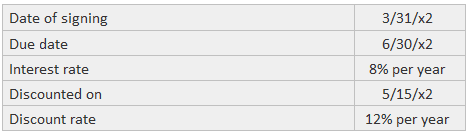

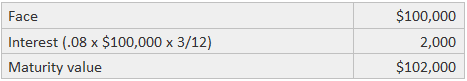

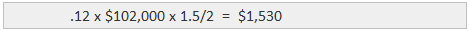

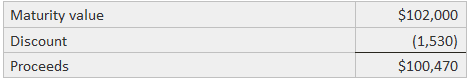

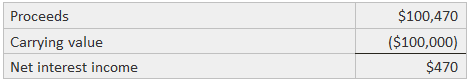

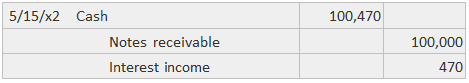

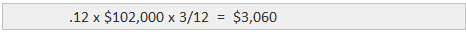

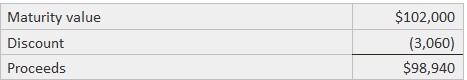

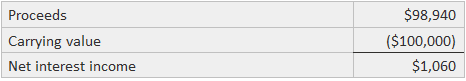

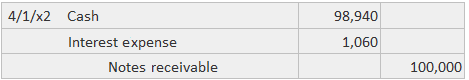

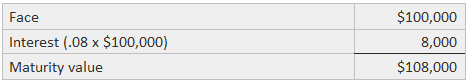

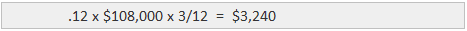

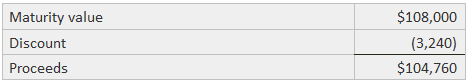

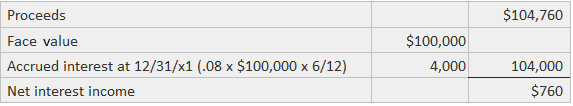

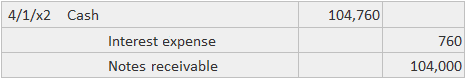

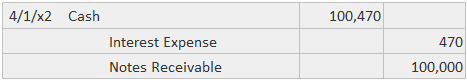

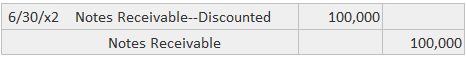

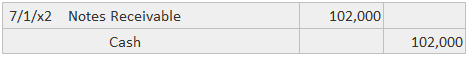

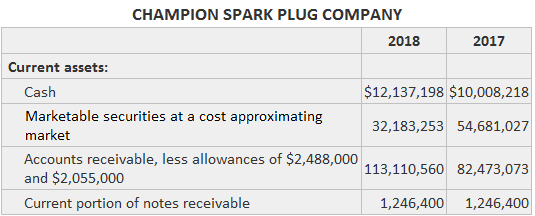

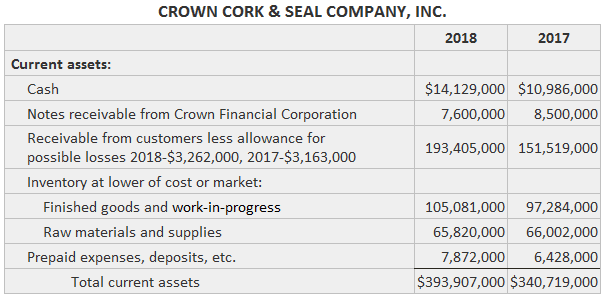

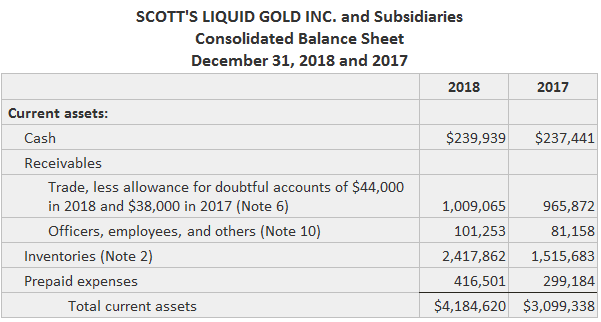

It is possible to use notes receivable to obtain immediate cash. This is done by giving a discount on notes receivable to a bank or other lender prior to their maturity date. Discounting means selling or pledging a customer's notes receivable to the bank at some point prior to the note's maturity date. The term "discount" is used because the bank deducts the interest it charges from the note's maturity value and thus discounts the note. The note is usually discounted with recourse. This means that the company discounting the note, known as the endorser, guarantees the eventual full payment of its maturity value. If the maker fails to make the required payments, the bank will present the note to the endorser and demand full payment. By discounting a note with recourse, the endorser has a contingent liability. A contingent liability is a possible liability that may or may not occur depending on some future event. In many cases, these liabilities are not included in the balance sheet with other liabilities. Rather, they are usually referred to in the footnotes of the financial statements. If the maker pays the bank, the contingent liability will end; if the maker defaults, the contingent liability will become a real liability. Given that most discounted notes are reviewed for their creditworthiness by both the bank and the endorser, contingent liability rarely turns into a real liability. One of the differences between notes receivable and accounts receivable is the greater negotiability of notes. A holder of a note can readily convert it to cash by discounting it at a bank, either with or without recourse. The bank accepts the note and gives the holder cash equal to its maturity value less a discount to the maturity value computed using a discount rate. As such, the bank receives its money back plus the discount when the note is paid by the maker at maturity. If the note is not paid at maturity, the bank can collect from the original holder of the note was discounted with recourse. If the arrangement is without recourse, the bank must find another solution. For notes discounted with recourse, the original holder is contingently liable for paying the note. That is to say, they will have to pay the note in the event of default. This type of liability is not disclosed in the balance sheet but should be described in a footnote if it is material. The five-step process is used in accounting for a discount on notes receivable is given as follows: In the next examples, this process is applied to calculate the discount on three notes receivable by the Sample Company. The Sample Company discounts a $100,000 note receivable on 15 May 2022. The following facts are known: Step 1: Compute the maturity value: Step 2: Compute the discount: Step 3: Compute the proceeds: Step 4: Compute the net interest income or expense: Step 5: Prepare the journal entry: Suppose that the same note in Example 1 is discounted on 1 April 2022 instead of 15 May. You can assume that all the other facts are the same. Step 1: Compute the maturity value: $102,000 Step 2: Compute the discount: Step 3: Compute the proceeds: Step 4: Compute the net interest income or expense: Step 5: Prepare the journal entry: Now, assuming the same facts as in Example 2, suppose that the note is assigned originally on 30 June 2021. The note is discounted on April 1, 2022. Step 1: Compute the maturity value: Step 2: Compute the discount: Step 3: Compute the proceeds: Step 4: Compute the net interest income or expense: Step 5: Prepare the journal entry: The example entries show the credit being made directly to the notes receivable account, just as if the note had been collected. This approach is always appropriate if the discounting takes place without recourse. That is to say, if the original holder is without further liability, then the asset is effectively transferred and its amount should be removed from the books. This approach is usually suitable if the discount on notes receivable is with recourse, as long as the disclosure of the contingent liability is made either parenthetically or in a footnote (e.g., stating that the note will be paid when it matures). However, since the holder is contingently liable for paying the maturity value to the bank, it may be appropriate to use a contra account, "Notes Receivable—Discounted." For Example 1, this journal entry would be made as follows: This account balance can be shown in the balance sheet as a deduction from all notes receivable. This approach is not commonly applied in practice. If the original entry has a credit to the regular notes receivable account, no entry is needed when the note is paid in full by its maker. If a contra account is used, a journal entry similar to the following one should be made: If the note is not paid and was discounted without recourse, no further entry is needed. However, if it was discounted with recourse, the original holder must record its payment to the bank and the restoration of the receivable to its full balance plus interest and any protest fee for failure to pay at maturity. If the note in Example 1 has defaulted and the Sample Company pays the bank the maturity value and a $100 protest fee, the following entry is needed: To provide additional information, the debit could be recorded to an account entitled "Notes Receivable—Dishonored." The following examples show sample disclosures of receivables from actual financial statements. Footnotes are also widely used as a supplement to the balance sheet disclosure to inform readers of other facts about receivables. Balance sheet disclosures of receivables are shown as follows: Disclosure of receivables, including footnote details (related-party receivables), are shown for Scott's Liquid Gold Inc. below. Jerome J. Goldstein, Chairman of the Board and President, assumed the company's obligation to purchase a condominium in Florida (near the Aquafilter plant) and agreed to reimburse the company for its advances toward the construction costs. On 31 December 2018, the company had a note receivable from Mr. Goldstein representing such advances. The note, amounting to $64,349.44, bears interest at 18% and is due on 31 December 2019.Discount on Notes Receivable: Definition

Discount on Notes Receivable: Explanation

Accounting for Discount on Notes Receivable

Example 1

Example 2

Example 3

Disclosures

Entry at Maturity

Example

Example

Note

Discount on Notes Receivable FAQs

It is possible to use notes receivable to obtain immediate cash. This is done by giving a discount on notes receivable to a bank or other lender prior to their maturity date.

Notes receivable are usually categorized as current assets, because companies expect to receive them within the next 12 months. However, notes receivable that are not expected to be paid for a period of more than a year may be classified as non-current assets.

When a customer uses a promissory note to buy merchandise, the store records this on the balance sheet by debiting notes receivable and crediting sales.

Notes receivable are debts owed to a business by customers. Notes payable are debts a business owes to another company, usually a supplier or vendor.

Notes receivable are also a type of financial asset.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.