Definition and Explanation

The original holder obtains cash at once in return for the proceeds collected in the future, except that the collection process is handled by a third party (often known as a factor).

If the assigned receivables are insufficient to repay the factor because of bad debts, the original holder must transfer additional receivables.

If the factor collects more than the amount advanced, the excess is turned back to the original holder, as well as any uncollected accounts.

Suppose that Sample Company obtains $80,000 cash on 31 December 2023 by assigning $100,000 of its receivables with recourse.

The factor will collect the receivables and keep the first $85,000 to repay the cash advance and a $5,000 service charge.

Settlement is to be made on 1 April 2024, which will involve making a payment to Sample Company of any excess cash and the return of the uncollected accounts. The journal entries shown below would be made.

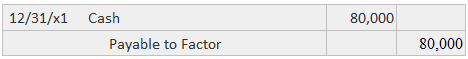

The journal entry used to record the cash received from the factor is as follows:

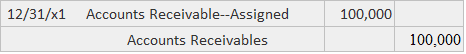

The journal entry used to record the transfer of the receivables to the factor:

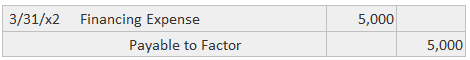

The journal entries to accrue the finance charge are shown below.

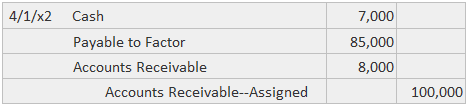

This last entry reflects the fact that the factor collected $92,000 cash and kept $85,000. The uncollected accounts are transferred back.

Example

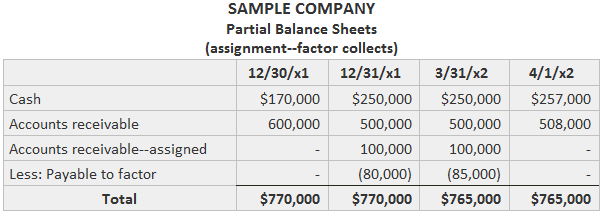

This example illustrates how the events described in the previous section would be reflected in Sample Company's balance sheet—assuming, for simplicity, that nothing else happens.

Notice that the payable to the factor is contra to the assigned receivables. Until informed about the amount collected and kept, the company will continue to carry the assigned receivables and the payable on the books at their original amounts.

The net result of the arrangement is that Sample Company exchanged $85,000 of its receivables for $80,000 cash.

Assignment Without Recourse

Assigning without recourse differs from assigning with recourse in that the factor does not get to substitute other accounts for the uncollectible ones.

The factor does not have to return any cash in excess of the amount advanced or any uncollected accounts.

In effect, assignment without recourse is the same as an outright sale of the receivables.

Accounting for this transaction is simple because it is the same as the sale of any other asset. The holder records a loss for the difference between the proceeds and the book value.

The factor (or buyer) usually obtains a high discount from the book value of the receivables because of the risk of uncollectibility.

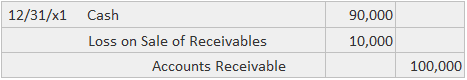

Suppose that Sample Company receives $90,000 cash on 31 December 2023 for assigning $100,000 of its receivables without recourse. The following journal entry would be recorded:

This arrangement is essentially the one used by retailers when they enroll in a bank credit card plan.

Upon submitting charge slips from customers, they receive a credit in their bank account for a percentage of the sale.

The cost is incurred by the retailer for the following purposes:

- Obtain the cash quickly

- Avoid bad debt losses

- Save clerical costs

- Increase sales

Since the arrangement dealing with credit cards is related to ongoing operations, the debit entry is made to an expense account instead of a loss account.

Factor Accounts Receivable FAQs

Factoring is a form of financing in which your company sells its Accounts Receivable (collectible debt owed to you by customers) to another business known as the "factor" at a discount.

No, regular businesses can successfully factor their Accounts Receivable. A factor will help your company complete all of the paperwork and advise you on how to optimize its factoring program.

A business should factor all of the Accounts Receivable that are within 90 days old. This will give you more control over your Cash Flow since you can factor on a regular basis instead of waiting until you have collected enough money to pay off an entire account payable.

No, it will not affect your company's credit rating. There is no impact on a company's current line of credit and it does not affect the company's ability to obtain additional borrowing in the future.

The factor will charge a separate fee for its services when it purchases your Accounts Receivable. This fee is usually not more than 1% of the total sales price and it may be negotiable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.