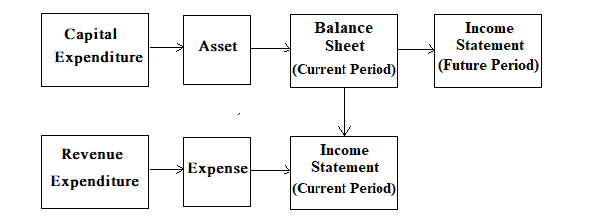

In accounting, the term expenditure refers to the payment of an asset or the incurrence of liability in exchange for another asset or service rendered. Expenditures occur in cash or on credit. The process results in firms receiving another asset, such as a delivery truck, or using a service, such as repairing a delivery truck. When the expenditure produces another asset, it is called capital expenditure. Thus, the term "capitalize," when used in this sense, means to consider an expenditure as an asset. When expenditure results in a service whose benefits are consumed in the current period, it is called an item of revenue expenditure. Revenue expenditures are current expenses and include ordinary repairs, maintenance, fuel, and other items required to keep assets in normal working condition. The following diagram illustrates the difference between capital and revenue expenditures. The difference between capital and revenue expenditures is important when determining periodic net income. This is because capital expenditures affect several accounting periods, whereas revenue expenditures affect only the current period's income. If an error is made and an item of capital expenditure (e.g., an equipment purchase) is recorded as revenue expenditure, the net income will be misstated for both the current and future period. The current period's income will be understated because the entire expenditure was expensed when only a portion of it (i.e., the current year's depreciation) should have been expensed. The income of future periods will be overstated because no depreciation expense is recorded in these years. Although over the useful life of the asset the error is self-correcting, the income is misstated in the interim. How do firms distinguish between capital and revenue expenditures? Clearly, the purchase of a delivery truck is a capital expenditure, whereas an engine tune-up is a revenue expenditure. But what about purchasing a wastepaper basket or ordering a major engine overhaul that practically constitutes a new engine? To establish consistent accounting policies that can be followed from year to year, firms develop guidelines or formal policies to handle these items. Materiality considerations play a large role in the design of such policies. Most firms put a minimum dollar limit for capital expenditures, ranging from $100 in small companies to several thousands of dollars in large companies. This problem is further complicated by the fact that the same item can sometimes be considered a capital expenditure and at other times a revenue expenditure. For example, the labor cost to adjust a new machine during installation is considered a capital expenditure and, therefore, forms part of the acquisition cost of the machine. This is because the expenditure is necessary to make the machine ready for use. On the other hand, the same labor cost subsequent to the operation of the machine is an item of revenue expenditure. This is because, at that time, it is a normal and recurring repair. Therefore, the purpose, as well as the nature, of the expenditure, must be considered when deciding whether an item is a capital or a revenue expenditure.Definitions

Expenditure

Capital Expenditure

Revenue Expenditure

Difference Between Capital and Revenue Expenditures

Capital vs Revenue Expenditures FAQs

Capital Expenditure refers to an expenditure that gives rise to the acquisition of a non-current asset. Examples of Capital Expenditure include the purchase of a new machine, a building or a delivery truck. Revenue expenditure refers to an expenditure incurred for rendering a service and does not result in the acquisition of another asset. Examples include expenses for general repairs or other routine maintenance.

Depreciation is considered to be a revenue expenditure because it does not result in the acquisition of another asset. Instead, Depreciation simply reduces the value of the existing fixed asset over its useful life. Capital Expenditures are expensed when they are incurred whereas Revenue Expenditures are expensed when they are used or consumed.

The labor cost associated with installing a new machine is considered to be Capital Expenditure because this is necessary for making the machine ready for use. On the other hand, if this would have been an on-going expense for maintaining the machine, it would have been considered either as a revenue expenditure or as an operating cost depending upon whether this is now during the initial stages of use.

Capital Expenditure refers to purchase of equipment which cannot be used immediately. Revenue expenditure refers to expenses for repairs and maintenance.

The purpose of a Capital Expenditure is to acquire Fixed Assets such as buildings, vehicles or machinery that will generate revenue in the future. This type of expenditures is excluded from the income statement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.