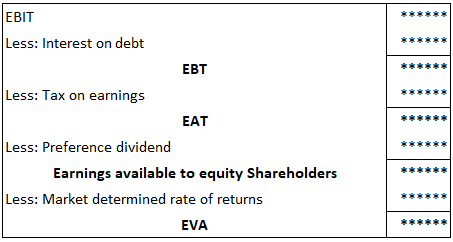

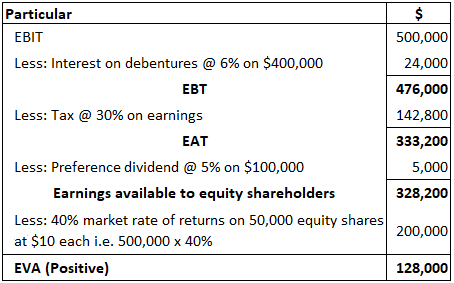

Economic value added (EVA) is a new concept that companies and their consultants use as a performance measure. In generic terms, "value-added" refers to the additional or incremental value created by an activity or business venture. Economic value added, or EVA, is also known as economic rent. It is a widely-recognized tool for measuring the efficiency of a company's resource use. In other words, EVA is the difference between the return achieved on resources invested and the cost of resources. The higher the EVA, the better the level of resource utilization. EVA can be calculated as net operating profit after tax minus a charge for the opportunity cost of the capital invested. EVA is based on the idea that a company must cover both the operating costs and capital costs. EVA can be positive or negative. Ideally, it will be positive. If EVA is negative, managers should quickly become concerned with how to improve and transform it. EVA helps managers to satisfy two important objectives when making financial decisions, namely: With all this in mind, it's clear that managers within companies should place considerable efforts in continuously improving EVA. Economic value added (EVA) is a financial measure of what economists sometimes refer to as economic profit or economic rent. This phrase is used because EVA measures the economic rather than the accounting profit created by a business. The difference between economic profit and accounting profit is essentially the cost of equity capital. A finance manager does not deduct the cost of equity capital when calculating profit. Their job is to measure the earnings per share (EPS) on behalf of the company's shareholders. By contrast, an economist calculates earnings by charging all types of costs, including the opportunity cost for the equity capital invested. Thus, earnings (profits) from the finance manager's viewpoint are different compared to the economist. EVA, in reality, does not consider whether the business is profitable. Instead, it takes into account whether any earnings remain after considering the cost of all resources (including the opportunity cost for equity capital). The opportunity cost for equity capital is the cost incurred to compensate the equity shareholders at a market-determined rate of return. If the earnings of the business are able to meet this obligation and some earnings are left for the exclusive use of a business, that "leftover portion" is called EVA, which is "positive." EVA is "negative" if the company's earnings do not compensate the opportunity cost for equity shareholders. This means that the firm's earnings (profits) are inadequate to compensate the equity capital at the required rate of return, as determined by the market. From the viewpoint of measuring EVA, all profitable businesses may not be capable of contributing to EVA (positive). If EVA is consistently negative, investors may move their funds elsewhere, believing that the company cannot generate adequate returns. EVA is gaining recognition as a useful measure today. This is because every company is interested in understanding the psychology of their investors and trying to retain them. Regarding the last point, this could involve altering the firm's capital structure by substituting lower-cost debt for higher-cost equity. Of course, this measure may lower net earnings, but it would improve EVA by lowering the total cost of debt and equity. EVA as an economic measure informs financial managers about the profitability status of their company. It enables them to take the necessary steps to improve the company's position if EVA is nil or negative. If EVA is positive, the question of how to improve it further is also a consideration that interests most professional managers. According to Stern and Stewart & Co., the developers of EVA, equity market values tend to be more highly correlated with annual EVA levels compared to most other performance measures of return on equity, cash flow growth, or EPS growth. When calculating EVA, the following three factors should be considered: Adjustments need to be made to arrive at figures for NOPAT and EBV. These adjustments are necessary to ensure accurate figures, which will form a good basis for calculations. According to Stern and Stewart & Co., there are over 160, and other different adjustments that can be made. The question of which type of adjustment to use and where depends on the industry, technology, and value creation process. If managers prudently use this tool, decisions are likely to be more effective and results-oriented. There are three ways to calculate EVA: Note: In the case of approaches (2) and (3), the return to equity shareholders is based on the market-determined rate of return. The new dimension is explained using the following format: Format for calculating economic value added (EVA) Notes: The EBIT of EREHWON Company is $50,000. Its capital structure consists of 50,000 equity shares of 10 each, 10,000 5% preference shares of $10 each, and 6% debentures to the extent of $400,000. The company comes under the tax bracket of 30%. The market rate of return on equity shares is 40%. Required: Calculate EVA and comment. Calculation of EVA for EREHWON Company EREHWON Company has been able to absorb the market rate of return to equity shareholders (40%) fully. There is excess earning leftover after charging all costs, including the opportunity cost of capital. Hence, this is not only a profitable company but also a thriving company with high prospects. Therefore, the financial manager should have no problem continuing with the same strategic operations. Another worthwhile point to note is that if the value of earnings available to equity shareholders is less than the EVA would be negative or it was equal to $200,000, EVA would be undefined or nil. Finally, if the EVA is either negative or undefined, the financial manager should seek to find corrective measures to change EVA to positive, helping the company to prosper.What Is Economic Value Added (EVA)?

Economic Value Added: Explanation

How to Calculate Economic Value Added (EVA)

How to Transform Negative EVA Into Positive EVA

How Economic Value Added (EVA) Helps Financial Managers

Benefits of EVA

Limitations of EVA

How Does EVA Work?

How to Calculate Economic Value Added (EVA)

Example

Solution

Interpretation

Economic Value Added (EVA) Concept FAQs

An example of a company that could be profitable but not thriving because its economic value added is negative is carbo ceramics.

Eva is calculated using after tax Cash Flows but reported earnings are before tax. Taxes reduce the amount of income that gets included in nopat.

Eva is positive if at least one of the following holds: ebit > ocf or sales > operating assets.

We should calculate eva and not just roi because we need to see the impact of capital structure on value creation.

Ocf = ebit + Depreciation - change in Working Capital - capex.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.