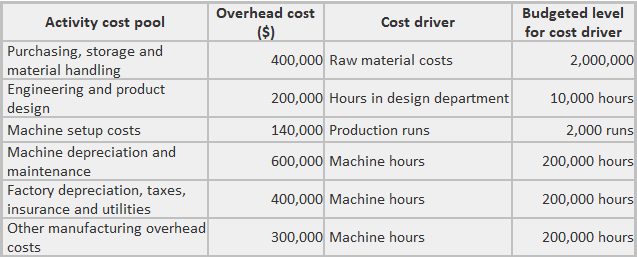

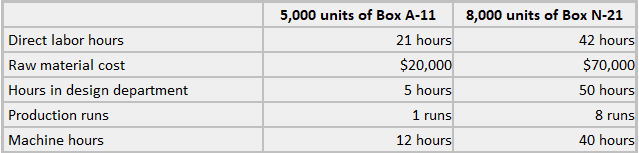

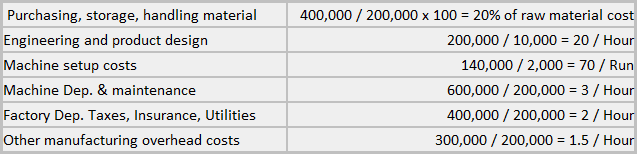

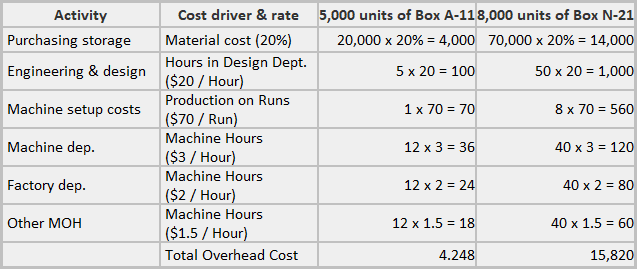

Activity-Based Costing (ABC) Activity-based costing uses cost drivers to assign the costs of resources to activities, along with unit cost as a way of measuring output. The four steps involved in activity-based costing (ABC) are described below. Perform an in-depth analysis of the operating processes of each responsibility segment. Each process may involve one or more activities, as required by outputs. This step is sometimes called "tracing." Traceability uses tracing costs in order to cost objects, thereby determining why costs were incurred. These can be categorized in three ways: Costs that can be traced directly to one output. Example: the material costs (varnish, wood, paint) to build a chair. Costs that cannot be allocated to an individual output; in other words, they benefit two or more outputs, but not all outputs. Examples: maintenance costs for the saws that cut the wood, storage costs, other construction materials, and quality assurance. Costs that cannot reasonably be associated with any particular product or service produced (overhead). These costs would remain the same no matter what output the activity produced. Examples: salaries of personnel in the purchasing department, depreciation on equipment, and plant security. Identify all of the outputs for which an activity segment performs activities and consumes resources. Outputs can be products, services, or customers (persons or entities to whom a federal agency is required to provide goods or services). Assign activity costs to outputs using activity drivers. Activity drivers assign activity costs to outputs based on individual outputs' consumption or demand for activities. For example, a driver may be the number of times an activity is performed (transaction driver) or the length of time an activity is performed (duration driver). Activity-based costing encourages managers to identify which activities are value-added—those that will best accomplish a mission, deliver a service or meet customer demand. It improves operational efficiency and enhances decision-making through better, more meaningful cost information. John Corporation manufactures special packaging boxes for the pharmaceutical industry. The company's Zedan plant is semi-automated, but the special nature of the boxes requires some manual labor. The plant controller has chosen the following activity-based cost pools, cost drivers, and pool rates for the Zedan plant's product costing system. Two recent production orders had the following requirements. Required: 1. Pool rates 2. Total overhead assigned 3. Overhead cost per box 4. Predetermined overhead rate 5. Assignment of overhead costsSteps to Implement Activity-Based Costing

1. Identify ABC Activities

2. Assign Resource Costs to Activities

Direct

Indirect

General & Administrative

3. Identify ABC Outputs

4. Assign Activity Costs to Outputs

Example: Activity-Based Management

Solution

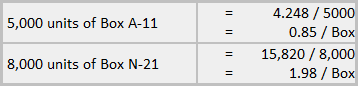

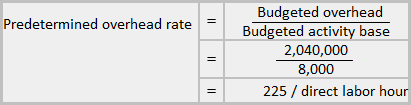

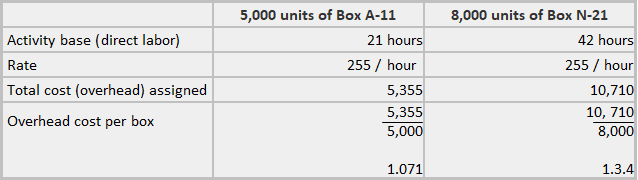

Computation of Unit Cost Under Activity-Based Costing FAQs

Activity-based costing (ABC) uses various cost pools to compute the costs of activities, which are then attributed to products, services or customers. ABC allocates indirect overhead costs according to how much a specific product, service or customer benefits from the overhead. It encourages managers to identify which activities are value-added--those that deliver the most benefit to specific products, services or customers.

Some of the benefits of ABC systems include improved decision-making, more accurate product costing, and enhanced operational efficiency. ABC can also provide valuable information for managerial accounting purposes, such as identifying which activities are value-added or identifying opportunities for cost-cutting measures.

Traditional cost accounting typically uses a single overhead rate based on machine hours, labor hours, or some other measure of production volume. Activity-based costing takes an activity-based approach that assigns costs more precisely and provides more accurate information for decision-making.

Activity-based costing example problem solution is calculation of cost of each activity based on its level of usage. If more number of times an activity is performed then the cost will be higher. Manager can allocate cost to products, services or customers based on their utilization of activities.

Activity-based costing helps in allocating cost to activities that are value-added. It also improves operational efficiency and enhances decision-making through better, more meaningful cost information.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.