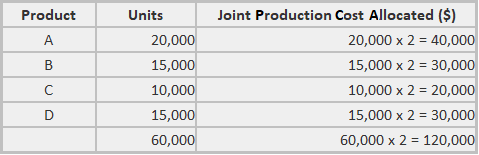

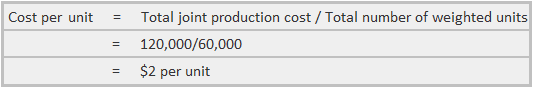

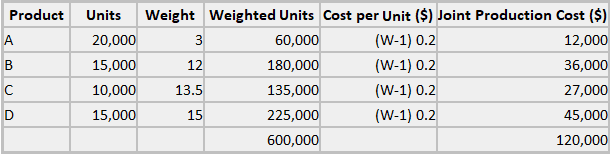

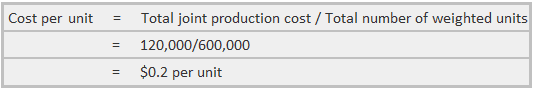

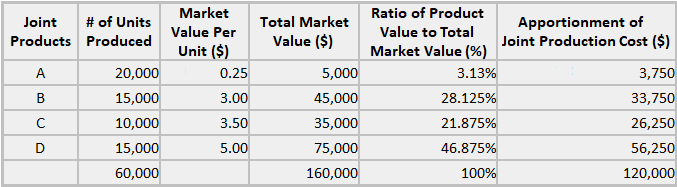

Several methods are available to allocate the joint production cost incurred up to the split-off point. These methods are: This method apportions the total production cost to the various products on the basis of a predetermined standard or index of production. An average unit cost is obtained by dividing the total number of units produced into the total joint production cost. As long as all units produced are measured in terms of the same unit and do not differ substantially, this method is simple and easy to apply. However, when the units produced are not measured in like terms, the method cannot be applied. Joint products A, B, C, and D are produced at a total joint production cost of $120,000. The following quantities are produced: Required: Calculate the joint production cost allocation using the quantitative method. Companies that use this method argue that all of the products produced using the same process should receive a proportionate share of the total joint production cost (based on the number of units produced). In many industries, the quantitative method does not give a satisfactory answer to the joint cost apportionment problem. For this reason, weight factors are often assigned to each unit based on unit size, manufacturing difficulty, manufacturing time, differences in the type of labor employed, the amount of material used, and so on. Finished production of every kind is multiplied by weight factors to apportion the total joint cost to individual units. Using figures from the previous example, the following weight factors have been assigned to the four products as follows: Required: Calculate the joint production cost allocation using the weighted average method. The joint production cost allocation would result in the following values: This method is popular due to the argument that a product’s market value reflects the cost incurred to produce it. The contention is that if one product sells for more than another, it is because it cost more to produce. Therefore, the way to allocate the joint cost is based on the respective market values of the items produced. The method is really a weighted market value basis using the total market or sales value of each unit (quantity sold multiplied by the unit sales price). Example: Joint products A, B, C, and D are produced at a total joint production cost of $120,000. The following quantities are produced: Additionally, product A sells for $0.25, B for $3.00, C for $3.50, and D for $5.00. These prices are market or sales values for the products at the split-off point (i.e., it is assumed that they can be sold at the point). Management may have decided, however, that it is more profitable to process certain products further before they are sold. Nevertheless, this condition does not destroy the usefulness of the sales value at the split-off point for the allocation of the joint production cost. Required: Calculate the joint production cost allocation using the market value method.Quantitative Method

Example

Solution

Working

Weighted Average Method

Example

Solution

Working

Market Value Method

Solution

Joint Cost Allocation Methods FAQs

The methods are ways of splitting the total joint costs between products. They all use some measure of production to do this, for example number or volume.

Use the split-off point to work out the proportion of joint costs that each product should carry. You can then multiply this share by the sales value to get the sales value of the project for each product, and use market value allocation methods to split these between them.

The easiest way is to sum up the joint cost for all the products, and divide by the total number of units. The unit cost is also split between them in proportion to their market value share.

The simplest method is just to allocate costs on a pro rata basis based on an agreed set of criteria (for example, number of employees). More advanced methods give weightings to the units based on other criteria such as market value.

This gives units different weights based on their cost or value. The simplest way of doing this is by allocating a fixed percentage to each unit (e.g., 1% Of joint costs per unit). More sophisticated methods allocate different proportions of the cost to each product based on sales value.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.