A bilateral contract is a type of legal agreement in which both parties involved make a promise to fulfill certain obligations to each other. In other words, it's an exchange of mutual commitments. Each party is both an obligor (a person who is bound to another) and an obligee (a person to whom another is obligated or bound). Bilateral contracts are pervasive in many aspects of life, including finance, real estate, and employment. They stand in contrast to unilateral contracts, where only one party makes a promise, and the other party accepts by performing the agreed-upon action. Every contract must have at least two parties, but a contract does not have to require both those parties to perform specific acts. Insurance and options contracts are examples of this. One party has the right, but not obligation to pay the premium while the other party is obligated to pay the coverage damages or option exercise price. When only one party has an obligation to perform, the contract is referred to as a unilateral contract. Much more common are bilateral contracts; where one party exchanges a promise in consideration for another party's promise. I.e. Both parties are obligated to perform some action. The offer forms the foundation of any bilateral contract. One party, known as the offeror, presents a proposal to another party, known as the offeree. This proposal indicates a willingness to enter into a contract under specified terms and conditions. In the context of finance, the offer could be a proposal to lend money, issue insurance, or enter into a partnership agreement. Acceptance follows the offer in the creation of a bilateral contract. It is the act of the offeree agreeing to the proposed terms and conditions laid out by the offeror. Acceptance must be clear, unequivocal, and communicated to the offeror to establish a legally binding contract. It's essential to note that any changes or modifications in the acceptance phase constitute a counteroffer, not an acceptance. Consideration is a legal term referring to something of value exchanged between parties in a contract. Each party must provide something - it could be a service, a product, money, or even a promise to do (or not do) something. Without consideration, a contract cannot be legally enforceable. Lastly, legal capacity is a critical element of any contract, including bilateral ones. This term refers to the ability of all parties involved in the contract to understand the terms and implications of the agreement. Generally, all adults have the legal capacity to enter into contracts, barring some exceptions such as mental impairment or duress. Loan agreements are common types of bilateral contracts in the financial world. In such agreements, a lender offers to lend a particular amount of money to a borrower, who accepts the offer and promises to repay the amount under agreed terms. Both parties are bound by mutual obligations - the lender to provide funds and the borrower to repay them. Derivative contracts, such as futures, options, and swaps, are bilateral contracts where two parties agree to buy or sell an asset at a specified future date. These contracts allow parties to hedge against potential market risks or speculate on future price movements. Each party has an obligation - one to sell and the other to buy the underlying asset at the contract's expiration. An insurer promises to provide financial protection against potential losses to the insured, who in turn promises to pay regular premiums. Both the insurer and the insured have clearly defined roles and responsibilities. In a partnership agreement, two or more individuals agree to share profits and losses of a business venture. This contract outlines each partner's roles, responsibilities, and the distribution of profits and losses. It's a mutual exchange of promises - each partner agrees to contribute to the business in some way. Bilateral contracts help mitigate risk in financial transactions by ensuring all parties fulfill their agreed-upon obligations. By stipulating the duties and responsibilities of each party, these contracts reduce uncertainties and provide legal remedies in case of a breach. Parties can negotiate and tailor the terms and conditions to suit their specific needs and circumstances. This flexibility allows parties to achieve an agreement that aligns with their strategic and financial objectives. Bilateral contracts can also enhance the contractual relationship between parties. They encourage cooperation and mutual respect, as both parties are obligated to fulfill their responsibilities. This collaborative approach can help strengthen business relationships and foster long-term partnerships. While bilateral contracts can provide legal protection, they also carry the risk of breach of contract. If one party fails to fulfill their obligations, it can lead to disputes and legal challenges. The process of resolving such breaches can be time-consuming and costly. Bilateral contracts in finance can often be complex, requiring detailed documentation to outline the specific terms, conditions, and obligations. The complexity can lead to misunderstandings if not properly managed. Additionally, preparing, reviewing, and finalizing such detailed contracts can be a time-consuming process. Bilateral contracts in finance must comply with various regulatory and legal requirements, which can vary by jurisdiction. Non-compliance can result in penalties and legal disputes. Navigating these requirements can be challenging and may require the assistance of legal professionals. When drafting a bilateral contract in finance, clarity is key. The terms and conditions should be specific and easy to understand, reducing the chance of misunderstandings or disputes. Ambiguities in a contract can lead to disagreements and potentially a breach of contract. These provisions, also known as "force majeure" clauses, provide guidance on what happens if circumstances beyond the control of the parties prevent the fulfillment of the contract. Such provisions can help manage risks and provide clarity during unpredictable situations. This includes local, state, and federal laws, as well as industry-specific regulations. Compliance not only prevents legal issues but also fosters trust between parties. Courts to look to when consideration is due or delivered in determining whether a contract is bilateral or unilateral. Consideration is a key concept of contract law that states a contract is not formed, and therefore no party is obligated to perform the contract, unless both parties give up something of value to the other in exchange for the other's consideration. In other words, a contract must be a this-for-that exchange of goods, services or promises and the consideration is the "this" and "that." The moment the contract is signed, bilateral contracts obligate both parties to deliver their consideration. Your home mortgage obligates you to pay the mortgage and the lender to tender the purchase price to the seller when signed. On the other hand, under a unilateral contract the promisor is not obligated to provide their consideration until and if the promisee delivers their consideration. Your insurance company does not need to cover your car if you are not making your monthly payments but you are not obligated to make those payments. A bilateral contract involves an exchange of mutual commitments between two parties, wherein both are both obligors and obligees. The key elements of a bilateral contract, such as offer, acceptance, consideration, and legal capacity, form the foundation of its enforceability. Bilateral contracts offer several advantages in finance, such as risk mitigation, flexibility in contract terms, and enhanced contractual relationships. They provide a framework for parties to negotiate terms that align with their strategic objectives and foster cooperation. However, there are also disadvantages to consider, including the potential for breaches, complexity in documentation, and regulatory challenges. Proper drafting of bilateral contracts with clear and specific terms, provisions for contingencies, and compliance with regulations can mitigate these drawbacks. In contrast to unilateral contracts, where only one party makes a promise, bilateral contracts create mutual obligations, ensuring both parties fulfill their commitments. What Is a Bilateral Contract?

Bilateral Contract Made Easy

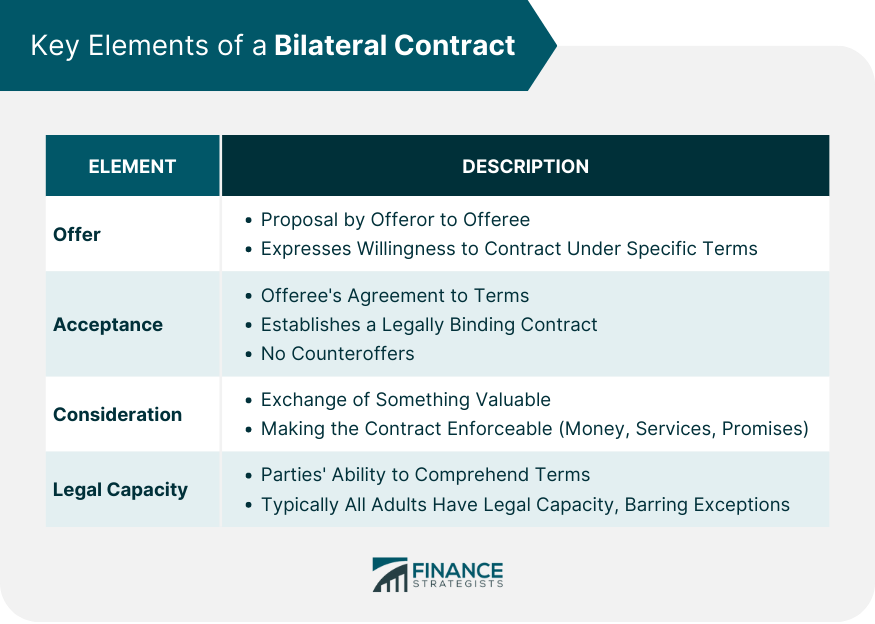

Key Elements of a Bilateral Contract

Offer

Acceptance

Consideration

Legal Capacity

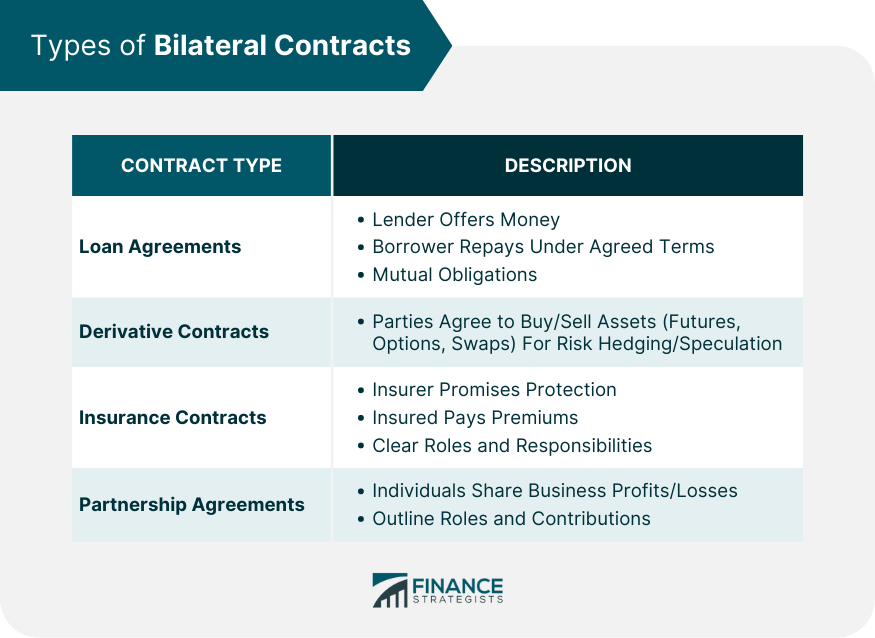

Types of Bilateral Contracts in Finance

Loan Agreements

Derivative Contracts

Insurance Contracts

Partnership Agreements

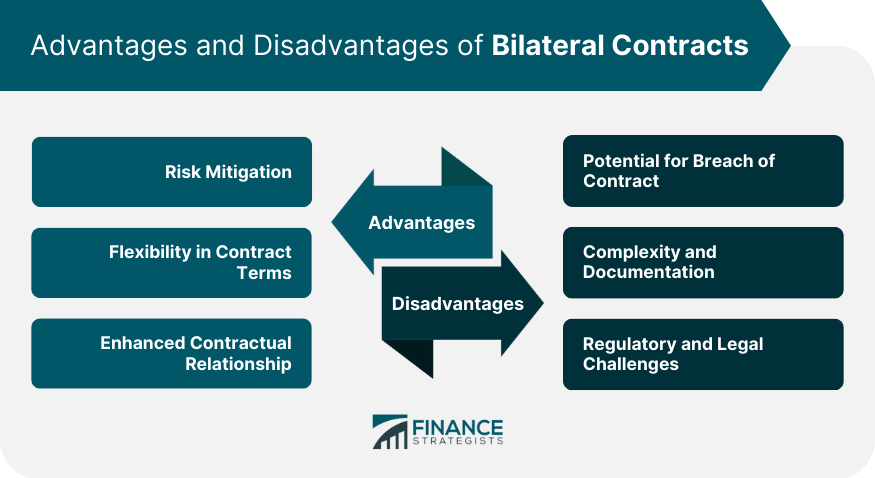

Advantages of Bilateral Contracts in Finance

Risk Mitigation

Flexibility in Contract Terms

Enhanced Contractual Relationship

Disadvantages of Bilateral Contracts in Finance

Potential for Breach of Contract

Complexity and Documentation

Regulatory and Legal Challenges

Best Practices for Drafting Bilateral Contracts

Clear and Specific Terms

Provisions for Contingencies

Compliance With Regulatory Requirements

Determining Unilateral From Bilateral Contracts

Conclusion

Bilateral Contract FAQs

A bilateral contract is one in which one party exchanges a promise in consideration for another party’s promise.

If a contract is bilateral it means that both parties are committed to providing something for the other.

An example of a bilateral contract is your home mortgage; it obligates you to pay the mortgage and the lender to tender the purchase price to the seller when signed.

A contract must be a this-for-that exchange of goods, services, or promises, and the consideration is the “this” and “that.”

Under a unilateral contract the promisor is not obligated to provide their consideration until and if the promisee delivers their consideration.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.