Intrinsic value refers to the true or fundamental value of an asset based on its underlying characteristics and properties, independent of external factors such as market conditions, supply and demand, and investor sentiment. It is an objective measure of an asset's value, which can be used to determine whether an asset is overvalued, undervalued, or fairly priced. Intrinsic value is commonly used in the fields of investing and business, but it can be applied to anything that has value. Knowing an asset's intrinsic value allows investors to make informed decisions about whether to buy, hold, or sell, while business owners can use intrinsic value to determine the worth of their company and make strategic decisions about growth and development. Understanding intrinsic value is crucial for investors and business owners because it provides an objective and fundamental measure of an asset's worth based on its inherent characteristics and properties. It allows investors to determine the true value of an asset, independent of external factors such as market volatility and investor sentiment. By understanding the intrinsic value of an asset, investors can make informed decisions about whether to buy, hold, or sell the asset. If an asset's intrinsic value is higher than its market value, it may be undervalued, and there may be an opportunity for growth and appreciation. On the other hand, if an asset's intrinsic value is lower than its market value, it may be overvalued, and it may be prudent to avoid investing in it. For business owners, understanding the intrinsic value of their company is crucial for determining the company's worth and making informed decisions about growth and development. By assessing the company's intrinsic value, business owners can identify areas where the company may be undervalued and where there may be opportunities for growth and expansion. They can also identify areas where the company may be overvalued and where strategic changes may be necessary to improve its intrinsic value. Understanding intrinsic value is essential for investors and business owners alike. Intrinsic value provides a fundamental basis for determining whether an asset is worth investing in or not. There are various methods of calculating intrinsic value, depending on the type of asset being evaluated, including: This method requires the investor to estimate the future cash flows of the asset, the rate of return that investors require for investing in the asset, and the expected growth rate of the cash flows. The present value of the discounted cash flows represents the asset's intrinsic value. The method of earnings multiples involves using a company's earnings or cash flows to estimate its intrinsic value. The most common earnings multiples used are the price-to-earnings ratio and the price-to-cash-flow ratio. These ratios are calculated by dividing the current market price of the asset by its earnings or cash flows per share. The resulting ratio represents the number of times the market is willing to pay for the asset's earnings or cash flows. This involves looking at the value of a company's assets and liabilities to determine its intrinsic value. Additionally, it involves subtracting the value of a company's liabilities from the value of its assets to arrive at its net asset value (NAV). The NAV represents the intrinsic value of the company. Intrinsic value is commonly used in the valuation of various types of assets, including stocks, bonds, and real estate: An example of intrinsic value in investing is the valuation of stocks. Investors can use various methods to calculate the intrinsic value of a stock, including discounted cash flow analysis, price-to-earnings ratios, and price-to-book ratios. If a stock's intrinsic value is higher than its market value, it may be a good investment opportunity, while if its intrinsic value is lower than its market value, it may be overvalued and not worth investing in. Intrinsic value is also used in the valuation of bonds. The intrinsic value of a bond represents the present value of its future cash flows, which are the coupon payments and the principal payment at maturity. The present value of the cash flows is calculated using the bond's yield to maturity, which is the rate of return that investors require for investing in the bond. If a bond's intrinsic value is higher than its market value, it may be a good investment opportunity, while if its intrinsic value is lower than its market value, it may be overvalued and not worth investing in. Intrinsic value is also used in the valuation of real estate. The intrinsic value of a property represents the present value of its future cash flows, which are the rental income and the resale value. The present value of the cash flows is calculated using the property's net operating income (NOI) and a capitalization rate (cap rate), which is the rate of return that investors require for investing in the property. If a property's intrinsic value is higher than its market value, it may be a good investment opportunity, while if its intrinsic value is lower than its market value, it may be overvalued and not worth investing in. Various factors contribute to an asset's intrinsic value, depending on the type of asset being evaluated. Some of the most common factors that contribute to intrinsic value include: Earnings: Earnings are a significant factor in the valuation of stocks and other types of assets. The higher a company's earnings, the higher its intrinsic value is likely to be. Cash Flows: Cash flows are also an essential factor in the valuation of assets. The higher the asset's cash flows, the higher its intrinsic value is likely to be. Growth Potential: The growth potential of an asset is another factor that contributes to its intrinsic value. Assets with high growth potential are more likely to have a higher intrinsic value than those with lower growth potential. Competitive Advantages: Competitive advantages such as brand reputation, intellectual property, and customer base can also contribute to an asset's intrinsic value. Market Conditions: Market conditions can also influence an asset's intrinsic value. For example, during times of economic uncertainty, the intrinsic value of stocks and other assets may be lower due to increased risk and volatility. Intrinsic value and extrinsic value are two different concepts that are often used in investing and finance. Extrinsic value refers to the value of an asset beyond its intrinsic value, such as the value that investors are willing to pay for a stock due to market demand or speculation. Extrinsic value can be influenced by external factors, such as market sentiment and supply and demand. Intrinsic value, on the other hand, is the true or fundamental value of an asset based on its underlying characteristics, independent of external factors. While extrinsic value can be volatile and subject to market fluctuations, intrinsic value provides a more stable and objective measure of an asset's worth. Intrinsic value is a fundamental concept in investing and business, providing an objective measure of an asset's worth based on its underlying characteristics and properties. Understanding intrinsic value is essential for investors and business owners alike, as it allows them to make informed decisions about whether to buy, hold, or sell an asset. Calculating intrinsic value requires an understanding of the specific asset being evaluated and the appropriate valuation methods. Some of the most common methods include discounted cash flow analysis, earnings multiples, and asset-based valuation. Factors that contribute to intrinsic value vary depending on the type of asset being evaluated, but they generally include earnings, cash flows, growth potential, competitive advantages, and market conditions.What Is the Meaning of Intrinsic Value?

Understanding Intrinsic Value

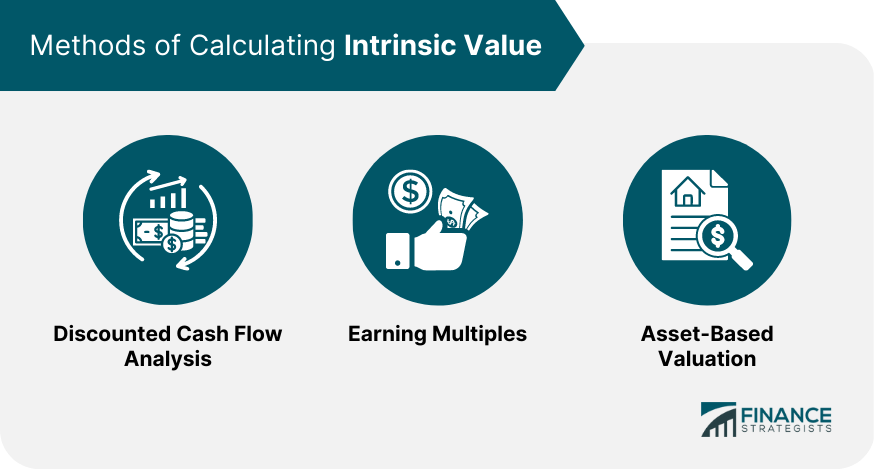

Methods of Calculating Intrinsic Value

Discounted Cash Flow Analysis

Earning Multiples

Asset-Based Valuation

Examples of Intrinsic Value in Investing

Stocks

Bonds

Real Estate

Factors That Contribute to Intrinsic Value

Intrinsic Value vs Extrinsic Value

Final Thoughts

For more information on how to calculate intrinsic value and apply it to your own circumstances, you may consult a wealth management professional.

Intrinsic Value FAQs

Intrinsic value refers to the true or fundamental value of an asset based on its underlying characteristics and properties, independent of external factors. It is important in investing and business as it provides an objective measure of an asset's worth, allowing investors and business owners to make informed decisions.

Intrinsic value for stocks and bonds can be calculated using various methods, including discounted cash flow analysis and earnings multiples. The present value of the cash flows represents the asset's intrinsic value.

Factors that contribute to an asset's intrinsic value include earnings, cash flows, growth potential, competitive advantages, and market conditions.

Intrinsic value is the true or fundamental value of an asset based on its underlying characteristics and properties, independent of external factors. Extrinsic value, on the other hand, refers to the value of an asset beyond its intrinsic value, influenced by external factors such as market demand and sentiment.

Understanding the intrinsic value of their company allows business owners to determine the company's worth and make informed decisions about growth and development. By assessing the company's intrinsic value, business owners can identify areas where the company may be undervalued and where there may be opportunities for growth and expansion.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.