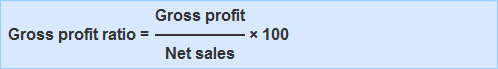

The gross profit ratio (or gross profit margin) shows the gross profit as a percentage of net sales. The ratio provides an indication of the company's pricing policy. Certain businesses aim at a faster turnover through lower prices. Such businesses would have a lower gross profit percentage but a larger volume of sales. Some businesses that have higher fixed costs (or indirect costs) need to have a greater gross profit margin to cover these costs. Such businesses aim to cover their fixed costs and have a reasonable return on equity by achieving a larger gross profit margin from a smaller sales base. Gross profit is defined as the difference between the net sales and the cost of goods sold (i.e., the direct cost of sales). The value of net sales is calculated as the sales minus returns inwards. The gross profit ratio is a measure of the efficiency of production/purchasing as well as pricing. The higher the gross profit, the greater the efficiency of management in relation to production/purchasing and pricing. The net profit to gross profit ratio (NP to GP ratio) is an extension of the net profit ratio. If we deduct indirect expenses from the amount of gross profit, we arrive at net profit. In other words, gross profit is the sum of indirect expenses and net profit. By expressing net profit (or indirect expenses) as a percentage of gross profit, we find out as to what portion of gross profit is consumed by indirect expenses and what portion is left as net profit. These two items (net profit and indirect expenses) are the main considerations that drive a company's pricing policy. If net profit as a percentage of gross profit is small, it may indicate any of the following three things: The gross profit ratio is calculated as follows: In the above formula, the variables are defined: Both components of the formula (i.e., gross profit and net sales) are usually available from the trading and profit and loss account or income statement of the company. Calculate and interpret the gross profit ratio from the following information of John Trading Concern for the year 2016. The two figures that are needed to calculate the gross profit ratio are the net sales and the gross profit. Since the data do not contain these figures, we need to calculate them at the outset. This can be done as follows: Net sales = Gross sales - sales returns = $4,850,000 - $50,000 = $4,800,000 In addition, the following calculation is applied for gross profit: Gross profit = Sales - Cost of sales = $4,800,000 - $3,600,000* = $1,200,000 *Cost of sales = Opening stock + Purchases - Closing stock = $570,000 + $3,660,000 - $630,000 = $3,600,000 At this point, we have calculated both net sales and gross profit. Therefore, we can easily compute the gross profit ratio as follows: GP ratio = (1,200,000/4,800,000) × 100 = 25% John Trading Concern achieved a gross profit ratio of 25% during the period. While this ratio may seem reasonable for a trading concern, it is impossible to pass a judgment on the adequacy (or otherwise) of this percentage unless the gross profit ratios of other businesses in the same field are known. Other pieces of information that are important for supporting an interpretation are the company's gross profit ratios over previous years, or the target gross profit ratio set by the company's budget for the year. This is a very important aspect of using ratios as a tool of evaluation. A ratio in itself is not particularly useful unless it is compared with similar ratios obtained from a related source.Gross Profit Ratio: Definition

Net Profit to Gross Profit Ratio

Gross Profit Ratio Formula

Example

Solution

1. Calculation of GP Ratio

2. Interpretation of GP Ratio

Gross Profit Ratio FAQs

The percentage of gross profit achieved by a company in relation to its total sales. It measures the overall effectiveness of management in relation to production/purchasing and pricing.

The higher the value, the more effectively management manages cost cutting activities to increase profitability.

The gross profit ratio only shows the profitability of a business, not its liquidity or cash position. Also, it doesn't consider other expenses that are necessary for running the company's operations.

Because gross profit ratio is based on revenue and gross profit which is not considered as a measure of success. It does not consider other important factors such as returns on investment, Working Capital and the quality of earnings. It is also difficult to compare companies in different industries with each other because there are many different methods for calculating gross profit.

A profit ratio shows how much profit a business generates on its sales. The net profit of a company, which includes the total of all the incomes of the company after deducting all expenses, can be calculated by dividing its net income by its total revenues. On the other hand, the gross profit of the company, which includes its total income after deducting all income (or sales) and expenses related to goods sold, can be calculated by dividing its gross profit by its total revenues. Both ratios provide different details about a business' performance and health.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.