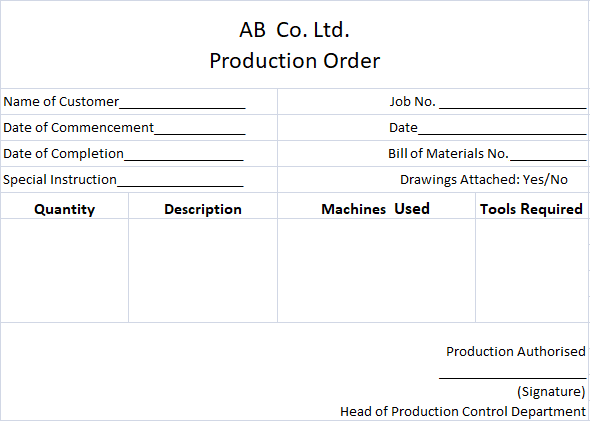

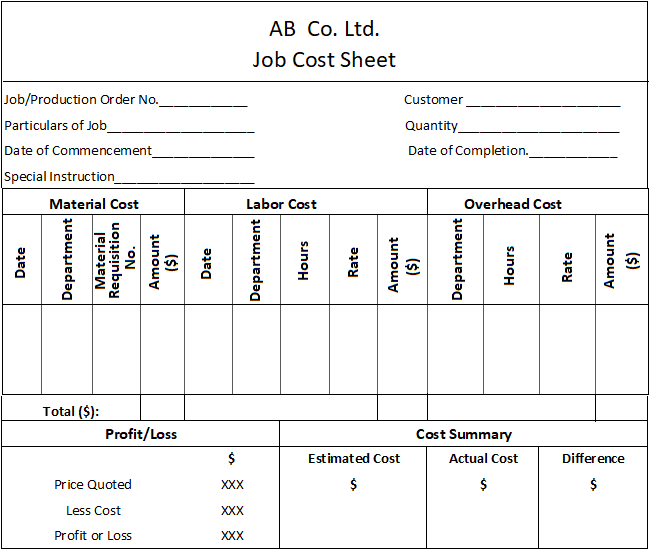

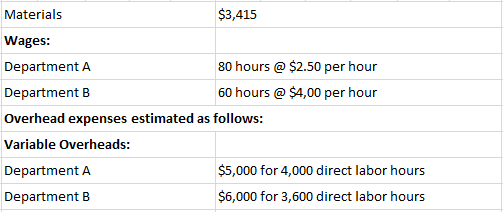

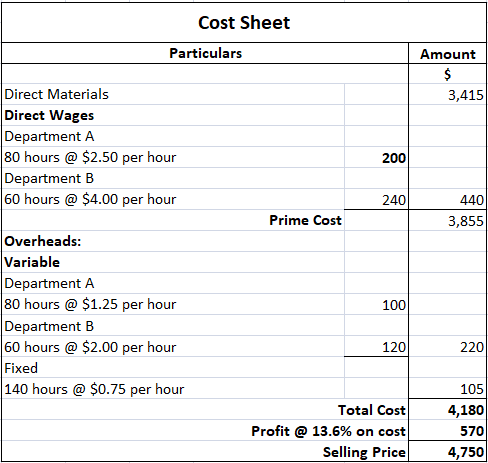

Job costing is a system in which costs are assigned to batches or work orders of production. Job cost sheets are prepared using this costing system. As a method of costing, job costing is applied to ascertain the costs of specific work orders, which are treated as small-sized contracts. These jobs are generally dissimilar, of a non-repetitive nature, and are not comparable with each other. Job costing is also known as job lot costing or lot costing. Under job costing, production is undertaken by a manufacturer against a customer’s order and not for stock. In a job costing system, each job or work order is of a specific nature. The jobs or work orders are generally executed in factories, workshops, and repair shops. However, jobs are sometimes completed outside the factory or workshop (e.g., plumbing jobs and sewerage works). The unit of costing, under any job costing system, is a job or specific work order. Finally, in job costing, production processes and requirements are determined first. In turn, expenses are ascertained in relation to these. The following are the main objectives of job costing (i.e., the advantages of job costing): Job costing is suitable in organizations that perform work according to customer specifications. For example, job costing is ideal for activities such as printing press, painting and decorating, vehicle garages, repair shops, electrical fittings, shipbuilding, engineering works, and plumbing works. The steps involved in the job costing system are summarized as follows: Production in any industry only happens after an order is received from the customer. When an order for a job is received and accepted by the manufacturer, the order, as well as the job, is given a specific number. This number is used to identify the order and job. Such a number is known as the job number. After accepting an order, the production planning department prepares a document known as a production order. The production order contains the following details: The production order takes the form of instructions issued to a foreman to proceed with the job. Thus, it serves as an authority to the foreman to indicate that the work should be started. A specimen of a production order is shown below. A bill of materials (BOM) is a list of all materials and parts required for a specific job. A BOM contains the details of all materials required and serves as an advanced notice to the storekeeper who may issue materials for the execution of the job on the basis of the Bill rather than on separate requisitions. The responsibility of preparing the BOM lies with the production planning department. The foreman receives a copy of the BOM along with the production order. The BOM authorizes the foreman to call for and receive the specified materials from the stores. If certain special tools are required for the job, a separate list known as the tool list is also prepared. To record all the direct and indirect costs incurred in the completion of each job, the costing department should prepare a job cost card or job cost sheet. The job cost sheet shows the direct material costs, direct wages, and overheads applicable to respective jobs. The job cost card must be designed to suit the needs of the organization. A specimen of a job cost sheet is shown below. The types of costs that should be recorded are as follows: Materials required for the job are issued from the stores on the basis of a BOM or a materials requisition form. The material costs of a job can be ascertained from the BOM or materials abstract prepared by the costing department using the materials requisition form. If any special material is purchased for a job, it is directly charged to the job on the basis of an invoice. If any surplus material is returned from the job to the stores, the job account is given due credit for the value of the same. The labor cost of a job is ascertained based on job card. A circulating job card is issued with each job to record the labor hours spent on different operations and the total labor cost on completion of the job. Overhead costs are accumulated on a departmental basis and then apportioned to the various jobs executed by each department on some equitable basis (e.g., direct labor hours or machine hours spent on each job). To avoid delays in distributing overheads on an actual cost basis, overheads are generally charged at predetermined rates (i.e., the rates worked out based on the previous period’s figures). Progress reports are received from departments to assess the extent of work completed from time to time, thereby ensuring that the job is completed within the stipulated time. On completion of a job, a job completion report is sent to the costing department. The total cost of a job is ascertained by posting all costs related to that job to the job cost sheet. If a job consists of a number of units of production, the total cost of the job is divided by the number of units to calculate the cost per unit. The amount of profit and loss on a job is computed by comparing the total cost of the job with the sales price. In job costing, the cost is maintained for each job or product by calculating all expenses, including materials, labor, and overheads. The following direct costs were incurred on Job No. 105 undertaken at ABC Engineering Works: Fixed Overhead: Estimated at $7,500 for 10,000 hours of normal factory working time. Required: Calculate the cost of Job No. 105 and estimate the percentage of profit earned if the price quoted is $4,750. 1. Overhead rates are calculated as follows: Variable overhead rates Fixed overhead rate = $7,500 / 10,000 hrs. = $0.75 per direct labor hour 2. Percentage of profit on cost is calculated as follows: = (Profit / Total Cost ) x 100 = (570 / 4,180) x 100 = 13.6% on costJob Costing: Definition

Features of Job Costing

Objectives/Advantages of Job Costing

Suitability of Job Costing

Costing Procedures Under Job Costing

1. Job Number

2. Production Order

3. Bill of Materials

4. Recording Costs

5. Completion of Job

6. Profit or Loss on Job

How to Calculate Job Costing

Example

How to Determine Job Cost Under a Job Costing System

Solution

Working

Job Costing FAQs

Job costing is a system in which costs are assigned to batches or work orders of production. Job cost sheets are prepared using this costing system.

As a method of costing, job costing is applied to ascertain the costs of specific work orders, which are treated as small-sized contracts. These jobs are generally dissimilar, of a non-repetitive nature, and are not comparable with each other.

In job costing, production processes and requirements are determined first. In turn, expenses are ascertained in relation to these.

Job costing is suitable in organizations that perform work according to customer specifications.

1. Job number, 2. Production order, 3. Bill of materials, 4. Recording costs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.