Defensive Interval Ratio (DIR): Definition

The defensive interval ratio (DIR) is used to measure a company's cash-based liquidity. It indicates the number of days that a company can operate without using non-current assets or other cash financial resources.

The defensive interval is also known as the defensive interval period (DIP) or basic defense interval (BDI). The defensive interval ratio is sometimes referred to as the financial efficiency ratio.

Formula For DIR

To calculate the defensive interval ratio (DIR), use the following formula:

Defensive interval measure = Total defensive assets / Projected daily operating expenditure

A detailed description and analysis of the DIR are presented in the next section.

Analysis of DIR

Components of DIR

The defensive interval measure is defined as the number of days an organization can operate without utilizing its non-current assets or other cash financial resources.

Total defensive assets are defined as cash, short-term marketable securities, and accounts receivable.

Finally, daily operational expenses (DOE) are calculated as follows:

DOE = (Annual operating expenses - Non-cash charges) / 365

Interpretation of DIR

Defensive assets are quick assets (i.e., cash and short-term marketable securities) and accounts receivables. Considering that the numerator is the total defensive assets, the net and current liabilities are not deducted from the total.

The ratio can be obtained by dividing the total defensive assets by the operating costs per day that could necessitate the use of resources that are defensive.

The best estimate for this figure is based on a company's cash budget for the most recent year. The cash budget of a company is, however, internal information that is unlikely to be accessible to an external analyst.

Due to this, the external analyst will base their projections about the entire operating expenses on the company's most recent income statement.

This amount will have to be corrected for expense items such as depreciation etc., which do not need the use of defensive assets, as well as for known changes in the projected operations.

While assuming the liquid standings of a business, an analyst must examine other information that is important for suitable evaluation such as the existence of different liability and asset valuation procedures.

The business even has revolving credit agreements with banks, and this information may be available by way of footnotes to the statements.

Defensive Interval Measure Demonstration

As mentioned above, the defensive interval ratio is a measure used to analyze a company's liquidity (i.e., how many days can the company operate without using its non-current assets?).

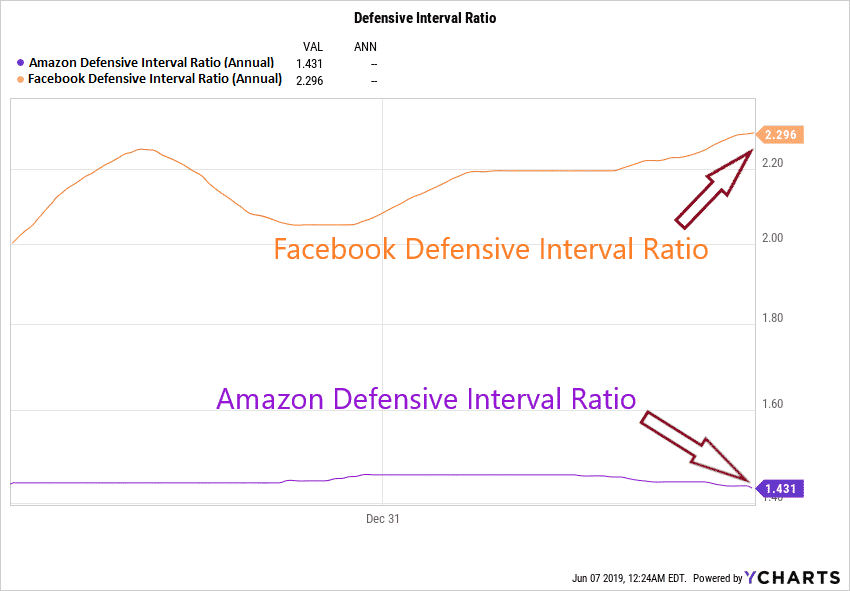

In the chart below, Facebook has a defensive interval ratio of 2.296 years, which means that the company can operate for almost 838 days without using its non-current assets.

On the other hand, Amazon has a defensive interval ratio of 1.431 years, indicating that it can stay operational for almost 522 days without using its non-current assets or any other financial resources.

Example

Global Industries is facing a gradual decline in its heavy industries unit. At the same time, the company expecting an advance cash payment from a customer in the next 80 days.

Required: The CEO of Global Industries has asked an analyst to determine the company's ability to stay operational until the payment is received. Using the following data, complete the analyst's task:

- Cash = $1,400,000

- Marketable securities = $3,500,000

- Accounts receivable = $5,100,000

- Average daily expenditures = $118,500

Solution

To determine how long Global Industries can remain operational, it is necessary to calculate the defensive interval ratio (DIR). This involves applying the following formula:

DIR = (Cash + Marketable securities + Accounts receivable) / Average daily expenditures

= (1,400,000 + 3,500,000 + 5,100,000) / 118,500

= 84 days

The above calculation shows that Global Industries' DIR is 84 days. In other words, the company's unit can stay operational for the next 84 days without using its non-current assets.

If the expected payment is received at a time later than 80 days, the unit will need to start using its non-current assets and other financial resources.

Defensive Interval Ratio (DIR) Calculator

Defensive Interval Ratio (DIR) FAQs

The defensive interval ratio (DIR) is a liquidity ratio used to measure a company's ability to stay operational without using its non-current assets.

The DIR provides valuable insight into the health of your company by evaluating your company’s ability to stay operational without using its non-current assets.

The DIR can be used when evaluating a company’s liquidity or assessing its ability to stay operational without using any of its non-current assets. The ratio is most useful when comparing similar companies in the same industry.

The DIR is calculated by dividing a company’s non-current assets by its average daily expenditures.

The equation that is used to calculate the DIR is: (Cash + Marketable securities + Accounts Receivable) / Average daily expenditures

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.