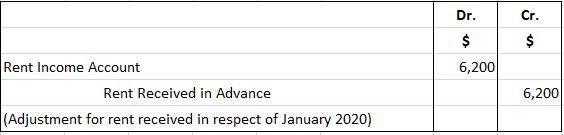

If a business has received a payment for a service that it has not rendered by the year-end, then this is considered income received in advance. Income received in advance should be excluded from the year's profit and loss account. In principle, this adjustment resembles an adjustment made for prepaid expenses. Mr. Jones is a property owner with several tenants. In 2019, he received cash for rent and credited it to his rent income account (income received in advance), amounting to $128,500. This amount included a receipt of $6,200 (income received in advance). The tenant used this to pay for their rent for January 2020 in advance of December 2019. The trial balance will, of course, show a credit balance on the rent income account of $128,500, but the fact is that the actual rental income for 2019 is only $122,300 ($128,500 - $6,200). Another important fact is that on 31 December 2019, Mr. Jones has a liability toward his tenant to let him use his property in 2020. The value of the current liability is $6,200, the amount of rent received in advance. It should be shown on his balance sheet on 31 December 2019. The trial balance on 31 December 2019 should, therefore, be adjusted as follows: The entry made in the journal to accommodate income received in advance is as follows: In Mr. Jones' case, the journal entry would be: The effect of the above journal entry is twofold:What Is Income Received in Advance?

Example: Adjusting Entries for Income Received in Advance

Journal Entries

Income Received in Advance FAQs

Income received in advance refers to a situation where a business has received a payment for a service that it has not yet rendered. This should be excluded from the year's profit and loss account.

The purpose of Adjusting Entries for income received in advance is to correctly reflect the actual income earned by a business for a given year. This will help in accurately preparing both the profit and loss account and the balance sheet.

Advance income should be shown as a current liability on the balance sheet.

Income is recognized when the service has been rendered. For example, if rent has been collected in january 2020 but still to be used by december 2019, then it should be recorded as income in the year 2020.

The actual income for a given year can be obtained by adjusting the Trial Balance to reflect income received in advance as an expense (not as part of the total revenue). The net result will indicate the actual profit or loss made.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.