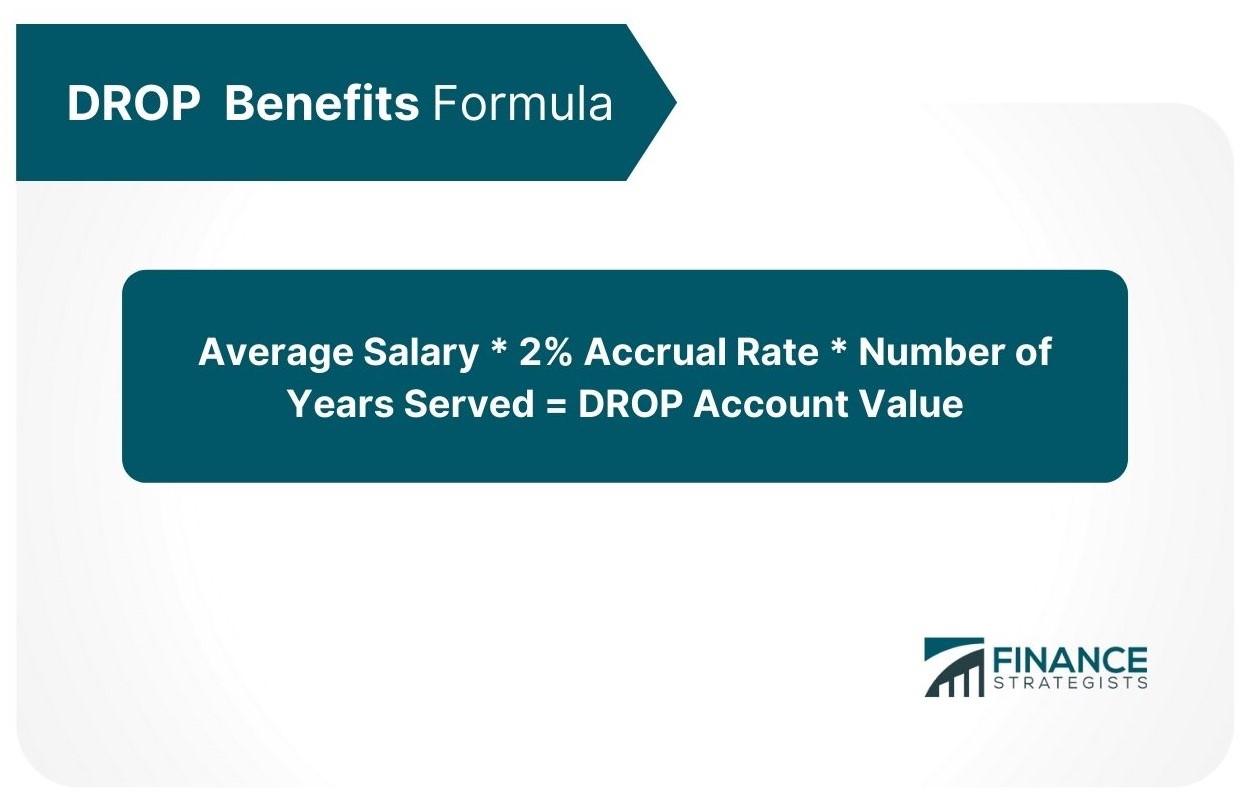

If you're nearing retirement age, Deferred Retirement Option Plans can be a powerful tool for you to create wealth, potentially maximize your retirement income, and leave more money to your loved ones. These plans are designed to keep employees on the job, keep valuable human capital in place, and allow employees to split their pension benefits between their pension and an immediate lump sum payment. Have a financial question? Click here. Deferred Retirement Option Plans are funded by employee payroll contributions, employers, and often with some state funding. This is a way for employees who are eligible to receive the pension benefits they've earned through years of service, but cannot or do not wish to stop working and risk losing their position. When the employee finally retires, this plan is dissolved and all funds are distributed to the employee. This allows the employee to start receiving the money they've earned without waiting until their normal retirement age and provides a source of income to supplement Social Security. DROPs work by allowing the employee to continue working past their retirement age, but their gross pay is offset with a reduction of pension payments. The employer places lump sum amounts into a Deferred Retirement Option Plan account, which are not taxed at the time of contribution. When the employee finally retires, they can begin withdrawing their pension funds as well as earnings on those accounts. For example, let's say that you are 55 years old but do not want to stop working. If you participate in Deferred Retirement Option Plan, instead of receiving the entirety of your pension at age 65, your current income is reduced by an amount equal to what would have been paid out as a pension. The remaining balance becomes part of your Deferred Retirement Option Plan account. When you finally do retire, you now have the Deferred Retirement Option Plan as well as your pension as a source of income. Due to the unique nature of Deferred Retirement Option Plans, they are only available in certain sectors. Law enforcement officers, firefighters, teachers, and other municipal employees may be eligible. Employees of private organizations are not eligible for this plan due to the lack of employer funding. However, DROP is becoming more common in state and local government organizations with the plan benefits being extended to public school employees. Keep in mind that these plans are voluntary, so you need to check with your employer before committing to this plan. For employees who are 55 years old at the time of enrollment into the retirement plan, your Deferred Retirement Period is five years or until you reach age 60, whichever occurs first. To calculate your DROP benefits, determine how much money will be contributed to the plan each year, multiply your average salary by a 2% accrual rate. Then multiply that by the years you've worked. This can be calculated by using this formula: For example, let's say an employee has worked for the same organization for fifteen years. $100,000 Average Salary * 2% Accrual Rate * 15 Years of Service = $30,000 Deferred Retirement Option Plan Account Value Keep in mind that the DROP Account Value depends on multiple factors: The age of the participant plays a large role in determining their plan benefit. Remember that Deferred Retirement Option Plans, as the name implies, are only available to employees who plan on retiring at some point. The older they are, the more likely it is for an employee to retire during a given time period. Calculations also take into account the rank of the participant. For example, if you are a police officer, you receive more plan compensation than someone with lower ranking or who is not certified as an emergency responder. Additionally, DROP rewards older employees for their experience and seniority. Another factor is the employee's pay rate. If you are drawing a normal salary, your plan benefit will be different from someone who draws hourly wages. Another factor to consider is the number of contributions made by your employer or state. While these plans are not meant to be huge income sources, they should act as a nice supplement to other retirement plans. However, if your plan is funded with huge amounts during your first few years of employment, this could provide a sizable income boost in the future. Finally, Deferred Retirement Option Plans have a waiting period before they become effective for the employee. After you have been with your employer for a set number of years, plan contributions start being made on your behalf. Once enough compensation has been received from contributions, you are eligible to receive distributions. While the plan may vary from state to state, they all share one major characteristic: once an employee begins drawing income from their plan account, it cannot be stopped. This is why Deferred Retirement Option Plans should only be used as a supplement to other retirement plans and not the main source of income. Roughly half of the states allow this plan to last for up to 10 years. This of course may vary by jurisdiction based on local guidelines and regulations. Overall, Deferred Retirement Option Plans are a nice perk to have as an employee. It comes with some risk, especially due to the lack of termination guidelines on the plan. But for those who expect to retire at some point in their lives, Deferred Retirement Option Plans can be a great way to boost your retirement income and give you some extra years to relax. What Is a Deferred Retirement Option Plan?

How Deferred Retirement Option Plans Work?

Who Is Eligible to Participate in DROP?

Calculating Your DROP Benefits

Age

Employee’s Rank/Position

Employee's Compensation

Plan Contributions

Number of Years Served

How Long May I Participate in DROP?

Final Thoughts

Deferred Retirement Option Plans FAQs

DROP plans are retirement plans that allow employees to continue working while still receiving their regular pay. These retirement plans were created so that an employee could receive a small, supplemental salary every month during the rest of their career. But once they retire, the plan benefits become available to them.

DROP plans work by allowing employees to continue drawing their regular paychecks during retirement. This is accomplished through the contributions made on the employee's behalf throughout their career. However, once they retire, all of those accumulated funds are available for withdrawal and distribution.

The Deferred Retirement Option Plan is only available to employees who are planning on retiring at some point. Once they reach a certain number of years with their employer, these plans are available for them to participate in.

Depending on the jurisdiction where you work, your Deferred Retirement Option Plan will have a time limit. This is designed so that employees do not continue drawing their salary while working for another employer.

DROP plans are a great way to guarantee income during retirement. It will also give you the chance to invest and consider other areas of your life while still receiving some taxable compensation on a monthly basis.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.