Activity-Based Costing (ABC) - Definition

An activity-based costing system (also known as ABC System) is a two-stage procedure for assigning overhead costs to products, which focuses on the major activities performed in the production process.

Activity-based costing is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each.

Moreover, Activity-Based Costing (ABC) has been developed as a more modern absorption costing method to overcome the problems of under-costing and over-costing and to produce more accurate product costs.

Explanation of Activity-Based Costing

Activity based Costing (ABC) is a systematic, cause & effect method of assigning the cost of activities to products, services, customers or any cost object.

ABC is based on the principle that “products consume activities”. Traditional cost systems allocate costs based on direct labor, material cost, revenue or other simplistic methods.

As a result, traditional systems tend to over-cost high volume products, services and customers and under-cost low volume.

Activity based costing should not be treated as an alternative to job costing or process costing but as one of the best tools for refining a costing system which provides a better measurement of the non-uniformity in the use of an organization’s overhead resources for job, products and services.

Activity-based costing incorporates in its costing system the basic and vital role of different activities. ABC System refined costing system by focusing on individual activities as the fundamental cost objects.

An activity is an event, task or unit of work with a specified purpose e.g., designing products, setting up machines, operating machines and distributing products.

In traditional absorption costing, overheads are first assigned or related to cost centers, (production and service centers) and then to cost objects i.e., products or services.

But in Activity-based costing system, overheads are related or assigned to activities or grouped into cost pools before they are related to cost objects i.e., products or services.

Thus, the activity based system system uses activities instead of functional departments (Cost Centers) for absorbing overheads.

The basic feature of functional departments is that they tend to include a series of different activities causing different costs that behave in different ways.

Further, the activities also tend to run across functions.

For example, the procurement or purchase of materials is made on the basis of a requisition note sent by a manufacturing department or stores.

The purchase requisition note is not raised in the purchasing department where most of the costs relating to procurement or purchase are incurred.

Activity costs tend to behave in a similar manner to each other i.e., they have the same cost driver or the factor causing a change in the cost of an activity.

Thus, it is believed that activity-based costing helps in presenting a more realistic picture of the behavior of costs.

Difference Between Traditional Costing and Activity-Based Costing

The basic distinction between traditional cost accounting and ABC is as follows:

Traditional cost accounting techniques allocate costs to products based on attributes of a single unit.

Typical attributes include the number of direct labor hours required to manufacture a unit, purchase cost of merchandise resold or the number of days occupied.

Allocations, therefore, vary directly with the ‘volume of units produced, cost of merchandise sold or days occupied by the customer.

In contrast, Activity based costing (ABC) systems focus on activities required to produce each product or provide each service based on each product’s or service’s consumption of the activities.

Using ABC, overhead costs are traced to products and services by identifying the resources, activities and their costs and quantities to produce output.

A unit or output (a driver) is used to calculate the cost of each activity consumed during any given period of time.

An activity based costing system can be viewed in two different ways:

- The cost assignment view provides information about resources, activities and cost objects.

- The process view provides operational (often non-financial) information about cost drivers, activities and performance.

Factors Prompting the Development of Activity-Based Costing System

Activity based costing System has developed basically on account of the limitations of the traditional absorption costing system.

The basic factors which have prompted the development of Activity based costing (ABC System) may be summarized as follows:

- The traditional methods applied for absorbing overheads lay emphasis on the calculation and application of overhead recovery rates which are acceptable for the valuation of stocks for the purposes of routine financial reporting.

The management is not able to find these different traditional methods of costing that may be helpful in making some hard decisions which may affect the product strategies.

- The rapid development of automated production has led to growing overhead costs. According to an estimate, the normal overhead rate which was 200% to 300% of direct costs about 15 years ago, has gone up to 500% to 800%.

- The ever increasing and severe market competition due to globalization has increased the necessity of more accurate product costs in order to avoid the disadvantages of under-costing and over-costing.

- There has been an increase in the tendency towards product diversification to secure economies of scope and increased market share requiring the ascertainment of more accurate product costs under the conditions of the fast-changing cost structure.

Importance/Advantages of Activity-Based Costing

Activity-based costing does not only apply to manufacture organizations: it is also appropriate for service organizations such as financial institutions, medical care providers and government units.

In fact, some banking companies have been applying the concept for years under another name - unit costing.

Unit costing is used to calculate the cost of banking services by determining the cost and consumption of each unit of output of functions required to deliver the service.

A major advantage of using Activity based costing (ABC) is that it avoids or minimizes distortions in product costing that result from arbitrary allocations of indirect costs.

Unlike more traditional line-item budgets which cannot be tied to specific outputs, ABC generates useful information on how money is being spent, if a department is being cost-effective, and how to benchmark (or compare oneself against others) for quality improvements.

Activity Based Costing also provides a clear metric for improvement. It encourages management to evaluate the efficiency and cost-effectiveness of program activities.

Some ABC systems rank activities by the degree to which they add value to the organization or its outputs.

This helps managers identify what activities are really value- added—those that will best accomplish a mission, deliver a service, or meet customer demand—thus improving decision-making through better information, and helping to eliminate waste by encouraging employees to look at all costs.

That is why an essential aspect of any ABC endeavor is to get a clear picture of the activities a business area performs.

When employees understand the activities they perform, they can better understand the costs involved.

Important Terms in Activity-Based Costing

The operation of the ABC System involves the use of the following terms:

- Cost Object: It indicates an item for which cost is calculated using the Activity-based costing System. For Example, a service, a customer or a product.

- Cost Driver: A cost driver is any factor or force that causes a change in the cost of an activity.

Cost driver may be divided into two parts:

(a) Resource Cost Driver and

(b) Activity Cost Driver.

The quantity measure of the resources used/consumed by an activity is called Resource Cost Driver. It is used to assign the cost of a resource to an activity or cost pool.

An activity cost driver is Really a measure of frequency and Strength of Demand, set on tasks by cost items.

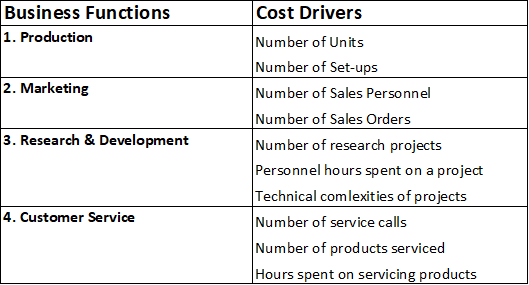

It’s utilized to assign activity costs to cost objects. The price drivers for various company purposes i.e., manufacturing, promotion, research and development, etc., have been provided below:

Steps to Follow in Activity-Based Costing

Activity Based Costing requires accountants to follow these steps.

- Step 1: Identify the activities that consume resources.

- Step 2: Assign costs to activities.

- Step 3: Identify the cost driver associated with each activity. A cost driver is a factor that causes, or "drives" an activity's cost.

- Step 4: Compute a cost rate per cost driver unit.

- Step 5: Assign costs to products by multiplying the cost driver rate times the volume of cost drivers consumed by the product.

Need or Objects of Activities-Based Costing

ABC System is needed by an organization for the purpose of accurate product costing in cases where:

- Production overhead costs are high in comparison to the various direct costs;

- The product range of the organization is highly diverse;

- Overhead resources used by various products are very different in amounts;

- Volume or quantity of production is not a primary driving force for the consumption of overhead resources.

Limitations of ABC System

The ABC System suffers from the following limitations:

- This system is more time-consuming due to the fact that the number of activities to which the overhead resources of an organization have to be related, is very large.

- It involves a high cost of operation and can be used only by large organizations. It is not suitable for small scale units.

- In some cases, the establishment of cause and effect relationship between Cost Driver and Costs may not be a simple affair.

Example

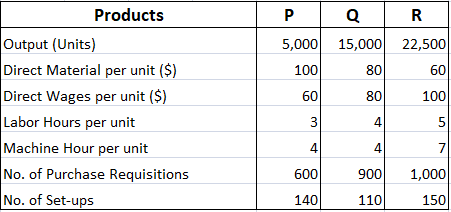

Jumbo Auto Ltd. produces three products ‘P’, ‘Q’ and ‘R’ for which the standard costs and quantities per unit are as follows:

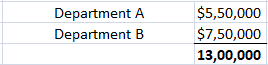

Production overhead split by departments:

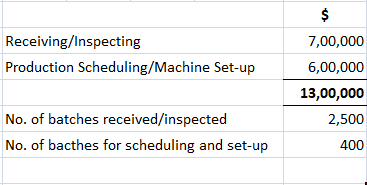

Department ‘A’ is labor intensive while Department ‘B’ is machine intensive. Total labor hours in Department A = 55,000 Total machine hours in Department B = 1,50,000 Production overhead split by activity:

You are required to:

(i). Prepare Product Cost Statement under traditional Absorption Costing and Activity-based Costing Method.

(ii). Compare the results under two methods:

Solution

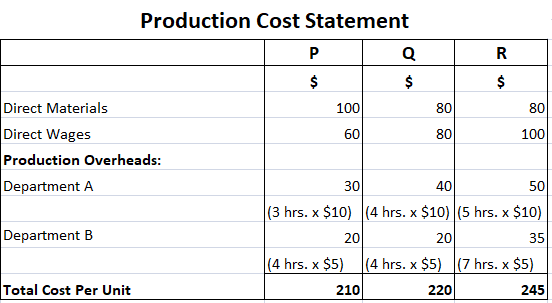

Traditional Absorption Costing

Calculation of overhead absorption rates: Department ‘A’ = $5,50,000 / 55,000 Labor hours = $10 per labor hour.

Department ‘B’ = $7,50,000 / 1,50,000 Machine Hours = $5 per machine hour.

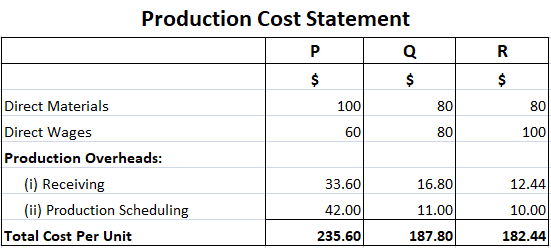

Activity-based Costing

Calculation of Cost Driver Rates:

(i). Receiving/Inspecting = $7,00,000 / 2,500 (No. of batches received/inspected) = $280 per requisition.

(ii). Production Scheduling/Machine Sets-up = $6,00,000 / 400 (No. of batches for scheduling) = $1,500 per set-up

Note: Calculation of Overhead per unit.

Receiving: Product P = ($280 x 600) / 5,000 = $33.60 Product Q = ($280 x 900) / 15,000 = $16.80 Product R = ($280 x 1,000) / 22,500 = $12.44

Production Scheduling: Product P = ($1,500 x 140) / 5,000 = $42.00 Product Q = ($1,500 x 110) / 15,000 = $11.00 Product R = ($1,500 x 150) / 22,500 = $10.00

Comparison of Results Under Both Costing Methods

From the above analysis, it is clear that the Traditional Absorption Costing Method and Activity-based Costing Method show different cost results.

Under the traditional absorption costing method, Product ‘R’ is more expensive while under activity-based costing method, product ‘P’ is more expensive.

If we assume that Activity-Based Costing is more accurate (which may or may not be possible), under traditional absorption costing method, product ‘R’ would be over-priced while product ‘P’ would be underpriced as a result of which sales for product ‘R’ would be less and sales for product ‘P’ would be more leading to a loss to the company.

Activity-Based Costing (ABC) FAQs

Explicit cost driver- explicit cost drivers are those which are included in the accounting records of an organization at the time of preparing Financial Statements. These include items such as salaries, raw material consumption etc. Implicit cost drivers- Implicit cost drivers are not recorded in the accounting records of an organization during the preparation of Financial Statements. These include factors such as machine hours, labor hours etc.

A cost pool consists of one or more similar activities that can't be identified easily with specific products, services, departments etc. Cost pools are used to account for the common costs of the organization.

A cost element refers to an account which receives and accumulates costs over a period of time. It also includes the revenue accounts that receive and accumulate revenues over a period of time.

A service level measures the number of requests that are processed by an organization within a set time frame. Generally, the higher the number of services within the predetermined time period, the more efficient is the organization.

Activity-Based Costing (ABC) is a method of cost accounting that assigns costs to products and services based on the activities that produce them, rather than allocating overhead costs using traditional methods such as direct labor hours or machine hours.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.