Line of credit interest rates are the costs incurred for borrowing money from a line of credit. They are expressed as an annual percentage rate (APR) and are applied to the outstanding balance of the line of credit. When a borrower accesses funds from the line of credit, they are charged interest on the amount drawn. Unlike loans, the interest rates on lines of credit are typically variable, changing in conjunction with broader interest rate environments or the lender's discretion. The average interest rates for a personal line for credit range from 8% - 10%. The average rate for a home equity line of credit, or HELOC, is 5.35%. Credit cards generally have the highest rates of any line of credit. Securing an LOC may get you a lower rate, but may also be a greater financial risk. These interest rates are an essential component of a line of credit as they directly influence the total repayment amount. In periods of economic prosperity, interest rates tend to rise, reflecting increased lending activity. Conversely, during economic downturns, central banks often lower interest rates to stimulate borrowing and investment. Lenders assess this through factors like credit score, repayment history, and current debt levels. Generally, borrowers with high credit scores and robust repayment histories are considered low-risk and are therefore offered lower interest rates. Different lines of credit such as personal, business, or home equity lines of credit, carry different levels of risk for the lender. For example, a business line of credit may come with a higher interest rate than a personal line of credit due to the higher risk associated with business ventures. Similarly, a secured line of credit like a home equity line of credit (HELOC) will typically offer lower interest rates than an unsecured line of credit. Collateral reduces the risk to the lender, providing a form of security. If the borrower defaults, the lender can seize the collateral to recover their losses. Because of this reduced risk, lines of credit that involve collateral typically have lower interest rates. Conversely, unsecured lines of credit, which do not require collateral, come with higher interest rates due to the increased risk for lenders. Variable interest rates on lines of credit change over time, fluctuating with market conditions. When market interest rates rise, the interest rate on the line of credit increases, and when market rates fall, it decreases. This variability can lead to changes in the amount of monthly payments, making budgeting a bit more challenging. However, during times of falling interest rates, borrowers can benefit from lower repayment costs. Unlike variable rates, fixed interest rates remain constant over the life of the line of credit. They provide stability, as the cost of borrowing does not change regardless of market conditions. This allows borrowers to plan their payments with certainty. However, fixed rates tend to be higher initially than variable rates to compensate for the risk the lender takes in locking the rate. Some lines of credit come with interest rates tied to the prime rate, a benchmark interest rate used by banks. When the prime rate changes, the interest rate on the line of credit changes correspondingly. The advantage of a prime rate-based interest rate is that it's typically lower than other rates. However, it fluctuates, making it harder for borrowers to predict their future payments. Some lines of credit, especially those with international banks, use the London Interbank Offered Rate (LIBOR) as a reference for their interest rates. Like prime rate-based interest rates, LIBOR-based rates adjust with changes in the benchmark rate. Borrowers should note that the LIBOR is set to phase out by the end of 2021, and alternative reference rates will be adopted. Given the potential for changes in interest rates, it's essential for borrowers to regularly monitor rate fluctuations. Understanding the current interest rate environment can help borrowers plan their line of credit usage and payments more effectively. Improving one's credit score and overall creditworthiness can lead to lower interest rates on lines of credit. Regularly reviewing credit reports, making timely payments, and keeping debt levels low can all contribute to a better credit score. Lenders may be willing to negotiate interest rates, particularly for borrowers with strong credit profiles or long-standing relationships. It's always worth discussing this possibility with the lender, especially if market interest rates have fallen or your credit score has improved. If interest rates drop significantly, it may be beneficial to refinance the line of credit. Refinancing involves replacing the existing line of credit with a new one, ideally with a lower interest rate. A borrower's credit score and credit history play crucial roles in determining the interest rate on a line of credit. Lenders view a high credit score and a clean credit history as signs of a responsible borrower, thus warranting a lower interest rate. Conversely, a low credit score or a history of late payments signals a higher risk to the lender, leading to a higher interest rate. Lenders also take into consideration the borrower's financial stability and income. A stable job with a consistent, high income demonstrates the borrower's ability to repay the borrowed funds, leading to a lower interest rate. A borrower with unstable employment or irregular income might be seen as a higher risk, resulting in a higher interest rate. The size and term of the line of credit can also affect the interest rate. Larger lines of credit or those with longer terms may come with higher interest rates due to the increased risk to the lender. Having a good relationship with the lender can also help secure a lower interest rate. For example, if you've been a loyal customer and have a history of timely payments, a lender might offer a lower rate to maintain the relationship. Similarly, if you have multiple accounts or services with the lender, you might qualify for a lower rate as part of a customer loyalty program. Borrowers can draw from their line of credit whenever needed, paying interest only on the amount used. This is particularly beneficial for businesses or individuals who need to manage cash flow or unexpected expenses. Lines of credit often have lower interest rates compared to other types of loans such as credit cards or payday loans. This makes lines of credit a more cost-effective borrowing option for many individuals and businesses. Moreover, some lines of credit offer interest-only payment options during the draw period, further increasing their financial flexibility. Certain types of lines of credit, such as home equity lines of credit, may come with potential tax benefits. The interest paid on these lines of credit may be tax-deductible, providing a significant advantage to borrowers. However, tax laws are subject to change and vary by location, so borrowers should consult with a tax advisor to understand potential tax implications. While variable interest rates can be advantageous in a declining interest rate environment, they can also lead to higher costs when rates rise. Increased rates translate to higher monthly payments, potentially creating financial strain for borrowers who haven’t budgeted for the extra cost. To secure a lower interest rate, lines of credit often require collateral or security. This places the borrower at risk of losing the collateral—such as a home or vehicle—in the event of default. It is crucial for borrowers to fully understand the terms and risks associated with secured lines of credit. Since many lines of credit feature variable interest rates, predicting the total interest cost over time can be difficult. This uncertainty can make budgeting challenging and may lead to unexpected increases in the cost of borrowing. Line of credit interest rates represent the cost of borrowing and can vary significantly based on several factors, including market conditions, the borrower's creditworthiness, and the type of line of credit. The factors influencing these interest rates range from broader economic conditions to individual borrower characteristics. The borrower's credit score, financial stability, and the loan amount and term all contribute to the final interest rate on a line of credit. The process of determining line of credit interest rates is complex and takes into account various aspects of the borrower's financial situation as well as the lender's policies. This can help borrowers better negotiate their interest rates and make informed decisions about their borrowing options.What Are Line of Credit Interest Rates?

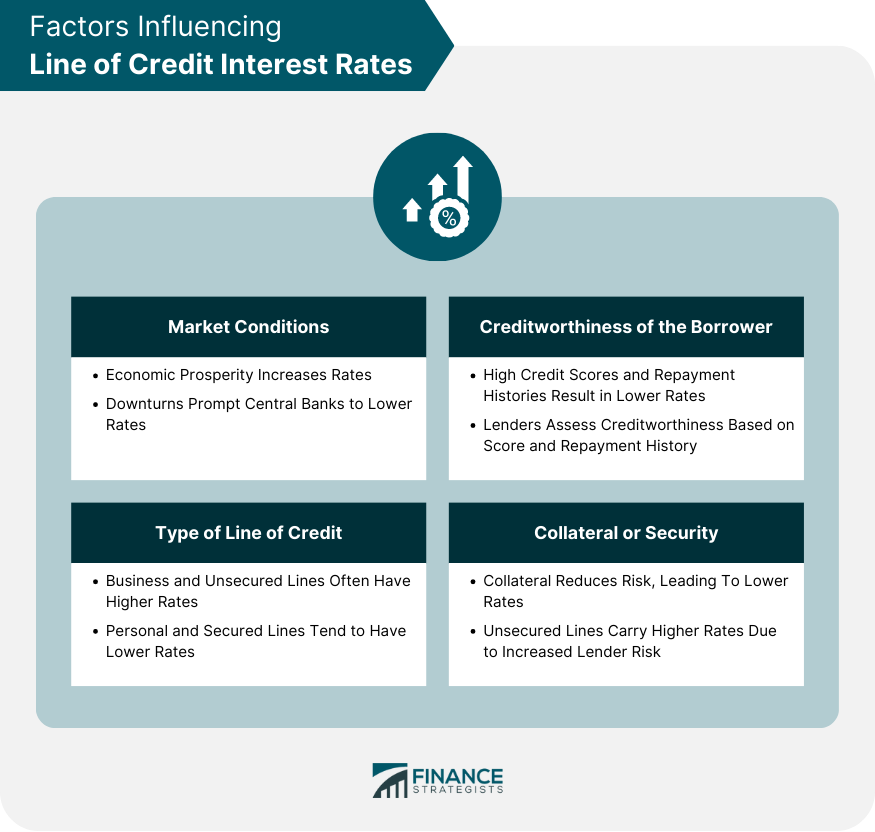

Factors Influencing Line of Credit Interest Rates

Market Conditions

Creditworthiness of the Borrower

Type of Line of Credit

Collateral or Security

Types of Line of Credit Interest Rates

Variable Interest Rates

Fixed Interest Rates

Prime Rate-Based Interest Rates

LIBOR-Based Interest Rates

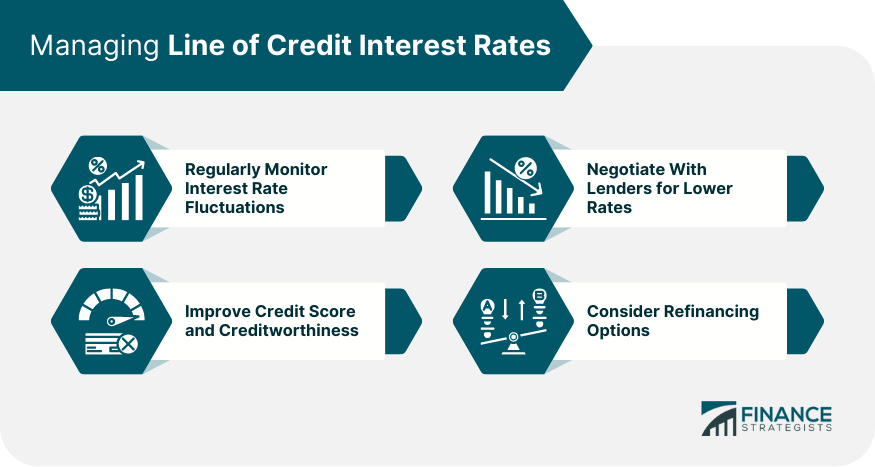

Managing Line of Credit Interest Rates

Regularly Monitor Interest Rate Fluctuations

Improve Credit Score and Creditworthiness

Negotiate With Lenders for Lower Rates

Consider Refinancing Options

Determining Line of Credit Interest Rates

Credit Score and History

Financial Stability and Income

Loan Amount and Term

Relationship With the Lender

Advantages of Line of Credit Interest Rates

Flexibility in Borrowing

Lower Interest Rates in Comparison to Other Loan Types

Potential Tax Benefits

Disadvantages of Line of Credit Interest Rates

Variable Interest Rates Can Increase Over Time

May Require Collateral or Security

Difficulty in Predicting Future Interest Costs

Conclusion

Line of Credit Interest Rates FAQs

The average interest rate for a line of credit generally ranges from 7-21%, depending on factors such as your credit score, income level, and other personal financial indicators.

Yes, typically if you have good credit with a high FICO score and a history of responsible borrowing, you can qualify for a lower interest rate on your line of credit.

You may be able to reduce the interest rate on your line of credit by consolidating other high-interest debt or taking out a personal loan with a lower rate.

Yes, different types of lines of credit may have different interest rate ranges based on factors such as the amount borrowed and the terms of the loan.

Interest rates on lines of credit can fluctuate depending on market conditions and changes in the Federal Reserve rate. It is best to check with your lender periodically to ensure that you are getting the best possible rate for your line of credit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.