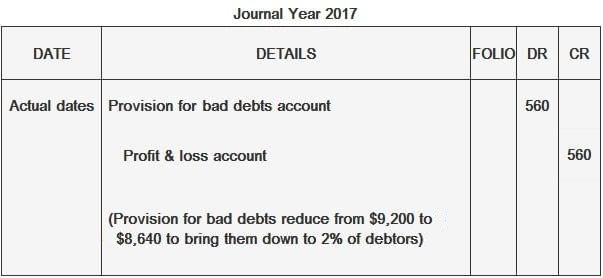

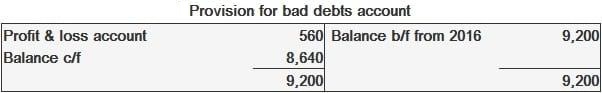

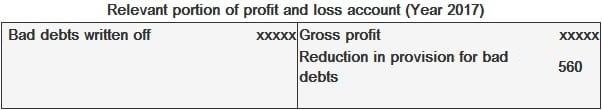

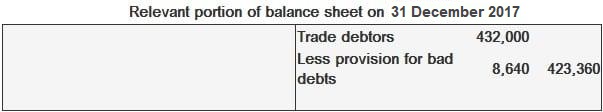

At the end of a financial year, if a business person feels that provisions for bad debts brought forward from the previous year are excessive, they can reduce them to a level that, in their opinion, represents a more accurate probable loss. The following journal entry is made to record a reduction in provisions for bad or doubtful debts: On 31 December 2017, David's trade debtors stood at $432,000 only. However, David still wants to maintain a provision for bad debts at 2% of debtors. Required: Show the relevant entries. At the end of 2017, provisions for bad debts should be 2% of $432,000 = $8,640. However, there already exists a provision of $9,200, which is brought forward from 2016. Therefore, this should be reduced by $560 ($9,200 — 8,640).Example

Reduction in Provisions for Bad or Doubtful Debts FAQs

The journal entry required to reduce the provision for bad debts is posted directly to equity. There is no impact on revenue or expenses. This will be similar if additions were made to provisions (in which case it would be shown as a deduction in equity).

No, because it is a contra asset account. The $8,640 provision for bad debts will be credited to this account which is then adjusted down by the adjustment made at year end. If credit balances are allowed to remain in accounts that normally should have debit balances, double-entry rules would be violated.

Debtors should be written off when it can be reasonably assured that the debtor will not pay the sum owed. The provision for bad debts should include an allowance for uncollectable debts and any net credit balances in these allowance accounts at year-end should be charged to bad debts expense. When an account is written off, the debit balance in the allowance account for uncollectable debts should be debited and a corresponding credit entry made to bad debts expense.

Yes, because a provision for bad debts is meant to represent future expected losses. Therefore, the customer has not been billed completely when the sale takes place so there is still value being created by having this account. In other words, there is hope that the customer will pay! This is unlike Accounts Receivable where the account is already closed off. If someone is owed money, then they are not owed anything else (unless there are subsequent sales).

Bad debt usually refers to an account that has ceased to earn income for a company because of late payments or non-payments, and doubtful debt is more severe and relates to accounts that may never be collected.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.