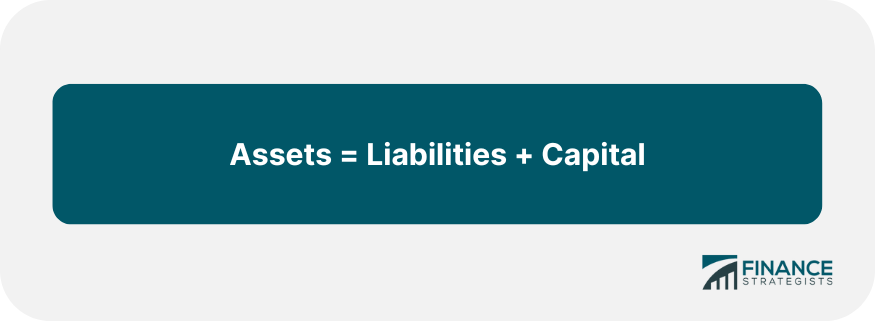

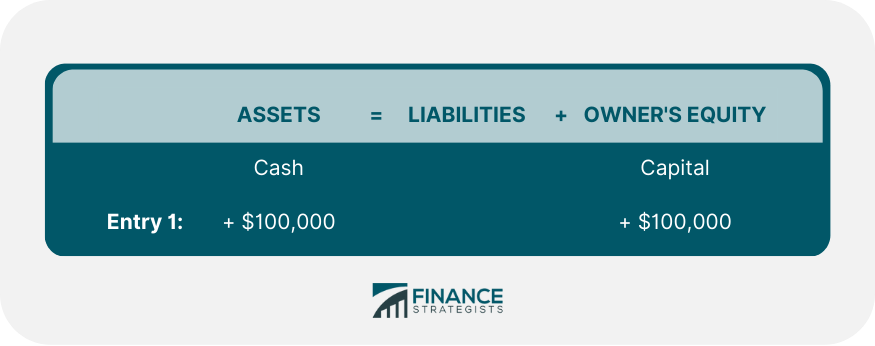

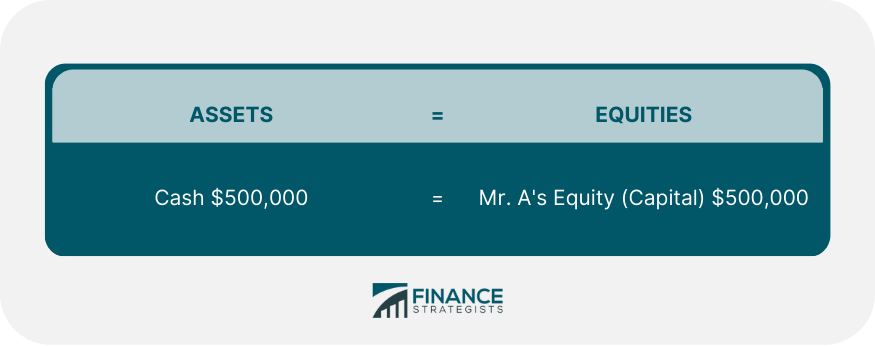

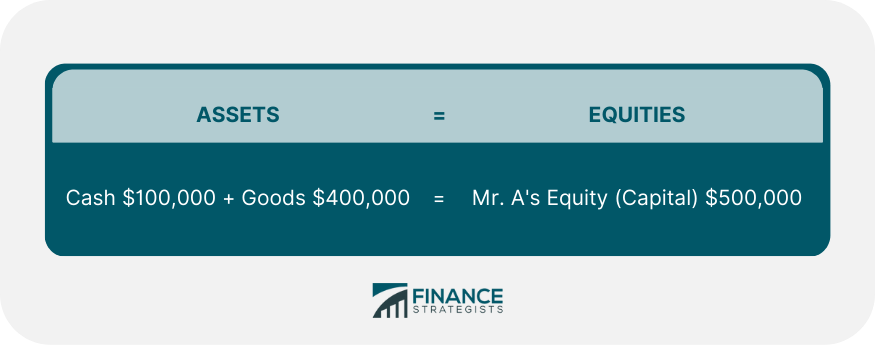

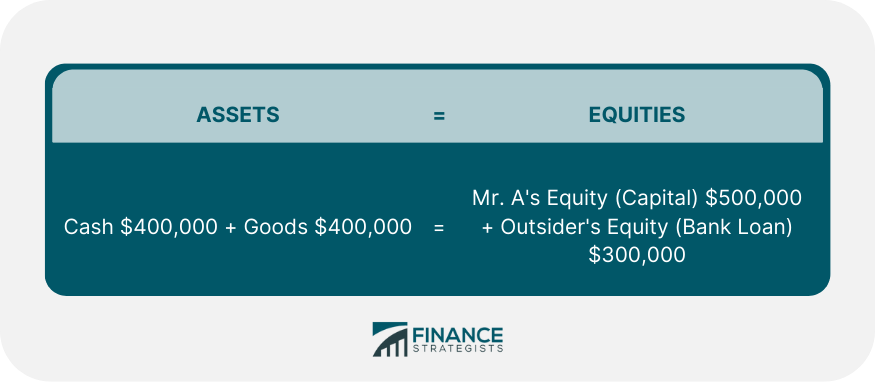

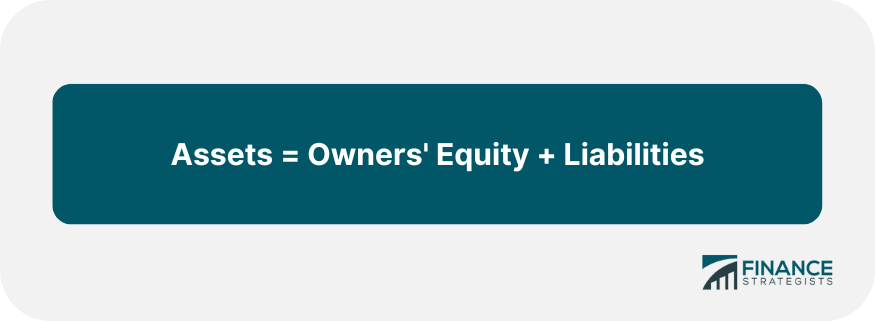

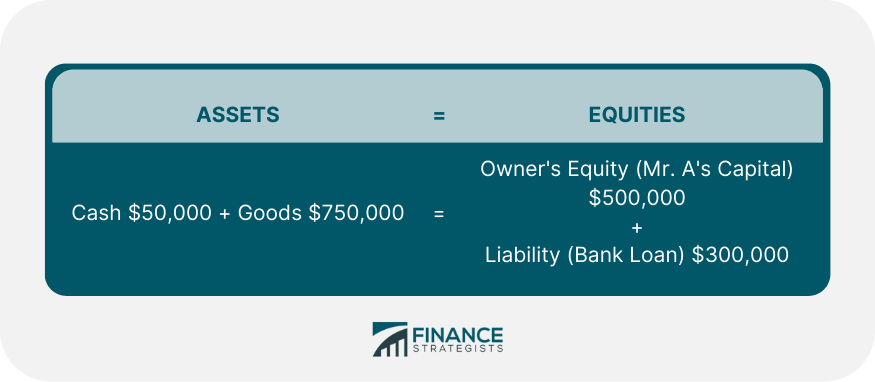

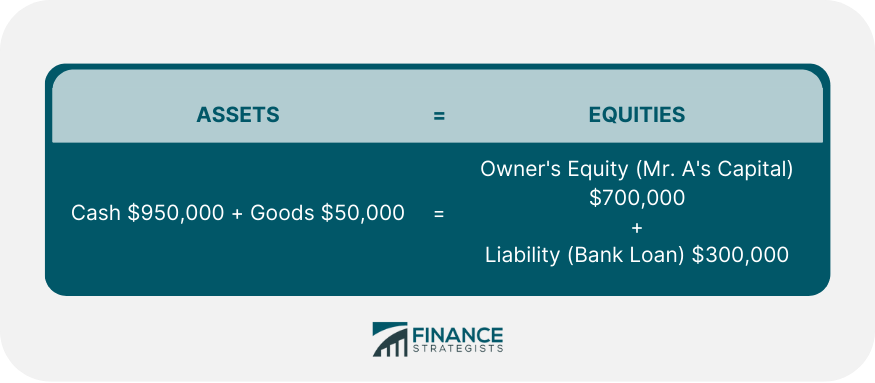

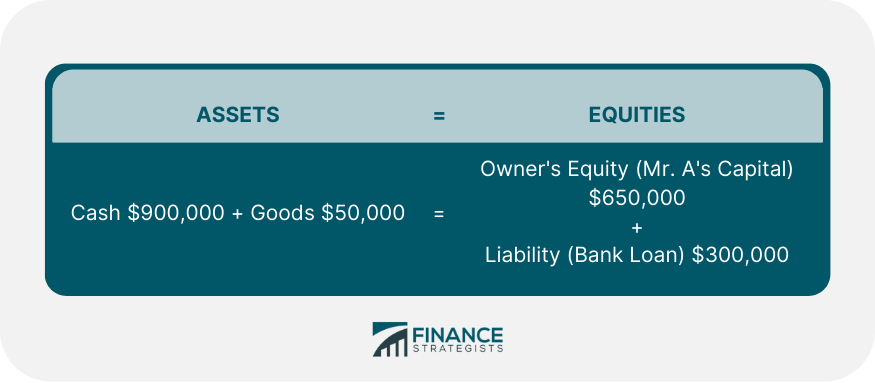

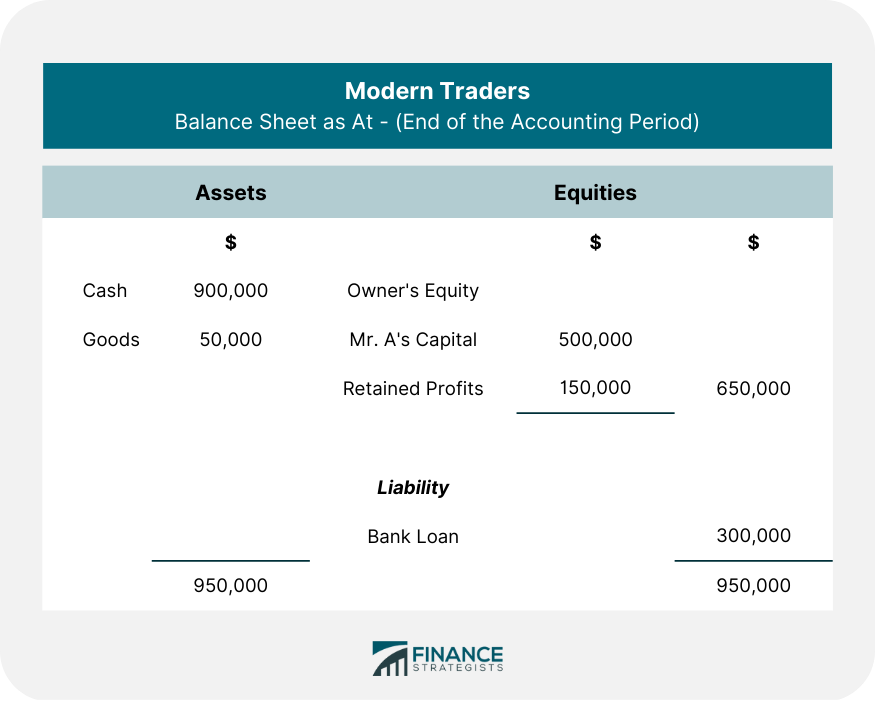

The dual aspect concept of accounting relates to the idea of double entry bookkeeping. To ensure a comprehensive and complete record, it is necessary to make two entries to record each transaction. This concept is based on the assumption that a business never truly owns anything. Anything that a business has (namely, assets) is owed either to outsiders (i.e., liabilities) or to the owner who is a separate entity (i.e., capital). Hence, when a business gets anything, it must record both facts: an increase in assets and an increase in liability or capital. Similarly, whenever anything leaves the business, there is a reduction in assets and a corresponding reduction in either liability or capital. This fact applies to all the transactions that a business may enter into at any stage of its existence. There are two types of claims against the assets of the business: one of the owners and another of the creditors. So, we can say that the total assets of a business are equal to its liabilities. Liabilities to owners are known as capital and liabilities to others are called liabilities. We can express this relationship between assets and liabilities in the form of the following equation: Thus, according to this concept, every transaction has two effects for the same amount: one is a debit and the other is a credit. This is explained with the help of the following example. If Mr. A starts a business with cash amounting to $100,000, it will have the following effects on the accounting equation: In defining the other accounting concepts, it was mentioned that accounting is essentially concerned with the business entity itself rather than its owners, managers, or employees. Clearly, then, the assets owned by a business enterprise are the property (or, in legal terminology, the equity) of the persons who provided the funds for the acquisition of such assets. For example, if Mr. A uses $500,000 in cash as the start-up capital for a business called Modern Traders, the assets owned by the company at that stage would be a cash balance of $500,000. Corresponding to this amount would be the equity (i.e., an amount that can be claimed by Mr. A). This relationship is expressed as follows: In accounting terms, this transaction is represented as follows: However, cash or other assets have now increased by $900,000, resulting in an extra amount of $200,000 on the equities side as well. To whom does this extra amount of $200,000 accrue as property? Clearly, the banker cannot claim more than the original sum of the money lent to the enterprise (i.e., $300,000). This is simply because the company's transactions have been profitable. So, the outsiders' equity or liability will remain constant at $300,000. Inevitably, we come to the conclusion that this sum belongs to the owners and should be recorded in the owners' equity. The resulting situation will now be: Clearly, the banker will not accept anything less than $300,000 (i.e., the original amount lent) because expenditure has been incurred by the enterprise. The amount of outsiders' equity or liability must, therefore, be maintained at its original figure of $300,000. The decrease in assets due to an expense incurred to earn profit would, therefore, be viewed as a reduction in the owners' equity. The final picture is shown as follows: Notice that the comparison of owners' equity at the beginning of the accounting period ($500,000) and at the end of it ($650,000) enables us to determine the profit for the period (i.e., $150,000). As this represents the economist's concept of profit, the accounting equation provides us with a method of profit measurement. Since the profit has not been withdrawn by the owner, we can prepare the balance sheet at the end of the accounting period as follows:Dual Aspect Concept: Definition

Every transaction affects the business in at least two aspects. These two aspects are equal and opposite in nature. It is also known as the accounting equivalence concept.Dual Aspect Concept: Explanation

This concept is based on the fact that if there is something given, someone else receives it. It can also be said that every time a transaction takes place, there is always a two-sided effect. A transaction may affect either both sides or only one side of the accounting equation.Example

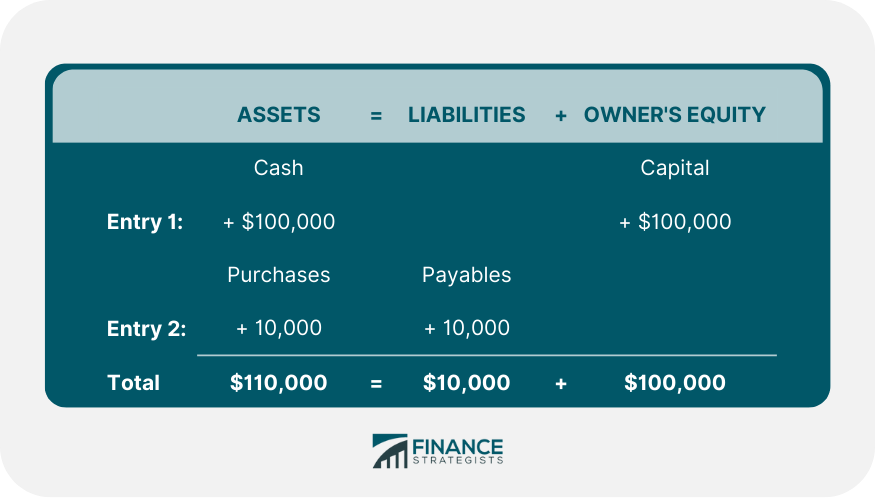

If Mr. A purchases goods as credit from Mr. B amounting to $10,000, then the latest position of the accounting equation will be as follows:

As this example shows, every new transaction will affect the accounting equation. It is important to remember that both sides of this equation will always remain equal.Further Explanation

Example 2

Suppose that after some time, goods worth $400,000 are purchased with this start-up capital. The position would change as follows:

Subsequently, if the business enterprise borrows $300,000 from a bank to finance its purchases, the new position would be:

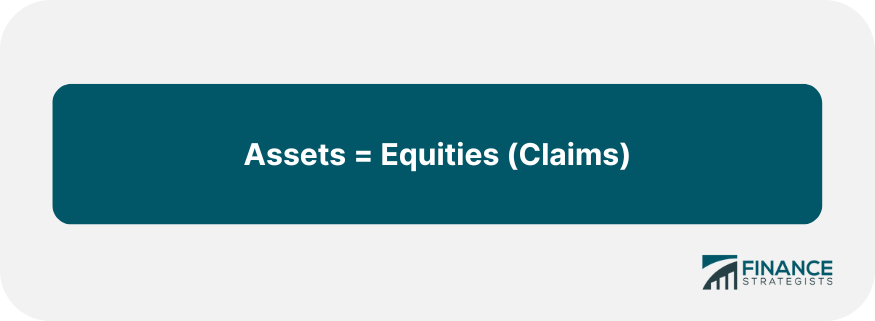

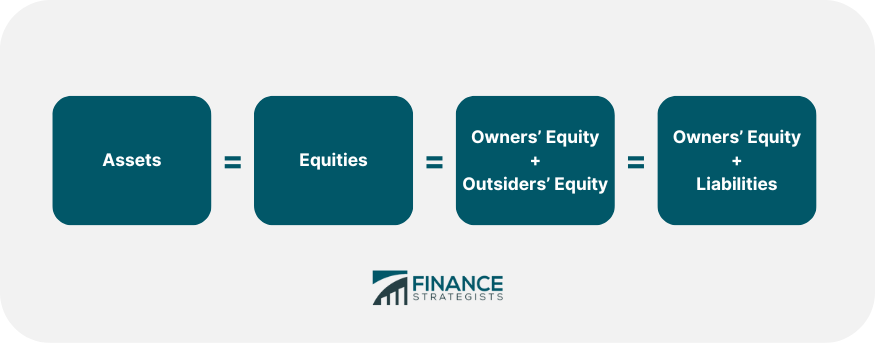

The equity or claim of an outsider is technically called a liability. So, we might rewrite our equation in the following way:

Thus, the accounting equation that finally emerges is:

This accounting equation can be used to record any business transaction, however complex. To pursue our accounting examples, assume that goods worth an additional sum of $350,000 are purchased in cash. The situation would now be:

Thereafter, goods worth $700,000 are sold for $900,000 cash. It is easy to make the necessary adjustments in the value of the goods, which will now come down from $750,000 to $50,000.

A few days after this transaction, the broker claims $50,000 as their commission for bringing the business to the enterprise, and the sum is duly paid.

This concept is technically stated as follows: "for every debit, there is a credit."

Dual Aspect Concept of Accounting FAQs

The dual aspect concept is not applicable only to transactions that are related to owners’ capital. Transactions on creditors’ claims, debts, dividends payable and so on must also be covered under this concept. Therefore, it can thus be said that this concept is applicable only to all types of business enterprises where transactions can be classified in terms of owners’ capital and outsiders’ claims.

This concept distinguishes between capital that belongs to outsiders and capital belonging to the company's shareholders. It is further based on the idea that for every transaction, an equal amount of transaction should be recorded on the opposite side, that is, a debit entry to compute net income.

Debits stand for an increase in liabilities or owners' equity while credits represent a decrease there. In short, a credit stands for a loss while a debit signifies profit.

Yes, in certain cases. To be more specific, it can occur when a company is unable to pay its creditors either because of insufficient cash or due to losses incurred by the company itself. In such situations, the debits are recorded as credits which changes owners' equity to reflect the firm's financial difficulties.

This concept is only applicable in cases where there are no income or expenses of a non-recurring nature, like dividends. No consideration is given in calculating net income (the total amount earned by the company during the accounting period) for dividends paid.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.