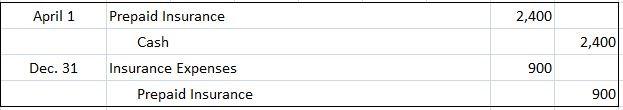

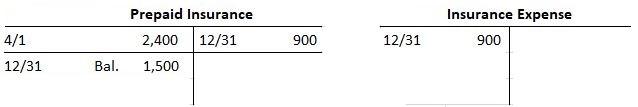

Prepaid assets are nonmonetary assets whose benefits affect more than one accounting period. They include items such as prepaid insurance and prepaid rent and essentially represent the right to receive future services. However, the rights to these future benefits or services rarely last more than two or three years. The matching convention requires allocation of the expenditure between the asset that represents the remaining economic benefits and the expense that represents the benefits used or consumed by the firm. The services represented by prepaid assets are a function of time. So, the allocation process is closely related to the term of service. The purchase of prepaid insurance will serve as an example. Suppose that Smith Company, which has a yearly accounting period ending on 31 December, purchases a two-year comprehensive insurance policy for $2,400 on 1 April 2019. When the insurance policy is purchased, the debit is to the asset account: Prepaid Insurance. The original journal entry, as well as the adjusting entry and the relevant T-accounts, are illustrated below. To adjust prepaid insurance for 9 months, the amount of the journal entry is: = Cost of insurance / Number of months of benefits received = $2,400 / 24 month = $100 Adjusting entry = 9 months x $100 = $900 If we assume that the entire original expenditure for insurance was recorded in the asset account, Prepaid Insurance, it is necessary on 31 December to decrease the asset account by the amount of insurance that has expired. In this case, assuming that the service represented by the asset expires equally each month, the Prepaid Insurance account must be reduced by $900. The balance of $1,500 in the Prepaid Insurance account represents the future benefits of the insurance policy, and the $900 balance in the Insurance Expense account represents the amount of benefits that have expired. The adjusting entry for prepaid rent or other prepaid assets follows a similar process. When you begin to make adjusting entries for prepaid assets, you should follow these steps: The adjusting entry decreases the asset account and records an expense for the amount of benefits that have been used or have expired.Prepaid Assets: Definition

Prepaid Assets: Explanation

1. Asset acquisition date

2. Accounting period length

Prepaid Assets FAQs

The matching principle is the basis for allocating expenses to the periods in which they are used or consumed. It requires that expenses be matched with the revenues they help generate.

Prepaid assets represent the right to receive future services, while deferred revenue represents the right to receive future cash payments.

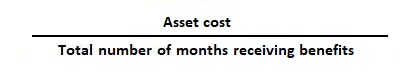

To estimate the amount of a prepaid asset's monthly benefit, divide the total cost of the asset by the number of months of benefits the asset represents.

When a prepaid asset expires, the asset is reduced in value by the amount of benefits that were used or consumed. The expense account associated with the prepaid asset is also increased by the same amount.

Deferred revenue should be recorded as an asset and classified as a current asset if it is expected to be realized in the next 12 months. If it is not expected to be realized in the next 12 months, it should be classified as a long-term asset.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.