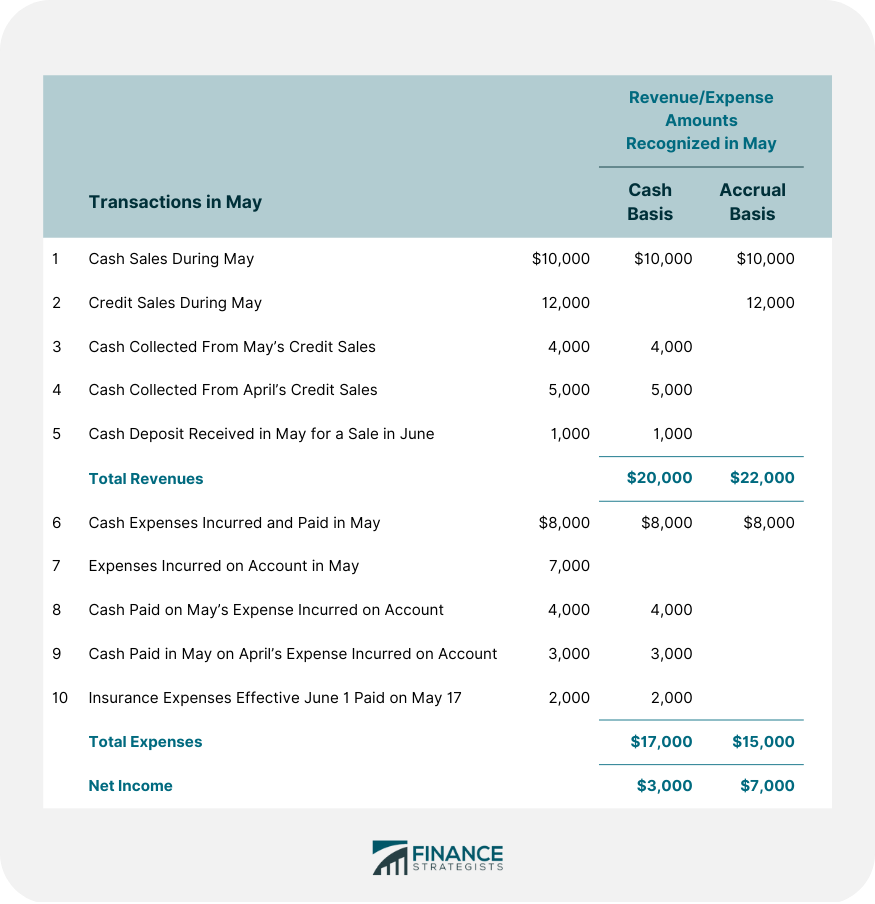

The cash basis and the accrual basis are the two basic methods of accounting. Each method identifies a different set of rules for recognizing revenues and expenses. The accrual basis of accounting means that revenues, expenses, and other changes in assets, liabilities, and owners' equity are accounted for in the period in which the economic event takes place, not when the cash inflows and outflows take place. Dissimilarly, in the cash basis of accounting, revenues and expenses are not recognized until the cash is received or paid. Revenues and expenses are matched optimally under the accrual basis of accounting. Under an accrual system, the financial effects of transactions and economic events are recognized by the enterprise when they occur rather than when the actual cash is received or paid by the enterprise. For example, sales are recognized as revenues when they are made and services are recognized when they are performed, regardless of when the cash from that sale or service is actually collected. That is to say, a sale on the account is recognized in the same manner as a cash sale is. The only difference is that Accounts Receivable rather than Cash is increased or debited at the time of sale. When the cash from the sale on the account is collected, no revenue is recognized. The collection of cash is just an exchange of one asset, Accounts Receivable—for another asset—Cash. At this point, the total amount of assets remains the same. The revenue and asset increases were recognized at the time the sale took place. With the accrual basis of accounting, if cash (e.g., a deposit or down payment) is received before the actual sale or provision of a service, no revenue is recognized until the sale is made. Instead, a liability to perform a future service or to deliver a product is recognized at the time the cash is received. This liability is usually referred to as unearned revenue. When the service is finally performed or the sale is made, the revenue is then recognized, and the liability is decreased. Expenses are recognized in a similar way. That is, expenses are considered to be incurred or used when the goods or services are consumed by the enterprise, not necessarily when the cash outflow takes place. For example, Carson Corporation records—as a June expense—the salaries earned by its employees in that month, even though those salaries may not be paid until July. This is accomplished by recording Salaries Payable in June. When June's salaries are paid in July, no expense is recognized at that time. Both a payable and Cash are reduced at that time, but no expense is involved. The decrease in the firm's net assets and the corresponding expense were recorded in June. In many cases, the cash is paid at the same time the expense is incurred. For example, plumbing repairs may be paid when the services are rendered. In this case, Repairs and Maintenance Expense would be recorded when the cash was paid. However, it is not the payment of cash that triggers the recognition of the expense. The expense is recognized because the plumbing services were received by the firm at that time. Finally, using the accrual basis of accounting, if cash is paid before incurring the expense, then no expense is recognized at that time. For example, if a firm prepays its rent for the month of June in May, the prepayment is considered an asset in May and is not considered an expense until June. With the cash basis of accounting, a sale is recognized when the cash is collected; likewise, an expense is recognized when the cash is paid. The cash basis of accounting, therefore, does not properly match revenues and expenses. This is because the recognition of revenue and expenses is contingent upon the timing of cash receipts and disbursements and, depending on this timing, the expenses of one period could be matched against the sales or services of another period. The cash basis of accounting, for this reason, is not considered a generally accepted accounting principle for financial reporting purposes. However, many professionals, who prepare financial statements solely for themselves, such as doctors and lawyers, use the cash basis to simplify their record keeping. In addition, most individuals use the cash basis to calculate their taxable income. An example of the difference between the accrual and the cash bases of accounting is presented below. The table shows how 10 transactions for the month of May affect income according to the accrual basis and cash basis. As this table shows, total accrual basis revenue is equal to cash sales made in May, plus all sales made on credit during this period. Total expenses during the period are equal to those incurred and paid in cash during May, plus expenses incurred on credit during the month. Cash basis net income is solely a function of when the cash is received and paid.Cash Basis vs Accrual Basis of Accounting: Definition

Accrual Basis of Accounting

Cash Basis of Accounting

Example

Cash vs Accrual Basis of Accounting FAQs

The cash basis of accounting is a method of recording transactions in which revenue and expenses are recognized when the associated cash is received or paid.

The accrual basis of accounting is a method of recording transactions in which revenue and expenses are recognized when they are incurred, regardless of when the associated cash is received or paid.

Some examples of revenue recognized under the Accrual Basis, but not on the cash basis, include sales made on account and interest earned.

Some examples of expenses recognized under the accrual basis, but not on the cash basis, include rent paid in advance and salaries paid in arrears.

The accrual basis of accounting records revenue and expenses on the books when they are incurred, while the cash basis records revenue and expenses on the books when they are received or paid.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.