Direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. These costs can be calculated by adding up the cost of all components and dividing by the number of units produced.

Raw materials are the basic material that is used to create a product. These can be plastics, metals, or even adhesives, for example. They need to have been transformed from their original state for them to become part of your product, and therefore they incur costs when they’re being produced into something else. Indirect tax, or taxes applied to all products equally, includes things like GST and VAT.Components of the Direct Materials Cost

1) Raw Materials Costs

2) Packaging and Container Charges

Packaging is an essential part of the production process, as it goes beyond protecting your product and helps to promote them.

The costs associated with packaging vary according to size and material used but could range from $0.25 for a small pouch up to $20+ for something like a gift box.3) Freight & Storage Charges

You must include this in your calculations as these charges can increase quickly depending on your suppliers’ location.

These storage costs can quickly accumulate if you have a large inventory, so it’s important to keep an eye on it. 4) Indirect Tax

This will vary depending on where you’re located, so it’s important that you include this in your calculations.5) Discounts

If you’re working with a distributor, they may be offering discounts to get the product into retail stores, for example. Calculation Example of the Direct Material Costs

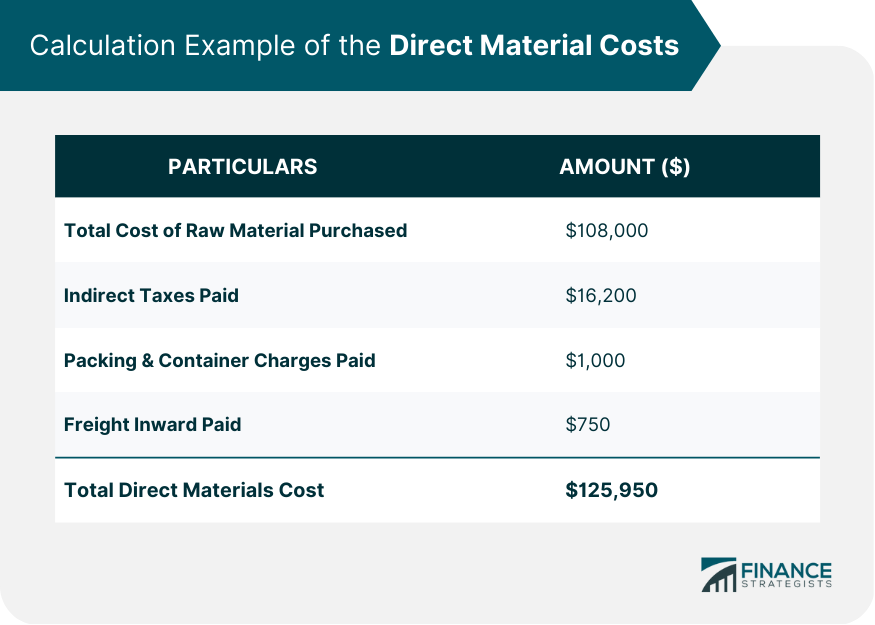

All expenses mentioned for Company ABC will be included in the computation for direct material costs, except for wages paid.

Examples of Direct Materials

When it comes to understanding direct materials cost, there are a few examples of how this can be applied.

In particular, these give some great real-life insight into what is involved in calculating the direct material costs as well as showing you some examples directly from the manufacturing business itself:

Why Does Direct Materials Cost Matter?

Key Takeaways

Direct Materials Cost FAQs

Direct Materials Cost is the cost of materials purchased directly in order to manufacture a product or provide a service.

Direct Material Cost can be calculated by multiplying the number of materials used by their unit cost.

Direct Material Cost is one type of manufacturing cost, along with labor and overhead expenses. It is generally the largest component of total production costs.

Companies should purchase materials when demand is expected to exceed supply in order to avoid any delays or disruptions in the production process.

Examples of direct material costs include raw materials, purchased components, packaging supplies, and finished goods inventory.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.