Under cost price method, materials issued to production, are charged out on the basis of actual cost i.e., the cost at which these have been purchased. As we already know, the actual cost of materials consists of purchase price or invoice price (less trade discount and quantity discount), import duty, sales tax, commission on purchase, freight, carriage, cartage, transit insurance and octroi duty. This method is considered to be the simplest and most scientific as it helps in recovering the actual cost of materials paid, from production. As such, it adheres to the costing principles. Under the actual cost method, the materials issued can be priced out on any of the following basis: Under this method, materials purchased or received first are deemed to be issued first. As such, the price paid for the earliest lot of materials in hand is taken as the basis for charging out the materials issued. Under this method, the various items on the debit side of the Stores Ledger (Receipts Column) are exhausted in chronological order. The stock in hand, under this method, is valued at cost of the current or latest purchases. This requires the maintenance of the record of quantity and value of every receipt of material. Example (FIFO) The operation of this method can be understood by the following example:Explanation of Cost Price Method

Basis of Cost Price Method

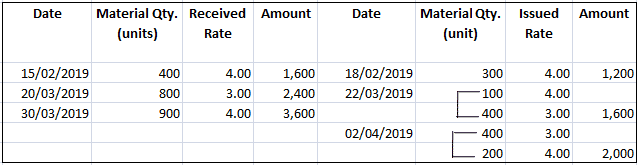

First-In-First-Out Method

Cost Price Method FAQs

The cost price method takes in to consideration when we calculate opening and closing stock. But it is not considered under calculation of purchase and sales returns, because these amounts are written off through subsequent process (sales).

The unit cost can be obtained from the Financial Statement. In case of budgeted accounts, it is directly provided by the auditor in "pro forma" accounts. In case of original accounts it is derived by analyzing budgets and cash books for a particular period.

The impact will be on opening and closing stock. It will affect the value of both these items, but it does not affect purchases, sales or purchase returns.

It will not affect total turn over. It only affects the stock valuation and purchase, sales returns.

Under this method, closing stock would increase by the difference between total purchases and total sales.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.