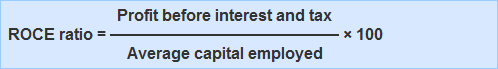

The return on capital employed (ROCE) ratio is calculated by expressing profit before interest and tax as a percentage of total capital employed. This ratio aims to show how well a company has used its total long-term funds. A high ROCE ratio reflects the efficient use of funds invested in a business. You can find capital employed by deducting current liabilities from total assets. The return on capital employed indicates how the management has used the funds supplied by creditors and owners. The higher the ratio, the more efficient the company has been in using funds entrusted to it. Return on capital employed is often abbreviated as ROCE. It is also sometimes given the alternative name return on investment or ROI. This is the profit expressed as a percentage of the net value of the money invested in the business. Many people believe that ROCE is the most important of all accounting ratios. Capital employed is the balance sheet total, which is share capital plus reserves in the case of a company. This is the shareholders' fund, which is the same as assets less liabilities. In some cases, profit before tax is used, and in other cases, profit after tax is used. Exceptional items may be included or excluded, and so may interest. Profit after interest and tax is the most commonly used figure. Normally, annual profit is compared to capital employed, as shown in the balance sheet at the end of the year. However, it is better (though in practice perhaps unnecessary) to use the average capital employed throughout the year. To obtain this, you need at least the opening and closing balance sheets. There are two ways to improve the ROCE ratio. The obvious way is to improve profit, but an alternative approach is to reduce the capital employed. To illustrate, consider the two ways that a fictional company—Costwold Components PLC—might have achieved a return on capital employed of 60%, as demonstrated below. Profit before interest and tax is also known as earnings before interest and tax or EBIT. Capital employed refers to the total long-term funds at the disposal of the company (i.e., the sum of equity, preference share capital, and long-term loans). A general approach to calculating capital employed from a given balance sheet is to deduct current liabilities from the total assets of the business. It can be expressed in the form of the following equation: Capital employed = Total assets - Current liabilities Note for students: It is a general practice to use average capital employed (i.e., capital employed at the beginning of the year plus capital employed at the end of the year divided by two) as the denominator of the formula. However, if capital employed at the beginning of the year is unknown or cannot be determined from the available data, it is not uncommon to use only the year-end figures to calculate capital employed. John Trading Concern has given you the following information for the end of year 2016: Required: Using the information above, calculate the return on capital employed ratio. Return on capital employed ratio = (Net profit before interest and tax/Capital employed) × 100 = ($500,000/$1,524,000*) × 100 = 32.81% *Capital employed = Total assets - current liabilities = $2,400,000 - 876,000 = $1,524,000 John Trading Concern has a 32.81% return on its total capital employed in the business. In other words, each dollar invested in the business generates $0.3281 in profit before interest and tax. Any parties that are interested in learning about the efficiency of the management in fund utilization can compare this ratio to the industry's average return on capital employed ratio.Return on Capital Employed Ratio: Definition

Return on Capital Employed Ratio: Explanation

Method 1: Increasing Profit

$000

Profit after tax

3,581

Capital employed

5,968

ROCE

60%

Method 2: Reducing Capital Employed

$000

Profit after tax

3,015

Capital employed

5,025

ROCE

60%

Formula for Return on Capital Employed

Example

Solution

Return on Capital Employed (ROCE) Ratio FAQs

The roce ratio determines the efficiency of a company in using its capital. It is found by dividing net income on the last line on the income statement by total assets from the balance sheet, which are listed at their historical cost—that is, their original value before they depreciate.

The reason why we use an average for year-end is because we do not want to allow a high level of debt at the start to have us pay interest on that money before it becomes capital employed. So, you need to net out your first day's debt from your first day's equity.

The main limitation is that you cannot use it to compare companies with different size balance sheets, i.E., If two companies have the same roce but one has a lot more capital employed. You can easily see that simply by looking at the denominator. So, if company a has $100 million in capital employed and a roce of 10%, and company b has $200 million in capital employed and a roce of 20% (double the amount), we should not conclude that it is twice as effective.

Yes, it can. You do not have to worry about size of balance sheets at all. It is very easy to calculate because you are only using information from the income statement and balance sheet.

Yes it can. However, the results may not be meaningful because all the different operations and segments of a business would have different assets. You could find that even within a single company, roce may not mean much for one division if it is only $5 million in net income but $50 million in capital employed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.