It is often convenient to record transactions relating to bills of exchange in the general journal. This is especially true when there are only a few transactions. However, in small, medium-sized, and large organizations, where numerous bills are drawn and accepted every day, special books need to be maintained to record transactions for bills of exchange. These books are a part of the journal known as the subsidiary books or special journal. At regular intervals, the amounts of various bills are totaled, and the total of the Bills Receivable Book shows the total amount of bills receivable. This is posted on the debit side of the Bills Receivable account in the main ledger. The total of the Bills Payable Book shows the total amount of bills accepted, which is posted on the credit side of the Bills Payable account. When these special journals are maintained, all transactions regarding bills of exchange are recorded in these books, except for the following entries (instead, these are recorded in general journal):

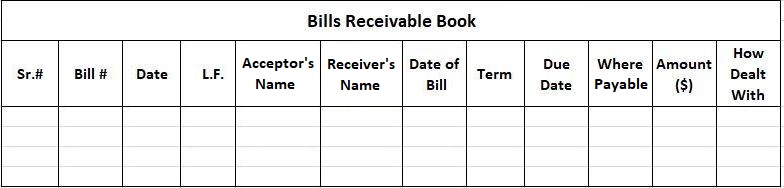

Specimen/Format of Bills Receivable Book

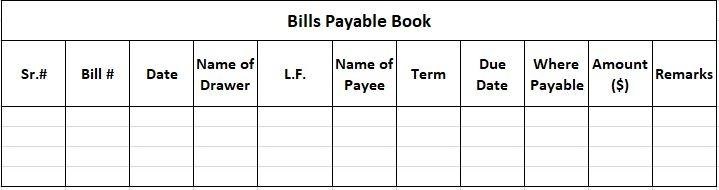

Specimen/Format of Bills Payable Book

Bills Receivable Book and Bills Payable Book FAQs

A bills receivable book is a book in which transactions relating to bills of exchange are recorded. This includes the recording of bills that have been drawn and accepted, as well as the recording of endorsements and dishonors.

A bills payable book is a book in which transactions relating to bills of exchange are recorded. This includes the recording of bills that have been accepted, as well as the recording of endorsements and dishonors.

The bills receivable book and the bills payable book are part of the journal known as the subsidiary books or Special Journal. These books are necessary because, in small, medium-sized, and large organizations, where numerous bills are drawn and accepted every day, it is not feasible to record all transactions relating to bills of exchange in the General Journal.

When it come to be ascertained that an amount due on account of a bill is to be paid in full, it is recorded in the bills receivable book and the transaction is passed through General Journal in debit side.

A bills receivable book records transactions relating to bills of exchange including recording bills that have been drawn and accepted, whereas a bills payable book records transactions relating to bills of exchange including recording bills that have been accepted.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.