Are you wondering about taxes? This book covers you, from the origins of taxation to how tax rates have changed over time. You will learn who pays taxes, how corporate taxes work, and what exactly state and federal governments do with all that money. The topic of this book will be how to file your taxes and what options you have after that. This book will also discuss why some individuals pay more taxes than others and how it is determined who must pay what amount. This book will also cover a variety of methods for reducing the amount of tax you will pay and contributing to ensuring that you get a refund from the IRS instead of having to make up the difference because your automatic deductions were insufficient. Finally, this book will look at the (relatively uncommon) Taxpayer’s Bill of Rights and how it can help you. The tax laws in the United States are complicated and frequently change, depending on your circumstances. However, I believe that when you have finished reading this book, your concerns about the United States taxation system will be addressed, as well as questions you did not know you had. After reading this book, you should feel more comfortable entering a new tax year. Do you ever feel baffled when determining where your tax money goes? You are not alone. Before we launch into the United States’ taxation history, let us first understand what taxes are and why we need to pay them. If any of this feels overwhelming, do not fret – everything will become crystal clear as we move along with the book. By its end, you will have a firm handle on taxes. This chapter will lay the groundwork for everything you learn in this book; nothing else will make sense without it. Come back to this chapter once you have finished reading the entire book; you will probably discover that it all makes much more sense then. A tax is a mandatory payment to state and federal governments levied on someone’s income and business profits and added to the cost of some goods, services, or transactions. For example, if you look at any pay stub or receipt in your home, you will see an area where taxes were deducted. We have a progressive tax system in the United States. This implies that individuals and businesses who earn more are taxed more than those who make less money. While this ensures that those who make less money can keep more of their earnings, taxing attributions is difficult. Later in this book, we will look at how tax rates vary based on your income, how much you make, and how much you will pay in taxes as you earn more. The history of taxes in the United States is fascinating and dates back to before the War of 1812. During the War of 1812, one of the first income taxes was proposed. The idea was inspired by the British Tax Act of 1798, which called for progressive taxation on all income. Because hostilities between Britain and America had ended with the signing at Ghent in 1815 and because there was no longer a requirement for additional funds, the tax was not implemented and was neglected for quite some time. To fund its war effort in the American Civil War, Congress’s first personal income tax was established in 1861. According to the Revenue Act of 1861, anyone earning more than $800 had to pay a 3% tax. However, by 1862 this law was no longer valid, and another replaced it. 1894 saw the passing of the Wilson-Gorman Tariff by Congress. The first peacetime tax in America was a 2% levy on all incomes over $4,000. This affected less than 10% of households at the time. The purpose of this act was to make up for lost revenue from tariff reductions. To comply with the new law, New York-based Farmer’s Loan & Trust Company announced that it would pay taxes and provide names of those it represented to the collector of internal revenue in the Department of Treasury, making them liable for taxation under the Act. Charles Pollock, a Massachusetts native shareholder of ten Farmer’s Loan & Trust Company stocks, took the company to court to cease paying taxes. It was decided on April 8th, 1895, that the Wilson-Gorman Act’s income taxation on property violated the Constitution. The court regarded a tax on property income as a direct tax, as defined by the Constitution. The Constitution stipulated that indirect taxes must be levied in proportion to the state’s population. Because the tax at issue had not been apportioned, it was invalid. The Sixteenth Amendment, which provided for Congress’ ability to collect taxes on any income, whether earned within or outside of the United States, and without regard to census data or other criteria, was proposed and declared valid shortly after this decision was reached. From then on, taxes were constantly being placed and developed into what they are now. The Internal Revenue Service (IRS) is a government agency that was established in 1862. Originally called the Bureau of Internal Revenue, the name was changed to the IRS in the 1950s when the agency underwent reorganization from an investment structure to one that hired professional employees. The President selects and confirms both the IRS Commissioner and chief counsel of the IRS, positions created during the agency’s modernization in 1998. The IRS is charged with three primary goals. First, they are expected to collect the most tax revenue with the fewest resources possible. Second, they must keep customers happy by continuously improving services and products. Finally, the IRS is obligated to maintain public confidence in the department’s fairness and efficiency while ensuring that all levels of integrity are maintained. Looking at historical data, we can see that tax rates have fluctuated considerably over the last century. The highest rate charged was 94% in 1944 and 1945, while the lowest was just 7% in 1913. Here is a more detailed timeline of how these rates have changed from 1913 to 2012: This only covers personal tax. Taxes must also be paid on properties and company profits, for example. Now that we know where taxes come from and what they are, we will look at who pays them and why. U.S. citizens pay federal income taxes to the Internal Revenue Service (IRS), a branch of the United States Treasury. In addition, many states have an additional state income tax. If your state does not charge an income tax, you may still be required to pay other types of taxes. This chapter will provide an overview of different types of personal taxes in the United States. The tax year always corresponds with the calendar year, from January 1st to December 31st. Your federal income taxes are due by April 15th every year, but you can request an extension which will give you until August 15th to file them. Keep in mind that even if you file for an extension, any taxes owed are still due on April 15th, and interest will accrue on unpaid amounts as of this date. Because of tax withholding, you will not have to pay all your income taxes at once. When you work for someone else, your employer must take deductions from your salary. Federal and state income taxes, if any, are two of the deductions taken. Your employer will also deduct social security and Medicare payments. On January 31st, your employer will be required to give you a Form W-2, a wage and tax statement, showing how much they have deducted from your pay to go towards income taxes. You must set aside money each quarter for your estimated federal and state taxes if you are self-employed. If you do not make these payments, you will owe not only the taxes but also interest and a hefty penalty. In America, the tax you pay is called a progressive tax. This means those who earn more have to pay more taxes than those who make less. For example, someone earning very little might not have to pay any taxes, while someone making hundreds of thousands annually would contribute more based on their higher earnings. The government designed the system this way because they believe that people with more money do not have to worry as much about providing for their families and can help support their communities through taxation. The IRS determines who falls into which tax bracket- the income range in which you will be taxed at a specific rate- by considering both your income and filing status. There are five options for filing status: single filer, head of household, married filing jointly, married filing separately, or qualifying widow(er) with a dependent child. Here is how tax brackets are determined, using the 2015 tax bracket set as an example. To better understand how this works, we will look at two individuals who file their taxes in the single bracket and how much tax they will have to pay. Keep in mind that this is not taking any possible deductions into account; instead, it is just talking about their income and how it would be taxed. This will help you visualize why people who make more money are taxed much more than those who make less. Person One: This person makes $31,998 for the year. On the first $9,225: 9,225 * 10% = $922.50 On the balance of $9,225 to $31,998: $31,998 – $9,225 = $22,773 then $22,773 * 15% = $3,415.95 Which makes their taxes a total of: $922.50 + $3,415.95 = $2,493.45 or 7.79% of their total income. Person 2: This person makes $248,685 for the year. This person makes a total of $31,998 for the year. On the first $9,225: 9,225 * 10% = $922.50 On the balance of $9,225 to $37,450: $37,450 – $9,225 = $28,224 then $28,224 * 15% = $4,233.60 On the balance of $37,451 to $90,750: $90,750 – $37,451= $53,299 then $53,299 * 25% = $13,324.75 On the balance of $90,751 to $189,300: $189,300 – $90,751= $98,549 then $98,549 * 28% = $27,593.72 On the balance of $189,301 to $248,685: $248,685 – $189,301= $59,384 then $59,384 * 33% = $19,596.72 When you add their income and deductions, they pay around $65,661.29 in taxes, or 26.4 percent of their overall revenue. Those who make more money generally pay a far more significant percentage of their overall income in federal income taxes. However, this was without any deductions being taken into account. When you include beliefs, these figures change; nevertheless, at the end of the day, a person that makes more money will pay a higher proportion of their earnings in taxes, even if it is not as high as the example above suggests. All money you earn or come across during the year is classified as income, which can have negative consequences. For example, if you receive a salary from working at a job, that classifies as income. But so does winning the lottery or finding a twenty-dollar bill on the street. There is one exception to this rule. Capital gains, not income, are generated if you buy and sell stocks or parts of firms for a profit. This is how the extremely wealthy acquire their wealth; they invest. When you examine the basic tenets of investing, it is more of a game than an investment. You are buying shares in a firm in the hopes that it will succeed and that you will be able to sell your shares and make money when it does. In casinos, if you gamble one thousand dollars and win one hundred thousand dollars, you have to pay income tax on ninety-nine thousand dollars. However, if you take the same amount of money and buy stocks with it instead, then sell the stocks for a profit later on, the government sees that as capital gain rather than income. Consequently, you would only end up paying half the taxes on your earnings. While the wealthy are given many tax breaks, one of the most significant is that they do not have to pay a sales tax when buying stocks. When regular wage-earners go out and purchase something- whether a can of beer or a new car- they are taxed on their purchases, but because the wealthy buy stocks as part of larger companies, they are not charged taxes on those purchases. While the less you can earn, the more taxes you pay, remember that those who make more are taxed at a higher rate. Consider the example we did earlier. Even though they can take some deductions, people with high incomes still contribute more to government taxes than those who make less money. Although businesses are taxed, the system they use to pay taxes differs from individual income taxes. We will explore company tax systems in more depth later, but first, let us look at some of the other types of personal taxes levied on individuals. Almost everything you spend money on in the United States is subject to taxes whenever you receive money from anywhere. These taxes are not always simple to understand, however. Various conditions allow people to be exempt from paying taxes. Here, we will explore some of the most frequent taxes in America and when they would typically apply. If you desire additional information about any of these taxes and how they might affect you, contacting an accountant or the IRS would be your best course of action for more specific details. A sales tax is a fee on certain goods and services consumers purchase. The amount of the tax is calculated as a percentage of the cost of the good or service. Sales taxes vary by state and sometimes by a municipality. They are considered regressive, meaning they are applied equally to all consumers based on what they buy. Let us say two people are at a grocery store, each buying $100 worth of groceries for the week. They both pay 7% tax on the entire amount of their groceries. The first person makes $2000 that week, making the sales tax on their groceries 0.35% of their income. The second person only makes $320 that week, though, meaning the sales tax takes up 2.2% of their income–even though they are paying the same percentage as the first individual in taxes, it hits low-income earners much harder since it is such a high percentage of what they make. This type of tax is usually enacted by your local government and collected periodically. Property taxes are based on the worth of the property and are typically paid yearly or monthly as part of mortgage expenses. Even though it can be seen as regressive in some aspects, it is not fully classified as such. The person earning less money would end up paying a higher percentage of their income. Although people who earn less may live in more affordable homes, their income taxes are often lower too. This makes it hard to say for sure that property taxes are always regressive. The estate tax, in its most basic form, is a progressive tax levied on the property of deceased individuals at their death. It appears to be unfair since it is imposed when a person’s home passes from one owner to another. The estate tax was implemented to prevent the accumulation of tax-free wealth among the country’s citizens, who already have the greatest amount of money. The existence of an estate tax is somewhat unfair at first sight. The fact that the first $5.43 million of an estate’s value is exempt from this tax makes it much less egregious than it appears at first glance. The gift tax is comparable to the estate tax in that it is only incurred when money or property changes hands from one person to another. If a transaction is valued at more than $17,000, it will be taxed, with the responsibility of payment falling on the recipient. This type of levy applies to items such as company shares and automobiles, and cash gifts. The gift tax is applied to all gifts, no matter who the giver is. This tax also hits lower-income people harder because it’s a flat percentage, regardless of income. So sometimes people would instead take a cash gift than a luxury car, for example, because it is easier to use the gifted money to pay the taxes on the cash than to find extra money from your salary to pay taxes on an expensive new car. The luxury tax is a fee imposed on items and services deemed non-essential or unneeded. This indirect tax only affects the product’s buyer if they purchase it. Luxury taxes now refer more prevalently to “sinful” goods like tobacco, alcohol, and high-end automobiles. An excise tax is placed on an item depending on how much of the item is rather than its total value. For example, if you buy a gallon of gasoline, the government will charge an excise tax for that fuel regardless of the price per gallon. Fees for services are assessed on a wide variety of things. The most commonly used ones are airline tickets, rental cars, hotel rooms, toll roads, and licenses. These taxes are also considered to be regressive taxes since they are the same for everyone, regardless of the amount of income you have. The payroll tax comprises two parts: the Medicare Tax and the Social Security tax. Both an employee and an employer pay Social Security taxes based on their earnings levels up to a maximum wage. The Medicare Tax, however, has no upper taxable wage limit. Both of these levies are categorized as regressive because they impose the same percentage on everyone regardless of how much money they make or at least until they reach the yearly wage ceiling for the Social Security Tax. The capital gain tax is levied on any gains generated by selling a property. Profits from the sale of real estate are exempt for up to $250,000 per person and $500,000 per couple if the property was a primary residence for at least two of the previous five years. Now that we understand how individual taxes work, let us look at corporate taxes and learn how businesses are taxed. We are aware that businesses are taxed differently from individuals. When a person earns income, they are taxed on a percentage of their entire income; this does not work the same for businesses. Businesses are taxed on profit–not income; therefore, anything classified as a business expense is not taxable. This permits huge corporations to make billions of dollars while only paying minimal taxes–and in certain instances, no taxes at all. Why do the tax laws in America always benefit those with large corporations and high incomes? It is unfathomable that a big company could avoid paying taxes. Our country’s tax laws are written by Congress, the legislative branch of government. The public chooses the people who are in Congress to serve. To be elected to Congress takes a substantial investment of money since running for office is costly, and if you do not want to campaign, you will not receive the votes necessary to become a member of Congress. This implies that individuals who wish to be elected to Congress must raise funds to campaign and get elected. The cash used in campaigns is generally raised from supporters who want things done in their favor by the government. Corporations hire people to donate money to politicians – we call them lobbyists – and in return, those members of Congress pass laws that favor the corporations. We do not see this as a bribe even though it is, but the money given by these corporations clearly influences how our politicians vote. This might result in a loophole in the legislation, allowing your firm to take advantage of a tax break. These loopholes are generally written so obscurely that no one can discover them except those seeking them. For example, consider a company that produces pencils. You form a business group with other pencil manufacturers to help you manage your taxes. You would like to pay less in taxes. A lobbyist employed by your organization’s business group hires members of Congress who share your views on taxation issues. You finance their election campaigns with money donated by you. When the laws are created, the people you have backed write into the tax code, “pencil makers do not have to pay taxes.” Of course, it would not be written in such detail. The phrase pencil would be inserted into the text in 800 words of a jam-packed language that never mentions the term. However, it would describe the tax law so that only you and other pencil makers could claim it. In fact, no one else would even notice those eight hundred words; therefore, they won’t protest about your receiving such a great bargain. You must register as a certain sort of business if you have a company. Limited liability companies (LLCs) and corporations are the two most popular types of businesses. While a limited liability company (LLC) is not a corporation, it is considered a “pass-through business.” These companies’ profits and losses are passed through the owners and shareholders. So essentially, the business income becomes the owner’s or stockholder’s income. That said, they are also responsible for paying any taxes on their tax return associated with said income. An LLC is made up of one or more business people or members. These members file Articles of Organization describing the company’s structure and operating agreement. The earnings and losses of the company are dispersed among these members based on their percentage in the partnership. An LLC is taxed according to the Adjusted Gross Income of its owners. You calculate AGI by subtracting tax-deductible expenses from your gross income. Some examples of business deductions are supplies, gas mileage, and equipment rental fees. A corporation is a legal entity that exists independently of the people who own it. Unlike an LLC, profits and losses of the corporation are taxed to the corporation itself rather than the owners or shareholders. A corporation is established by filing a Corporate Organization form with state authorities and naming stockholders and a board of directors to manage corporate operations. LLC members are taxed according to their share of all income, while corporate owners only receive dividends, which they are taxed on as regular income. The corporation is taxed on its profit at the corporate rate. There are two types of businesses, and while the preceding information is accurate for both, there are vital distinctions to be aware of. The Internal Revenue Service allows you to transform your company into an S Corporation if you fulfill the requirements of a domestic corporation with no more than 100 authorized shareholders and just one class of stock. S Corporations Many people think the “s” in S Corporation means small, but it stands for Subchapter S in the Internal Revenue Code. This type of business is limited to less than one hundred shareholders and offers protection from liabilities for them. The income generated by the corporation goes directly to the shareholders, who are then responsible for taxation on it. How Are Tax Rates Different for C and S Corporations? By default, you are a C corporation if you do not choose to be an S corporation with the IRS. Taxation is most apparent in distinguishing the two types of businesses. C Corporation shareholders receive dividends or shares of the corporation’s revenue and can then sell those shares. The double taxation predicament that C Corporation owners face occurs when the corporation pays taxes on its profits while the owners get taxed again on the shares they receive. And if these owners also work in the business, they must be paid a salary (taxed as personal income). Dividends are not paid to the owners of an S Corporation. Instead, a tax return is filed that displays the company’s net profit or loss for the year. Then, this amount is passed onto the shareholders, who report it on their income tax returns–although they do not receive it as dividends. What Are the Advantages of Being an S Corporation? S Corporations have the same liability protection as regular corporations. This means that shareholders are not held responsible for corporate debts or lawsuits. These corporations have their total profits lowered by the sum paid to owners as employees. So, in other words, the self-employment tax for an S Corporation is lower than those who own a sole proprietorship or partnership. An S Corporation’s most significant advantage over a C Corporation is the avoidance of double taxation. With an S Corporation, the owners pay taxes on their share of the profits, but the corporation does not have to pay income tax. When an S Corp’s earnings fall short, any profits made by the corporation are passed through to each owner’s tax return. This loss may reduce the amount of any other source of income. The LLC business structure offers the unique ability to be taxed as an LLC, C Corporation, or S Corporation. This can create significant tax advantages for businesses, provided they meet the eligibility requirements. Now that we understand that everyone pays taxes and the amount you pay correlates with your income, let us look at where all these tax dollars go. There are Federal and State taxes, so we will explore each individually. If you were to ask the American people what percentage of their tax dollars are allocated where, they will have assumptions, but those assumptions are nowhere near where the money is going. The federal budget is split into two categories: discretionary and mandatory. We will compare the two categories to see how they compare and examine the entire national budget. Health – A large chunk of your tax dollars go towards funding health care in the United States. This money is put into programs such as Medicare, Medicaid, and the Children’s Health Care Program, making up 28 cents of every federal tax dollar. Social Security – Social Security is the second largest expenditure for the federal government, making up 25.3 cents of every tax dollar. Military – The third-largest share of your tax dollar goes toward defense and homeland security, which amounts to 16.2 cents out of every federal tax dollar. This includes funding for the current war and military operations and interest in the national debt related to military spending. Agriculture, Commerce & Transportation – 8 cents from every federal income tax dollar is going towards agricultural and transportation expenses. Veterans – Every four federal tax dollars paid supports our veterans in some way, whether through health care, mental health services, housing, or financial aid. Social Services – 4.3 percent of every income tax dollar is spent on education, training, and social services. This money is used to pay for primary, secondary, and higher education and other beneficiaries such as employment training centers. International Affairs – 2 cents of your tax dollar are sent to foreign affairs, which includes humanitarian aid, international financial initiatives, and the conduct of foreign policy. Environment, Energy, And Science – 2 cents of each income tax dollar goes to environmental programs, energy investigations, and other science, technology, and space-related initiatives. Housing And Community Development – Housing aid and community development programs account for 1.1 percent of each tax dollar spent. Other – If you total up the costs above, you will see that 9.1 percent is missing from your dollar. This sum covers things like legislative and judicial branches, as well as independent agencies and departments of Commerce, Interior, and Treasury, as well as interest in nonmilitary obligations. Please remember that the following percentages are from 2008 and have changed since then. Also, 1.1 cents may not seem like much for housing and community development, but it adds up to a lot of money; this doesn’t include money from state taxes, either. This should give you a good sense of how your Federal Income tax is being spent. Although taxes vary from state to state, it is essential to know where your money is going. The following numbers are based on the average of all states in 2013; however, they do not consider federal funds that the states also spend in a year. Education Spending – On average, each state devotes about 25% of its overall expenditure to primary and secondary public education. A state will typically pass the costs on to local school districts rather than paying them directly. Higher education, including community colleges, trade schools, and university systems, receives an additional thirteen percent of the state’s funds (around thirty-eight cents out of every dollar spent toward taxes). That means that of each dollar you pay in taxes to your state government, approximately thirty-eight cents go toward some sort of education. Health Care Allocation – After educational spending, the next largest area of expenditure for states is on health programs. The lion’s share of this funding goes to Medicaid and the Children’s Health Insurance Program (CHIP). In an average month, these two programs benefit more than 45 million children, parents, elderly citizens, and disabled people. Ultimately, approximately sixteen cents out of every dollar you pay in state taxes goes towards healthcare costs. Transportation Expenses – On average, five percent of every state’s expenditures go towards transportation services, including public transportation systems, infrastructure spending, and road and bridge repairs. In other words: for every dollar you pay in taxes to your state, five cents goes into funding these services. Corrections Facilities – This category covers state prison costs, juvenile justice, and parole programs. In fact, corrections costs make up around four percent of all state expenditures. Four cents go towards correctional facilities and programming for every dollar you pay in taxes to your state. Low-Income Assistance – Only a small fraction of state spending, around one percent, is put towards aiding those with low incomes. Programs that help low-income individuals include the Temporary Assistance for Needy Families program and general assistance to support low-income health care initiatives. In other words, barely any money from your state taxes goes towards helping people in poverty. Each state’s funds are divided into several distinct programs. The last thirty-five cents of each state dollar is spent on various additional initiatives. Here are some examples of other important activities that may be deducted from your home state taxes: While the average across all states was used to determine these numbers, it is important to note that there can be significant variations in spending from state to state. For example, Vermont spends 32% of its budget on kindergarten through grade twelve education, while West Virginia spends just 10% on the same category. Similarly, Missouri puts approximately 36% of its budget into Medicaid, while Wyoming puts only 7% into the program. If you have an employer, they will usually withhold your federal income taxes from your paycheck and submit a form called a W-2 to the IRS. When you file your taxes, the IRS will tell you if you owe any additional money or are due for a refund. You will have to make up the difference if you pay less than what you owe. But if you overpay, then you are due for a refund. To help ensure that come tax time, you do not end up owing money to the IRS, there are things you can do throughout the year. We will look at some of those measures in this chapter, so start preparing for next year’s taxes. Get Organized – The essential thing you can do, according to any financial expert, is to be organized about your finances. You may utilize personal finance software to assist you in maintaining accurate records. Keep track of your spending, including mileage charges incurred for business purposes, and get receipts for your charitable donations. You must keep meticulous records of any stocks you buy or sell and your stock options. This way, come tax season, you will be prepared to have everything in order—the last thing you want is to realize that something crucial is missing from your filing. Contribute To Your 401 (k) – By contributing the maximum to your 401(k) plan, you can defer taxes on your contributions and let them grow through compound interest. Adjust Your Withholding – The amount of money your employer is taking from your pay to offset taxes is known as your withholding. If you have gotten married, changed marital status, or moved into a new tax bracket, talk to your employer about changing how much they take out of your check. You should make estimated tax payments to the right taxing body if enough taxes are not taken from your paychecks or if you are self-employed so you do not get penalized at year’s end. Contribute to Your IRA – An IRA is an individual retirement account. It is important to contribute to your IRA early in the year to take advantage of compound interest. Another advantage of contributing to your IRA is that, in most cases, the contributions are tax-deductible. Consider Tax Efficient Investments – It is best to make some investments over others. Tax-free municipal bonds and tax-efficient mutual funds are two examples of tax-efficient investments. These investments will assist you in avoiding paying large amounts of taxes at the end of the year. Make Charitable Donations – The amount of money you give to a charity may be subtracted from your taxable income. Only the cash given to the organization is deductible, not the pledge itself. Ensure The IRS Has Your Address Right – Every year, the IRS sends out tens of thousands of undeliverable refunds because of incorrect addresses. Not only does this mean you miss out on your refund, but it could also prevent you from getting other important communications from the IRS. The most important thing to avoid owing money on your taxes is to be organized and prepared. If you are ready, that eliminates any scrambling around April 14th to get everything together so you can file before the deadline. When it comes to filing your taxes, there are several options. You can either do your taxes or hire someone to complete them. Both have benefits. You can file your taxes for free using the IRS’s blank forms. You have the option to submit these forms online or through snail mail. Another method to accomplish them yourself is by purchasing tax preparation software. The benefit of this approach is that while you are paying for the software, it guarantees you do not overlook anything. Income tax preparation software works by walking you through the income tax process, asking you questions, and ensuring nothing is missing. Another advantage of this method is that you may stop the procedure and return to it later if something has been forgotten. Hiring a professional to complete your taxes decreases the likelihood of errors. Still, if you forget to bring certain documents with you to your appointment, you might have to pay an additional fee for another visit. If you are a US citizen living in another country, the same regulations and requirements for filing taxes from income on estates, gifts, and earned income apply to you as if you were living in the United States. Additionally, estimated taxes must also be paid. You must convert currencies from US dollars to US dollars on your income tax return. Taxpayers use the yearly average exchange rate to report foreign-earned income received throughout the year at regular intervals. If, however, you made foreign transactions on days when rates may have differed, you can also convert by using the exchange rates that were in effect on those days. As a United States citizen living overseas or in the military stationed outside the country, you are automatically granted a two-month extension on your tax filing and payment dates. If you cannot file your return before this automatic extension elapses for any other reason, you may request an additional extension by submitting Form 4868 beforehand. You will still owe interest on unpaid taxes from the return’s original due date if approved for these extensions. Preparing yourself to file your taxes correctly is a critical step in avoiding paying more than you owe in taxes. Because your situation will differ from your neighbors, you must understand any tax rules and exemptions that may apply to you and your specific circumstances. Not many people know this, but the IRS has placed ten fundamental rights for American taxpayers. In this chapter, we will explore each one briefly. Many people are confused and overwhelmed by tax season, but it does not have to be that way. If you familiarize yourself with your rights as a taxpayer and what you can expect from the IRS, the process will be much less stressful. Remember that rules and regulations bind the IRS just like everyone else; they are also obligated to explain everything to you clearly, so there’s no confusion. You have a right to understand how the tax system works, and there are plenty of resources available to help ensure that you do. Filing taxes as an adult might seem daunting, but it is really not that bad. We are here to help you by sharing valuable information about filing your taxes. To begin, you will need to obtain a W2 form from your employer. This paper or document informs the IRS about your work, financial status, and how much tax you paid. Please remember that this form must be requested and collected from your place of business. If you do not ask for it yourself, the company or employer will never deliver it to you since they are under no legal obligation. Even if you have changed jobs numerous times throughout the year, you must still acquire a W2 from each employer. The 1098-E form is the most challenging for former students. Namely, this form is intended to reimburse your student debt. If you repaid your student loan in full, that money would be subtracted from the overall sum of your student loan. Get a tuition receipt to be relieved of an extra $4,000 on your student loan for educational costs. The electronic 1040EZ, 1040, & 1040A Tax Forms have become one of the most widely used tax filings. They are speedy and remove the inconvenience of mail-in forms. A plethora of websites offer free tax filing–including the IRS website. Many taxpayers eagerly await filing their federal and state tax income returns because it gives them back some extra money. Filing status is essential since it determines filing requirements, special and standard deductions, tax brackets, and other factors. It also has an impact on Social Security taxation thresholds. The IRS uses a system based on an individual or family’s ability to set aside money for taxes. So, if you are single and do not have children, the government believes you can contribute more to the budget than someone with kids. Therefore, your tax percentage will be higher. Filing jointly as a married couple allows you to simplify and streamline the process. The five tax status categories are: The IRS understands that sometimes children are away from home for reasons beyond their control, like a vacation or spending time with the other parent if you are divorced or separated. If this is the case, and it falls in line with your custody agreement, the IRS will not count those days against you when determining head of the household status. The law defines household expenses as costs that collectively concern the home, such as renovations, mortgage payments, rent, coverage for the property itself, insurance policies for those who live there, and groceries. On the other hand, individual excluded expenses would be things like education and medical bills, clothes, vacation plans, life insurance, and any mode of transportation. Filing Status for Married Couples: If one spouse is unemployed or earns low wages, the other spouse may seek a deduction for their nonworking partner. It is also a good idea to file separate tax returns if the foreign spouse receives income outside the United States since additional income earned abroad would be subject to US taxation. Let us start by determining which incomes are taxable. Two types of income can be taxed: those you earn and those you do not. Some examples of unearned income are interest, money made from selling property, stocks, or other assets, winnings from gambling, payments received after a divorce settlement, and earnings generated by businesses or farms. You do not have to pay taxes on all forms of income. Instead, it only applies to taxable income, including scholarships from teaching or tutoring services. Non-taxable scholarships given for educational purposes do not need to be reported. Your scholarship becomes taxable when you receive a paycheck for the services you provide under the grant agreement – this is called study-work income. Fringe benefits are free services and other advantages the employer pays for, such as transportation. Unless expressly permitted by law, fringe benefits are generally taxable. A cafeteria plan is a collection of benefits supplied by your employer that you would prefer to receive in place of money. Cafeteria plans include accident insurance and health insurance (but beware, since Archer MSAs or long-term care insurance are not included in the package), adoption assistance, dependent care assistance, health savings accounts, group term life insurance payments (in addition to unavoidable expenses that cannot be excluded from salaries). The following cannot qualify as cafeteria plan benefits: Remember the W2 form from the previous chapter? That is the form all the fringe benefits will be included as taxable. The perks provided by the employer can vary from really attractive benefits, like rent or cars, to smaller ones. The benefits’ value will be calculated according to their fair market value and costs on the market. Capital gains are the money earned when selling an asset, like land, stocks, bonds, or mutual fund shares. Did you know that there are long-term and short-term capital gains? Most people only focus on the latter. Short-term capital gains refer to profits earned from selling an asset held for no more than one year. The thing with these kinds of sales is that they are taxed at a higher rate— up to 37%. This might dissuade you from offloading newly acquired assets immediately and holding onto them until they become long-term gainers. Long-term capital gains are profits from assets you have sold that you have owned for over a year. These rates start from 0%, 15%, or 20% for the last tax year. We discussed the highest short-term gain rate, which might be subject to an additional surtax for Medicare up to almost 37 %, depending on your income. Low taxpayers (bracket 10/15%), for example, can potentially expect a 0% rate, while other taxpayers will have to pay the 15% or 20% tax rate unless exempted from it under tax legislation. Examine any exemptions in the tax code since you may be a taxpayer exempt from paying taxes. Real estate capital gains in depreciation come with a 25% tax rate unless you are a low taxpayer (10 and 15% bracket). Non-capital losses are caused by the sale of capital assets (e.g., stock, real estate, bonds, mutual funds). Losses are classified as short-term and long-term capital losses. Capital losses may be used to reduce taxable income and must be reported to tax authorities only if anticipated to improve in value. They can be disclosed to obtain deductions on your tax return. We have both realized and unrealized losses, as well as recognizable gains. Unrealized losses are not to be reported and refer to when the asset you bought drops in value, but you do not sell it immediately. Instead, wait until its value increases again and then sell it. You can only report the realization of the loss (assuming you still sold it at the price you purchased) when the actual sale happened. The IRS recently introduced a new form- the 8949, which makes it easier to compare gains and losses given by investment companies. Although capital losses do not make you whole again, they offer an opportunity to get some money back through tax returns. Many Americans are unaware of which retirement account to select…so which one is superior? Traditional IRA or Roth IRA? Let us look at the differences between these two accounts so you can pick the right option for you. An individual retirement account (IRA) can affect your finances and your family’s long-term savings. The traditional IRA is available to all persons who earn income and are under 70, whereas the Roth IRA has specific eligibility requirements that must be met. You can contribute to a Roth IRA if your income is below the specified amount defined by the IRS, depending on your marital status and how you earned that income. Usually, only incomes from work (rather than non-work sources like rentals or investments) are eligible. The amounts and limits the IRS specify for taxes depend on your modified adjusted gross income. Keep in mind that the specified amounts, including numbers indicating income levels, may change. Eligible participants for Roth IRA account contributions include heads of households and single individuals who earn an annual salary lower than $161,000. To file jointly as a married couple, your household income must have been lower than $228,000 in 2023 and no more than $240,000 in 2024. Any of the given categories means you are eligible to file for a Roth IRA contribution, but further on, your age affects how much you can save for retirement. If you are married or single and under 50, you can contribute $7,000 to your Roth IRA fund. It is still possible to set aside $7,000 for each, even if only one spouse is employed. For persons over 50, the same total contribution applies; however, they can set aside an extra $1,000. This additional amount makes up for the $8,000 limit on Roth contributions for persons from age 50 onwards. Rental income is, as previously mentioned, also taxable. To stay on top of things and avoid penalties, renters and landlords should keep detailed records of their rental expenses, including costs, incomes, dates, etc. An easy way to organize this information is by using spreadsheets or financial software- which many people use nowadays. As a landlord, you will want to list all expenses, such as property management commissions, cleaning, repairs, advertisement costs, real estate taxes, and mortgage interest rates. Be sure to include the security deposits, utility bills, and trash removal fees. Additionally, remember to leave room for depreciation of the property itself over time. Rental property losses can also be used to take advantage of certain deductions since passive activity losses are deductible. When other expenses are considered, such as the mortgage, repairs, property tax, and sometimes insurance, it is not always guaranteed that the rental fee will generate a net profit. If depreciation is added to those expenses, it is possible that the landlord’s costs could be higher than what they make from renting. If their losses total more than $25,000 in a year, the passive activity limitations- set at this precise amount- come into play. This means that within one tax year, a landlord cannot lose more than $25,000. If you want to sell a property you have been renting out, know that the process differs from selling your own home. When selling a rental property, you must subtract the cost basis from the sale price. You work hard for your money and want to ensure that you take advantage of every opportunity to save on taxes. When it comes to tax deductions for moving expenses, there are several windows where you may claim them. The most usual scenario is that individuals who moved due to a career or business relocation and those who relocated their company or started a new business in a new location can deduct their taxes. The IRS offers an online test to check whether you qualify for a deduction for moving expenses. The criteria are linked to the reasons for relocation. If you’re moving for work, you will almost certainly be able to get a deduction, but only if you fulfill the distance and time requirements (distance traveled from your old home to the new job was greater than 50 miles and elapsed time between jobs was less than one year). The time standards are concerned with when you worked and whether or not you were employed as an employee for 39 weeks over the first year of your business or start-up. Armed Forces members are not bound by time and distance criteria, as they may be relocated upon request from their superiors. Moving costs should also be recorded on Form 3903, which has a space for that. The IRS will evaluate which moving expenses can be deducted and usually allow the following: You can also file for charitable deductions if you donated to a qualifying charity organization. The donation could be in property or cash form. In some cases, the deductions can reach as high as 50% of your adjusted gross income; however, it only goes up to 20% or 30% for fraternal societies, veterans organizations, and cemetery organizations. This all depends on defined limitations. Another factor here is what sort of organization qualifies as a charity. There is a detailed list that outlines which type of organization is eligible: A deduction may also be possible if you have a US or international student living with you under a written agreement from one of the qualified organizations that assist students in learning opportunities. The student cannot be your relative and has to be enrolled full-time. You can deduct charitable contributions if you pay them in cash or before the tax year expires. You can use some strategies to get more deductions on your income taxes. For example, if you spent your own money on expenses related to charitable work. Let us say you participated in a fund-raising action and made cookies for the purpose. Make sure to calculate the ingredient costs, which can help support your claims if audited. Other qualifying expenses include, for example, funding activities for unprivileged children as part of a program from a qualified organization. These activities could be movie tickets, dinner, or athletic event tickets that you bought for them. You can deduct travel and lodging expenses if your employer sends you to a convention. If you donated to a specific individual, non-qualified organization, donor-advised fund, or other similar entity, you would not be eligible for charitable contribution deductions. They also cannot claim a tax deduction for their time spent on a specific cause, personal expenses, appraisal fees, etc. A casualty loss is when natural disasters like floods or earthquakes damage your property. If the damage to your personal property is only partial, your loss will be less than the adjusted basis. However, if you were renting out the property or it was destroyed, your loss would amount to the adjusted basis. You can also write off theft losses, which will amount to the adjusted basis of the loss due to theft. This is because after an item is stolen, its market value equals zero. Both losses qualify as itemized deductions, which necessitate completing Form 1040. The amount you can deduct for a casualty loss depends on the ratio of your adjusted gross income to the extent of the loss. You can only deduct losses that exceed 10% of your adjusted gross income. This means that if the loss is less than 10%, you will not be able to deduct anything. You are also expected to minimize or reduce your loss by receiving reimbursement from the insurance company. The amount you receive from the insurance company further reduces your casualty loss deduction. Given the sensitivity of casualty losses, it is essential to keep records. The IRS will most likely audit you on this topic, so when you file for a casualty loss deduction, be prepared by ensuring that you have proof that the asset or property was under your ownership (e.g., receipt, agreement), as well as evidence of its fair market value (repair costs appraisal, etc.). You could save thousands of dollars in taxes if you have dependents that rely on your income. There are multiple categories of dependency which make you eligible to file for this deduction. Parents, children, and relatives typically qualify as dependents. The dependent must be a Mexican, Canadian, or US citizen to file a joint return with their spouse (e.g., your married daughter files jointly with her husband). Otherwise, they do not meet the qualifications. Eligible children include your own, step-children, adopted, and fostered children under 19 or 24 years old if they are full-time college students. Disabled children qualify regardless of age. The child must be living with you for at least six months. Also, part-time working kids whose incomes are not enough to support themselves and depend on your income qualify as dependents. Only parents and a few other specific relatives do not have to reside with you to be claimed as dependents. All other family members, though, must live with you to qualify. Also, only one person can claim any given dependent – if two people try claiming the same dependent, neither will receive the deduction. Your employer usually withholds income tax from your paycheck and then sends the money to the IRS, so you do not have to worry about that. But if you are self-employed or make money in other ways—from interest, dividends, stocks, business profits, or alimony—you might have to pay estimated taxes. It is a good idea to pay your taxes on time, and if you withhold tax payments, you risk having your account closed by the IRS. To discover how much you owe, estimate your income and deductions. Turbo Tax software is commonly used for this purpose, which can accurately calculate your taxes. It is also a good idea to review your taxes from the prior year to refresh your memory on what incomes and deductions you have to submit. Usually, the tax payment process involves four separate installments. The amount you pay each time may vary, depending on factors such as whether you have withheld taxes or made a lot of money in a quarter. The AMT is a tax mechanism created to keep wealthy individuals from not paying taxes. Inflation exemption from the AMT is automatically updated every year. The AMT aimed to establish a fixed minimum level for all taxpayers, particularly rich ones, who used deductions and fell below the minimum taxable income requirement. This system aims to balance the tax deductions by implementing an extra fee. This ensures that those who received lowered amounts of regular income taxes through exemptions and other benefits pay their fair share. If you have children, this tax credit can benefit your family by worth up to $2,000 per dependent child. The qualifying criteria are that the child has to be under 17 and must also be your dependent for you to receive the maximum amount of $2,000 back from income taxes. Your adjusted gross income determines the tax credit amount, which may be lower than if you did not have children. The amount is again dependent on your situation. When filing jointly as a married couple, the limit is $400,000, and when filing separately as a married couple, it is $200,000 in adjusted gross income. Any outstanding tax debt, regular or alternative, will also lower the child tax credit amount. So make sure you are paid up before filing. If you owe in taxes more than the child tax credit, you can apply for an additional child tax credit. Low- and moderate-income earners may be eligible for the Personal Credit or Earned Income Tax Credit. To apply, you will have to file a separate tax return that meets specific criteria. By doing so, you could pay less in taxes overall and even receive a refund. Eligible persons are employees who work for an employer and run or own their businesses, including farmers. Additional rules may apply if you are a worker with or without qualifying children. Your income, including your adjusted gross income, must not exceed the IRS-defined maximum amount unless you qualify for one of a few exceptions. Furthermore, if you have or do not have a qualifying kid, essential criteria must be fulfilled, and additional rules followed. If you are married, one of the fundamentals is to provide your social security numbers and those of your spouse and any qualifying children listed on your tax return. The social security number must be provided before data and employment verification is accepted. Remember that if you are married, you cannot submit it separately; you must do so when married and filing jointly. The maximum taxable investment income for 2024 is $7,830; however, if you are single, head of the household, or widower, your registered income must be at least $1. You qualify if you have no qualifying children and your income is under $17,640. The following applies to those with qualifying children: If you are married and decide to file your taxes jointly (which is necessary to get personal credit), the income for a couple with no qualifying children must not exceed $24,210. If they do have qualifying children, then the numbers change and are as follows: Please note that these numbers are only valid for the April 2024 tax year and are subject to change. Still, they provide a good framework for giving you an idea of what the incomes have to look like to apply for a tax return for personal credit. To qualify for the child tax credit, your child must meet the age requirements, live with you full time, and be listed as a dependent on your taxes. If you don’t have any qualifying children, you must have been a resident of the United States for at least six months out of the year, be between 25 and 65 years old, and not able to be claimed as a dependent by someone else. The IRS has lower eligibility criteria for qualifying children with disabilities or special circumstances such as military or clergy staff, disaster-affected persons, or disabled persons. Estimated taxes are all those extra taxes Americans must pay throughout the year, on top of their regular income tax. Regular taxes are automatically transferred to the IRS by our employers. Estimated taxes, however, are special and include incomes from your own business (self-employed persons), dividend and interest rate incomes, capital gains, alimony, prize money, and income, as well as alternative minimum taxes. They are usually paid every quarter, too, and mandatory – meaning if you do not pay your share of the untaxed income you receive to the IRS, penalties will follow. To avoid that, fill out the estimated tax Form 1040-ES, which is also very convenient for calculating the estimated taxes. Do not forget that all American citizens are obliged to report estimated taxes; they are your responsibility, so you have to take care of them. Since the American tax system relies on regular tax payments, reports must be submitted to the IRS, including estimated taxes. According to the IRS, estimated taxes should be submitted four times a year. You can calculate your estimated taxes for the entire year by dividing them by four to get the amount you need to pay quarterly. You can use IRS Form 1040-ES to complete this calculation, or utilize different finance calculators and software online, such as TurboTax. To compute the taxable income, you must add the predicted adjusted gross income, regular income subject to tax, annual credits, and deductions taken through tax returns. To determine your deductions, look at your estimated taxes from last year. Although it may seem easy, many people delay submitting their estimated taxes and spend the money without setting aside taxes. They convince themselves that they will make up the amount later, which often leads to underpaying your taxes. If you owe more than $1,000 in taxes, you could be fined or even have to pay interest on the money you owe. The American tax system is quite complex, but knowing all the loopholes and deductions can save taxpayers money. Tax-Free Residence Sale refers to selling your home in a way that circumvents the capital gain tax. Before 1997, if a seller used the money from their house sale to buy a new, more expensive home within two years, they did not have to pay taxes on the property sale. In the past, home-sellers were not given any tax benefits. However, the Taxpayer Relief Act has changed this and now offers a few advantages to those selling their houses. If you sell your house for $250,000 or less (and sometimes up to $500,000), you are not required to pay anything to the IRS because taxes on profit are only owed if the amount sold is greater. You can only use this tax break if you sell the house you live in–your primary home. If you are selling any other properties, like a rental house that you finally sell, those cases will be considered capital gain and taxed as such. In addition to the property requirements, there is also a time requirement: you must have lived in your current home for at least two years. You can invest in securities that are not taxed. This implies that the interest earned on your stock assets will remain in your pocket. Several debt instruments are marketed to raise capital and are tax-free at all three levels of government (state-federal-local). They are known as municipal bonds because they are issued by municipalities and pay no taxes until they mature. Tax-free investments are most popular among those who pay the highest taxes, such as general obligation bonds and revenue bonds. These types of bonds finance government projects or others with money specifically set aside for the project. A certain level of risk is involved in investing in bonds, as they are closely linked to interest rates. For instance, you will earn less if interest rates move against you. Additionally, these bonds may not be liquid enough to sell if needed. Given that every investment entails some degree of risk, you might as well choose a risky investment that provides tax breaks. Two possible educational tax credits could help cover a higher education student’s costs. These credits often result in more income tax savings than a simple tuition deduction would provide. The first credit is the American Opportunity Credit which could save you up to $2,500 in taxes per student. Students who attend college at an eligible university for federal student aid may qualify for this credit, which is available during their first to the fourth year of studies. The credit covers typical school expenses such as tuition, books, and other materials needed for classes. Students with a felony drug conviction are not qualified. The other credit is the Lifetime Learning Credit. Anyone who pays taxes and attends a minimum of one course at a university that is a member of the federal student aid program can apply. The applicants do not have to pursue a certificate to be eligible but simply be enrolled in one course. It covers tuition fees and book expenses, supplies, etc. As a student or the dependent of one, you have the chance to make some considerable reductions in what you owe come tax season by applying for either of two credits. Make sure not to let this golden opportunity slip through your fingers. As an honorable member of the American military, you are entitled to a myriad of advantages, one of which is taxes. This tax group receives some of the best tax breaks and benefits compared to others. For example, serving in a combat zone excites you from paying income taxes for that month or month. However, it is important to note that The IRS keeps a detailed list of qualified combat zones just in case. If you are a married military personnel, you do not have to be physically present when filing taxes jointly. Your spouse can complete the process by proxy with a power of attorney. The mobile nature of military work comes with the perk of special deduction rules for reimbursement purposes. Additionally, members of the military who are transitioning back into civilian life and searching for a job can apply for special deductions to cover travel and other fees. The IRS provides free tax assistance to military members and their families, so they understand the often confusing military tax rules, filing for a deduction, exemption, etc. If you want to start your own company, consider the associated costs. So it is vital to understand where you may save money, particularly taxes. Let us have a look at what you can expect from being self-employed. It’s as easy as it sounds. You can claim a deduction for some business expenses if you open an office in your home. The requirements are not difficult to fulfill. To be eligible for a home business deduction, all you have to do is operate a business from a premise at home that is exclusively used for commercial purposes regularly. An additional requirement is that your home serves as your primary base of operations from where you manage all business affairs. Even if you are a small business owner who conducts business both inside and outside the house, meaning at two locations, you can still apply for a deduction for the expenses related to work performed at your home. Home businesses have to estimate the percentage of their home used for work to deduct it from their taxes. The home office deduction can also be utilized by employees who do some or all of their job duties from home. Small company owners may not enjoy the topic of retirement plans, but it is a little simpler for them when they know that each retirement plan has tax benefits. Keogh, Simple, and SEP retirement plans are known for their tax breaks, which is why American small business owners favor them. The Simple IRA is a retirement savings plan for individuals that allows them to contribute independently. Individual retirement accounts have a contribution arrangement put in place by the employer. Regarding contribution limits, this plan has the lowest restrictions compared to other plans, and an employer must include 100 workers to be eligible for the Simple IRA. Employees are not required to make regular contributions, but employers must (up to 3%). For now, the restriction is set at $16,000 plus any catch-up contributions; it might be increased again.). People aged 50 or older can get an extra $3,500 in catch-up contributions. The SEP Plan requires that all employees receive the same perks. The payments are deductible, so employers and workers may anticipate income tax breaks. Under this plan, employers must withhold 25% of their employees’ salaries and deposit them in their SEP accounts. The self-employed have a lower cap of 18.6% of net profit. The Keogh Plan is not as commonly known or used as the other two retirement plans, but it does have higher contribution limits. Although contributions are made before taxes, allowing for a deduction that year, retirees will pay taxes on withdrawals. Withdrawals can only be made at age 59 ½, and any prior withdrawals could result in penalties. The administrative procedure of this plan is more demanding than others. Finding the best savings plan for you and your employees is a complicated task. Employers and employees must make precise calculations to determine which retirement plan is ideal for them and which will offer them the most tax advantages. Some people are in different circumstances; one plan may work for one person but not another, and vice versa. There is also an open window for a deduction on the business usage of automobiles. Simply tally up your vehicle expenses using the standard mileage rate or real-time costs you had to pay, then claim a deduction. The criteria are pretty basic, and almost every self-employed person can apply, but be sure to check out IRS information on specific requirements. The term “self-employment tax” refers to social security and Medicare taxes. The IRS offers Form 1040 to compute self-employment taxes. Since 2012, the percentage of the tax rate for this tax has been lowered, and in 2016 it was 15.3%. We are coming to the end of our tax guidebook. Take a quick look at penalties, tax extensions, amended returns, and IRS audits. We have already mentioned taxes throughout the book and when it is a good idea to avoid them. So, let us go through what was said previously. The IRS will impose a penalty if you do not pay your taxes on time. The deadline for submitting your return is April 15th, also known as Tax Pay Day. You are required to have paid all of your tax obligations before this date. Make sure you submit your tax returns by the due date and be tax-free by April 15th each year. Although you may not be able to pay your taxes immediately, you must file documents on time to avoid additional penalties. And if you are honest with the IRS about what you owe, They will work with you, for instance, by setting up a payment plan. The failure-to-pay penalty is a fee you are charged when you do not pay your taxes. This penalty accumulates to ½% of 1% for each unpaid tax bill. If you usually pay 90% or more of your taxes, you can request an extension for filing (but still on time), where the IRS will not charge you with the failure-to-pay penalty. They will only expect you to pay what is remaining of the amount that you owe. According to the IRS, all late taxpayers and submitters are permitted to ask for a six-month extension before submitting their tax returns. The best news is that it is practically automatic, with no special requirements, as long as you send your extension request promptly using the correct form. However, always double-check the laws in your state, as some have entirely different extension request forms. You can submit Form 4868 online or via hard copy by the deadline–it is free and easy with no added complications. After the IRS grants you six more months, calculate all relevant tax data and incomes for a more efficient return. It is better to file an extension than pay costly penalty fees for failing to file on time. Although amended returns are not required, if you choose to file one, it is essential to know that this means all entries must be corrected–not just those that will result in a refund or higher taxes. Form 1040X must be used to file an amended return and can only be submitted in hard copy format; electronic filing is not an option. Some individuals file an amended tax return simply because they made a mathematical mistake, but there is no need to worry about this since the IRS will correct and catch up on these mistakes in three years. The due date for filing amended returns is three years after you submit your original return. When you know you can get something out of it, filing an amended return may result in a better tax return, so it is well worth doing it. The IRS taking a closer look at your taxes is rare, but it does happen. We will explore some reasons why this might occur so that you can be prepared. If you earn a million dollars in one year, the IRS may audit you to ensure you follow the law. The wealthy elite usually target IRS audits since they have more money to tax. The IRS may audit you if you take too many charitable deductions in the second scenario. If you give away more money to charity than you make, the IRS will likely show up at your doorstep. Estate taxes are also a problem for the IRS, especially if the estate is large. They may reexamine everything you have done. You will be subject to an audit if you don’t disclose all of your earnings. The most significant benefit is maintaining a thorough accounting of all your earnings so that reporting does not slip away from you. To ensure you avoid any hefty fines, take care to file your taxes correctly and note that purposely withholding payment is never worth it since the IRS always catches on. This book walks you through how to use all the tax advantages and breaks available to stay within the law—and keep more money in your pocket. The key is working with, not against, the IRS. Taxes are a crucial part of our society, and it is important to be up-to-date on the latest changes. Paying taxes is essential to maintaining a functioning society, but it can be difficult to understand everything. Whether you file your taxes yourself or have someone else do it for you, make sure you understand the process and all the options available to get the most out of your return. The best way to stay out of trouble with the IRS is to stay informed and always pay your taxes on time. Understanding how taxes work can also help you take advantage of deductions and other benefits that you may not have been aware of. If you have any questions, do not hesitate to reach out to a tax professional. They will be able to help you sort out any confusion and make sure you are following the law.Introduction

Taxes: What Are They and Where Do They Come From?

Definition of Taxes

History of Taxes

What is the IRS?

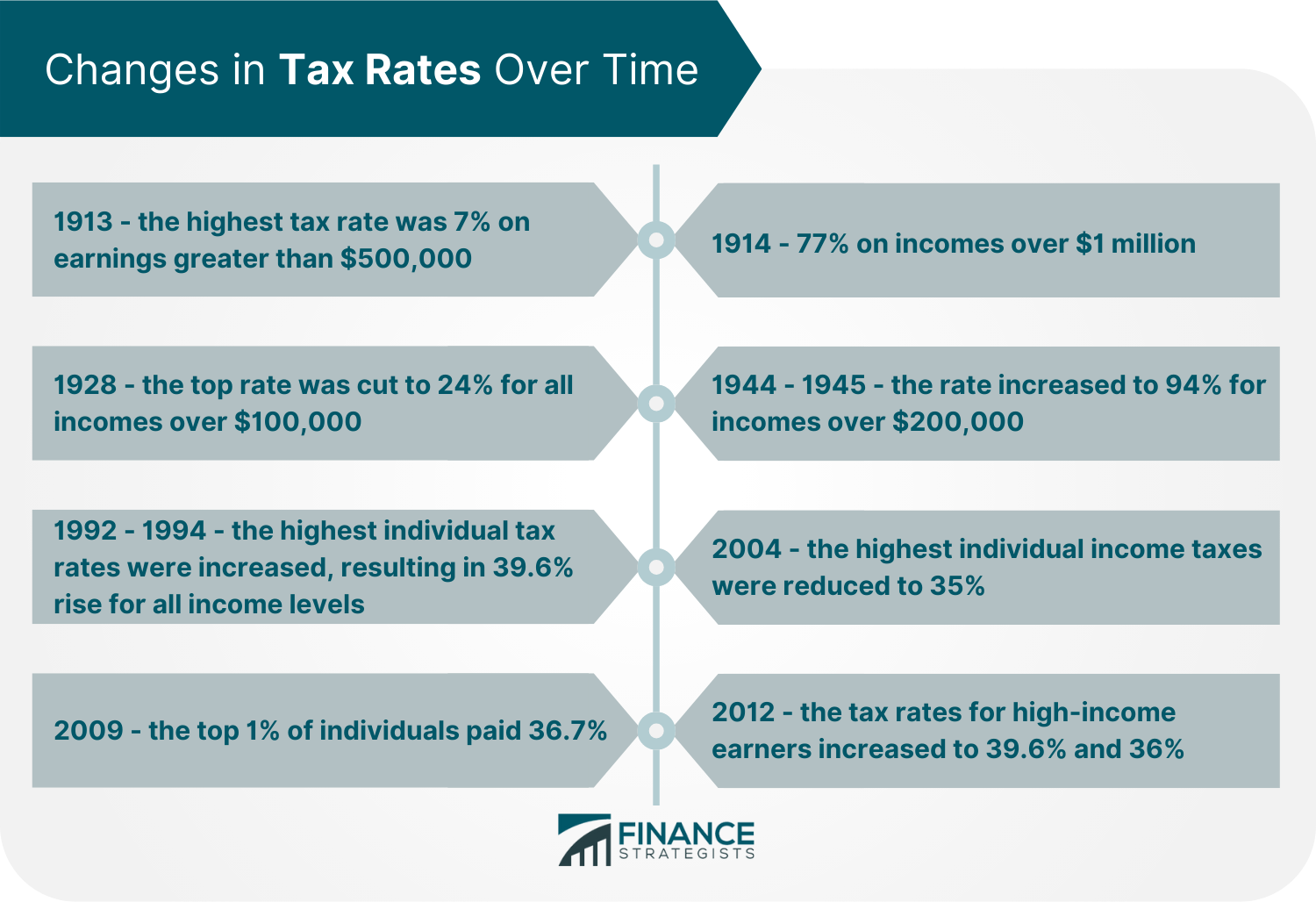

A Look at How Income Tax Rates Have Changed Over Time

In 1944 and 1945, that number increased to 94% for incomes over $200,000 (around $2.69 million in today’s money).

The top rate was lowered to just 50% for earnings above $86,000 in 1981, except from 1988 to 1990, when the threshold for paying the top rate was even lower for all incomes exceeding $29,750.The Different Types of Personal Income Taxes

Tax Withholding

Progressive Income Tax

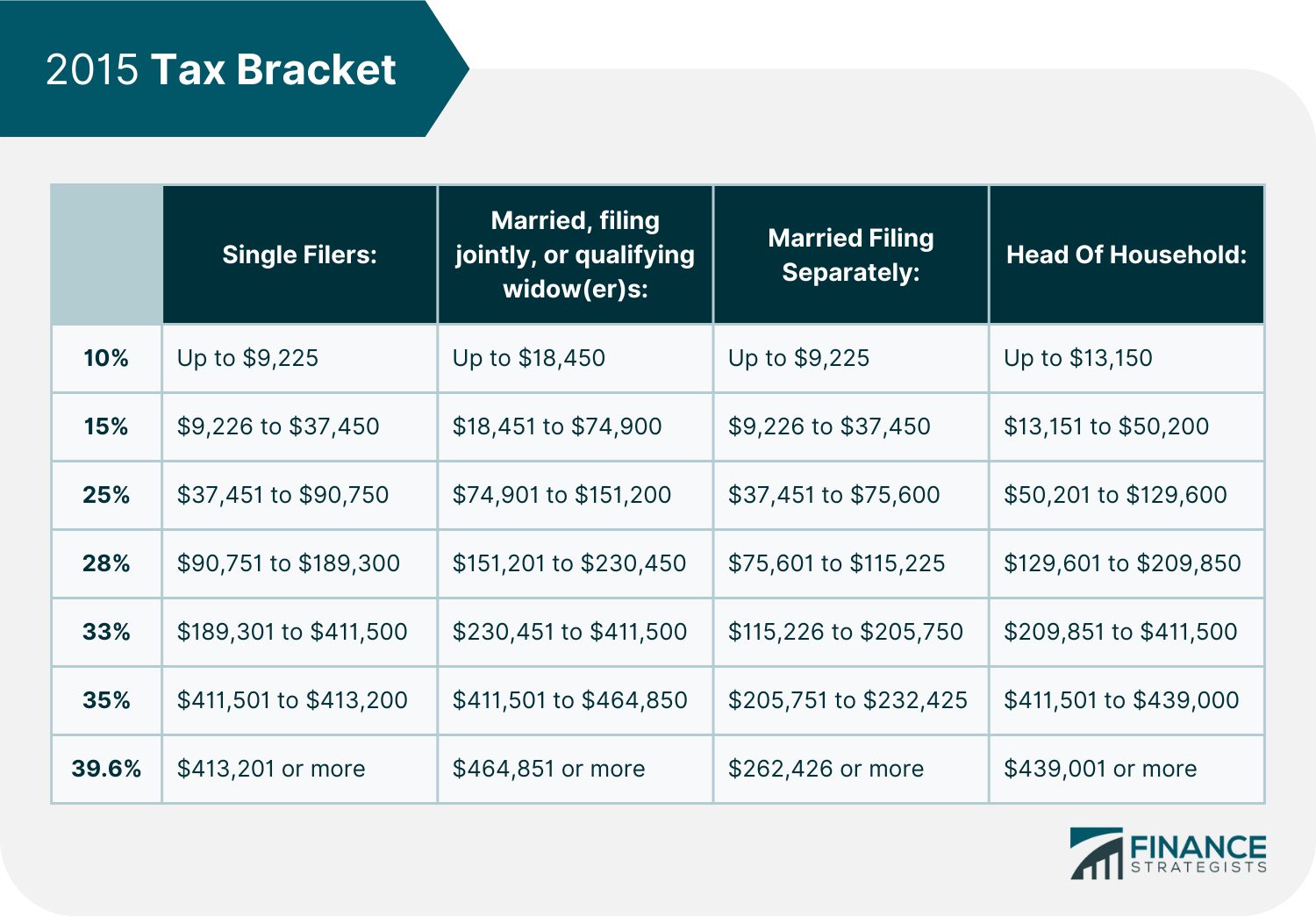

Tax Brackets

In addition, you must have paid more than half the cost of living for that year and had an eligible person living with you (excluding temporary absences) for more than six months.

The Tax Break on Capital Gains

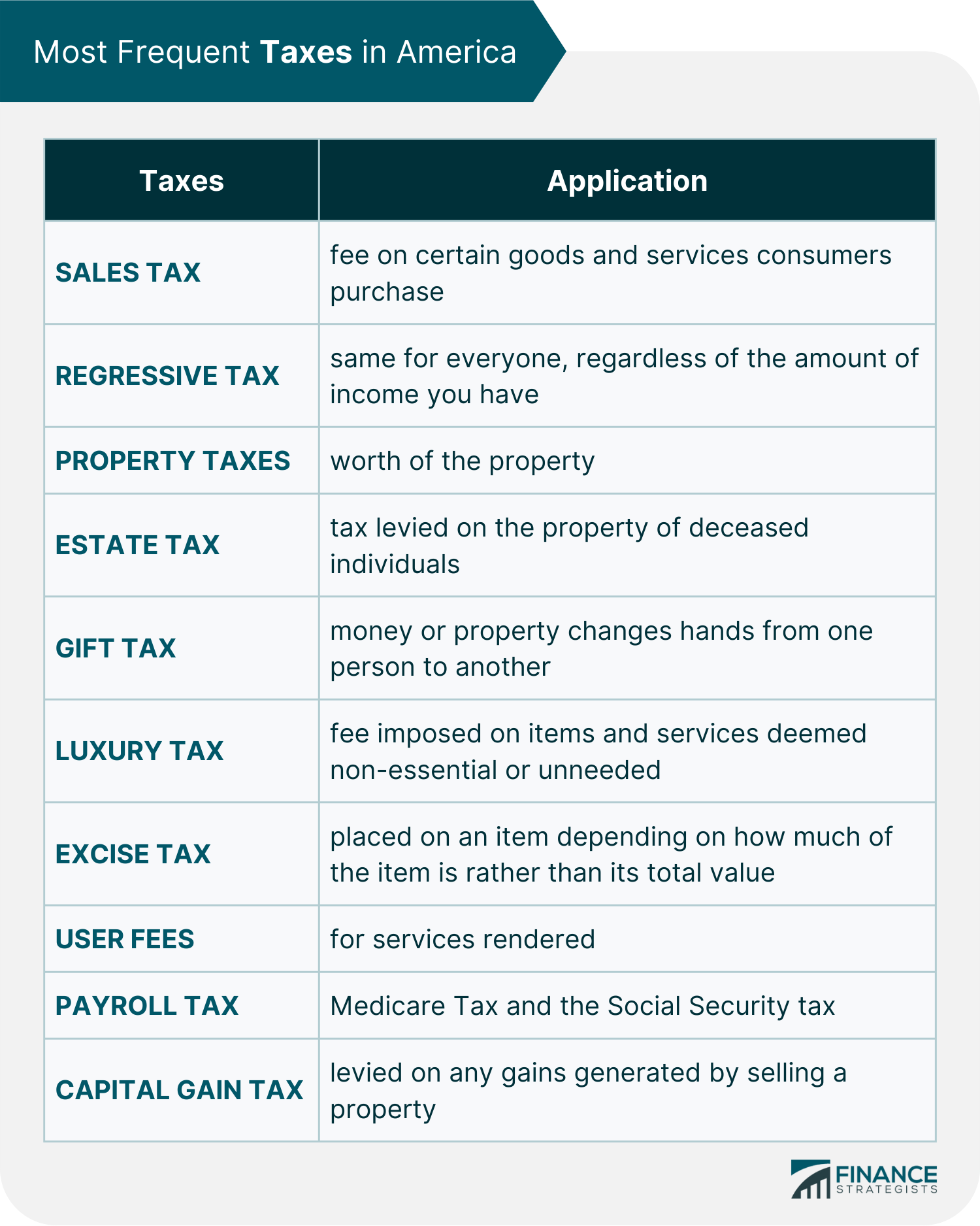

Additional Personal Taxes

Sales Tax

This system leads to lower-income households being more affected by the tax because they often spend a more significant proportion of their income on these taxes.Regressive Taxes: An Explanation

Property Tax

If two people live in the same area and have houses of equal value but earn significantly different incomes, the regression would be evident because they pay the same amount in property taxes. Estate Tax

Because the vast majority of persons do not have an estate valued at more than $5.43 million, only about one percent are affected by this tax.Gift Tax

Luxury Tax

Excise Tax

User Fees

Payroll Tax

Capital Gain Tax

How Do Corporate Taxes Work?

Corporate Tax Laws: How Are They Made?

Various Business Types

Limited Liability Companies

Corporations

What Happens to All This Tax Money?

Federal Taxes

State Taxes

Getting Ready to File Your Individual Income Taxes

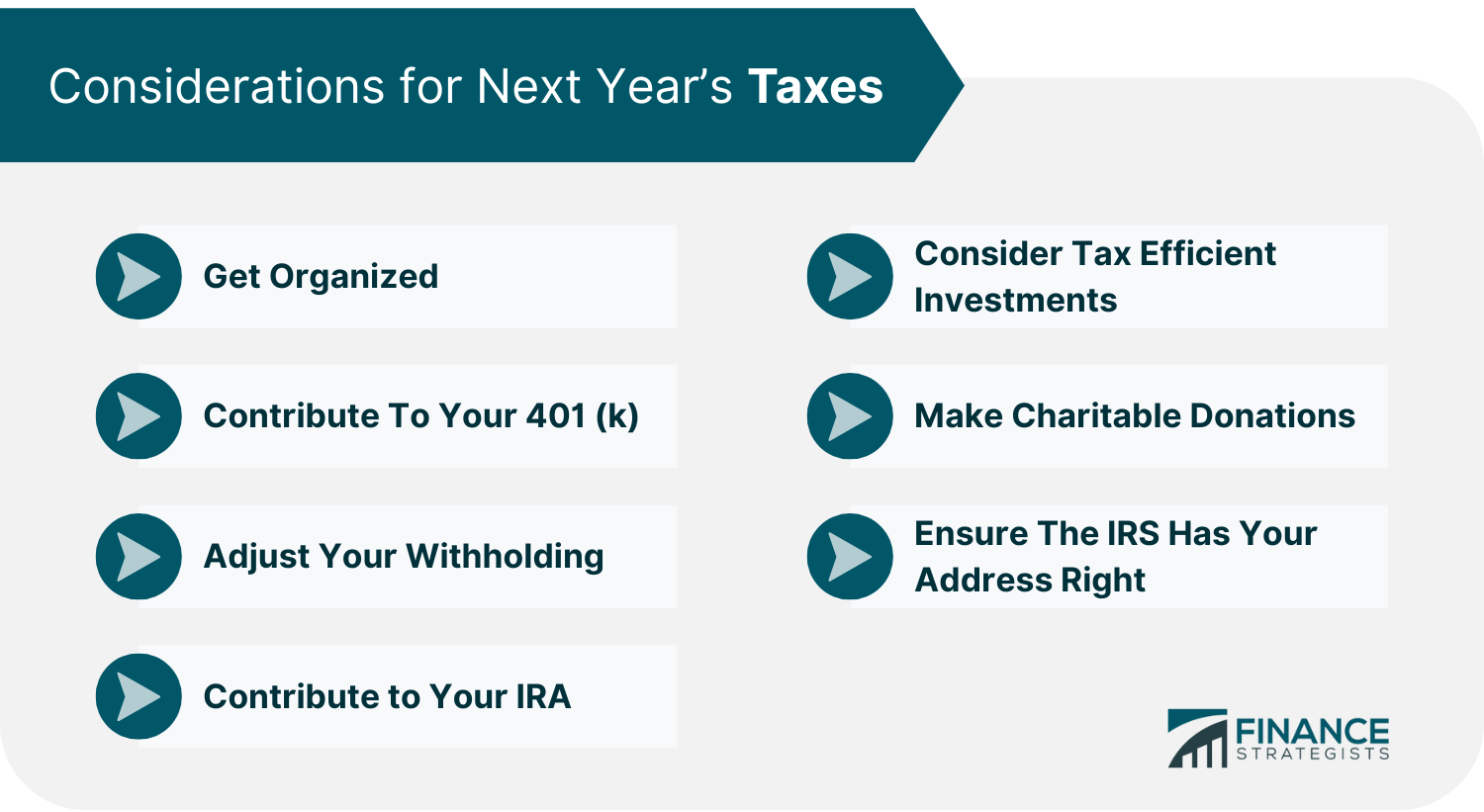

How to Prepare Your Taxes

How to File Your Taxes While Residing Abroad

Bill Of Rights For Taxpayers

They are entitled to an explanation of all tax rules and IRS procedures in every form, publication, notification, correspondence, or instruction.

Taxpayers also have a right to be informed of all IRS decisions regarding their tax accounts and clear and succinct explanations of the outcomes.

They should be addressed straightforwardly and entitled to contact a supervisor if they experience any poor service.

They are also entitled to a response from the agency, regardless of whether it agrees with their viewpoint.

They also can receive a written response from the Office of Appeals on their decision. Taxpayers can also take their disputes to court.

Taxpayers also have a right to expect that anyone who wrongfully uses or discloses taxpayer return information will be held accountable.

Taxpayers also have the right to receive assistance from the IRS Taxpayer Advocate Service if they are dissatisfied with the IRS’s resolution of their tax issues or have financial hardship. (IRS.gov)

Filing Fundamentals

Filing Status: Which Form Should Be Submitted?

They must manage more than half of the household expenses.

A head of the household must prove that they provided for a family member, such as a child, parent, or relative, amounting to more than 50% of their money expenditure during this period.

The individuals you cared for must be registered to live with you for the previous six months by the date of filing, except parents.

Additionally, if another dependent – like a relative – dies before the end of the tax year, but you met all other requirements to claim head of household status, you can still do so.

But it is important to note that different federal laws may take other definitions of what “single” means.

If you and your spouse file a joint return, both of you are liable for any unpaid taxes and penalties, even if only one of you is to blame.

However, there may be instances in which the law exempts one spouse from liability if that person did not know about the other spouse’s negligence. Also, spouses can request a “separation of liability.”

A joint tax return must be filed if spouses’ tax years begin on the same day, they are still married by the deadline, and neither is a foreigner with no clear residency status.

It is simple to do the math. The major drawback of filing separately is that both spouses must take the basic deduction, and neither can claim education tuition or interest deductions on student loans.What Types of Income Must Be Reported?

Salaries, wages, tips, bonuses, disability benefits, unemployment compensation, commissions, and noncash fringe benefits are all made money.Fringe Benefits

Archer medical savings accounts, minimal benefits, athletic facilities, educational assistance, employee discounts, cell phones from employer, meals reimbursements for moving costs, retirement plan, transport, tuition reduction, working for condition benefits, and scholarships fellowships.

The IRS also provides guidelines for calculating the value. Employers could be subject to high penalty fees if they fail to report all the benefits provided to their employees adequately.Capital Gains & Losses

Traditional IRA (Internal Revenue Service) and Roth IRA

Rental Income

What Tax Breaks Are Available?

Deductions for Casualty Losses

Claiming Deductions Based on Dependents

How Much Do You Owe in Taxes?

The Alternative Minimum Tax (AMT)

Child Tax Credit

The Earned Income Tax Credit

Estimated Taxes

Strategies for Tax Savings

Tax-Free Residence Sale

Investing in Securities

Tax Credits for Education

Armed Forces

Planning Business Strategies

Home Office Deduction

Keogh, Simple, or SEP

Keogh Plan

Self-Employment Tax

To End This

Tax Penalties

Filing an Extension

Amended Returns

IRS Audit

Final Thoughts

Taxes FAQs

Taxes are payments that you are required to make to the government. The money that you pay in taxes is used to fund public services and infrastructure.

The IRS is the agency responsible for collecting taxes. They are also responsible for enforcing tax laws and issuing refunds.

You have to pay taxes because it is the law. The government requires that you contribute a portion of your income to help fund public services and infrastructure.

The amount of taxes you owe depends on a number of factors, including your income, filing status, and whether you have any dependents. You can use the IRS Tax Tables to estimate how much you will owe in taxes.

Taxes are typically due on April 15th of each year. However, if you file for an extension, you may have until October 15th to file your return.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.