The current purchasing power (CPP) method is also known as general price-level accounting. In the United States, the CPP method is recommended by the Accounting Policy Board and the Financial Accounting Standards Board (FASB). CPP adjusts historical cost based on changes in the general level of prices, as measured by the general price level index. Changes in the general level of prices represent changes in the general purchasing power of the monetary unit. CPP is a mixed method in which financial statements are prepared on a historical basis. These statements, in the end, are converted based on the current purchasing power of the currency. Profit and loss items and balance sheet items are adjusted with the price index. The basic idea of the CPP method is to apply changes in the value of money in response to changes in general price index. In general, inflation reduces an individual's purchasing power to purchase goods and services, while deflation increases an individual's purchasing power to purchase goods and services. Historical financial statements show transactions at various points in time and, as such, they also show replacement purchasing powers at various points in time. CPP accounting transforms diverse historical measures into a single measure: namely, that of current purchasing power, which represents purchasing power at the same point in time. Thus, CPP accounting makes all accounting numbers comparable in terms of general purchasing power. This is achieved by removing the mixed purchasing power element from historical financial statements. CPP differs from Current Cost Accounting (CCA) in that, under CPP, the current values of various assets are not worked out; instead, financial statements are stated in terms of dollars of uniform value. Hence, the CPP method considers changes in price levels that are denoted by the general price index. Thus, all amounts are expressed in units of equal purchasing power. Since the CPP method reflects the effects of changes in the general price level, it is also known as general price-level accounting. The CPP method distinguishes between monetary items and non-monetary items. Monetary items are those assets and liabilities that represent a claim to receive, or an obligation to pay, a fixed amount of foreign currency. Examples of monetary items include cash, accounts payable, accounts receivable, and long-term debt. Monetary items are translated at the current rate while non-monetary items (such as fixed assets, stock, plant and buildings) are translated at historical rates. During a period of rising prices, holding monetary assets results in a loss of purchasing power. Likewise, creditors tend to gain during a period of rising prices as debts are now repaid in dollars of less purchasing power than those originally borrowed. Non-monetary items such as stocks, plants, and buildings increase in value in an inflationary context. The lower cost and net realizable value can be taken and then further adjusted. Various indices can be used. For example, the index used could be the cost of living index or the general index of retail prices. The following techniques are applied to understand the CPP method: In this method, historical figures are stated at current purchasing power. Items of profit and loss and balance sheet items are adjusted with the help of general price index number. Conversion Factor = Current Price Index Number / Previous Price Index at the Date of Existing Figure A building was purchased in 2024 for $160,000. The general price index was 250. Convert the figures in current dollars in 2025 using the general price index of 500. = Current Price Index / Previous Year Index at the Date of Existing Figure = 500 / 250 = 2 times Converted Value = Historical Cost x Conversion Factor = $1,60,000 x 2 = $3,20,000 Multiple transactions take place over the year in any business, including purchases, sales, and expenses. To convert such items, the average index of the year can be taken as the one index for all such items. When such an index is not available, the index of mid-year can be taken. For the conversion of historical costs in terms of CPP of currency, monetary accounts are those accounts of assets and liabilities that are not subject to reassessment of their recorded values due to change of purchasing power of money. The CPP method is useful when the aim is to maintain purchasing power in general. It is further suitable: There are several implementation problems associated with the CPP method:Definition

Explanation

Monetary and Non-monetary Items

Techniques to Understand the Current Purchasing Power (CPP) Method

Conversion Technique

Example

Solution

Mid-Period Conversion

Monetary and Non-monetary Accounts

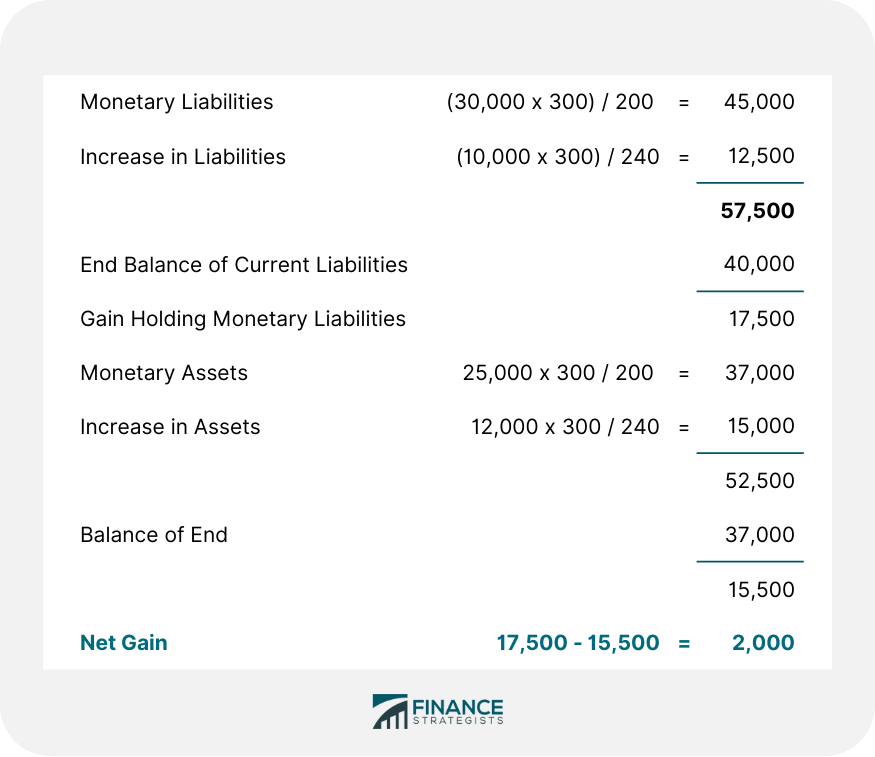

Example

Solution

Suitability of the CPP Method

Implementation Problems for CPP Method

Current Purchasing Power Method FAQs

The current purchasing power method is a technique used to measure financial performance and assets over time by adjusting figures for the effects of inflation. This allows users to understand the true value of money in terms of what it can purchase at a specific point in time.

The CPP method offers several advantages over traditional accounting methods, including the ability to track trends over time, maintain the purchasing power of investments, and evaluate corporate profits more accurately.

The CPP method can be used for a variety of purposes, including evaluating financial performance and assets over time, understanding the true value of money in terms of what it can purchase, and tracking inflation trends.

Yes, there are several potential problems that can arise when implementing this accounting technique. These include difficulties in training personnel to use and interpret adjusted figures, choosing an appropriate price index, and resistance from managers and labor unions.

In order to convert historical figures into their current purchasing power equivalents, the average index of the year or mid-year can be used. Monetary accounts are those that remain unaffected by changes in purchasing power, while non-monetary accounts are subject to reassessment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.