The accounts receivable turnover ratio, also known as the debtors turnover ratio, indicates the effectiveness of a company's credit control system. Much like the inventory turnover ratio, the accounts receivable turnover ratio shows how many times debtors are extended credit that they fully repay each year. It is calculated as shown below. Fine Company sells goods on credit. The following data relates to the company's most recent accounting period: Required: Calculate Fine Company's accounts receivable turnover ratio. Accounts receivable turnover ratio = Sales/Average accounts receivable = $480,000/$900,000* *(1,000,000 + 800,000)/2 = 5.33 times (A rather slow rate of debtors turnover for a trading company).Definition

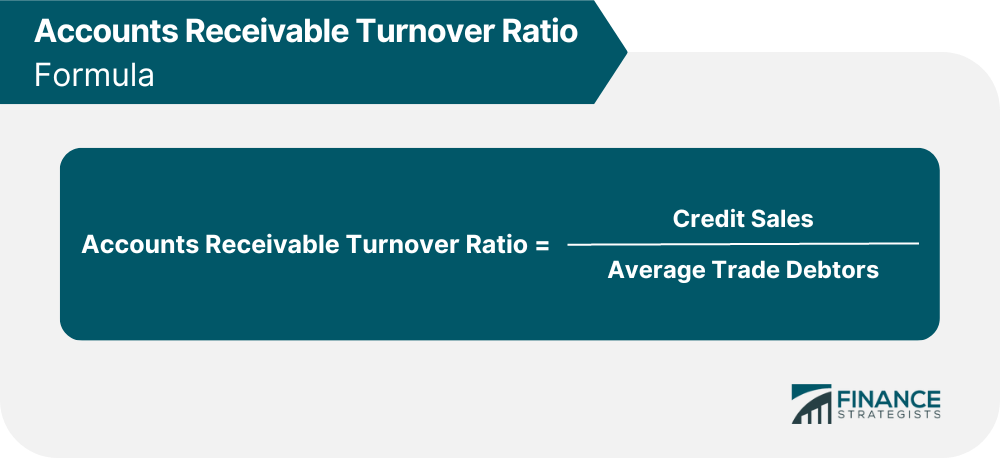

Formula For Accounts Receivable Turnover Ratio

Example

Solution:

Accounts Receivable Turnover Ratio FAQs

The accounts receivable turnover ratio (A/R turnover) is a measure of how quickly a company collects its accounts receivable. It is calculated by dividing the annual net sales revenue by the average account receivables.

A good accounts receivable turnover ratio varies depending on the industry. However, a ratio of less than 10 is generally considered to be indicative of a company having Collection problems.

The accounts receivable turnover ratio can be affected by a number of factors, including: -The credit terms offered to customers -The collection policies and procedures in place -The age of the receivables -The industry in which the company operates

An accounts receivable is the sum of the beginning and ending account balances divided by two.

The accounts receivable turnover ratio is calculated as follows: Accounts Receivable turnover = net credit sales / average Accounts Receivables

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.