An investment refers to any asset that is obtained for cost on the grounds that it is expected to provide value in the future that will exceed its initial cost and time to value. This happens due to an appreciation of the asset's value. This could be because of: An investment is an asset that will eventually provide value that exceeds the initial cost. The term investment can apply to almost any asset, including intangible assets such as education. In terms of the stock market, investing typically refers to the purchase of stocks or bonds. These securities are designed to provide an investor with future value that will exceed their initial cost. Investments can also be made in other assets. Investing in real estate, for example, could mean buying an inexpensive property, renovating to increase its value, and then selling or leasing for more than the original cost. Have questions about investments? Click here. Investments in finances are instruments that investors purchase in order to realize a greater return later. Most often, these instruments are stocks. For example, an investor may purchase $1000 in stocks from a company. The company uses the money to fund and grow operations. As the company develops, the value of the investor's shares may grow to $1200. The investor will have realized a $200 profit from their investment. There are many types of investments available on the market; from stocks and bonds to mutual funds and ETFs. Below is a list of some common financial investments: A capital investment is a type of investment that involves putting down a sum of cash to finance a purchase that will provide long-term value. It is also sometimes used to describe the purchase of things like long-term equipment. Capital investments are often made by wealthy individuals, venture capital groups, or financial institutions. In such a case, the investment in the business is expected to return value to the investor. Fixed income investments are so named because they are designed to deliver a "fixed" amount of income on a regular basis. Bonds are among the most common fixed income investments. They offer a consistent return on principal over time. Other fixed income investments include preferred stocks, which pay dividends, as well as CDs and money market funds. Risk is a term that is not unanimously defined by investors. Generally, the probability that an investment will yield either a loss or underperformance can be thought of as the investment's level of risk. High risk investments are those that have a relatively high chance of ending up with a loss. Junk bonds, for example, carry a greater than average risk that the issuing company will default. Low risk investments are those with a relatively low risk of failure. Government bonds and stable indices like the S&P 500 are examples of fairly low risk investments. Investment management refers to the service of managing a client's investments, including allocation, buying and selling, and other forms of handling. Investment managers can help ensure a well diversified portfolio, and can be beneficial when investing large amounts of money in different asset classes. An investment portfolio is a basket of assets that may be comprised of stocks, bonds, real estate, cash, ETFs, mutual funds, and more. Investors aim to have a well diversified portfolio. This means that their portfolio contains a variety of different assets (such as stocks, bonds, and real estate). Assets are often chosen to intentionally react differently to market changes. This is to offset any losses from a random market swing. Return on investment, or ROI, is a metric that evaluates approximately how much value has been gained from an investment relative to the cost. For example, if you had purchased an asset for $100 and the value appreciates to $120, then you have gained $20 worth of value for an ROI of 20%. Return on investment is calculated using the following formula: Take the current value of the investment and subtract the cost of the investment. Divide by the cost of the investment and you have the return on investment. For example, say that you bought an asset currently worth $1000.You initially purchased the asset for $800. The return on investment for that asset would be: An investment bank is a financial institution that advises and makes investment transactions on behalf of clients. These clients may be individuals, corporations, or governments. Despite being called banks, investment banks do not accept deposits and usually don't offer traditional banking services. This is due to the Glass-Steagall Act of 1933 that enforces the separation of investment and commercial banks. An investment company is a business that invests the pooled capital of investors. Their goal is to make investments that grow the investor's asset bases. Usually investment companies invest in mutual funds. While the main purpose of an investment company is to hold and maintain investor's accounts, they may offer services such as tax management, recordkeeping, and portfolio management.Define Investments in Simple Terms

What Do Investments Mean in Finance?

Types of Investments

Capital Investment

Fixed Income Investments

High Risk vs Low Risk Investments

What Is Investment Management?

What Is an Investment Portfolio?

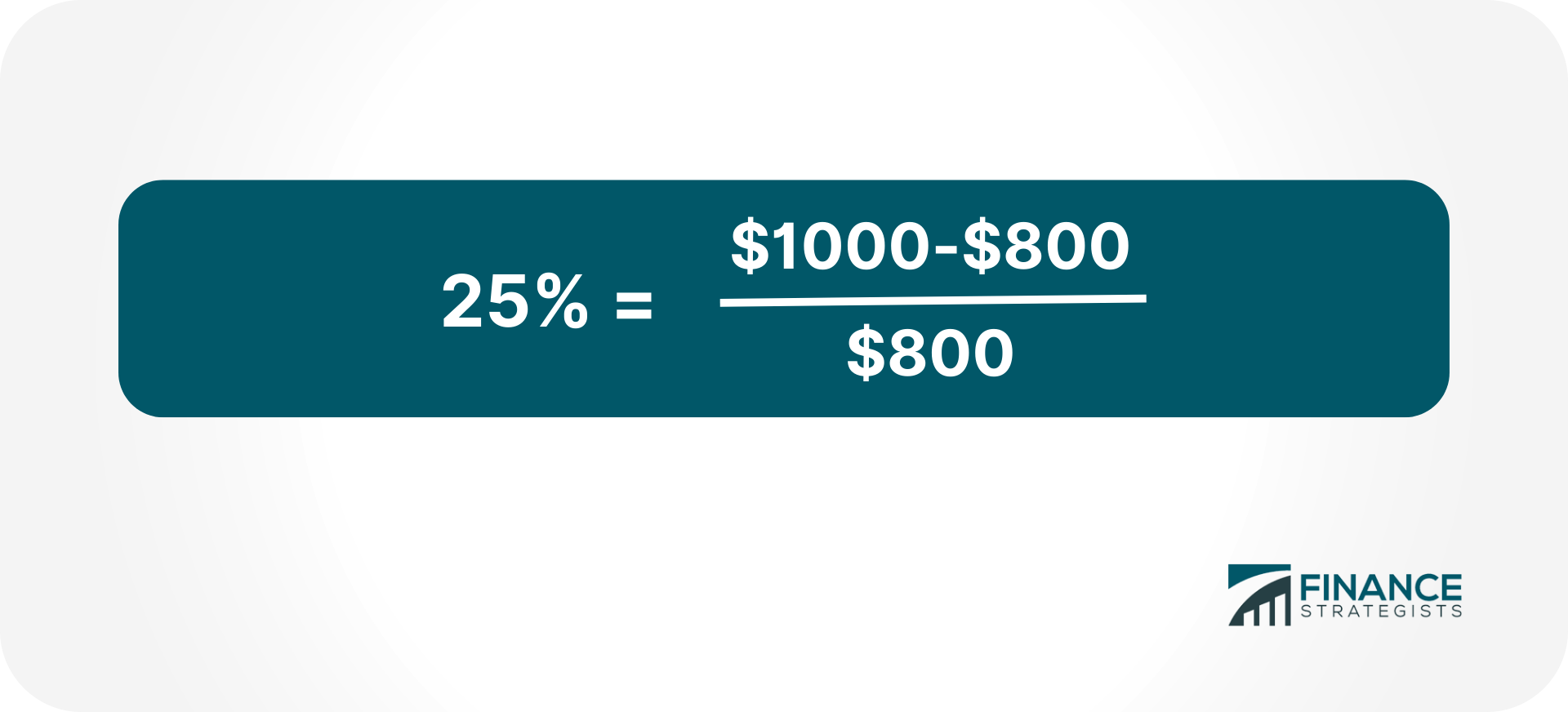

Return on Investment

Return on Investment Formula

Investment Banking

Investment Companies

Investments FAQs

An investment is an asset that will eventually provide value that exceeds the initial cost.

Investments in finances are instruments that investors purchase in order to realize a greater return later. Most often, these instruments are stocks.

There are many types of investments available on the market, from stocks and bonds to mutual funds, ETFs, etc.

Investments grow due to an appreciation of the asset’s value. This could be because of a change in market conditions (such as with stocks), a change in the overall supply (such as the works of a particular artist growing more expensive as collectors accumulate more of the overall supply), or because of a direct improvement being made (such as with buying real estate and renovating to increase the value).

ROI is a metric that evaluates how much value has been gained from an investment relative to the cost. For example, if you had purchased an asset for $100 and the value appreciates to $120, then you have gained $20 worth of value for an ROI of 20%.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.