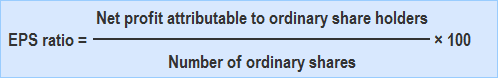

The earnings per share (EPS) ratio is effectively a restatement of the return on equity (ROE) ratio. While the ROE ratio is calculated as a percentage, taking total net profit and total equity into consideration, the EPS ratio shows how much profit has been earned by each ordinary share (common share) in the year. Net profit attributable to ordinary (common) shares is arrived at by deducting corporation tax and preference dividend from the amount of net profit earned in any particular year. The following information was extracted from the balance sheet of John Trading Concern at the end of a financial year: Required: Calculate John Trading Concern's earnings per share (EPS) ratio. Earnings per share (EPS) ratio = $224,000*/80,000 shares = 2.8 * Net profit attributable to ordinary shareholders = 480,000 - 240,000 - 16,000 = $224,000 The earnings per share (EPS) ratio is 2.8. This means that each ordinary share (common share) of the company earns $2.80 during the period.Formula

Example

Solution

Interpretation

Earnings Per Share (EPS) Ratio FAQs

The earnings per share (EPS) is a valuable measure of profit allocation across a company. It shows whether profits have been distributed mainly to shareholders, or mostly retained within the business. In this way, it can be seen that companies with higher EPS ratios are more likely to have a successful business model that is geared toward higher levels of returns to shareholders.

The earnings per share ratio can be calculated from information taken from the income statement and the statement of financial position.

The EPS ratio can be calculated by dividing the net profit attributable to ordinary shareholders by the weighted average number of ordinary shares in issue.

There are a number of factors that can impact EPS, including the company's revenue, costs, and share count. Changes in any of these factors can affect the company's profitability and, consequently, its EPS.

EPS can be used to make investment decisions by comparing it to the EPS of other companies in the same industry. This can help investors determine which companies are more profitable and may be a better investment option. Additionally, analysts often use EPS when making recommendations about which stocks to buy or sell.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.