The Generally Accepted Accounting Principles are a set of rules and procedures companies follow when preparing their financial statements. It includes guidelines on balance sheet classification, revenue recognition, and materiality. Issued by the Financial Accounting Standards Board (FASB) and adopted by the United States Securities and Exchange Commission (SEC), GAAP strives to standardize and regulate the methods used in accounting across all industries. GAAP guidelines are centered around these fundamental principles: GAAP is generally viewed as a reliable system for financial reporting.

Following GAAP guidelines assures lenders and investors that companies are being truthful and accurate in their reporting. With this in mind, most financial institutions will look for annual GAAP-compliant financial statements as a part of their debt covenants when issuing business loans. Consequently, most companies in the United States, even private ones, choose to adhere to GAAP.

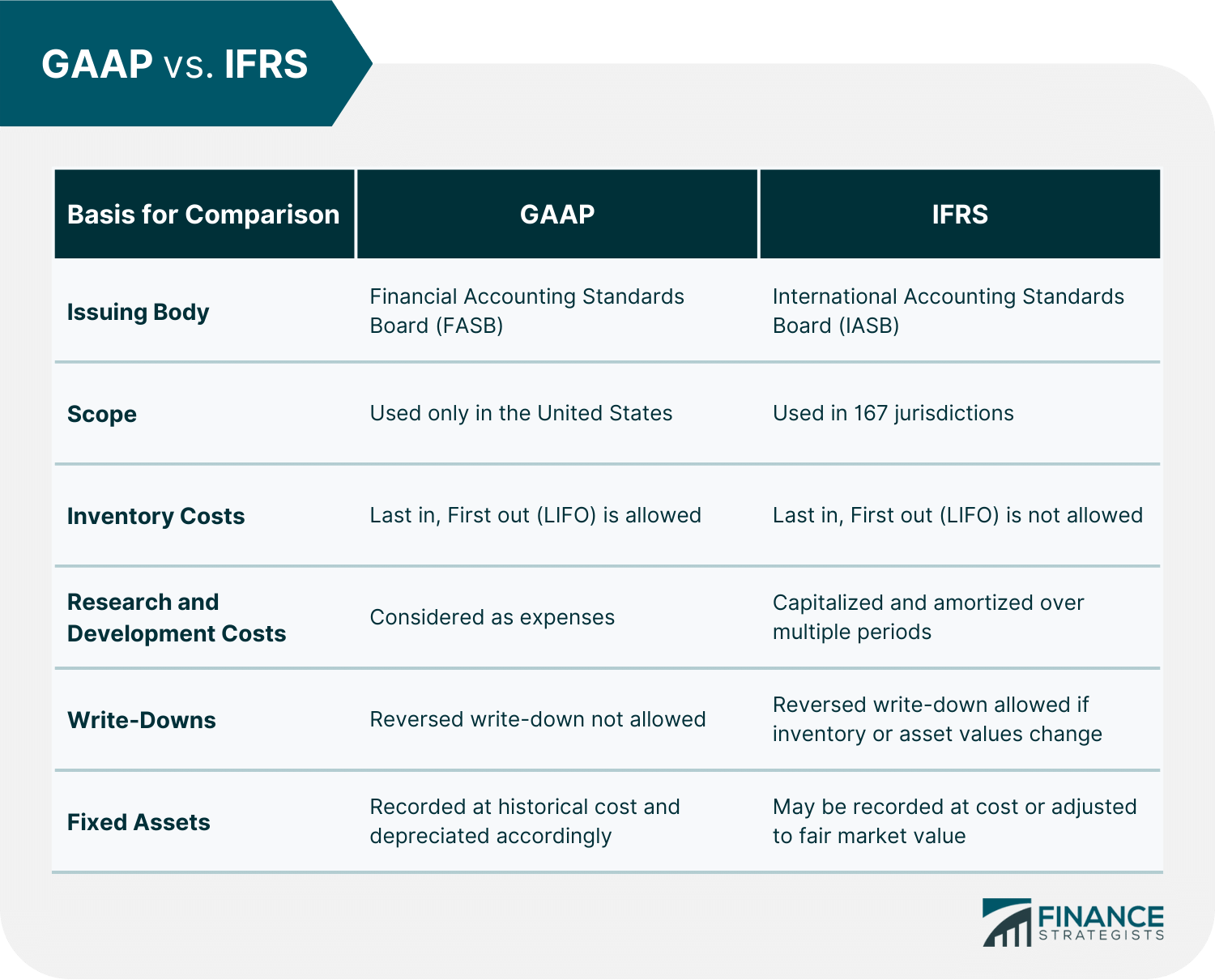

When a company is not abiding by GAAP accounting standards, it is difficult to make accurate comparisons between its financial status and those of other businesses. A distorted picture of a company’s financial health could be presented when non-GAAP measures are used. Thus, investors tend to be wary when companies are not using GAAP standards. The Generally Accepted Accounting Principles are a set of accounting standards and procedures companies use to compile their financial statements. GAAP is designed to ensure that financial reporting is transparent and consistent from one company to another. While GAAP is the standard for financial reporting in the United States, IFRS is the standard used in over 167 jurisdictions worldwide.

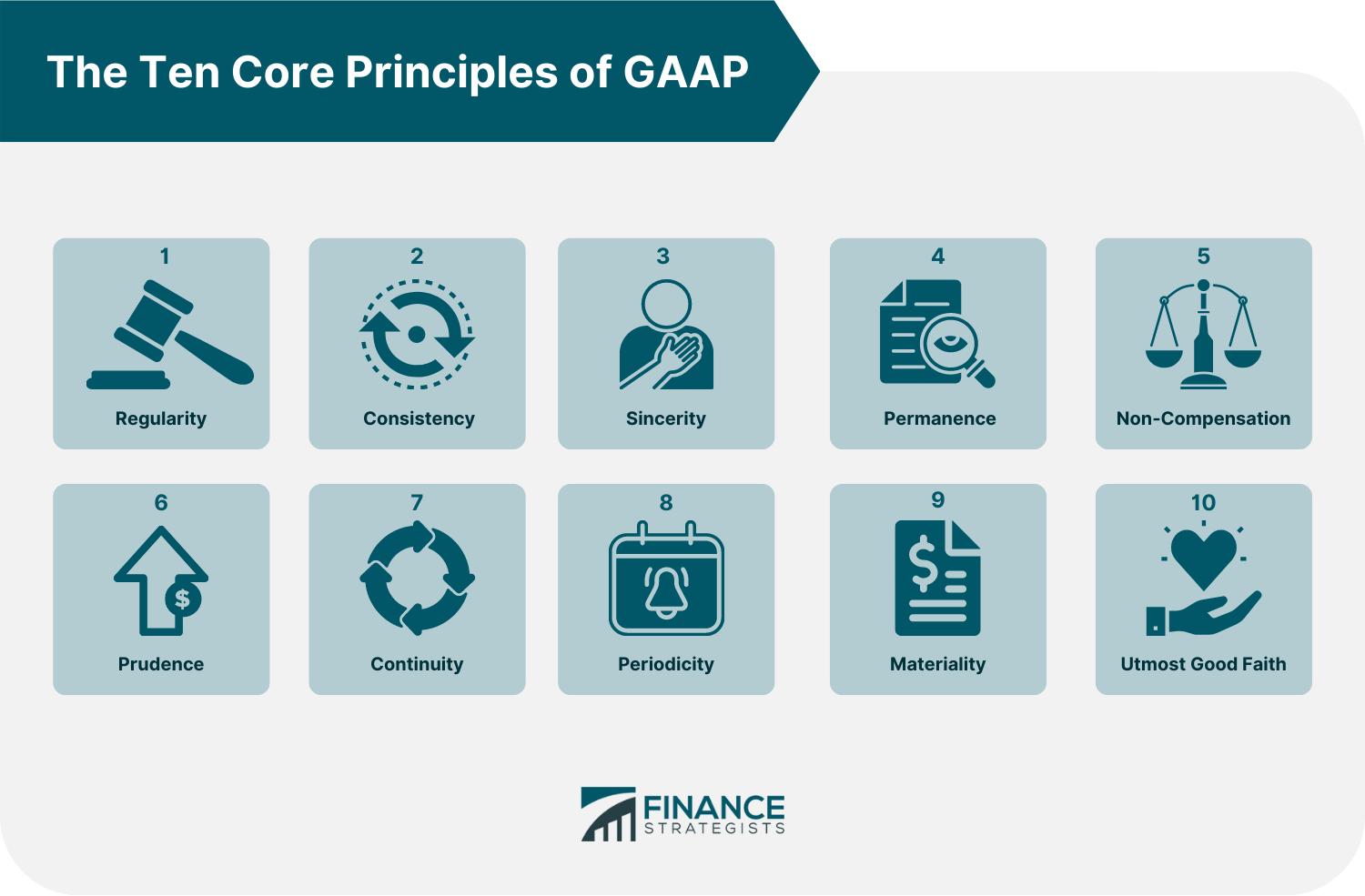

GAAP consists of 10 core principles: regularity, consistency, sincerity, permanence, non-compensation, prudence, continuity, periodicity, full disclosure, and utmost good faith. There are some notable differences between GAAP and IFRS, but both sets of standards aim to improve financial reporting.How GAAP Works

The Ten Core Principles of GAAP

The Principle of Regularity

This concept presupposes that accountants comply with GAAP rules and regulations as a standard practice.The Principle of Consistency

This principle means accountants are expected to consistently apply the same standard throughout the reporting process, from one period to the next.

Changes or updates in the standard should be fully disclosed in the footnotes to the financial statement.The Principle of Sincerity

Under this principle, accountants must provide an accurate and unbiased depiction of the financial situation of a business.The Principle of Permanence

With this, accountants are directed to consistently apply the same financial reporting procedures for easy comparison.The Principle of Non-Compensation

There should be full disclosure of financial information, both negative and positive. This should be achieved without compensating debt by an asset or revenues by an expense.The Principle of Prudence

Financial data representation should be based on facts or well-informed judgment and not on speculation or guesswork.The Principle of Continuity

In creating financial statements, such as in the valuation of assets, accountants are urged to assume that the business will continue its operation in the foreseeable future.The Principle of Periodicity

According to this principle, entries should be accurately reported in the appropriate period.The Principle of Materiality

Accountants must fully disclose all financial data and information in financial reports. This means that both negative and positive information must be reported.The Principle of Utmost Good Faith

With this principle, it is assumed that there is utmost good faith or honesty among all the parties involved in every transaction.GAAP Implementation

GAAP provides concise and relevant data that makes it easier for all interested parties to determine the financial health of a business. This is one of the reasons why companies need to adhere to GAAP.GAAP Compliance

State-By-State Compliance

There are four classifications of GAAP compliance for the United States: fully GAAP compliant, mostly GAAP compliant, somewhat GAAP compliant, and not at all GAAP compliant.

Below are some of the states that fall within these classifications:

Fully Compliant States – Utah, Arizona, Louisiana, Wisconsin, Virginia, North Carolina

Mostly Compliant States – Ohio, Nevada, Tennessee, Florida, Mississippi

Somewhat Compliant States – California, New Hampshire, Montana, South Dakota,

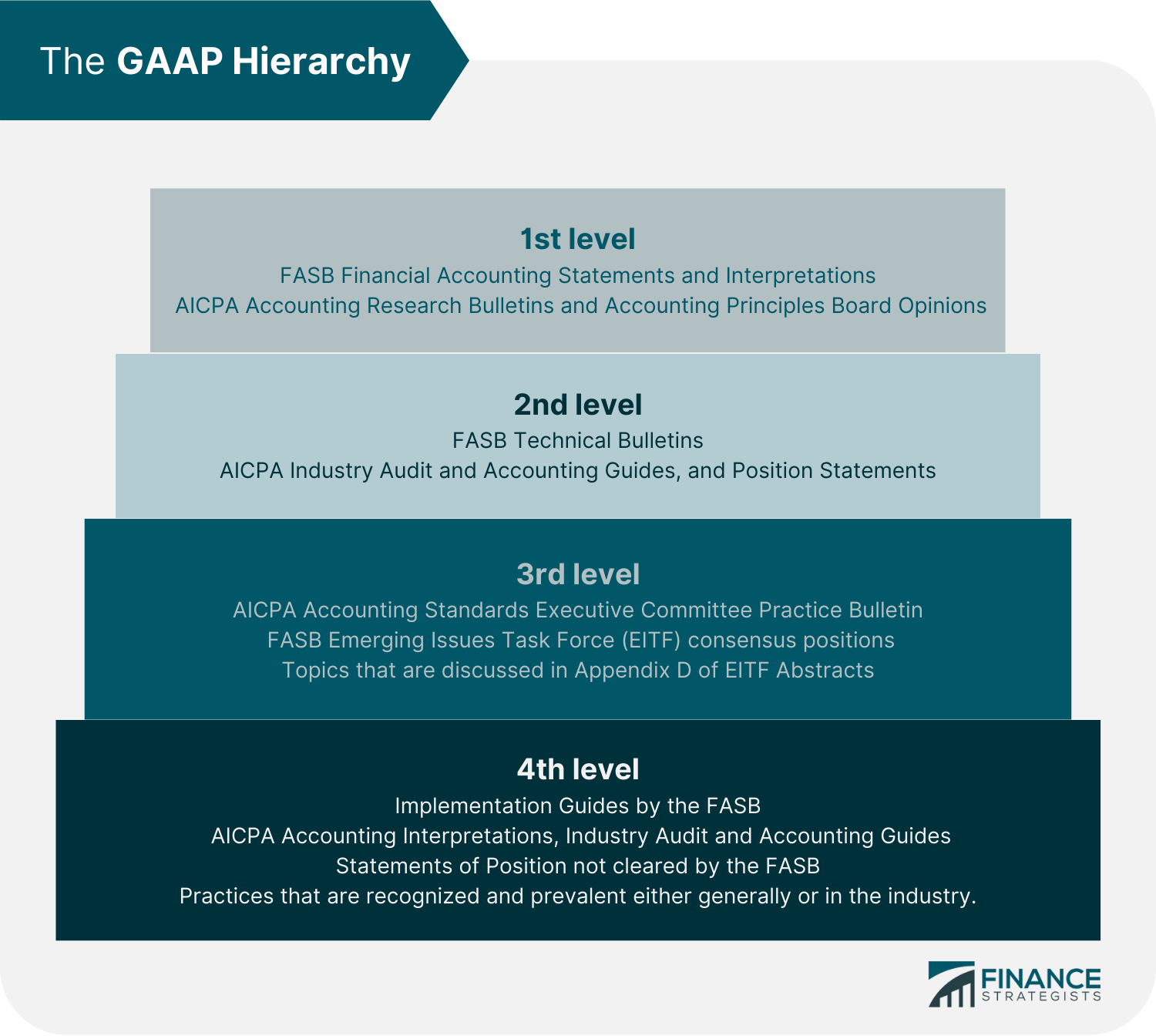

Non-Compliant States – Washington, West Virginia, Idaho, New York, North Dakota, VermontGAAP Hierarchy

History of GAAP

GAAP vs IFRS

Final Thoughts

Generally Accepted Accounting Principles (GAAP) FAQs

GAAP is an acronym for Generally Accepted Accounting Principles. This is a set of accounting principles and procedures that companies use to compile their financial statements. It is important because it ensures that financial reporting is transparent and consistent from one company to another.

GAAP helps standardize financial reporting so that investors and analysts can easily compare the financial statements of different companies. It aims to regulate the definitions, presumptions, and methods used in accounting across all industries.

GAAP is used by accountants and other financial professionals to compile financial statements for companies. It is also used by investors and analysts to compare the financial statements of different companies.

The Financial Accounting Standards Board (FASB) issued the GAAP. However, there was some influence from previous regulatory bodies, such as the Accounting Principles Board (APB).

While GAAP is the standard for financial reporting in the United States, IFRS is the standard used in over 167 jurisdictions worldwide. There are also differences in some of its rules, such as their treatment of research and development costs. Under GAAP, these are recorded as expenses. However, under IFRS, these costs are capitalized and amortized over multiple periods.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.