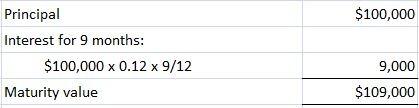

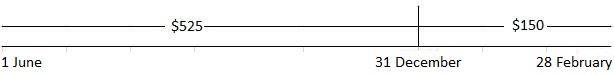

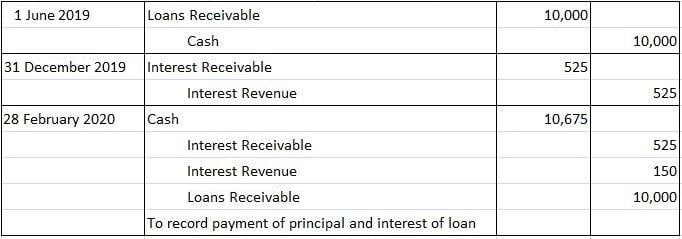

Accrued interest refers to the payment made for the use of money. Many loans or notes are interest-bearing and have the following characteristics: The accrued interest on investment is an asset that will be shown on the balance sheet under the heading current assets. Additionally, "interest income" will become part of the income statement. In general, the correct amount of accrued interest can be calculated using the following formula: i = p x r x t where: To illustrate the use of the above formula, assume that Ozark Company borrows $100,000 at 12% for 9 months. In this example, the principal of the loan is $100,000, the annual interest rate is 12%, and the maturity value is $109,000, which is calculated as follows: To illustrate how interest accruals are calculated and recorded, assume that on 1 June 2019, the Smith Company lent $10,000 to one of its suppliers at 9% interest. The loan's maturity date is in 9 months (i.e., 28 February 2020), at which time both the principal and the total interest are due. In this situation, 9% represents the interest for 1 year. This must be prorated in order to determine the interest income for 9 months. In this example, as well as others, interest is based on 12 30-day months. Once the loan is made, the Smith Company immediately starts earning interest revenue. However, the revenue is not recorded until the end of the accounting period (in this case, 31 December). It would not be correct to wait until the due date of 28 February to recognize the interest revenue earned through 31 December 2019. This would violate the matching convention because no revenue would be recognized in 2019 and too much would be recognized in 2020. Although it is possible to record the interest on a daily basis, this involves excess record keeping. For this reason, a single adjusting entry is made at the end of the accounting period. In this example, the $10,000 9% note earns interest from 1 June 2019 to 31 December 2019 (7 months lasting 30 days each), which amounts to $525 and is calculated as follows: i = $10,000 x .9 x 7/12 = $525 The total accrued interest for the 9-month term of the loan is $675, or $10,000 x .09 x 9/12. Thus, the interest revenue recognized in 2019 is $525, and the interest earned for 2020 is $150 (total interest for 9 months of $675 less $525 earned in 2019). These relationships are illustrated in the timeline below. The appropriate journal entries for the following dates are shown in the table below: At the maturity date, the cash account is debited for the entire value of the loan. Interest receivable of $525 is credited for the interest recognized in the prior period. Also, interest revenue is credited $150 for the interest earned during the current period. Finally, the principal of the loan of $10,000 is credited.Accrued Interest: Definition

Formula to Calculate Accrued Interest

Example

Total interest revenue $675

Accrued Interest FAQs

Accrued interest is the accumulation of interest that a borrower owes for “time value” on a loan from the beginning of the term. For example, if an individual borrows $2,000 at 8% interest for 6 months, then over the course of five months there will be $10 in accrued interest ($2,000 x .08 X 5/6).

Accrued interest is calculated by multiplying the principal of the loan by the annual interest rate and then dividing by the number of days in the applicable time period.

Accrued interest is generally only recorded once at the end of the accounting period.

The accrued interest is generally added to the principal of the loan and then repaid as a single payment at maturity.

Prepayment of accrued interest is generally allowed, but the prepayment may or may not be able to be deducted as an interest expense. Check with a tax advisor to see if there is a specific deduction for prepaid accrued interest.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.