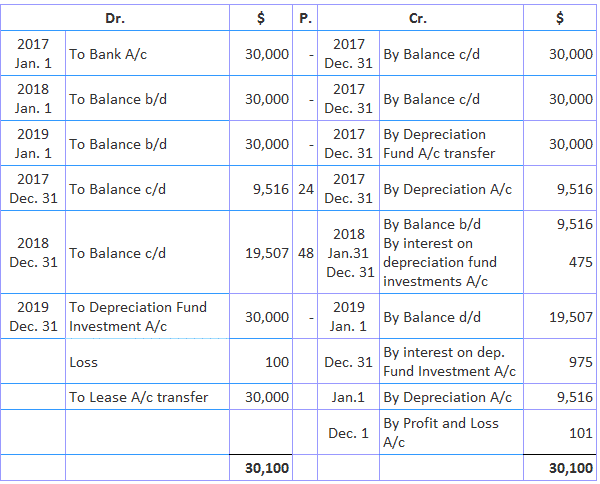

The sinking fund method of assets depreciation is also known by other names, including the redemption fund method and amortization fund method. It requires depreciation on an asset to be provided through a depreciation or sinking fund. This is brought into being by accumulating the amount of depreciation at a flat rate charged to the profit and loss account every year investing the amount of depreciation annually allocated to the fund in outside securities bearing interest at a stipulated rate which is also credited to the fund and invested in securities. The process continues year after year till the time for the replacement of the asset when the securities are sold and amount realized for purchasing the new asset so that fund is sometimes called 'Cumulative Depreciation or Sinking Fund.' The asset is shown at its cost value in the balance sheet while the depreciation accumulated separately on the depreciation fund is placed on the liabilities side of the balance sheet. It makes provision for the replacement of the asset at the end of its working life while such a feature is conspicuous by its absence in other methods. The main disadvantage of the sinking fund method is that as depreciation on the amount remains fixed throughout the life of the asset, it has a tendency to place an equal burden on the profit and loss account. The result is that the profit and loss account is let off lightly in earlier years and is heavily burdened in later years. The sinking fund method of assets depreciation is ideally suited for plant and machinery, as well as other wasting assets that require replacement. A company purchased a lease for $30,000 on 1 January 2024. The lease is to be renewed at the end of 3 years. For this purpose, a sinking fund is established. The sinking fund investments will realize 5%. Sinking Fund Table shows that it is necessary to invest $0.317208 each year to achieve $1 at the end of 3 years, the rate of interest being 5%. On 1 December 2024, the investments were realized for $19,400. A new lease was purchased on the same date for $35,000. The balance at bank before realization of investments was $20,000. Required: Give entries in the company's books. The annual instalment required will is 30,000 x 0.317208, or $9,516.24. Lease and Sinking Fund MethodMerits and Demerits of Sinking Fund Method of Assets Depreciation

Application of Sinking Fund Method

Example

Solution

Sinking Fund Method of Assets Depreciation FAQs

The Sinking Fund Method is a technique used to calculate the annual Depreciation of an asset. In this, a fixed amount is periodically set aside in a special account to accumulate funds for major repairs or replacement at the end of the useful life of an asset.

Merits: - it makes provision for the replacement of the asset at the end of its working life. - It is an acceptable method if a minimum rate of interest cannot be earned on current funds. Demerits: the Sinking Fund Method places an equal burden on the profit and loss account in earlier years, i.E., Depreciation remains fixed throughout the life of an asset. - The method tends to lower the apparent profits in earlier years and increase them in later years.

The Sinking Fund Method should not be used for a short life or rapidly depreciating assets. The firm must have sufficient reserves for this.

This depends upon how much Depreciation will accrue each year and what period is to be covered. If Depreciation is $10,000 and the firm wants the fund to grow to $25,000 within 5 years, it has to set aside $2,083 each year as investment in its sinking fund account.

The Sinking Fund Method of Depreciation can be used for most types of assets like buildings, machinery, plant, and equipment, etc.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.