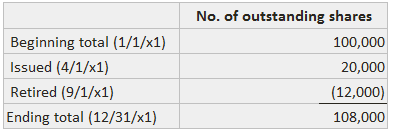

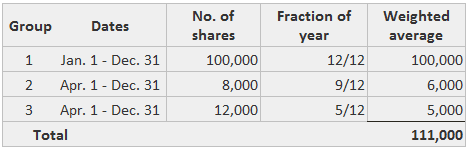

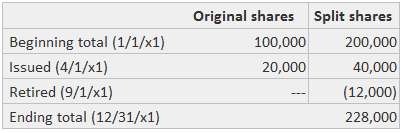

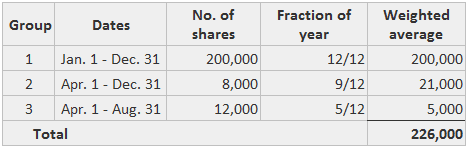

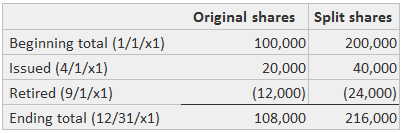

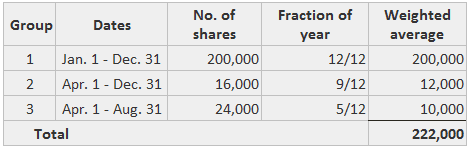

For the denominator to be consistent with the numerator, it should reflect the earning power resulting from the issuances of new shares or the retirement of old shares. For example, if the denominator includes the whole of a group of new shares issued late in the year, it would not be consistent with the earnings derived from the resources available to the firm throughout the entire year. Consequently, the generally accepted accounting principles (GAAP) require the use of an average number of shares outstanding as the starting point for all denominators. Further, the number of shares used in computing the average is to be weighted by the fraction of the year that the shares were actually outstanding. When the number of outstanding shares is changed by a stock dividend or split, the firm's earning power is not affected. However, a stock dividend or split does have the effect of creating a new "type" of common share in the sense that the percentage of ownership per share is altered. Consequently, the treatment of stock dividends and splits is different from the treatment used for issuances of shares in exchange for assets or services. Specifically, the number of actual shares outstanding must be altered to what it would have been if the split or dividend had occurred at the year's start. This adjustment is made if the split or dividend occurs during the year or even after the year-end. Thus, the denominator is expressed in terms of the type of common share that exists at the time the financial statements are released, rather than the type that exists when the earnings were achieved. Different scenarios for calculating the weighted average of outstanding shares are shown in the following examples. Suppose that Sample Company had 100,000 shares of common stock outstanding on 1 January 2021, that 20,000 shares were issued for cash on April 1, 2021, and that 12,000 shares were retired on 1 September 2021. The ending total of outstanding shares can be calculated as follows: The shares can be grouped according to the length of time that they were outstanding. In this case, group 1 consists of 100,000 shares that were outstanding for the entire year, while groups 2 and 3 are included in the 20,000 shares issued on 1 April. Group 2 consists of the 8,000 shares outstanding from 1 April to the end of the year and group 3 is the 12,000 shares outstanding from 1 April to 31 August. The weighting of each group by the fraction of the year it was outstanding is shown below. Thus, the situation during the year was equivalent to having 111,000 shares outstanding throughout the year. For this example, assume the same events as in Example 1. Alongside this, add a two-for-one stock split on 1 July. Therefore, the shares outstanding after that date (and retired on 1 September) are not the same as those that existed prior to that date. Before grouping the shares, they all must be converted to the same type. The following table shows the calculations: Group 1 consists of 200,000 split shares that were effectively outstanding for the entire year. Of the 40,000 split shares issued on 1 April, group 2 consists of 28,000 shares that were outstanding until the end of the year, while group 3 consists of the 12,000 that were retired on 1 September. The calculation of the weighted average is shown below. If the split that occurred on 1 July 2021 in Example 2 instead takes place on 1 February 2022 (i.e., before the income statement for 2021 is published), the shares used in the denominator must be adjusted for the change as follows: In this case, group 1 consists of 200,000 shares deemed to have been outstanding from 1 January to 31 December. Of the 40,000 split shares issued on 1 April, group 2 consists of 16,000 considered to have been outstanding from 1 April to 31 December, and group 3 is composed of 24,000 that were outstanding from 1 April to 31 August. The weighted average is calculated in the following way: In this case, the same result could have been achieved by multiplying the 111,000 shares from Example 1 by a factor of 2. This shortcut is used to adjust the average outstanding shares for earlier years covered by comparative statements.Explanation

How to Calculate the Weighted Average of Outstanding Shares

Example 1

Example 2

Example 3

Weighted Average of Outstanding Shares FAQs

Weighted average shares outstanding is the process of weighting every number of common stock to reflect how much time they were in effect.

There are many ways to calculate this, an example would be: take one share and multiply it by the number of days it is in affect, then add each amount together to get the total shares outstanding.

Weighted average shares must be used when you want to find out how many common stock were in effect during a specific time frame. Common examples would be calculating the company's earnings per share or per-day outstanding share.

Weighted average shares is the number of all common stock that is in affect for a specific time frame, whereas basic shares are companies issued amount of common stock with actual stock certificates that have been issued.

There is no specific formula, the calculation needs to be done by hand or with a computer program.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.