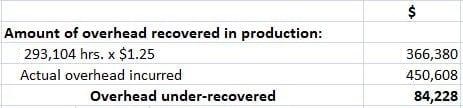

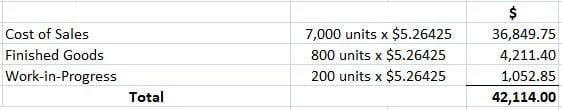

Where the absorption of overheads is made using a rate based on actual data, the overhead absorbed must be equal to the actual overhead incurred. But where a pre-determined rate is used, there is generally a difference between the overhead absorbed and the overhead incurred. If the absorbed amount is less than the actual overhead, there is said to be an under-absorption of overhead. For example, if during the month of March 2019, overheads absorbed are $9,500 and actual overheads are $10,000, there is an under-absorption of overheads to the extent of $500. In the case of under-absorption, the cost of production is deflated to the extent of the amount under-absorbed. On the other hand, if the absorbed amount is in excess of the actual overhead, there is said to be an over-absorption of overhead. For example, if during April 2019, overheads absorbed are $10,800 and actual overhead are $10,000, there is an over-absorption of overhead to the extent of $800. In the case of over-absorption, the cost of production is inflated to the extent of over-absorption. The main causes of under-absorption and over-absorption of overheads are: The under-absorbed and over-absorbed overhead costs may be disposed of in any of the following ways: Under this method, an under-absorbed or over-absorbed overhead is apportioned to work-in-progress inventory, finished goods inventory, and cost of sales by means of a supplementary overhead rate. The amount of the under-absorbed overhead is adjusted by adding it back to the cost of production. This is done by applying a positive supplementary rate. By contrast, an over-absorbed overhead is deducted through a negative supplementary rate. The supplementary rate is obtained with the following formula: Supplementary overhead rate = (Overhead incurred - Overhead absorbed) / Quantum of base This method has the ultimate effect of charging the actual overhead to the cost of production. For this reason, the distinction between the recovery at pre-determined rates and at actual rates no longer exists. The use of this method is generally recommended in the following cases: Under this method, the amount of overhead that remains under-absorbed or over-absorbed at the end of the year is transferred to an overhead reserve of suspense account to be carried forward to the next year's accounts for absorption. This method can be applied when the normal business cycle extends over more than one year and overhead rates are pre-determined on a long-term basis. This method is not commonly used. This method is usually applied in unusual circumstances, causing an abnormal increase or decrease in actual overhead costs. The amount of overhead under-absorbed or over-absorbed is transferred to the costing profit and loss account. If the predetermined overhead rate is applicable for a year, it is unproblematic to transfer the differences between the overhead absorbed and overhead incurred to the costing profit and loss account. However, if the same is applicable to a shorter period, the work of comparing the actual and estimated overheads will have to be done at frequent intervals. The other main disadvantage of this method is that the stocks of work-in-progress and finished goods remain under-valued or over-valued. Furthermore, they are carried forward as the same values to the next period. The total overhead expenses of a factory are $4,50,608. Taking into account the normal working of the factory, overhead was recovered in production at $1.25 per hour. The actual hours worked were 2,93,104. How would you proceed to close the account of works, assuming that besides 7,800 units produced (of which 7,000 were sold), there were 200 equivalent units in work-in-progress? On investigation, it was found that 50% of the unabsorbed overhead was on account of an increase in the cost of indirect material and indirect labor, and the other 50% was due to factory inefficiency. As shown below, 50% of unabsorbed overheads are attributable to an increase in the cost of indirect materials and indirect labor. So, 50% of $84,228 (i.e., $42,114) is recovered by a supplementary rate. Total number of units produced or in work-in-progress = 7,800 + 200 = 8,000 units Supplementary rate = 42,114 / 8,000 = $5.26425 per unit So, the amount totaling $42,114 would be as follows: The balance of the 50% difference caused due to factory inefficiency should be transferred to the costing profit and loss account. This is because it is an abnormal loss.What is Under-absorption and Over-absorption of Overheads?

Causes of Under-absorption and Over-absorption of Overheads

Treatment of Under-absorbed and Over-absorbed Overheads

(1) Use of Supplementary Rate

(2) Carry Forward to the Next Year's Accounts

(3) Transfer to Costing Profit and Loss Account

Example

Solution

Under-absorption and Over-absorption of Overheads FAQs

In under-absorption of overhead, the absorbed amount is less than the actual overhead

Over-absorption of overheads happens if the absorbed amount is in excess of the actual overhead

In the case of under-absorption, the cost of production is deflated to the extent of the amount under-absorbed. For example, if during the month of march 2019, overheads absorbed are $9,500 and actual overheads are $10,000, there is an under-absorption of overheads to the extent of $500.

In the case of over-absorption, the cost of production is inflated to the extent of over-absorption. For example, if during april 2019, overheads absorbed are $10,800 and actual overhead are $10,000, there is an over-absorption of overhead to the extent of $800.

The main causes of under-absorption and over-absorption of overheads are: - under-utilization of production capacity - seasonal fluctuations in production (for seasonal factories) - errors in predicting overhead costs or the quantum or value of the base - major changes in production methods - major changes in working capacity

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.