Average period of credit received is calculated in weeks (or months) in order to determine how long a company takes to pay off its trade creditors.

It is incorrect to assume that a company that is successful in having a long credit received period is efficient.

Like everything else in the world, credit comes at a price. If a company takes too long to settle its trade payables, it will suffer from various negative impacts. For example:

- The company won't be allowed any cash discounts

- The company's suppliers will build in a factor for delayed payments in their prices

- The company may find it difficult to procure materials during periods of low supply, particularly if suppliers favor companies with better payment histories

Having a reputation for being a late payer causes countless difficulties. Hence, it is in the best interest of the company to ensure that its average credit received period is consistent with the industry average.

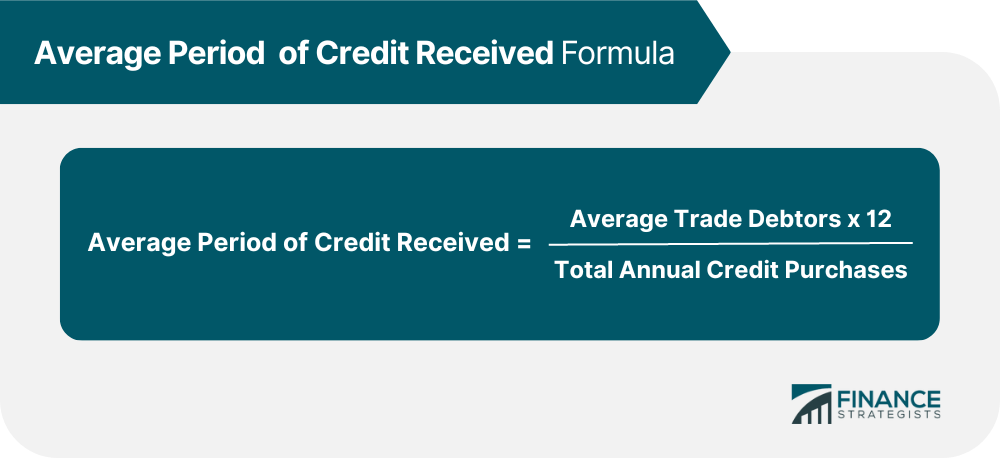

Average period of credit received is calculated as follows (for an answer in months):

Example

Consider the following information:

- Creditors: $500,000

- Net purchases: $3,660,000

Required: Calculate the average period of credit received.

Solution:

Average period of credit received = (Creditors/Purchases)×12

= ($500,000/$3,660,000)×12

= 1.64 month

As this solution shows, the company takes 1.64 months on average to pay off its creditors.

Average Period of Credit Received FAQs

The average period of credit received is calculated as follows (for an answer in weeks): Average Period of Credit Received = Creditors/Net Purchases×5.2)

A company's net purchases are calculated as follows: Net Purchases = Creditors − (Creditors/Credit Received)×Purchases

A company's creditors are calculated as follows: Creditors = Invoices Outstanding with Suppliers + Accrued Payable + Other Amounts Payable + Unbilled Costs

Companies with an average period of credit received that is greater than the industry average are always late payers. A comparison can be made with the industry average by using ratios. For example, if your company's ratio for this metric is 3.75, then your company is taking 3.75 times longer to pay its creditors than the industry average.

Your company is a late payer if its creditors/purchases ratio is greater than 1.5. For example, if your company's ratio for this metric is 1.7, then your company takes 1.7 times longer to pay its creditors than the industry average.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.