The average stock retention period ratio provides another way to examine the average stock and rate of stock turnover.

It is calculated to show the period, in weeks or months, for which stock remains with a business before it is sold off.

Obviously, if the rate of stock turnover is high, the average stock retention period will be low, and vice versa.

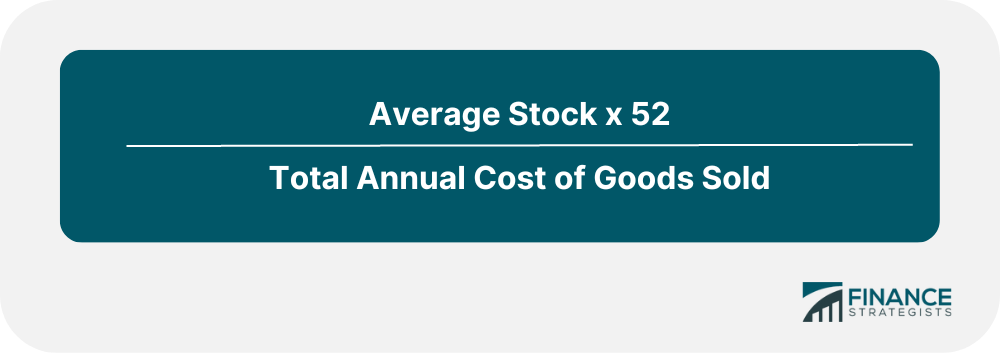

The average stock retention period (in weeks) is calculated as follows:

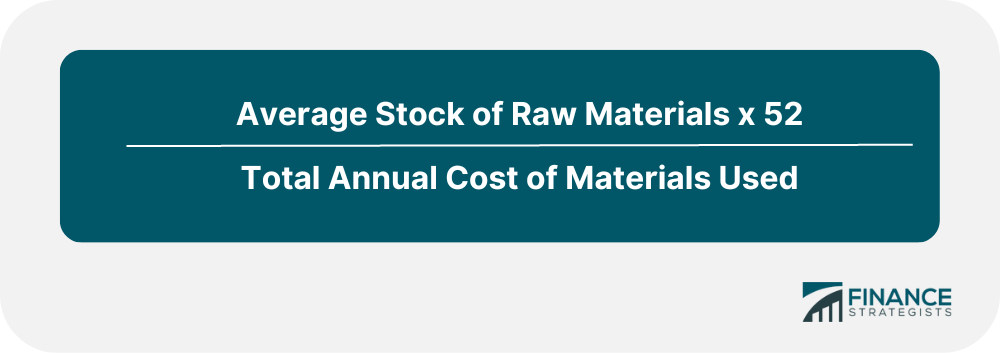

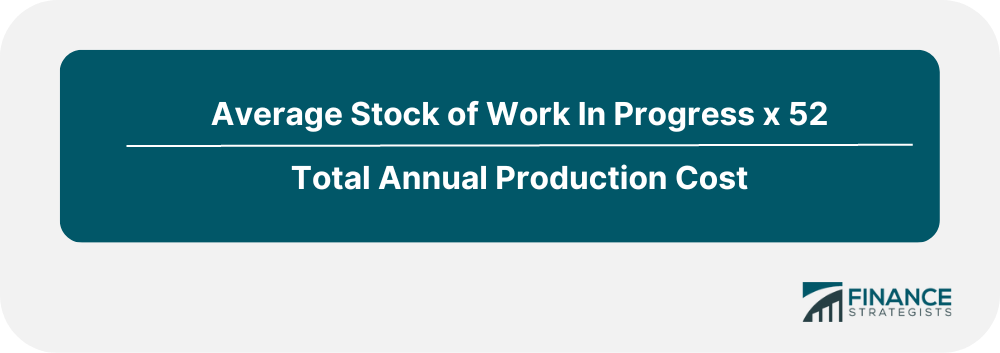

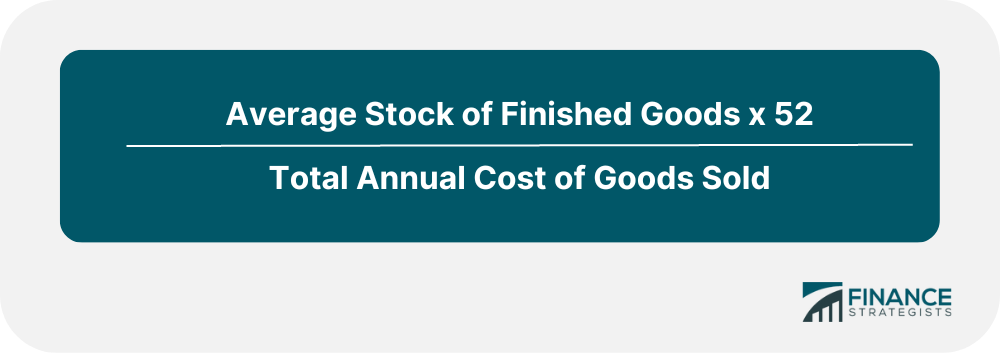

In manufacturing businesses, the average stock retention period is calculated for each class of stocks.

The average stock retention period for raw materials is calculated as follows:

The average stock retention period for work-in-progress is calculated as follows:

The average stock retention period for finished goods is calculated as follows:

Example

The following information relates to ABC Trading Company:

- Opening stock: $570,000

- Closing stock: $630,000

- Cost of goods sold: $3,600,000

Required: Calculate and interpret the average stock retention period for ABC Trading Company.

Solution

Average stock retention period = (Average stock / Cost of goods sold) × 12

= (600,000/3,600,000) × 12

= 2 months

Interpretation

Generally speaking, an average stock period of 2 months is quite high for a trading concern.

However, it's important to consider ABC Trading Company's nature of business and the goods it sells.

Industry norms should also be analyzed before passing a judgment on the efficiency or suitability of this ratio.

Average Stock Retention Period Ratio FAQs

Average stock is calculated simply by adding opening stock, closing stock and cost of goods sold then dividing the total by 3.

An investor, auditor or analyst would have to look at the industry they are in and compare the number to other companies in that industry to determine if the value is exceptional.

The average stock turnover ratio is the total sales divided by the average stock.

When someone calculates the average stock period, their calculations will include the opening and closing inventory values as well as costs of goods sold. Closing costs of goods sold and opening inventory values are variable costs. Closing sales and opening inventory values are also recognized as the cost of inventory sold.

The average stock turnover ratio is calculated by dividing the sales for a period by the average stock.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.