An IRA, or individual retirement account, is a type of savings account that allows you to save for retirement. You can contribute money to an IRA on a pre-tax or post-tax basis, and the money in your account can grow tax-free. There are a number of different types of IRAs, including Roth and traditional IRAs. Have questions about IRA transfers? Click here.

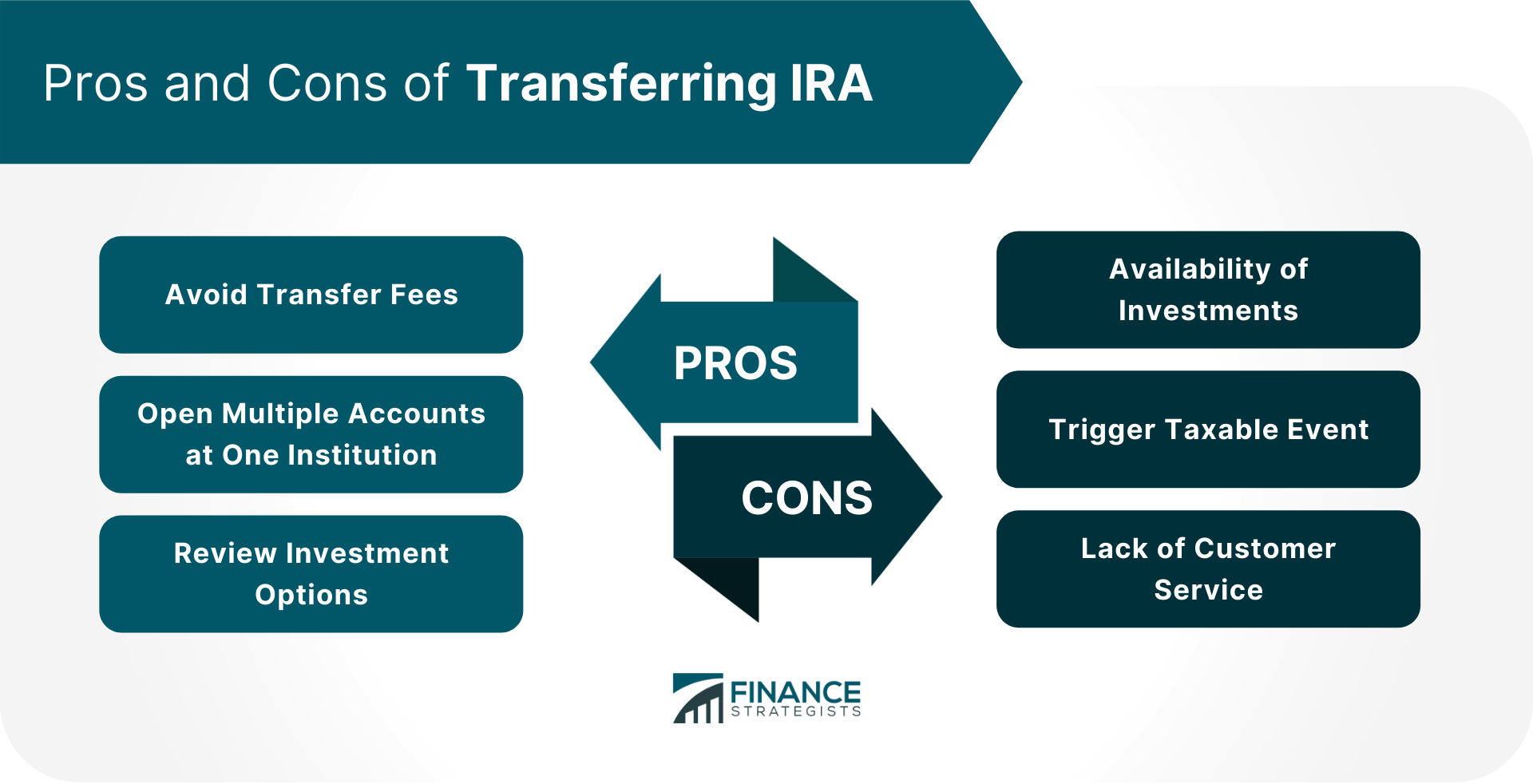

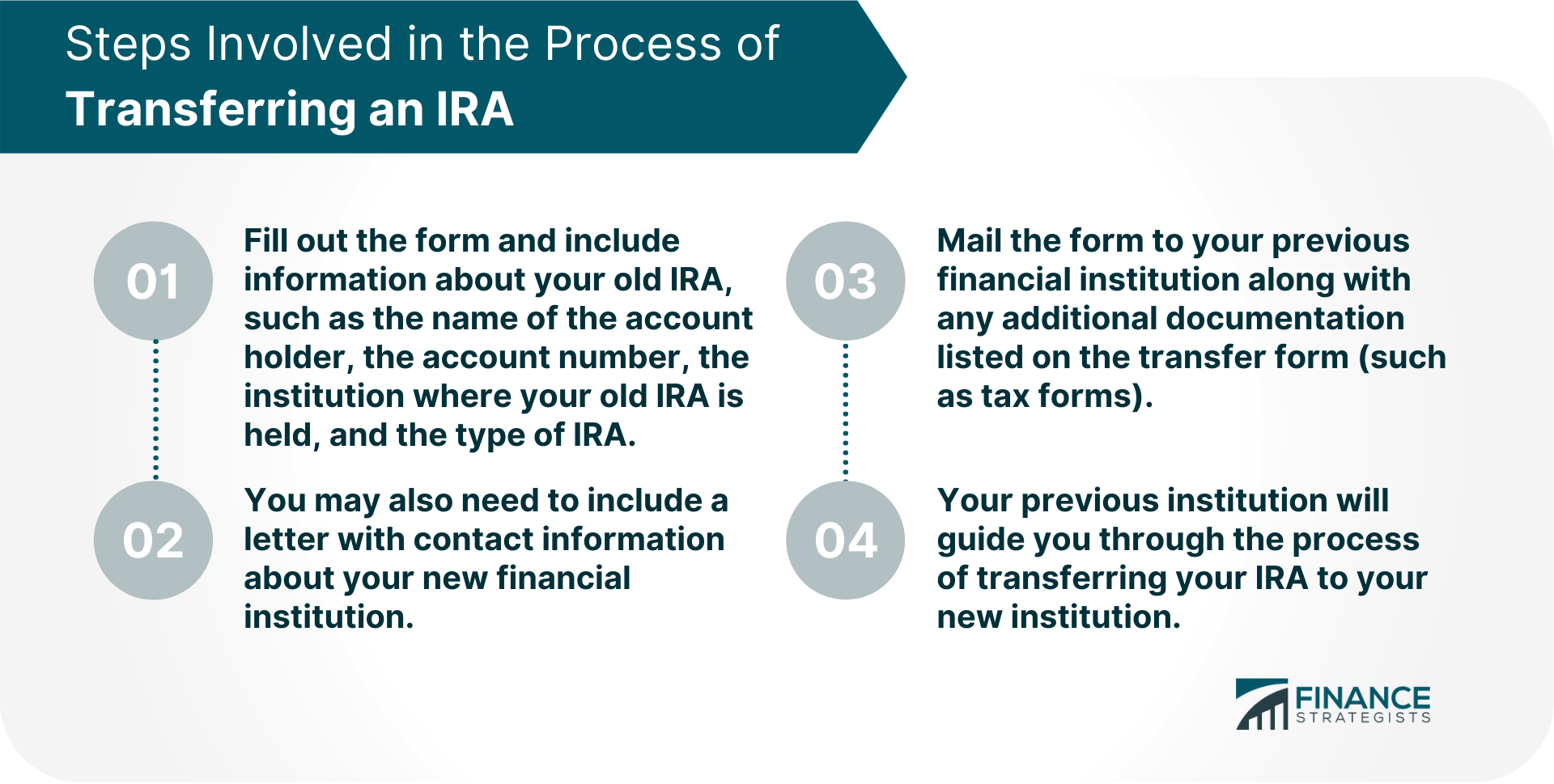

If you have an IRA with a previous financial institution, you may be able to transfer it to your new institution. This can be a great way to save on fees and get started with your retirement savings plan. Transferring an IRA can help you avoid fees and get started with your retirement savings plan. However, there are some other factors to consider before transferring your old IRA: Putting your money in a savings or checking account is usually less expensive than investing it. Compare the costs of transferring an IRA at your current institution to fees you'd incur by opening up a new IRA at another institution. If you are considering moving your IRA from one financial institution to another, make sure to look into the investment options at the new institution. You don't want to be stuck with the same investment options you had at your previous institution. When transferring an IRA, you will trigger a taxable event. This could mean that you'll owe taxes on the money that's transferred. Make sure you are aware of the potential tax implications before transferring your IRA. If you are considering transferring an IRA to another financial institution, check out the reviews for your new institution beforehand. This will give you an idea of how reputable it is and if its fees are reasonable. There are two types of IRA transfer: This is when you move your IRA to another institution without triggering a taxable event. For example, if your previous IRA provider goes out of business, you may need to rollover your old IRA into another institution. Rollover transfer is a good option if you want to transfer IRA without incurring a taxable event. With a direct transfer, your new institution will move the money in your IRA directly from your previous account to your new one without having to go back to you for permission or send it back when the transaction is complete. To avoid triggering a taxable event, you may need to fill out the Internal Revenue Service form with your new institution. Consult with a professional tax attorney before proceeding with either of these transfers. If you are considering transferring an IRA, there are also some benefits to consider. Depending on which IRA provider you choose, you could transfer your IRA without having to pay fees. This can make the process of transferring an IRA easier and less expensive for you. Transferring IRA can help you open up multiple accounts at one institution. This is ideal if you want to put different currencies or investments into separate IRA accounts. When transferring an IRA, you have the opportunity to review the investment options available to you. Depending on your current provider, you may be able to open up a new IRA with better investment options. There are also some downsides and things to think about before transferring an IRA: Make sure to find out what investments are available through the new institution before transferring your IRA. You may not be able to find the same investments you currently have. When transferring an IRA, you will trigger a taxable event. This means you will have to pay taxes on the money that's transferred. If you're unhappy with the customer service at your current institution, transferring your IRA may not be the best solution. Make sure to research the customer service at the new institution before transferring your money. There are a few steps involved in the process of transferring an IRA from one institution to another: Transferring an IRA can help you consolidate your accounts, review your investment options, avoid transfer fees and open up multiple accounts at one institution. It's important to consider if the new IRA provider has all of the investments you need as well as look into any costs associated with transferring your money. In addition, transferring an IRA can trigger a taxable event, so be sure to understand the implications before making a decision.What Is an IRA?

Transferring My Existing IRA From One Institution to Another

Review Fees

Review Investment Options

Understand Tax Implications

Check Out Your New Institution's Reviews

Types of IRA Transfer

Rollover Transfer

Direct Transfer

Benefits of Transferring IRA

For example:

Avoid Transfer Fees

Open Multiple Accounts at One Institution

Review Investment Options

Cons of Transferring IRA

Availability of Investments

Trigger Taxable Event

Lack of Customer Service

The Steps Involved in the Process of Transferring an IRA

The Bottom Line

Transferring IRA FAQs

An IRA is an individual retirement account, which is a type of savings account that allows you to save for retirement.

Yes, you will trigger a taxable event when transferring your IRA from one institution to another. This means you will have to pay taxes on the money that's transferred.

First, you will need to fill out a form and include information about your old IRA. Then, mail the form to your previous financial institution along with any additional documentation.

There are two types of IRA transfers: rollover and direct.

The benefits of IRA transfer include consolidating your accounts, reviewing your investment options, and opening multiple accounts at one institution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.