There are three main methods used to calculate earnings per share (EPS):

- Simple EPS

Each method is discussed below.

Simple EPS or Basic EPS

This approach to calculating simple EPS is the least complicated of the three. It is used when a firm has a simple capital structure; that is, it does not include any securities or other agreements that could lead to the issuance of additional common stock.

On some other occasions, it can be used when it is not materially different from the other measures.

The denominator of simple EPS is the weighted average of the number of common shares outstanding during the year. If a stock split or stock dividend happens during the year, special adjustments must be made before calculating the average.

The numerator of simple EPS is calculated as the amount of earnings related to common stock.

The starting point for the calculation is the reported net income. Any dividends declared on preferred shares are deducted from net income because they are not related to common stock.

If the preferred stock is cumulative, the full amount of dividends is deducted, even if a smaller amount is actually declared.

Primary EPS

This approach to calculating primary EPS is more difficult compared to simple EPS. It is used when a company has a complex capital structure; that is, there are securities that are common stock in substance even though their actual form is different.

These securities are known as common stock equivalents and can include the following:

The denominator of primary EPS consists of the weighted average of the outstanding shares and the number of shares that would have been issued if the common stock equivalents had been exercised.

The calculation includes only those equivalents that are likely to be exercised in the next five years.

GAAP specifies the criteria by which these particular securities can be identified. The assumption of exercising, in turn, leads to other assumptions having to be made.

For example, if it is assumed that warrants are exercised, it follows that cash would have been received and which assumptions should be made concerning the use of that cash.

The numerator of primary EPS begins as net income less preferred dividends but may be adjusted further if the assumed exercising of a common stock equivalent would influence the reported income or the amount of preferred dividends.

Consequently, the numerator that is actually used in the calculation is possibly quite different from the figure presented on the income statement.

If the effect of the assumed exercising of a common stock equivalent is to increase primary EPS above simple EPS, the security is said to be anti-dilutive and will be excluded from the calculation.

Fully Diluted EPS

The method to calculate fully diluted EPS is the most complex of the three. It is designed to produce a "worst-case" version of EPS from the point of view of the common stockholders.

That is, calculating fully diluted EPS is intended to determine how low EPS would have been if every dilutive event that could have occurred under existing circumstances actually did take place.

This calculation includes the effects of events that might be unlikely under present conditions.

The denominator of fully diluted EPS is computed as if all dilutive securities and agreements were actually exercised. Thus, securities that are not common stock equivalents are also added to the number of common shares.

The numerator is adjusted for any changes in net income or preferred dividends that would have occurred if the additional common shares had been issued.

Neither the numerator nor denominator is affected by anti-dilutive securities.

Multiple Presentations

Under certain circumstances, GAAP requires a firm to present more than one EPS figure. Depending on the materiality of the effects on the numerator and denominator, the firm may have to present these figures:

- Simple EPS

- Both primary and fully diluted EPS

Examples

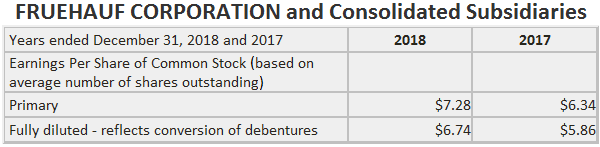

The example below shows that the disclosures provided by the Fruehauf Corporation include both primary and fully diluted EPS.

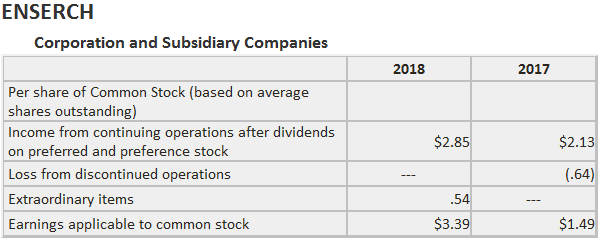

The other example shown below indicates that Enserch Corporation chose to report several details about its income on a per-share basis.

Various Types or Methods of Computing Earnings per Share (EPS) FAQs

EPS stands for earnings per share. Essentially it is just what the name says, how much money was earned over a certain period of time by each share that was outstanding at that time. There are various ways to calculate this, but in general there are three main ones: 1) basic EPS 2) diluted EPS 3) fully diluted EPS.

Basic EPS is what you would get if you simply divided the earnings for a period of time by the number of common shares outstanding during that same period (or over some specific time interval). Sometimes companies can have other types of securities on top of their common stock, and those can have an effect on the EPS figure.

Diluted EPS is basically the same thing as basic EPS, but it takes into account all possible securities that could be outstanding. This can include stock options, convertible debt, warrants, and other securities that could be exercised at some point during the period of interest (the "period of interest" is usually defined as a year unless otherwise noted).

Fully diluted EPS takes into account all possible securities that could be outstanding over the entire period of interest. This means that it includes data in its calculation for securities that are not in existence at all during the period being considered, but have the potential to come into existence in the future.

Anti-dilutive securities are simply those which would have a negative effect on EPS. If there is a certain number of them outstanding during the period of interest, they will cumulatively decrease the amount of EPS that you get because if you were to add up all of the shares and multiply it by the earnings during the period of interest, their presence could potentially change the outcome of that calculation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.