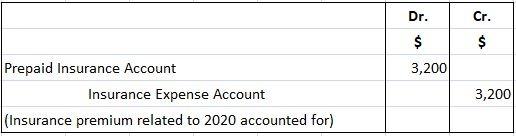

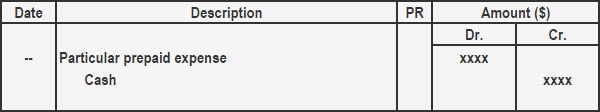

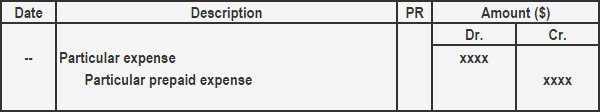

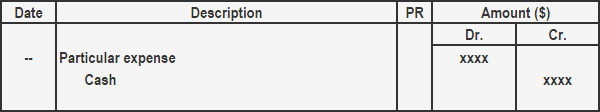

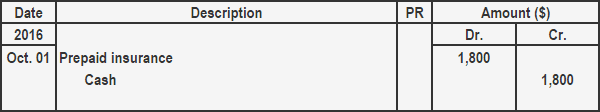

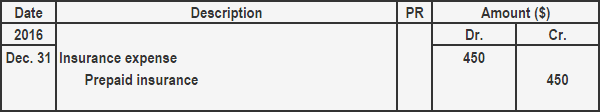

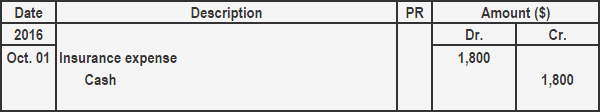

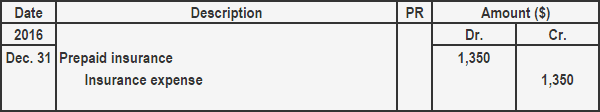

Unexpired or prepaid expenses are the expenses for which payments have been made, but full benefits or services have yet to be received during that period. Such payments fall into two portions. The first portion, comprising received benefits, is an expense. As for the second portion, which involves the incoming benefits or services used in the coming period, this represents current assets, otherwise known as unexpired expenses, prepaid expenses, or expenses paid in advance. At the end of the accounting period involving advance payment, the expired portion becomes part of the income statement like any other expense; the unexpired portion becomes part of the balance sheet like any other current asset. At the end of the year, there may be expenses whose benefits have been received but not paid for and expenses that may have been paid, but their benefit will appear in the next financial year. On 1 September 2019, Mr. John bought a motor car and got it insured for one year, paying $4,800 as a premium. When he paid this premium, he debited his insurance expenses account with the full amount, i.e., $4,800. The trial balance, drawn up on 31 December 2019, assumed that he had no other insurance and his insurance expenses account would show a balance of $4,800. However, only a part of this amount relates to 2019. The premium covers twelve months from 1 September 2019 to 31 August 2020, i.e., four months of 2019 and eight months of 2020. It would be incorrect to charge the whole $4,800 to 2019's profit and loss account. The correct insurance expenses for 2019 comprise 4/12th of $4,800 = $1,600. The balance, $3,200 (4,800 - 1,600), relates to 2020 and should be charged to that year's profit and loss account. Although Mr. John's trial balance does not disclose it, there is a current asset of $3,200 on 31 December 2019. Thus, what has been paid for remains an asset unless it is fully used. Mr. John's trial balance on 31 December 2019 will, therefore, require adjusting to show that: The following journal entry accommodates a prepaid expense: In Mr. John's case, the journal entry would show: The above journal entry would have two effects: Prepaid or unexpired expenses can be recorded under two methods - asset method and expense method. The accounting process under both methods is explained below. This method sees an expense paid in advance recorded as an asset. The payment of expense in advance increases one asset (prepaid or unexpired expense) and decreases another asset (cash). The journal entry at the time of payment shows: An expired portion of prepaid expense increases the expense and decreases the asset by making the following adjusting entry at the end of the accounting period: This method initially records the advance payment as an expense by making the following journal entry: Adjusting Entry If a portion of advance payment remains unexpired at the end of a period, the following adjusting entry is made to convert that portion into an asset (i.e., prepaid expense): The Blue Sky Sports Merchant closes its books on 31 December. On 1 October 2016, It paid an insurance premium of $1,800 for 12 months. What adjusting entry should be made in the books of Blue Sky on 31 December 2016? Using the asset method to record the advance payment for its insurance premium will record the whole amount of $1,800 as an asset by making the following journal entry on 1 October 2016: On 31 December 2016, the following adjusting entry will convert the expired portion of prepaid insurance (1,800 × 3/12 = $450) into an expense: Using the expense method Using the expense method will record the whole amount of $1,800 as an expense by making the following journal entry on 1 October 2016: On 31 December 2016, making the following adjusting entry will convert the unexpired portion of insurance (1,800 × 9/12 = $1,350) into an asset: Notice that the amount for which adjustment is made differs under two methods, but the final amounts are the same, i.e., an insurance expense of $450 and prepaid insurance of $1,350. Impact on financial statements If Blue Sky prepares its financial statements on 31 December 2016, the expired portion of advance payment (i.e., $450) will appear on the income statement as an expense and the unexpired portion (i.e., $1,350) will appear on the balance sheet as a current asset.Prepaid Expenses: Definition

Prepaid Expenses: Explanation

Example

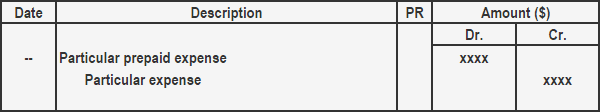

Journal Entries for Prepaid Expenses

Accounting Process for Prepaid or Unexpired Expenses

1. Asset Method

Entry at the Time of Cash Payment

Adjusting Entry

2. Expense Method

Entry at the Time of Cash Payment

Example

Solution

Prepaid Expenses FAQs

Prepaid expenses are payments made in advance for goods or services that will be received or used in the future.

Prepaid expenses are recorded as an asset on a company’s balance sheet because they represent future economic benefits.

The amount of time a prepaid expense is reported as an asset should correspond with how long the payment will provide a benefit to the organization, usually up to 12 months.

The accounting process for booking prepaid expenses is to initially record the payment as an asset and then gradually reduce that balance over time as the goods or services are used.

Organizations typically use a prepaid expense ledger to monitor the total amount of money spent on prepayments, when payments are due, and when they will be received. This helps ensure that companies are accurately accounting for their assets while also staying up-to-date with any upcoming liabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.