A 401(k) plan is terminated when the plan sponsor decides to stop sponsoring the plan. In most cases, the plan sponsor can terminate their plan at their discretion. However, terminating a plan requires more than a mere decision by the sponsor. The IRS website states that "The IRS considers a 401(k) plan terminated only if: The date of termination is established (this can take the form of a plan amendment, liabilities' resolution, or complete discontinuance of contributions); The benefits and liabilities under the plan are determined as of the date of plan termination; and All assets are distributed as soon as administratively feasible, generally within one year after the date of plan termination. A 401(k) plan that has not distributed its assets as soon as administratively feasible is considered an ongoing plan and must continue to meet the qualification requirements, including amending the plan document for law changes. If you maintain another plan, you may have to transfer employees' elective deferral accounts to the other plan rather than distributing them to employees." Have questions about 401(k) Plan Terminations? Click here. It is also possible to only partially terminate a 401(k) plan. This can happen if the sponsor makes a change or takes action that causes a significant decrease in plan participation (usually at least 20%). The IRS website states that a plan can be partially terminated due to "Layoffs, plan amendments, or business reorganizations that cause a decrease in plan participation are counted even if they result from economic circumstances beyond the employer's control." There are special considerations for those who are partially vested in the plan being terminated. All plan participants automatically become 100% vested in the plan on the date of termination, regardless of the actual vesting schedule or how far along each participant was in the schedule. When a company undergoes restructuring, it often leads to significant changes in its operations, management, or structure. Such changes can affect the company's financial health and stability, leading to decisions about discontinuing certain employee benefits, including 401(k) plans. In some cases, the restructuring may lead to the creation of a new business entity, which may have its retirement plan. Terminating the old 401(k) plan can provide flexibility for the company and align with its new strategic goals. Mergers and acquisitions can result in the merging of different company cultures, operations, and benefits packages. When two companies combine, they might possess two separate 401(k) plans. To streamline operations and provide uniform benefits to all employees, the new entity might decide to consolidate these plans, leading to the termination of one or both existing plans. This is often done to reduce administrative burdens and to ensure that retirement benefits align with the overarching goals and strategies of the newly formed company. Bankruptcy is a financial state where a company cannot meet its debt obligations. When a company declares bankruptcy, its assets might be sold to pay off creditors. In such scenarios, continuing a 401(k) plan might be untenable. The termination of a 401(k) plan during bankruptcy ensures that employees can access their funds and that the company meets its legal obligations regarding the plan. Lastly, when a business closes, it ceases all operations permanently. In such cases, there's no need to continue the 401(k) plan as there are no employees to contribute to or benefit from it. The plan termination process ensures that participants receive their due benefits and that the company settles any outstanding obligations related to the plan. A crucial first step in the 401(k) plan termination process is notifying all plan participants about the impending termination. This is not just a best practice but a regulatory requirement. Employees have a right to know about changes that affect their retirement savings. Notifications should be clear, detailing the reasons for termination, the process, and how it will affect the participants' assets. Once a 401(k) plan is terminated, participants will need to decide how they want their funds distributed. They generally have several options: take a lump sum distribution, roll over the funds to an Individual Retirement Account (IRA) or another employer's plan, or in some cases, leave the funds in the current plan. This is especially true if the plan is being replaced by another within the same company. Each option has its advantages and potential drawbacks, and the best choice often depends on individual financial situations and goals. The distribution method chosen by participants can have tax implications. Taking a lump sum distribution, for instance, can lead to immediate taxation and potential penalties if the participant is below the age of 59½. On the other hand, rolling over the funds to an IRA or another 401(k) plan can allow the participant to defer taxes until the funds are withdrawn in retirement. Participants should be aware of these implications when making their decisions. In 401(k) plans, vesting refers to the percentage of the account the employee truly owns, especially concerning employer contributions. By the time of plan termination, some employees might not be fully vested. Depending on the plan's rules and the company's decisions, termination might result in immediate full vesting for all participants, or employees might only receive the vested portion of their account. The termination of a 401(k) plan can disrupt an employee's retirement planning. Such plans are often central to an individual's retirement strategy, offering a structured way to save and invest for the future. When terminated unexpectedly, participants may need to reassess their retirement goals and find alternative ways to make up for potential shortfalls. Many 401(k) plans feature employer contributions, where companies match a portion of the employee's contributions. Termination of the plan might mean the loss of future employer-matched funds, which can significantly reduce the potential growth of retirement savings over time. While participants typically retain their vested employer contributions, the loss of future matches can be a blow to their retirement strategy. A 401(k) plan's termination might necessitate the liquidation of investments, which can have market implications. If many participants decide to liquidate simultaneously, it could potentially affect the market prices of the underlying assets. Moreover, participants might miss out on potential market rebounds if they're forced to cash out during a market downturn. When a 401(k) plan is terminated, participants might consider rolling over their funds to an IRA or another employer's 401(k) plan. While this can be a smart move to maintain tax-advantaged growth, it's essential to be aware of rollover rules, potential fees, and the investment options available in the new account. The Employee Retirement Income Security Act (ERISA) sets standards for retirement plans to protect participants. When terminating a 401(k) plan, companies must ensure they comply with ERISA regulations, which dictate the proper handling of plan assets, timely communication with participants, and the fair distribution of funds. ERISA and other regulations emphasize the importance of clear and timely communication with plan participants during termination. Participants should be informed about the reasons for termination, the timeline, distribution options, and any other pertinent information. This not only ensures regulatory compliance but also helps maintain trust and goodwill among employees. During termination, it's crucial to handle plan assets with care and in the best interests of participants. Funds should be distributed or rolled over promptly, and any fees or costs associated with termination should be transparent and reasonable. Companies should avoid any actions that could be perceived as mismanagement or misappropriation of assets. Companies terminating a 401(k) plan must meet specific reporting requirements. This includes filing a final Form 5500, which is an annual report about the plan's financial conditions and operations. Proper documentation ensures transparency and demonstrates compliance with regulatory obligations. Clear and transparent communication is key during a 401(k) plan termination. Companies should inform participants well in advance, provide resources to address concerns, and be available for questions. This approach can mitigate anxiety and confusion among employees and facilitate a smoother transition. Given the complexities of rollovers, companies should consider offering assistance, either through in-house experts or external financial advisors. This can help participants make informed decisions and ensure a smooth transition of funds to new retirement accounts. Ensuring full compliance with ERISA and other applicable regulations is not just a legal necessity but also a demonstration of a company's commitment to its employees. Companies should be thorough in their documentation, reporting, and asset handling to ensure the protection of participants' rights and interests. Given the potential financial ramifications of a 401(k) plan termination, companies should consider offering financial counseling services to participants. This can provide employees with the knowledge and tools they need to navigate the termination and adjust their retirement planning accordingly. A 401(k) plan termination occurs when a sponsor decides to cease the plan, and it involves adhering to IRS guidelines, communicating effectively with participants, and ensuring compliance with fiduciary responsibilities. The reasons for termination, including company restructuring, mergers and acquisitions, bankruptcy, and business closure, underscore the need for careful planning and transparent communication. Participants face potential disruptions in retirement planning, loss of employer contributions, investment impact, and rollover considerations. Adhering to best practices, such as transparent communication, assistance with rollovers, regulatory compliance, and offering financial counseling, can mitigate the negative consequences of plan termination. Balancing legal obligations, participant needs, and effective communication is crucial in navigating the complex landscape of 401(k) plan termination.Overview of 401(k) Plan Termination

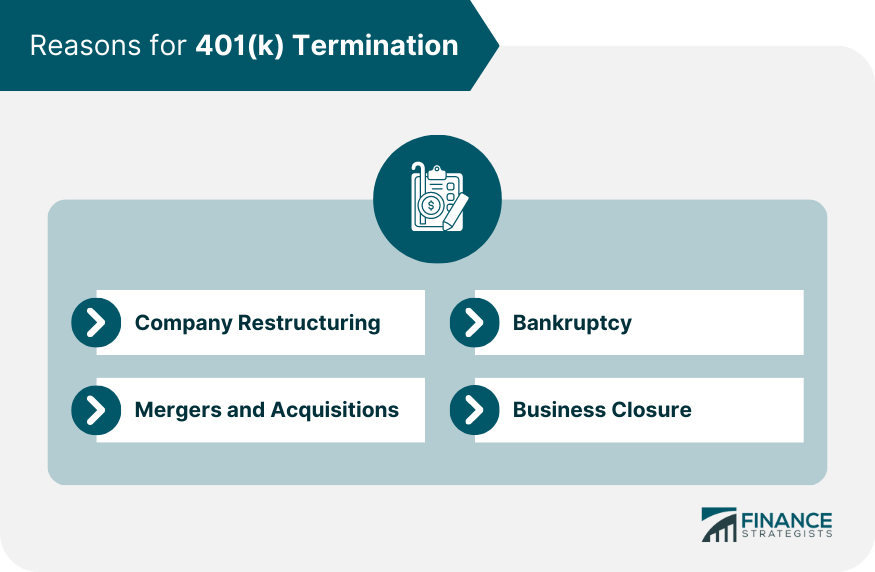

Reasons for 401(k) Termination

Company Restructuring

Mergers and Acquisitions

Bankruptcy

Business Closure

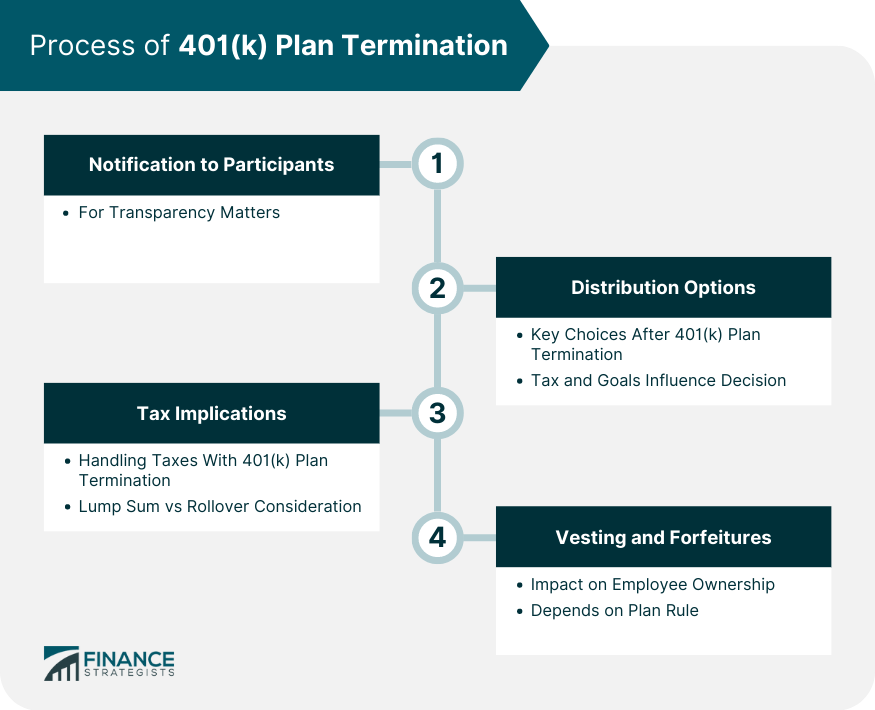

Process of 401(k) Plan Termination

Notification to Participants

Distribution Options

Tax Implications

Vesting and Forfeitures

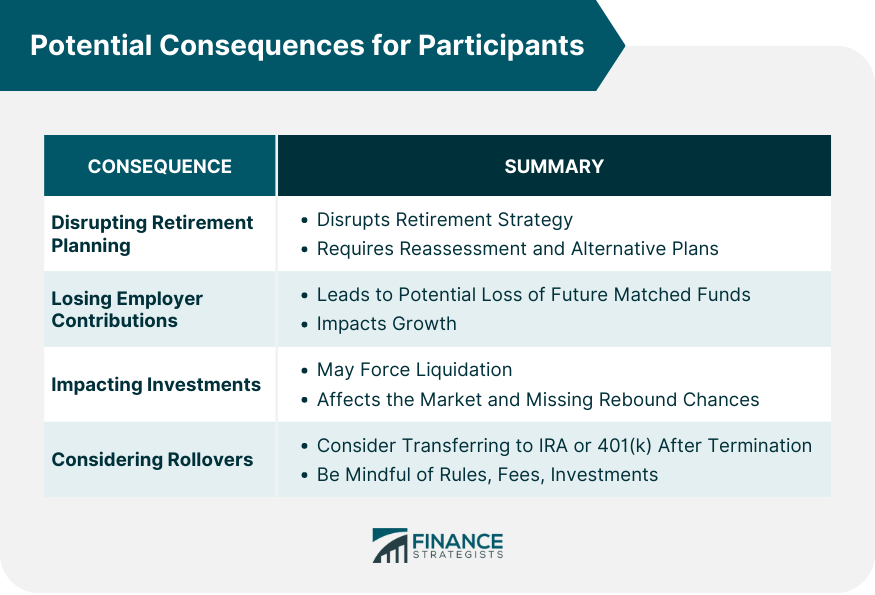

Potential Consequences for Participants

Disruption of Retirement Planning

Loss of Employer Contributions

Investment Impact

Rollover Considerations

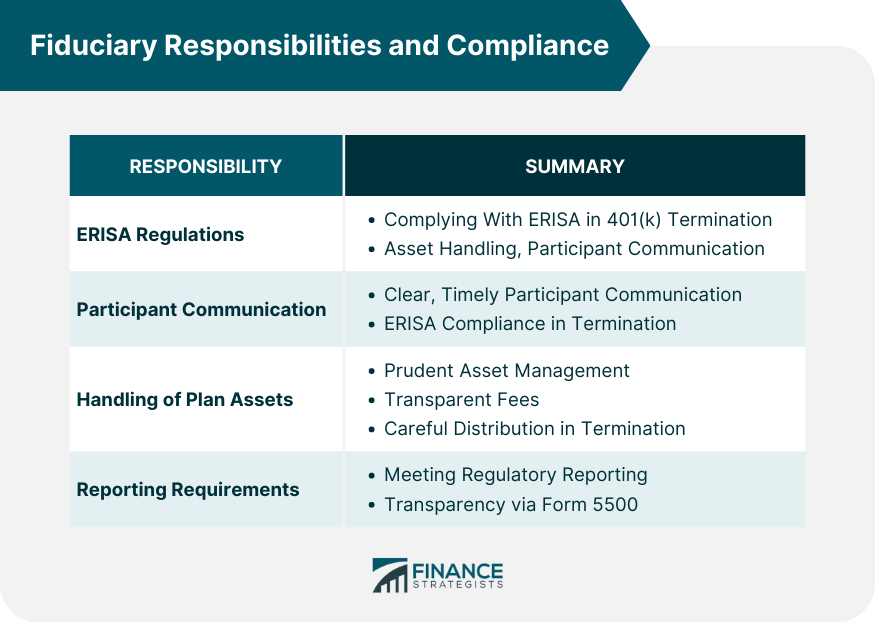

Fiduciary Responsibilities and Compliance

ERISA Regulations

Participant Communication

Handling of Plan Assets

Reporting Requirements

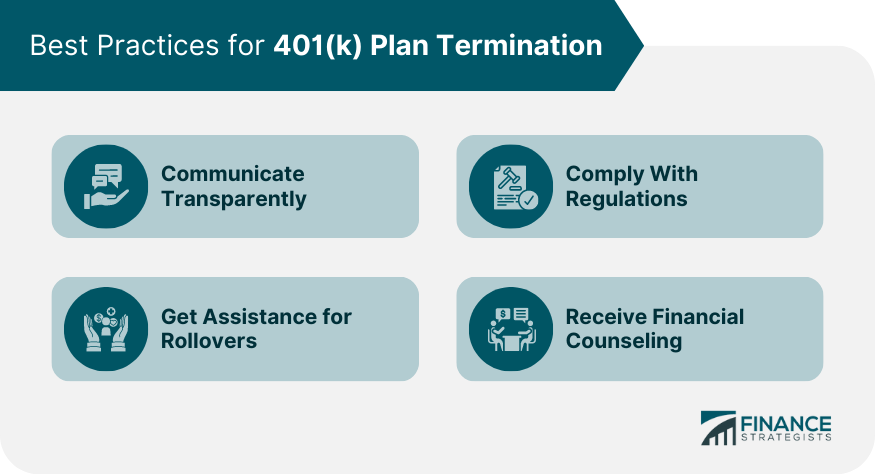

Best Practices for 401(k) Plan Termination

Communicate Transparently

Get Assistance for Rollovers

Comply With Regulations

Receive Financial Counseling

Conclusion

401(k) Plan Termination FAQs

A 401(k) plan is a retirement plan offered by an employer designed to help employees save for retirement.

A 401(k) plan is terminated when the plan sponsor decides to stop sponsoring the plan. In most cases, the plan sponsor can terminate their plan at their discretion.

You must submit a written request to the administrator of your 401(k) plan and provide them with instructions on how you wish to proceed with terminating the plan.

When you terminate your 401(k) plan, any vested funds in the account will be distributed according to the terms of the plan document and any applicable laws. Depending on your situation, you may be able to transfer or roll over some or all of those funds into another qualified retirement savings vehicle, such as an IRA or another employer's qualified retirement plan.

Generally, no. Unless your plan documents state otherwise, there are usually no fees or penalties associated with terminating a 401(k) plan. However, any applicable taxes may apply to distributions from the plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.