Investing via a 401(k) retirement plan offers immediate, pre-tax savings on your contributions. Your income is reduced by the amount of your contribution before any taxes are withheld from your pay or counted as part of your taxable income. One major disadvantage to 401(k) accounts becomes evident when you take money out: any withdrawals are taxed as regular income. So, if you withdraw money in, say, the 20% tax bracket, you'll pay taxes at that rate on all the funds you take out – including your original contributions and all the investment gains. Some 401(k) plans include a matching contribution from your employer. If your match is, say, 100% of the first 3% of employee contributions, you receive an immediate 3% return on your investment. Investments in individual stocks offer no comparable tax benefits. However, some stockbrokers allow investors to purchase pre-IPO shares (privately held companies that are not yet publicly traded) in their taxable accounts. These shares often offer an enormous return on investment, but have strict terms, are not guaranteed to work out, and do not always provide the same protections for your money that a more established company might. A 401(k) account's restrictions can be severe. Some plans allow only pre-determined mutual funds to be chosen from a list provided by the plan administrator. Others have restrictions on what can be done with your funds when you leave the company. It's either in the form of a withdrawal fee or in full forfeiture if you don't roll your money into an IRA within so many days after leaving your job. On the other hand, investing in individual stocks offers a great deal of liquidity. You can buy and sell stocks as you please, within the limits of your available funds. This enables you to tailor your portfolio to match your specific risk tolerance and time horizon. Contributions to a 401(k) account are made before taxes are deducted from your pay. This lowers your taxable income for the year. Some employers match employee contributions, like getting an immediate return on your investment. Money taken out of a 401(k) account is not taxed as regular income. This only applies to withdrawals made after you have stopped working for the company that sponsors your 401(k) plan. Employers often choose low-risk mutual funds for401(k) plans since this is most likely to be suitable for most employees. Most 401(k) plans only allow investment in predetermined mutual funds. If you don't like the funds your plan provides or if they happen to be performing poorly, you're stuck. If you need to access your funds before that age, you'll have to pay the penalty and regular income taxes for the withdrawal. Once you stop working for a company that sponsors your 401(k) plan, it can take back any money they contributed on your behalf should you leave the company before reaching the age of 59-1/2. Most 401(k) plans only offer low-risk mutual funds. If most of your assets are tied up in this type of fund, you may not be able to reach your long-term investment goals. You can invest in any company or company you please within the limits of your available funds. This allows you to tailor your portfolio to match your specific risk tolerance and time horizon. Stocks have notably offered a higher rate of return than the average mutual fund, but this may not be true in the future. Stocks are riskier investments than 401(k) accounts or low-risk mutual funds since they offer a higher rate of return. This also means you could potentially lose your entire investment. Stocks are riskier investments than 401(k) accounts or low-risk mutual funds. This means you could lose your entire investment if the stock market crashes. Time commitment You need to be willing to spend time monitoring your portfolio to make sure it stays on track. If you invest in individual stocks, you pay taxes on any money made from selling or redeeming shares. This is not the case with 401(k) plans or low-risk mutual funds. When deciding whether to invest in a 401(k) or stocks, it's essential to consider your specific goals and risk tolerance. If you are thinking of a low-risk option with minimal maintenance, a 401(k) may be the best choice for you. But if you're willing to take on more risk in order to potentially earn a higher return, stocks may be a better option. It's crucial to remember that there is no one-size-fits-all answer. The best investment for you may vary depending on your age, income, and other factors. It's also essential to be aware of the risks and rewards associated with each investment before making a decision. Considering the pros and cons of each option will help you make a more informed decision about where to invest your money. Lastly, remember that it's important to invest for the long term. Don't try to time the market - you're more likely to lose money that way. Instead, find an investment that aligns with your goals and risk tolerance, and stick with it.Tax Savings

Deciding between investing in 401(k) and stocks? Click here.Employer Matching

No Comparable Tax Benefits

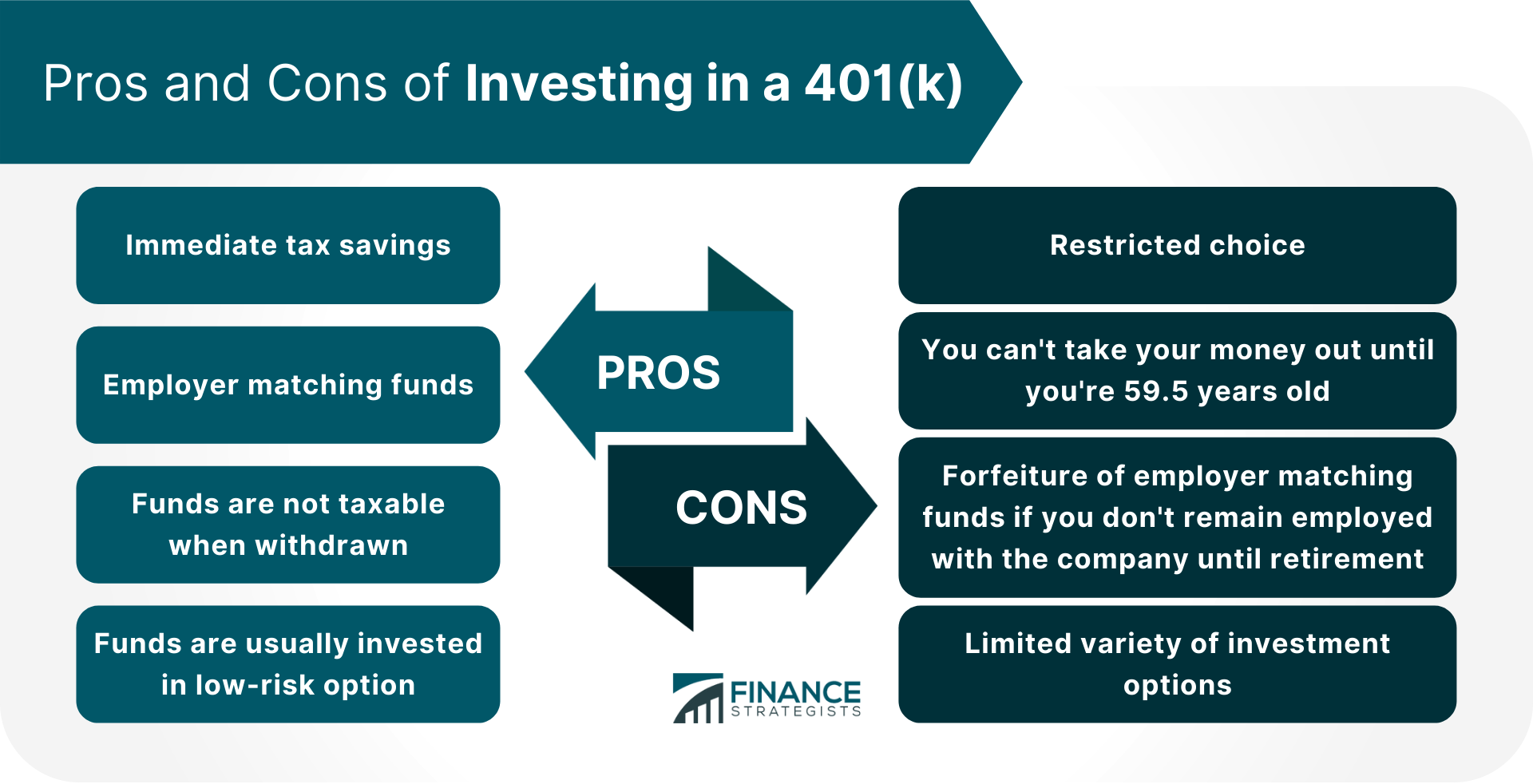

Pros and Cons of Investing in a 401(k)

Pros of Investing in a 401(k) Include:

Immediate Tax Savings

Employer Matching Funds

Funds Are Not Taxable When Withdrawn

Funds Are Usually Invested in Low-Risk Options

The Cons Include:

Restricted Choice

You Can’t Take Your Money Out Until You’re 59.5 Years Old

Forfeiture of Employer Matching Funds if You Don’t Remain Employed With the Company Until Retirement

Limited Variety of Investment Options

Pros and Cons of Investing in Stocks

Pros of Investing in Stocks Include:

Ability to Create a Personalized Portfolio

Higher Potential Returns

Higher Potential for Loss

The Cons Include:

Possibility of Losing Your Entire Investment

Taxes

How to Decide Which Investment Is Right for You?

401(k) vs Stocks FAQs

A 401(k) account is an employer-sponsored retirement savings plan. You usually don't pay taxes until you withdraw your funds, and while it's possible to take out a loan from your 401(k), you'll have to pay the money back with interest.

The majority of people should invest in a 401(k), especially if their employer offers matching funds.

401(k) plans are investment accounts that offer pre-tax contributions and allow you to invest in a variety of mutual funds. Stocks, on the other hand, provide an opportunity to invest directly in individual companies or exchange-traded funds. 401(k)'s offer potentially lower risk and higher returns than stocks, but stocks provide more control over the portfolio and potentially higher returns.

It depends on your goals, risk tolerance, and time horizon. 401(k) plans provide pre-tax contributions, but limited investment options. Stocks offer more control over the portfolio, but also carry more risk. Ultimately, the best investment for you may vary depending on your age, income, and other factors.

The significant risk is that you could lose your entire investment if the stock market crashes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.