What Is Return on Equity (ROE)? Definition

The return on equity ratio (ROE ratio) is calculated by expressing net profit attributable to ordinary shareholders as a percentage of the company's equity.

The equity of a company consists of paid-up ordinary share capital, reserves, and unappropriated profit. This represents the total interest of ordinary shareholders in the company.

The ROE ratio shows how a firm's management has been able to utilize the resources at its disposal. It is used to measure the profitability of the firm in relation to the amount invested by shareholders.

Formula

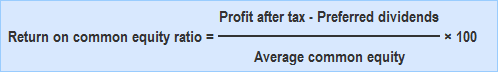

To calculate the return on common equity ratio, or ROE ratio, use the following formula:

Net profit attributable to ordinary shareholders is arrived at by deducting all prior claims (e.g., interest on long-term loans, corporation tax, and preference dividends) from the amount of net profit disclosed by a company's profit and loss account.

Equity for this purpose means only ordinary shares (i.e., common stock)—it does not include preferred shares.

It is generally calculated by deducting total liabilities and preference equity from the total assets of the business. In other words:

Common equity = Total assets - (Total liabilities + Preference equity)

Average equity is calculated by adding the equity at the beginning of the year to the equity at the end of the year and dividing the total by 2.

ROE calculated using the above formula is the ultimate test of a company's profitability from the point of view of its ordinary shareholders (i.e., common stockholders).

Therefore, as previously noted, this ratio is typically known as the return on ordinary shareholders' equity or return on common stockholders' equity ratio.

Return on Total Equity

In practice, different versions of the ROE ratio are used.

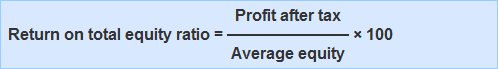

For example, a popular variation of the ROE ratio is to calculate the return on total equity (i.e., ordinary shares plus preferred shares).

In this case, the net profit before the deduction of dividends on preferred shares is used as the numerator in the formula, while the total of ordinary equity and preferred equity is used as the denominator.

The ratio calculated in this way is typically known as return on total equity, which is stated as follows:

Note for students: Since equity changes throughout the year, the average equity figure should be used.

If average equity cannot be calculated from the available data (e.g., beginning equity is not known), the equity at the end of the period may be used as the denominator.

Example

John Trading Concern has provided you with the following data for the year ended 2019:

- Total assets: $2,400,000

- Total liabilities: $1,076,000

- 8% preference shares: $200,000

- Net profit after tax: $240,000

Required: Calculate the return on common equity ratio and return on total equity ratio.

Solution

Return on common equity:

Return on common equity ratio = ($224,000*/$1,124,000**) × 100

= 19.93%

*Profit to equity shareholders = Net profit after tax - Dividend on preference shares

= $240,000 - $16,000

= $224,000

**Equity of ordinary shareholders = Total assets - Total liabilities - Preference shares

= $2,400,000 - $1,076,000 - 200,000

= $1,124,000

Return on total equity:

Return on total equity ratio = ($240,000/$1,324,000*) × 100

= 18.13%

*Equity = Total assets - Total liabilities

= $2,400,000 - $1,076,000

= $1,324,000

Return on Equity (ROE) Ratio FAQs

The return on equity ratio varies from industry to industry and depending on a company’s strategies. For example, a retailer might expect a lower return due to the nature of its business compared to an oil and gas firm.

Average equity = (Beginning Equity + Ending Equity) / 2

The ratio measures the returns achieved by a company in relation to the amount of capital invested. The higher the ROE, the better is the firm’s performance has been in comparison to its peers. It also indicates how profitable it would have been if all funds invested were shared by the investors and it shows how well a company is efficiently using its assets.

If ROE is very high, then the firm has been doing exceptionally well in making profits with just a little capital invested. However, if it is low, then there might be something wrong with the decision making and the firm is not using its assets optimally.

The ratio measures the relationship between a company’s net income and shareholder equity. It indicates how much return the shareholders have been getting on an investment for each dollar invested. If profits are increasing, then shareholders should receive more from this investment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.