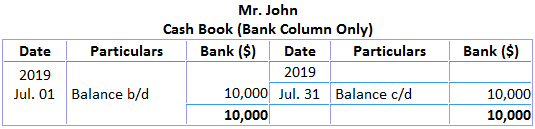

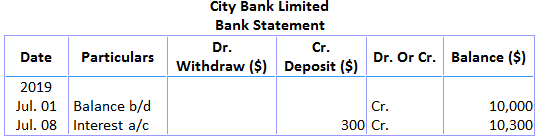

Depositors (customers) and banks sometimes do not align when a transaction takes place, which leads to a difference between the balances of their respective books. The bank records these transactions in the bank statement but does not alert the depositor, who may only find out when they receive the bank statement. The following items tend to remain unrecorded when a bank statement is received: The following discussion will help clarify how these items cause a difference between the bank balance shown by the cash book and the bank statement. When banks allow interest on customers’ deposits, they credit their accounts without alerting them. The bank balances have increased, but the customers only find out about it at the end of the month when they receive a bank statement. When interest is allowed by the bank, it is credited to the customer's account. The bank balance as per the passbook would increase. No entry is made in the bank column of the cash book regarding interest on deposits, meaning the cash book would show less bank balance. Suppose on 1 July 2019, the bank balance of Mr. John, as per the cash book and bank statement, was $10,000. In July 2019, the bank credited his account for interest on deposits of $300. At the same, this transaction was recorded in the cash book because no intimation was made by the bank. At the end of the month, Mr. John balanced his cash book and bank statement. The bank statement records $300 for interest on deposits and shows a balance of $10,300. The customer has received no information, and the balance is less than that of the bank statement. The above example has proved that when an amount is credited to the customer's account and if that amount is not yet recorded in the cash book, the cash book shows less balance, and the bank statement shows more. The amount of interest has been added to the customer's account. Therefore, when preparing the bank reconciliation statement, the customer should debit the amount of interest to bring up the bank balance at the level of the bank statement. Sometimes the bank follows the instructions of its client and collects interest on their investment and credits the same to their bank account. However, it takes a few days to send an intimation to the customer. The customer makes the entry in the cash book only when receiving intimation. Meanwhile, the cash book shows less bank balance compared to the bank statement. The bank collects interest on investments and dividends on shares for its client. On receiving the dividend, the bank credits the customer's account. In the bank statement, the customer's bank balance has increased, but such information is not intimated to the customer. Therefore, this transaction has not yet been recorded in the cash book, and it will show less balance than the bank statement. Sometimes debtors, instead of paying cash to the relevant individual or organization, directly deposit the due amount into their bank account. The bank, on receipt of the amount, credits the bank account. However, it has not been recorded in the cash book because the bank has not intimated the customer. Therefore, the cash book shows less bank balance, and the bank statement shows more. All the items credited (added) in the bank statement but not recorded in the cash book have the same effect on the bank balance. In all these cases, the cash book shows less balance, and the bank statement shows more. Any increment (amount credited or added by the bank) in the bank statement not recorded in the cash book is treated like interest on deposits credited by the bank but not recorded in the cash book. Thus, whenever the bank credits (adds) an amount to the customer's account in the bank statement but has not yet recorded it in the cash book, it is debited while preparing the bank reconciliation statement.Unrecorded Transactions

Interest on Deposits Credited by the Bank but Not Recorded in the Cash Book

Effect of Interest on Deposits on the Bank Balance

Example

1. Treatment of Interest on Deposits Not Recorded In Cash Book In the Bank Reconciliation Statement

2. Interest on Investments Collected by the Bank, but Not Recorded in the Cash Book

3. Dividend Collected by the Bank but Not Recorded in the Cash Book

4. Amount Directly Deposited into the Bank by Debtors but Not Recorded in the Cash Book

Effect and Treatment of All Above-mentioned Increments While Preparing a Bank Reconciliation Statement

Unrecorded Transactions Treatment in Bank Reconciliation Statement FAQs

Depositors and banks sometimes do not align when a transaction takes place, which leads to a difference between the balances of their respective books. The bank records these transactions in the bank statement but does not alert the depositor, who may only find out when they receive the bank statement.

The following items tend to remain unrecorded when a bank statement is received:1. Interest on deposits credited by the bank but not recorded in the cash book2. Interest on investments collected by the bank but not recorded in the cash book3. Dividends collected by the bank but not recorded in the cash book4. The amount directly deposited into the bank by the debtors but not recorded in the cash book5. Interest on an overdraft debited by the bank but not recorded in the cash book6. Bank charges debited (deducted) by the bank but not recorded in the cash book7. Amounts directly paid by the bank as per standing orders but not recorded in the cash book

When interest is allowed by the bank, it is credited to the customer’s account. The bank balance as per the passbook would increase. No entry is made in the bank column of the cash book regarding interest on deposits, meaning the cash book would show less bank balance.

When an amount is credited to the customer’s account and if that amount is not yet recorded in the cash book, the cash book shows less balance, and the bank statement shows more.Therefore, when preparing the Bank Reconciliation Statement, the customer should debit the amount of interest to bring up the bank balance at the level of the bank statement.

All the items credited (added) in the bank statement but not recorded in the cash book have the same effect on the bank balance. In all these cases, the cash book shows less balance, and the bank statement shows more.Any increment (amount credited or added by the bank) in the bank statement not recorded in the cash book is treated like interest on deposits credited by the bank but not recorded in the cash book. Thus, whenever the bank credits (adds) an amount to the customer’s account in the bank statement but has not yet recorded it in the cash book, it is debited while preparing the Bank Reconciliation Statement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.