Accounting Ratios are ratios used to analyze a company's business and current financial standing. They are indicators of the company's financial health and measure various metrics associated with it, including profitability and liquidity. Accounting ratios are also used to spot and analyze companies in potential financial distress. The importance of accounting ratios differs based on the type of industry. For example, the inventory turnover ratio is an important accounting ratio in the retail industry but it has almost no significance for a boutique advisory firm. The three most common types of accounting ratios are debt ratios, liquidity ratios, and profitability ratios. Each of these ratios provides a window into a specific aspect of company operations. They are also known as solvency ratios and measure the debt of a company relative to various other figures. Debt ratios measure a company's long-term ability to pay off its debt obligations. The three most common debt ratios used by analysts are: Debt-to-Equity Ratio: This ratio measures the extent to which a company is financed with debt relative to equity. Debt Ratio: This ratio measures the company's financial leverage or the extent to which its assets are financed by debt. Long Term Debt Ratio: This ratio is similar to the debt ratio, except it measures long-term indebtedness – meaning it takes into account long-term debt for a company. Liquidity ratios are similar to debt ratios in that they are used to calculate a company's indebtedness. But they do not consider all assets and liabilities for a company in their calculations. Instead, liquidity ratios restrict their calculations to current assets and liabilities to measure the company's liquidity or ability to service short-term debt. If a company does not have sufficient liquidity, then it could tip over into bankruptcy. Here are a few common liquidity ratios: Current Ratio: This is the most common liquidity ratio used by analysts and measures a firm's capability to meet its short-term debt that is due in less than a year. Quick Ratio: This ratio measures a company's ability to meet its short-term debt with its most liquid instruments. Cash ratio: This ratio measures a company's ability to cover its debt obligations using only its cash holdings. This category of ratios measures a company's ability to generate profits from its overall revenue figures by considering expenses or equity. Some of the most commonly-used profitability ratios are as follows: Earnings Per Share (EPS): This ratio measures a company's profits on a per share basis i.e., it calculates the earnings accruing to each stakeholder in the company based on the number of shares that it has floated in the markets. Return on Equity (ROE): This ratio is similar to earnings per share and calculates a business's profitability from stockholder investments. Gross Margin: This ratio measures the profitability of a company by subtracting Cost of Goods Sold (COGS) from the overall profit figure. Accounting ratios are calculated on a periodic basis, usually yearly or quarterly, to analyze a company's cash flow and financial situation. Taken together over a period of time, the ratios provide a window into the company's operations and priorities. For example, debt ratios can be used to determine whether the company has enough liquid assets to avoid bankruptcy due to a business disruption. Profitability ratios are used to sift through revenue figures and calculate the company's actual profits. It is important to remember that no single ratio provides a comprehensive picture of a company's operations but it does provide useful information relating to a specific aspect of the company. As such, it is always best to use the ratios together to analyze an outfit. For example, high inventory figures can lead to high debt ratios and also affect profitability figures, depending on the company's inventory turnover. The other important thing to remember about accounting ratios is that they differ between industries. What might be considered as an important accounting ratio in one industry may not be as important in another. For example, the technology industry does not carry much inventory and the inventory turnover ratio is not such a useful metric to measure a company's performance in the industry. The same cannot be said of a company operating in the manufacturing industry because inventory turnover is the lifeblood of its operations. On the other hand, profitability ratios might be an important metric to measure for the tech industries. Tech companies make fewer capital investments as compared to traditional companies. But the services of major tech conglomerates like Google and Facebook are free. As such, their profitability ratios are important indicators of their ability to monetize their services while maintaining a lean outfit at the same time.Common Accounting Ratios

Debt Ratios

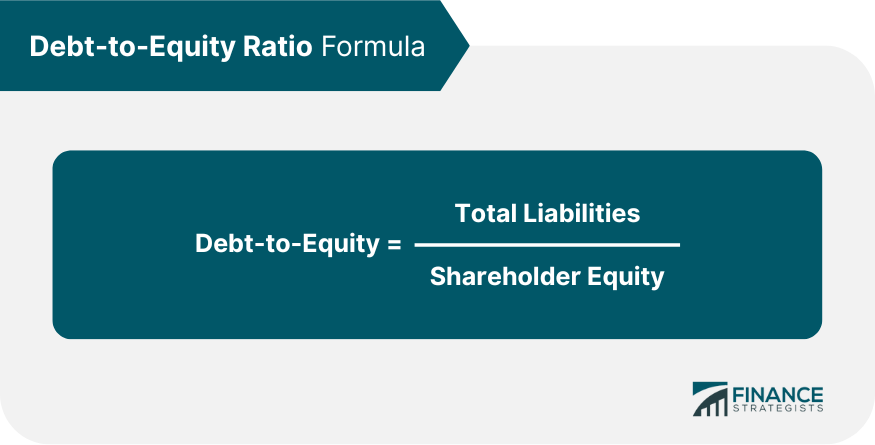

The formula to calculate this ratio is:

It is generally calculated using debt commitments for a period of one year.

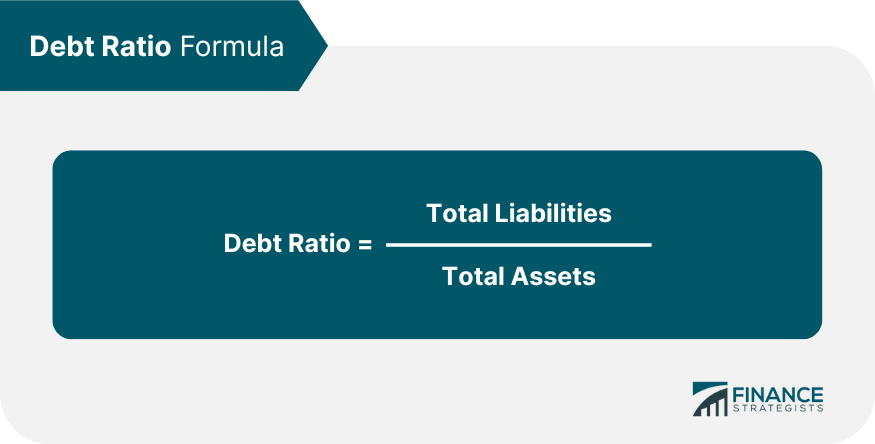

The formula to calculate this ratio is:

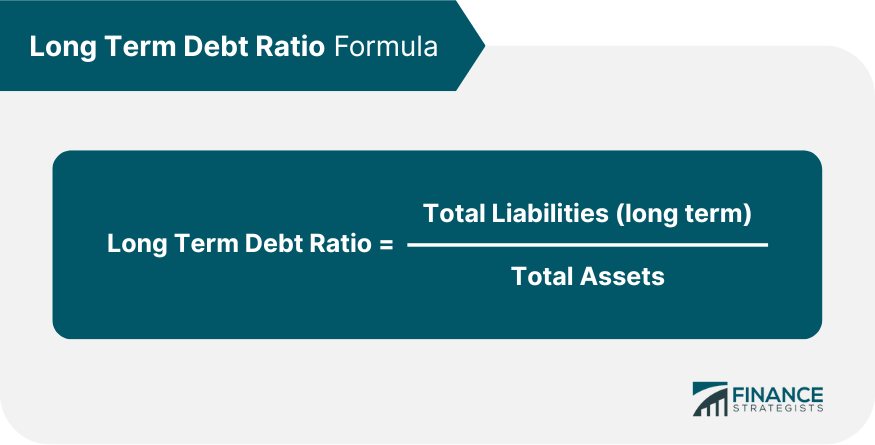

The formula to calculate this ratio is:

Liquidity Ratios

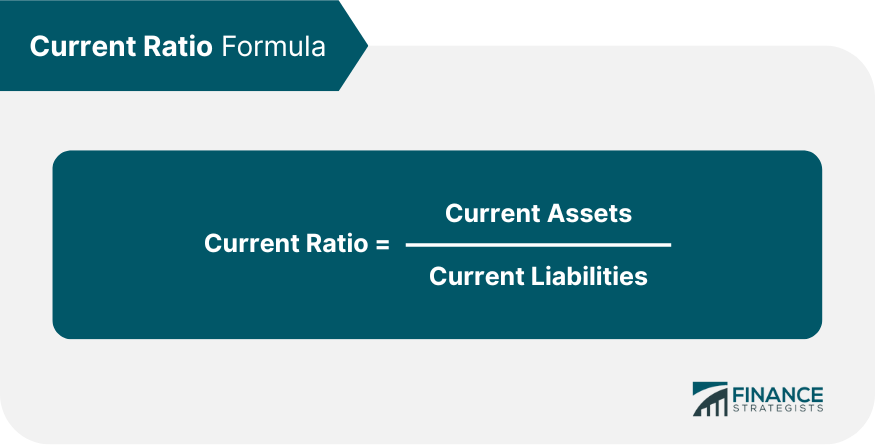

It is calculated as follows:

In this context, liquid assets are those assets that can be converted to cash immediately or within a very short duration of time.

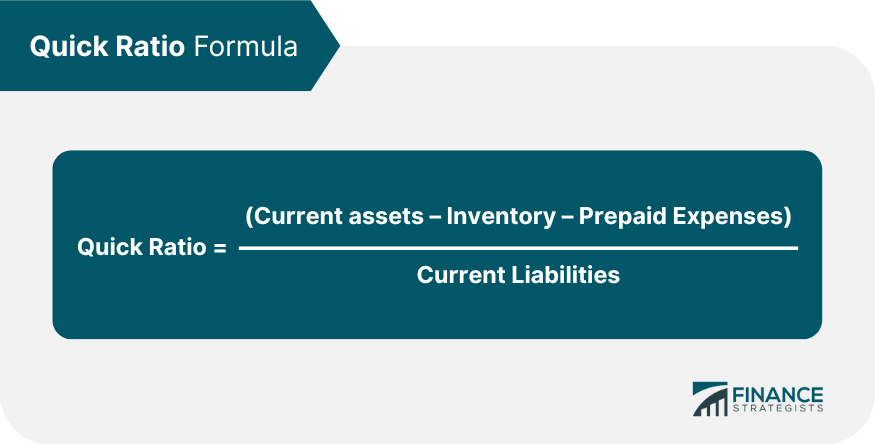

The formula to calculate quick ratio is as follows:

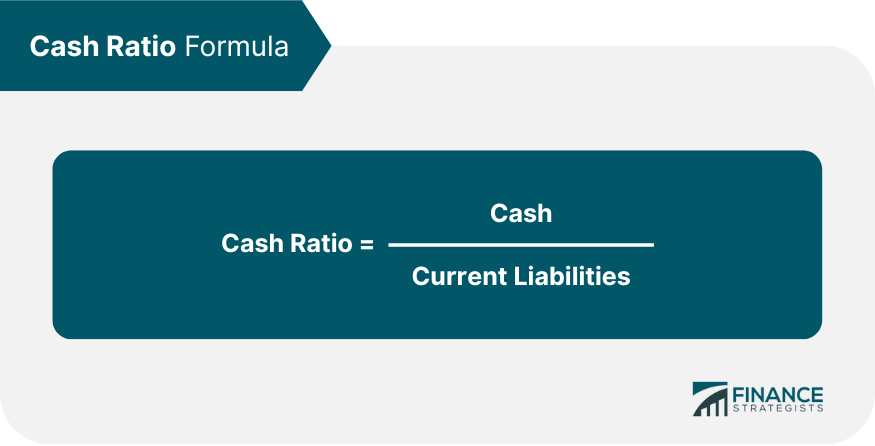

The formula to calculate cash ratio is:

Profitability Ratios

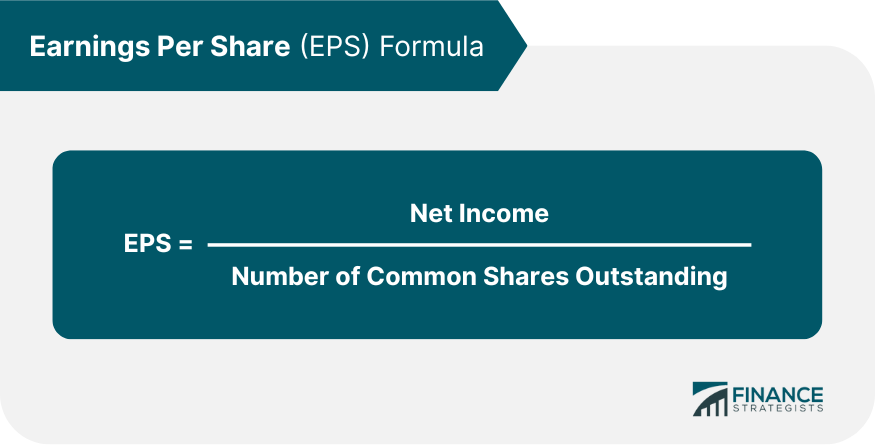

It is widely reported by publicly-listed companies during earnings season and is calculated as follows:

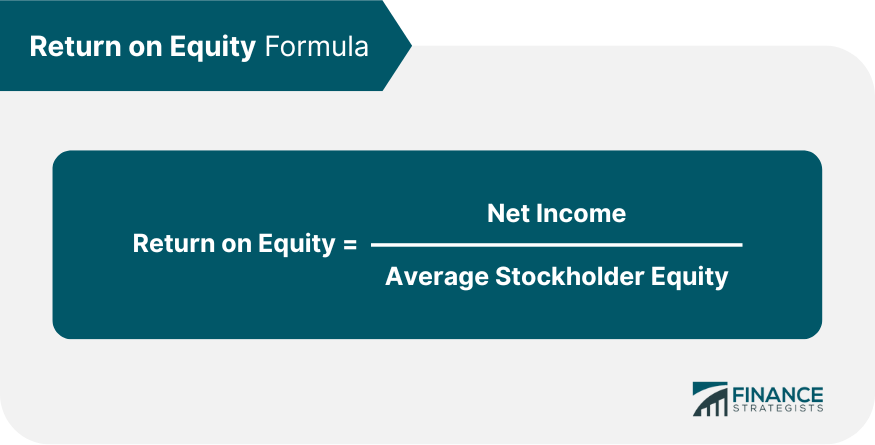

The formula to calculate to ROE is:

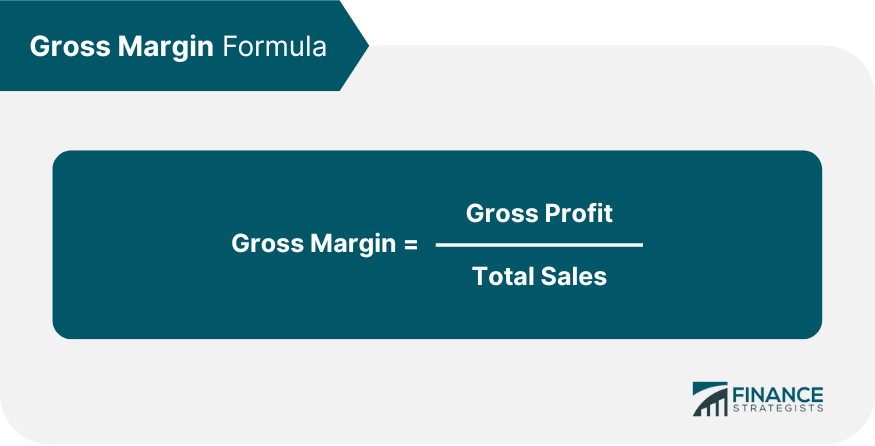

The formula to calculate gross margin for a company is as follows:

Using Accounting Ratios for Analysis

Accounting Ratios FAQs

Accounting Ratios are indicators of a company’s financial health, including profitability and liquidity. Accounting ratios are also used to spot companies in potential financial distress.

Debt ratios measure the debt of a company relative to various other figures and a company’s long-term ability to pay off its debt obligations.

Liquidity ratios calculate a company’s indebtedness in regard to measuring the liquidity or ability to service short-term debt.

Profitability Ratios measure a company’s ability to generate profits from its overall revenue figures by considering expenses or equity. Examples are Earnings Per Share (EPS), Return on Equity (ROE), and Gross Margin.

Accounting Ratios provide a window into the company’s operations and priorities. For example, debt ratios can indicate whether the company can avoid bankruptcy due to a business disruption. Profitability ratios are used to calculate the company’s actual profits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.