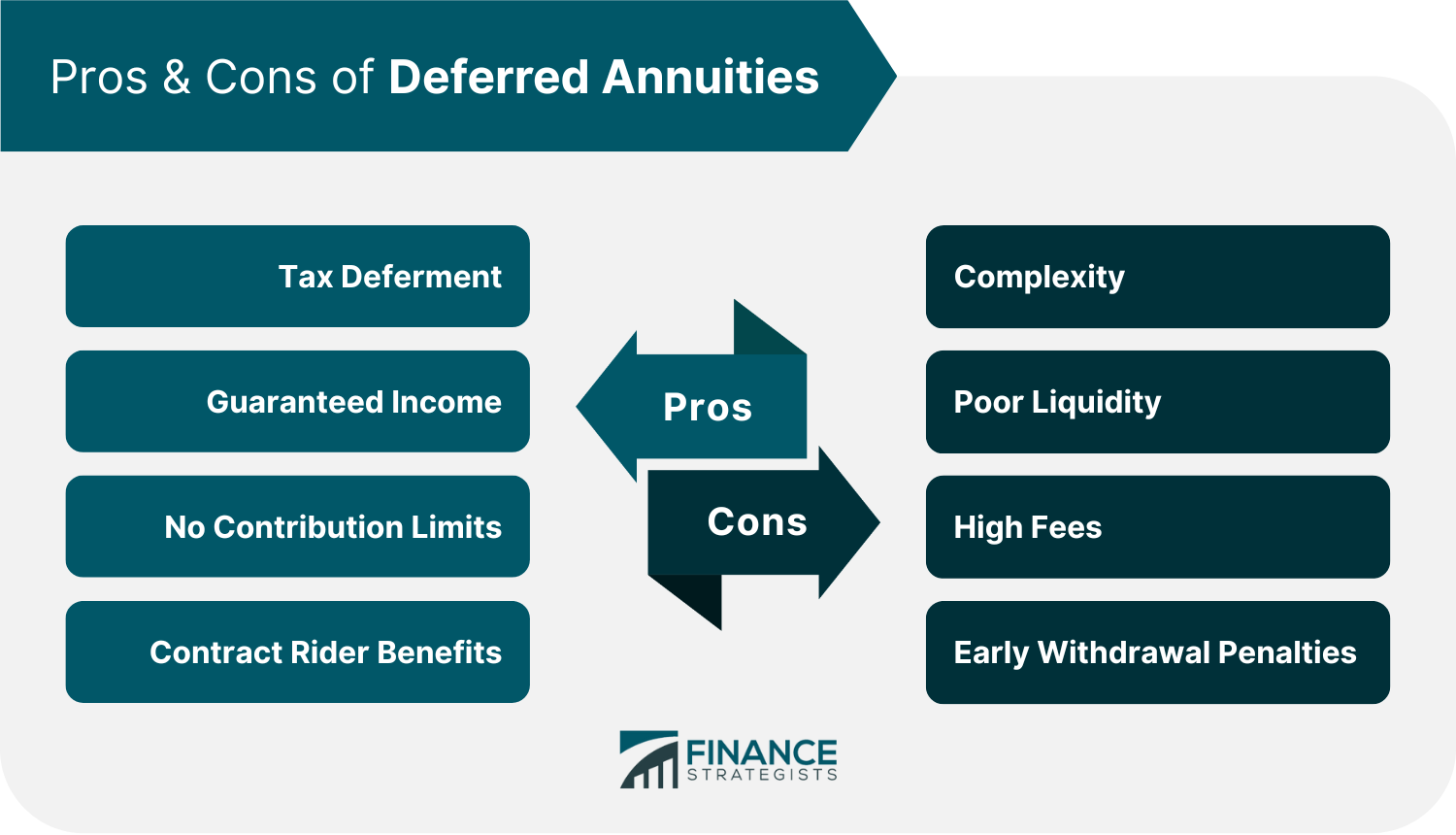

Advantages of a Deferred AnnuityTax-Deferment

Guaranteed Income

No Contribution Limits

Contract Rider Benefits

Disadvantages of a Deferred Annuity

Complexity

Poor Liquidity

High Fees

Early Withdrawal Penalties

Deferred Annuity vs. Immediate Annuity

Is a Deferred Annuity a Good Investment?

Final Thoughts

Deferred Annuity FAQs

It depends. Deferred annuities are primarily insurance products rather than high-growth equity investments. On their own, they might not be enough to provide for your post-retirement needs. However, they make an excellent complement to other retirement planning tools.

Yes, losing money with a deferred annuity is possible, particularly if you select the variable type. Variable deferred annuities do not guarantee a minimum payout, and returns are solely tied to the performance of the policy’s investment portfolio.

Individuals who have not yet maxed out other retirement savings vehicles, such as Individual Retirement Arrangements (IRAs) or 401(ks), may consider these options before buying an annuity. This is because annuities are less liquid and come with higher fees.

Like traditional IRAs, deferred annuities are funded with pre-tax dollars. This means that taxes are only paid on a deferred annuity once the policy owner begins to receive payouts.

With an immediate annuity plan, you may start receiving a stable income within a year after investing your money. On the other hand, in a deferred annuity plan, you may begin to receive payments after at least a year or more after investing your money.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.