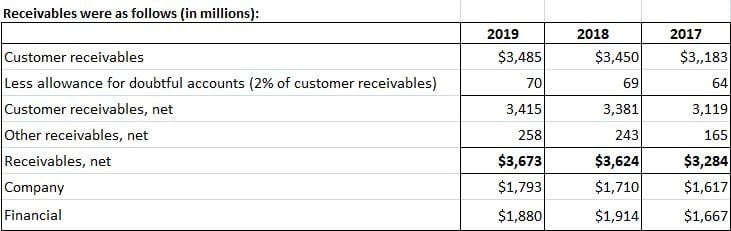

Accounts receivable arise from credit sales. For many retail firms, accounts receivable represents a substantial portion of their current assets. The function of a company's credit department is to establish and enforce credit policies. Credit policies should protect the firm against excessive bad debts but should not be so restrictive as to eliminate customers who, despite not having a perfect credit rating, are likely to pay. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services from another party. Generally, only existing legal rights are disclosed in the body of the balance sheet. Contingent (or potential) rights to collect may be disclosed in footnotes if they are material and if sufficient information is provided to allow the reader to understand the contingency. For example, if the management believes that it will win a lawsuit that it filed against another company, a receivable cannot be recorded until management has signed a settlement or the court has entered judgment in its favor. The primary sources of receivables are transactions with customers in which they are allowed to pay later. These items are collectively labeled as trade receivables. Receivables occasionally arise from lending cash to others, but these transactions are unusual for most businesses that are not financial institutions. Other types of transactions may create receivables, such as payments of advances and deposits, or filing for tax refunds. Compared to cash, there is more risk associated with receivables because of the possibility of not collecting the total amount due. This risk can be reduced by a collateral agreement with the debtor. The risk can be tolerated if it produces income through finance charges or through increased sales. Management tries to reduce the risk by controlling the procedures for granting credit. Controls are also created to assure that the balances of the receivables are correctly stated and that debtors are correctly billed. Receivables come in various types. Most of them, however, can be classified as either accounts or notes. Trade accounts receivable that arise from ordinary sales are usually collected within a year or the operating cycle and thus are classified as current assets. Other receivables that arise from loans to outsiders, employees, or stockholders should be shown separately from trade receivables. If the receivable is due within a year or the operating cycle, it should be classified as current. If the receivable arises from a loan to a stockholder or employee and there is no definite due date, it should be considered noncurrent. It is included in either the long-term investment or other asset section of the balance sheet. J. C. Penney's annual report provides a good example of how receivables are presented in corporate financial statements. In the current asset section of its 31 January 2020 balance sheet, total receivables are listed net at $3,673 million. However, in the footnotes to the statements, this figure is disaggregated, as shown below: When receivables are discounted with recourse, the issue arises as to whether the transfer should be treated as a sale or as collateral for a loan. The FASB has rules beyond the scope of this article that are related to this issue. In any event, any contingent liability arising from discounted notes treated as sales should be disclosed in the notes to the financial statements. To help financial statement readers assess a company's earning power, GAAP call for the reporting of interest income earned from receivables and the losses incurred through non-collection. To assist the assessment of solvency, accountants categorize receivables based on when they are due. Receivables that are expected to be collected within 12 months of the operating cycle are classified as current. All others are non-current. Additionally, accountants disclose the net amount of cash that is expected to be collected, as well as any collateral agreements. To help financial statement users make other decisions, GAAP call for other disclosures regarding receivables. One of the most commonly used methods for providing this information involves distinguishing trade from non-trade receivables. Trade receivables arise from normal transactions with customers. Non-trade receivables, on the other hand, arise from transactions that are outside this normal line of activity. Users may be interested in knowing the origin of these receivables as well as the amounts and due dates. This form of disclosure is helpful in dealing with related-party transactions between the firm and any of the following stakeholders: The purpose of the disclosure is to reveal that the receivable arose from a transaction that may not have been executed at arm's length. Consequently, receivables from these related parties are separately identified to ensure that users are aware of the underlying events. Other categories of non-trade receivables are disclosed separately if there is significant information conveyed to the reader by doing so. In the event that separate classification is not helpful, they can be combined into a single other receivables item.Accounts Receivable: Definition

Impact of Accounts Receivable on Companies

Types of Receivables

Charge accounts for customers are prime examples of accounts receivable. They are known as open accounts if the customer is free to add to them. They typically bear interest only after a set amount of time has passed.

A due date is usually established for notes, and they bear interest from the day on which they are signed.

Both notes and accounts receivable are legally enforceable. Notes may be more easily converted into cash because quite often they are negotiable instruments.

That is, they can be more easily sold or transferred to others.Classification of Receivables

Example

Accounting Objectives

Accounts Receivable FAQs

Accounts receivable is a legal claim against another party. If someone owes you money, that obligation is accounts receivable.

The impact of accounts receivable is two-fold. It will be reported in two separate assets, current assets and non-current assets. This happens because it could eventually become a liability if there were to be a default or it may mature into cash after time passes. The other impact is that they will impact the income statement during the period that they are not collected. The company will have to make a policy decision on whether or not to report an interest expense related to the accounts receivable.

There are two types, accounts and notes. Notes are a little more complicated and they follow a different accounting treatment.

Notes have a specific definition under GAAP but for the most part, this will be an IOU from one company to another that may or may not get paid off in time. When it becomes due, it becomes an account receivable.

There are two dates, 1) contractual and 2) GAAP. The contractual date is the due date as agreed by the debtor and creditor. This date could be any time frame depending on what both parties agree to. The GAAP due date is typically 12 months from the balance sheet date but this can vary based on industry, company policy, and other factors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.