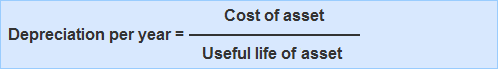

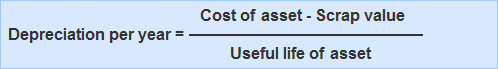

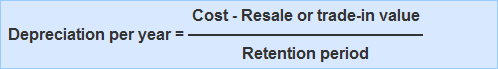

As the name implies, under the fixed installment method of depreciation, the amount of depreciation each year is fixed and equal. At year-end, a fixed amount is removed from the book value of the asset and charged to the profit and loss account or income statement. This is the oldest and most widely used method of depreciation. A fixed amount of depreciation is charged every year during the lifetime of the asset. At the end of the asset's useful life (e.g., the end of a machine's life), the value of the asset will be zero. This is also known as the straight-line basis for calculating depreciation or the original cost method. Certain assets perform the same service over their entire lifetime, and when their useful life is over, they are of no value to their owners. A good example is a leasehold property. If someone acquires property on a 100-year lease, the property will not be of any value to them after 100 years as it would return to the original owner. For such a fixed asset, depreciation per year is arrived at by dividing the cost over the number of years it is expected to have a useful life. (i) Simplicity: The fixed installment method is simple to understand and easy to apply. (ii) Zero Value: Under this method, the value of the asset during its effective working life will be zero. (iii) Suitable for Assets with an Expiry Period: This method is suitable for assets that depreciate more over time (e.g., leasehold properties and patents). (i) Concept of Zero Value: Under this method, the value of assets after their working life will be zero, which is incorrect (i.e., because no assets have zero value). (ii) Equal Amount of Depreciation: In this method, the amount of depreciation remains constant throughout the working life of the machine, which is illogical. The amount of depreciation should be greater in the initial years and lower in the later years. (iii) No Thought to Interest: Only the original cost of an asset is depreciated; no thought is given to the fact that the same investment made in a different place would fetch interest. (iv) Difficulty in Additional Purchase of Fixed Asset: The method creates difficulties in respect of depreciation on additions to assets that have a different life span. ABC Ltd. acquired a plot on a 100-year lease for $125,000. Calculate the plot's depreciation per year. Depreciation per year = $125,000 / 100 years = $1,250 Most fixed assets have some value even after their useful life is over. For example, if a trader buys a machine with an expected useful life of 10 years, it is likely that after 10 years, even though the machine may not be active and useful, it will still be worth a few dollars as scrap. This amount is called an asset's scrap or residual value. For assets that are likely to leave a scrap value, depreciation per year is calculated by using the following formula: ABC Ltd. purchased a machine for $124,000. It is expected to last for 6 years and leave a scrap value of $4,000. Calculate its depreciation per year. Depreciation per year = ($124,000 - $4,000) / 6 years = $20,000 Some businesspeople prefer not to keep their fixed assets until the end of their useful life. Instead, they sell fixed assets off when they are still in working order. The price fetched is called the resale value, or if the asset is traded in for a new one, the trade-in value. For such assets, depreciation per year is calculated as follows: XYZ Ltd. purchased a machine for $124,000. It expects to use it for 5 years and sell it for $34,000. Calculate its depreciation per year. Depreciation per year = ($124,000 - $34,000) / 5 years = $18,000 The fixed installment method is also known as the straight-line method. It is particularly suitable for assets that provide a similar service over their entire useful life and whose useful life can be estimated with reasonable accuracy. Examples of such assets are leasehold properties, large pieces of machinery, plants, and mines.Fixed Installment Method: Definition

Fixed Installment Method: Explanation

Advantages/Merits of Fixed Installment Method

Disadvantages/Demerits of Fixed Installment Method

Formula

Example 1

Scrap or Residual Value

Example 2

Trade-in Value

Example 3

Summary

Fixed Installment Method FAQs

As the name implies, under the fixed installment method of Depreciation, the amount of Depreciation each year is fixed and equal. At year-end, a fixed amount is removed from the book value of the asset and charged to the profit and loss account or income statement.

Fixed installment method is the oldest and most widely used method of Depreciation. Certain assets perform the same service over their entire lifetime, and when their useful life is over, they are of no value to their owners. A good example is a leasehold property. If someone acquires property on a 100-year lease, the property will not be of any value to them after 100 years as it would return to the original owner.

The advantages of fixed installment method includes: 1. Simplicity 2. Zero value 3. Suitable for assets with an expiry period

The disadvantages of fixed installment method includes: 1. Concept of zero value: 2. Equal amount of Depreciation 3. No thought to interest 4. Difficulty in additional purchase of fixed asset

The formula of fixed installment method of Depreciation is: Depreciation per year = cost of asset / useful life of asset

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.