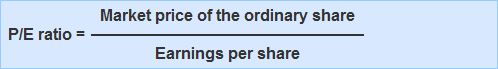

The price-earnings ratio is the ratio of a company's share price to its earnings per share. It is the most important measure that investors use to judge a company's worth. The price-earnings ratio is also known as the price-to-earnings ratio and P/E ratio. The P/E ratio shows the number of times higher a company's share price is compared to its earnings per share for the last twelve months. It is, therefore, also referred to as the earnings multiple and price multiple. To calculate the P/E ratio, compute the market value per share divided by the company's earnings per share. The P/E ratio should be compared with the share market as a whole, focusing on other companies in the same industry as well as the same company over the last few years. You can calculate the P/E ratio using the following formula: If the P/E ratio is high, this means that the company's shares are selling at a good price. Generally, there is an acceptable price-earnings ratio that prevails in the market. If a company's earnings per share increases but its price-earnings ratio remains constant, its share price is likely to increase. Suppose that the annual earnings per share ratio of John Trading Concern is 2.8. Also, the market value of the company's shares is $25. Calculate the price-earnings ratio. To calculate the price-earnings (P/E) ratio, we apply the formula: Price earnings (P/E) ratio = $56/2.8 = 20 The company's P/E ratio is 5.36. This means that the market price of an ordinary share at John Trading Concern is 20 times higher than the earnings per share (for the last 12 months). In other words, we can say that an investor who purchases the company's shares is willing to pay $20 for each dollar of earnings. A high P/E ratio indicates that investors are willing to buy the shares of the company at a higher price. This is because they anticipate a positive financial performance in the future. By contrast, a low P/E ratio suggests the opposite. As stated earlier, there is usually an acceptable range for the P/E ratio that must be researched and considered carefully for the purposes of investment. Whether a company's P/E ratio is acceptable or not for the purpose of investment can be determined by comparing it with that of other similar companies or the industry's average ratio.Price-Earnings Ratio: Definition

Formula for Price-Earnings Ratio

Example

Solution

Interpretation

Price Earnings Ratio FAQs

The P/E ratio is helpful when comparing two or more companies to see which one is relatively undervalued. The lower the P/E, the better value it appears for investors. A high corporation’s P/E ratio implies that investors don't think its stock price will rise much in the future.

To find a company’s price-earnings ratio, divide its current share price by its per-share earnings. The higher the ratio, the more expensive the stock is to investors who are buying it on expectations that they will be rewarded with large capital gains. The lower the ratio, the better value it appears for investors.

If a company’s P/E is lower than that of its industry average, then this implies that their stock is currently undervalued and offers some potential as an investment.

Analysts use this ratio to determine if a company’s current share price is overvalued or undervalued compared with its earnings per share. If the P/E is high, they consider it overvalued and recommend that investors wait for their stock price to drop before purchasing. If the P/E is low, they consider it undervalued and recommend that investors buy their stock since its price will likely increase in the future.

A common method of calculating a price earnings ratio involves using two years because this gives the analyst the ability to compare a company’s performance over time. The current year is typically used in conjunction with the previous year since this provides enough information for comparison.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.